Tydzień w gospodarce

Category: Raporty

(©American Enterprise Institute)

A few examples to illustrate the point: In a recent story in “The New York Times’s” Business section, an article began with this statement: “One of the most urgent questions in economics is why pay for middle-income workers has increased only slightly since the 1970s, even as pay for those near the top has escalated” (Scheiber, 2021). Conservative commentator David Brooks declared in 2017 that “middle-class wage stagnation is the biggest economic fact driving American politics.” A 2018 analysis by the Pew Research Center had this headline: “For most U.S. workers, real wages have barely budged in decades.” Populist politicians on the political right and progressives on the political left share this view, as well.

Many economists agree. Economists assume wage stagnation as a fact in commentary written for the public (e.g., Krugman, 2021; Stiglitz, 2020) and in academic and policy papers (e.g., Azar et. al, 2020; Hoynes and Rothstein, 2019; Sachs et. al, 2015; Benmelech et. al, 2022; Benmelech et. al, 2019).

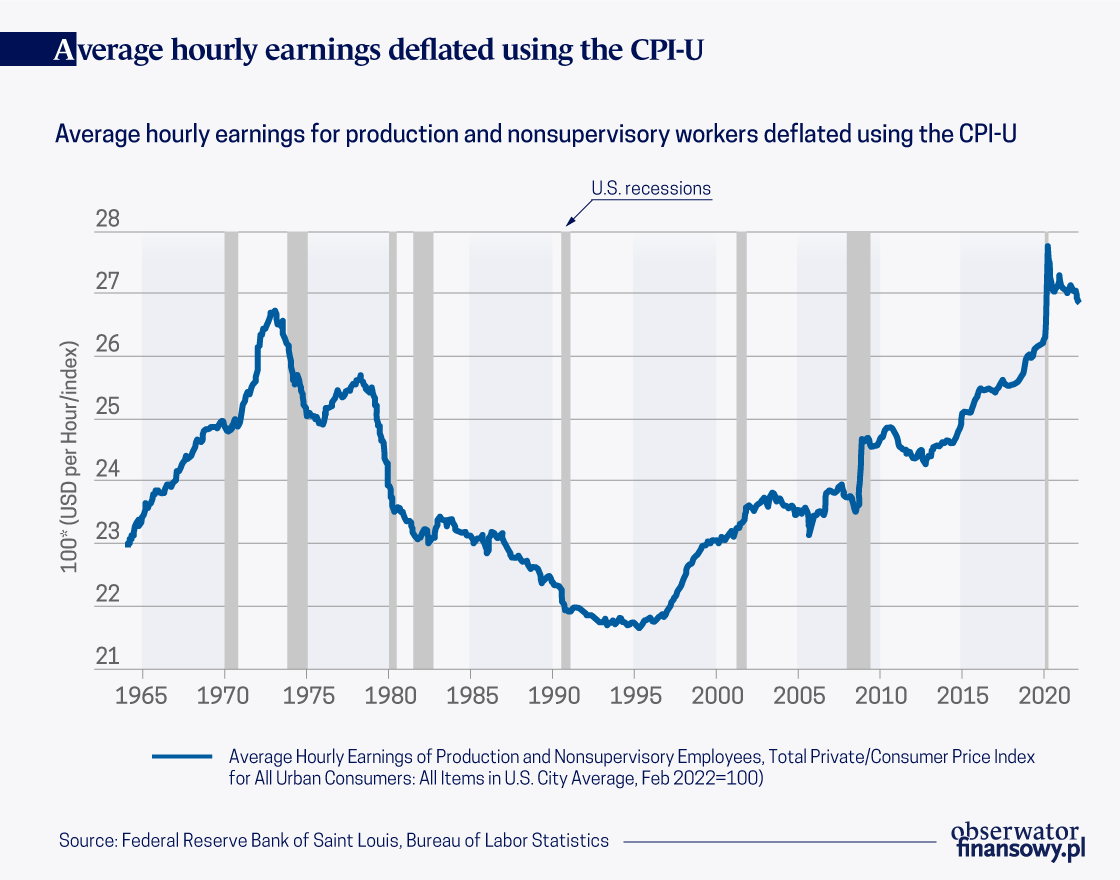

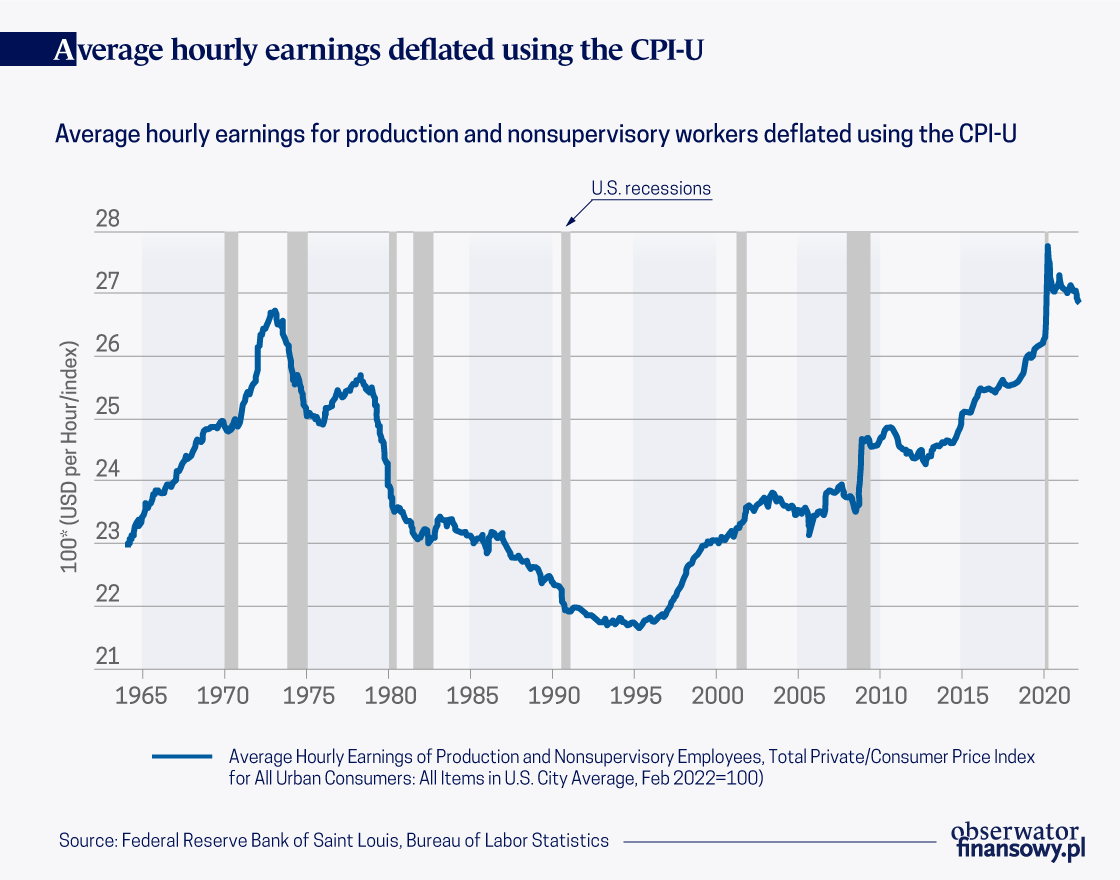

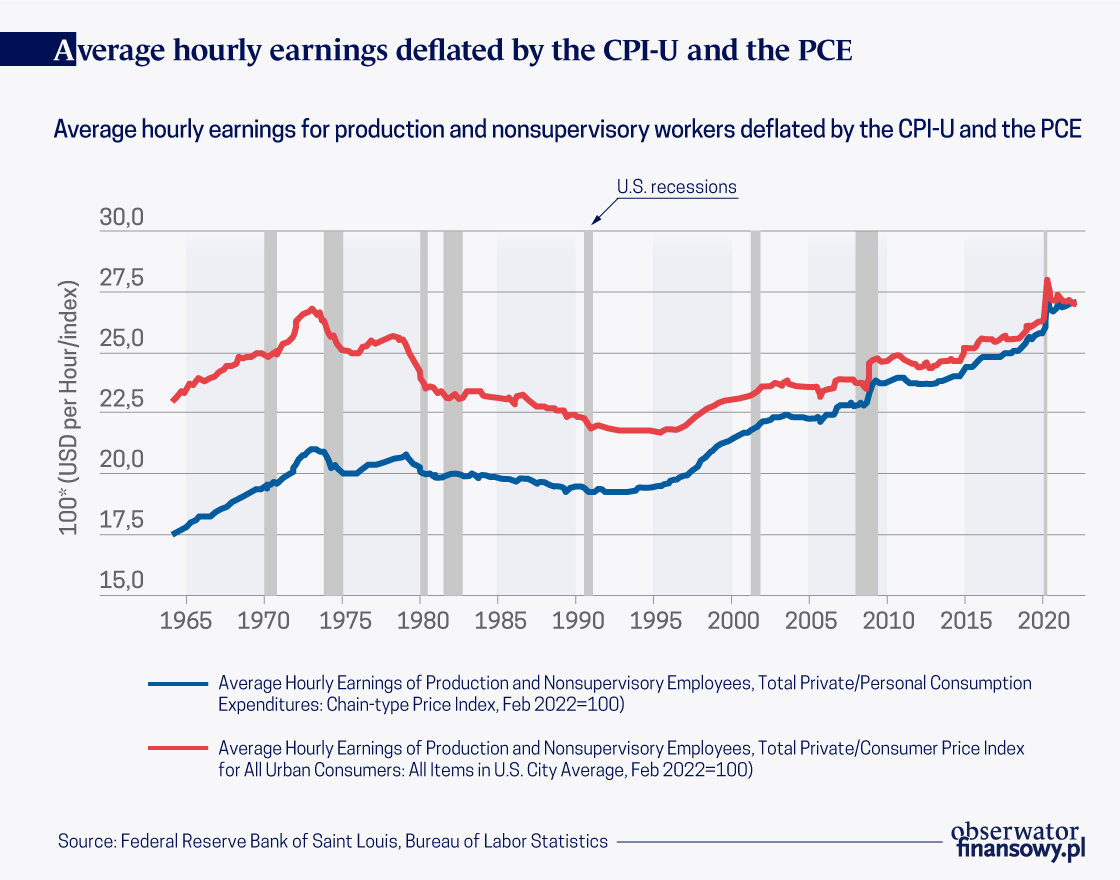

This view has empirical support. See the growth of inflation-adjusted average wages for production and nonsupervisory workers, shown in Figure 1. A startling fact is that average real wages have grown by only 0.7 percent over the half century beginning in February 1973. In February 2022 dollars, wages have grown over this period by $0.18. There is no question that an $0.18 increase over a half century is correctly interpreted as stagnant.

Many descriptions of U.S. wage stagnation begin in 1973 (or 1979) because that was the previous peak in the series, the rapid growth in inequality that began around that time, and due to perceived shifts in the economy during the 1980s away from organized labor and towards a greater emphasis on economic efficiency (e.g., Mishel et. al, 2015).

The starting year for wage growth calculations is crucially important, but has received relatively little attention in the academic and policy debates around wage stagnation. See my recent book, for more detailed discussion of this issue.

Calculating wage growth using 1973 (or 1979) as a base year mechanically produces smaller growth magnitudes because 1973 was a previous peak of the series and because 1978/1979 was a local maximum of the series.

A quick glance at Figure 1 — which contains the full available time series for average hourly earnings for production and nonsupervisory workers — does not lead one to conclude that 1973 is the obvious base year for economists or analysts to choose. The year the series begins, 1964, might be more natural. With that as the base year, wages have grown by 17 percent. That may still be interpreted as stagnant, but still much faster than growth calculated from 1973.

In Strain (2020), I make several arguments that — at least for the purpose of the policy debate — July 1990 is a sensible base period. First, I argue that when political leaders and political leaders argue that “wages have been stagnant for decades,” many people hear that as referring to their own wages. But 1973 was a half century ago. Choosing a more recent base year is more sensible, and even one three decades ago may be too far in the past because it would apply to too few current workers. Second, July 1990 was a business cycle peak, which helps to avoid overstating wage growth by estimating it from a trough.

The third reason I argue in Strain (2020) for 1990 as the base year rests on the fact that the U.S. experienced two decades of stagnating – actually, declining – average real wage growth, beginning in the early 1970s and ending in the early 1990s. Averaging wage growth from that period with the decades that followed – i.e., averaging economic outcomes from two different economic regimes – arguably distorts our understanding of wage growth over time. Finally, the earlier the base year, the harder it is to adequately adjust for inflation. Measuring changes in a typical consumption bundle from 1990 to 2022 is challenging enough given quality improvements in continuing products and the vast number of new goods and services that have entered the typical bundle during that period. Going back a half century is even harder, still.

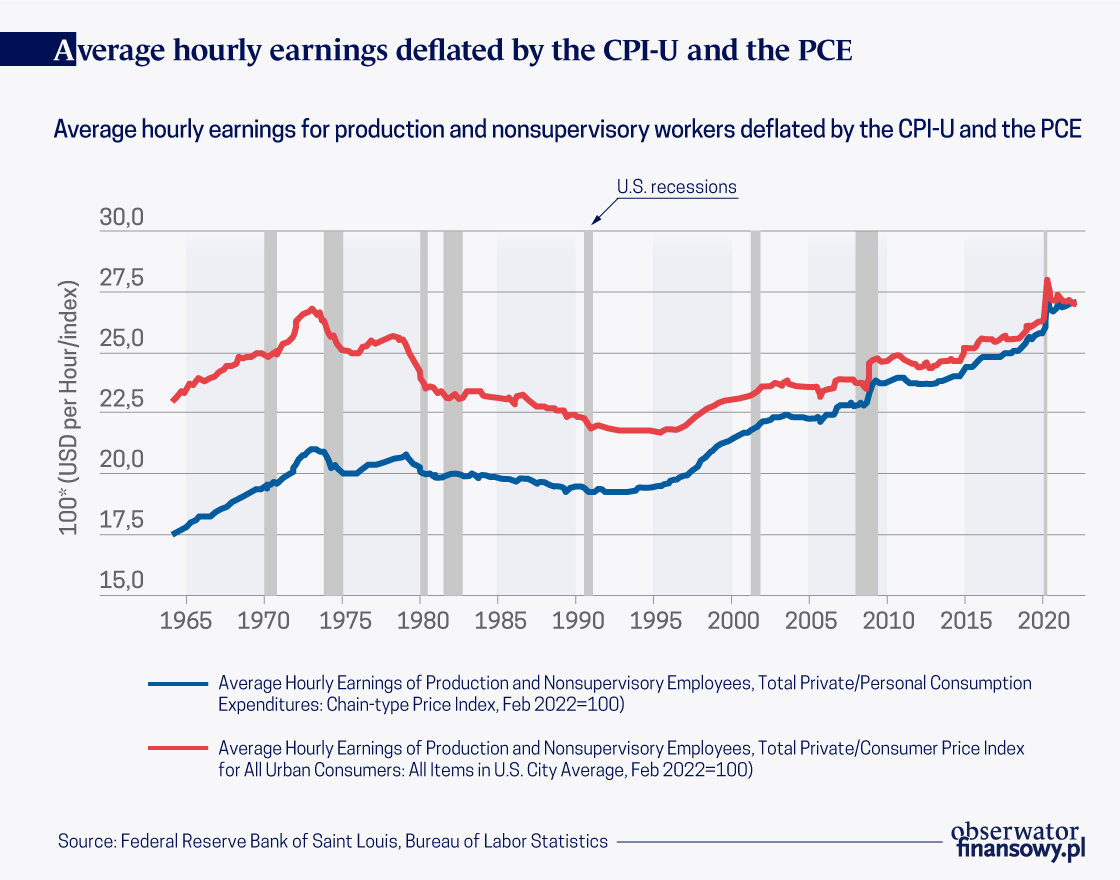

In addition to selecting the base year, the issue of inflation adjustment is of first-order importance. So far, I have been using the consumer price index, which is arguably the most prominent measure of inflation. There is widespread recognition that the headline CPI may overstate the rate of inflation, particularly over longer periods of time (Boskin et. al, 1998; Broda et. al, 2009). Given that, many economists use a CPI research series (known as the CPI-U-RS) that attempts to account for some of these issues, though the CPI-U-RS does not deal adequately with substitution bias over the periods of time in question (Moulton, 2018).

An alternative to the CPI is the personal consumption expenditure price index (PCE). There are numerous technical differences between the two indices, and each has strengths and weaknesses. The CPI is specifically designed to capture price changes in a typical consumption bundle, whereas the PCE includes all expenditures made for consumption, including those made by third parties (e.g., employer-provided health insurance premiums). The CPI focuses on urban consumers, while the PCE tries to capture all consumers, and does a better job capturing price changes faced by rural populations.

The most important advantage of the PCE is its more realistic treatment of consumer substitution across goods in response to price changes. For example, if the prices of strawberries goes up, consumers will buy fewer strawberries and more raspberries. Because of the PCE’s ability to better capture this type of substitution, it is the measure used by the nonpartisan Congressional Budget Office when analyzing trends in wages over time. The PCE is also the Federal Reserve’s preferred measure of consumer price inflation (though of course the Fed studies many measures of price changes across several distinct markets, including consumer goods and services).

Because the CPI overstates inflation, calculations using the CPI for inflation adjustment understate real wage growth. Figure 2 shows two series for the average real wage for production and nonsupervisory workers. One is deflated by the CPI and one by the PCE. Both are expressed in February 2022 dollars, so the closer the series is to February 2022 the closer real wages are to nominal wages.

The presentation in Figure 2 highlights how conclusions — quantitative, but perhaps also qualitative — are driven in part by the choice of price index, and how the further in the past the base year, the larger the role the choice of price index plays.

Using July 1990 as the base period, average real wages using the CPI grew by 21 percent over the three-decade period ending in February 2022. Real wages grew by 39 percent using the PCE.

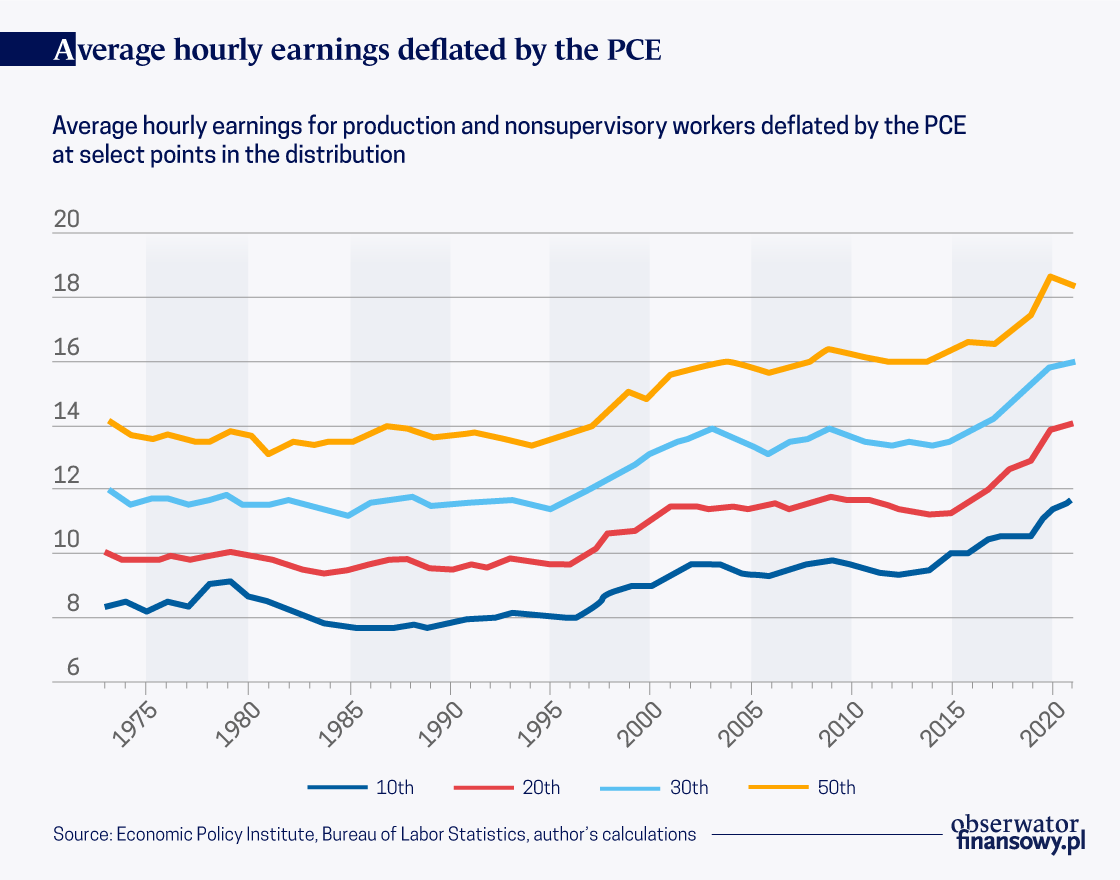

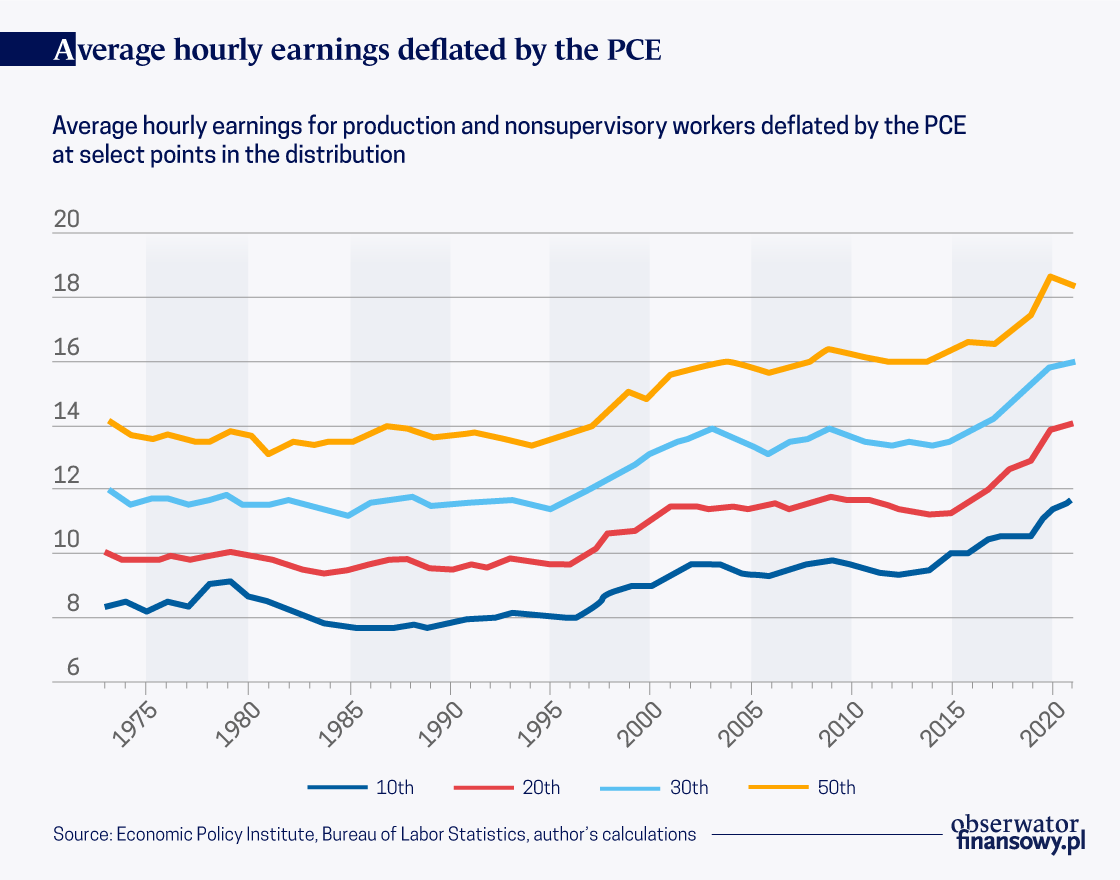

So far, I have been discussing average wages. Because the analysis has focused on production and nonsupervisory workers — workers who are not managers, roughly speaking — there is less reason than usual to be concerned that average wages produce a distorted picture of what is happening to “typical” workers because of growing inequality. Still, some concern may remain. Figure 3 shows real wage growth for the median worker and at other points in the distribution.

Since 1990, real median wages grew by 34 percent. Real wages at the tenth, twentieth, and thirtieth percentiles grew over this period by 50, 48, and 38 percent, respectively.

The ubiquity of 1973 might argue for economists and analysts to adopt a new standard base year. But it would be better still for scholars and commentators to take a more nuanced approached when describing wage growth over time. Wage trends over the past half century are too nuanced to be succinctly summarized without considering the 1970s and 1980s separately from the three decades that followed.

Thirty-nine percent growth in average wages over the past three decades (and 34 percent median wage growth) is slower than wage growth at the top of the distribution. But given the choice between “stagnant” or “not stagnant,” the latter is the more accurate characterization.

A 39 percent increase in purchasing power is a significant increase. My characterization of wage growth over this period would be “solid, but not spectacular.” Of course, policy should not be content with this pace of growth. It is not “fast enough.” Policymakers should focus on policies to boost productivity, which will quicken the pace of wage growth, along with measures to increase competition in the labor market.

References

Azar, José A., Ioana Marinescu, Marshall I. Steinbaum, Bledi Taska, “Concentration in US Labor Markets: Evidence from Online Vacancy Data,” Labour Economics, vol. 66, 2020.

Benmelech, Efraim, Nittai Bergman, and Hyunseob Kim, “Strong Employers and Weak Employees: How Does Employer Concentration Affect Wages?” Journal of Human Resources, vol. 57, 2022.

Benmelech, Efraim, Nittai Bergman, and Hyunseob Kim, “What’s Causing Wage Stagnation in America,” Kellogg Insight, December 2, 2019.

Boskin, Michael J., Ellen R. Dulberger, Robert J. Gordon, Zvi Griliches, and Dale W. Jorgenson, “Consumer Prices, the Consumer Price Index, and the Cost of Living,” Journal of Economic Perspectives, vol. 12, no. 1, Winter 1998.

Broda, Christian, Ephraim Leibtag, and David E. Weinstein, “The Role of Prices in Measuring the Poor’s Living Standards,” Journal of Economic Perspectives, vol. 23, no. 2, Spring 2009.

Brooks, David, “The Economy Isn’t Broken,” The New York Times, September 15, 2017.

Desilver, Drew, “For most U.S. workers, real wages have barely budged in decades,” Pew Research Center, August 7, 2018.

Hoynes, Hilary W. and Jesse Rothstein, “Universal Basic Income in the United States and advanced countries, Annual Review of Economics, vol. 11, 2019.

Krugman, Paul, “Pumps and Dumps and Chumps,” The New York Times, February 4, 2021.

Mishel, Lawrence, Elise Gould, and Josh Bivens, “Wage Stagnation in Nine Charts,” Economic Policy Institute, January 6, 2015.

Moulton, Brent R., “The Measurement of Output, Prices, and Productivity: What’s Changed Since the Boskin Commission?” Brookings Institution, July 2018.

Sachs, Jeffrey D., Seth G. Benzell, and Guillermo LaGarda, “Robots: Curse or Blessing? A Basic Framework,” NBER Working Paper Series, no. 21091, April 2015.

Scheiber, Noam, “Middle-Class Pay Lost Pace. Is Washington to Blame?” The New York Times, May 13, 2021.

Stiglitz, Joseph E., “The Truth About the Trump Economy”, Project Syndicate, January 17, 2020.

Strain, Michael R., The American Dream Is Not Dead: (But Populism Could Kill It), Templeton Press, 2020.

The article is published in a series of articles in Obserwator Finansowy written by governors of central banks and distinguished economists. The series is under the special patronage of the Governor of Narodowy Bank Polski, Professor Adam Glapiński. The authors of the articles have agreed to waive their fees for writing the texts, and in exchange NBP shall donate the amount equivalent to the fees onto the account of the National Bank of Ukraine in order to support the NBU during the war. Below is a foreword by the Governor of NBP to the whole series:

On 24 February a huge tragedy occurred, in the face of which it is impossible to simply move on as if nothing had happened.

Nobody can remain indifferent to the misfortune that has befallen the Ukrainian nation.

All of us are shocked by the press reports, and particularly by what we see in the mass media.

Fighting Ukraine is not only its brave soldiers, but also an army of thousands of civilians trying to preserve normality in a country stricken by Russian aggression.

This army includes the staff of the National Bank of Ukraine, with whom NBP is in constant contact.

Aware of our Ukrainian colleagues’ needs, we have invited several central bank governors and eminent economists to share their knowledge on the economic processes taking place around the world.

It is rare for such a distinguished group of authors to feature in Obserwator Finansowy, which is published by NBP. It is also worth underlining that all the authors have waived the fees for their articles in order to donate them to meet the needs of our colleagues working in the National Bank of Ukraine.

I believe that you will find the series of these articles interesting, especially since they not only share the knowledge and experience of their authors, but also express goodwill towards the war-afflicted NBU.

Prof. Adam Glapiński, Governor of NBP