(Stephanie Jones, CC BY-NC-SA 2.0)

However, this would require a loosening of the current rigid budgetary rules — write the analysts of the German Institute for Economic Research (DIW Berlin). Both private and public investment in the Eurozone still hasn’t returned to the levels recorded prior to the financial crisis. It is likely that one of the main factors responsible for this situation is the high level of public debt and the resulting credit limitations.

Germany is one of the economies that stand out in the sluggish Eurozone. The public and private investment in that country has already rebounded to levels slightly higher than those achieved before the crisis. The robust investment activity of local government units is particularly noteworthy — this applies especially to those local governments that have reported increases in tax revenues resulting from the general acceleration of economic growth. However, these are still isolated cases, as many regions and cities have their hands tied when it comes to investment due to the high levels of social spending and the existing debt burdens.

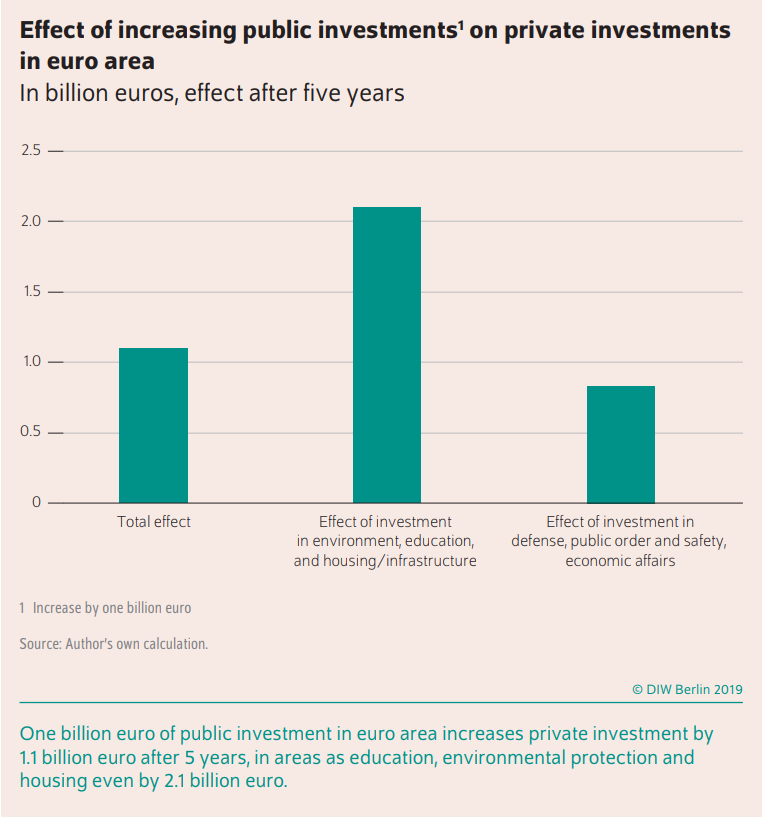

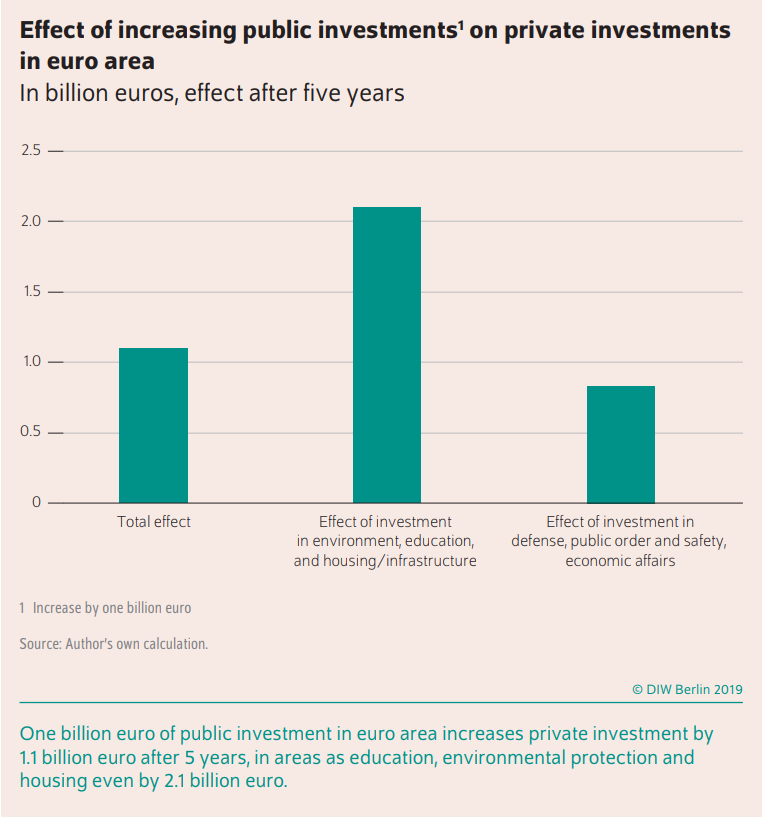

DIW Berlin analysts have examined the short-term and medium-term impact of public investment on the volume of private investment for the entire Eurozone in the years 1991-2018. The model employed by the researchers has shown the occurrence of a so-called ‘crowding in effect’, which means that investment activity in the private sector is stimulated by public spending.

An increase in annual public investment of 1 per cent raised private investment by 0.2 per cent in the medium term. Given the fact that private investment is five times larger than public investment in the Eurozone countries, investments from the public budget for an amount of EUR1bn result in private expenditures of EUR1.1bn over a period of five years. Moreover, public spending on areas such as environmental protection, education, infrastructure and housing have a significantly stronger effect on private investment than spending on areas such as defense or public order and safety.

And since Germany is leading the Eurozone when it comes to the recovery of investment expenditures towards the pre-crisis levels, the ratio of private to public investment in that country is higher than the average and amounts to seven to one. Consequently, the potential crowding in effect in Germany would be even higher, reaching nearly EUR2bn in the private sector for every EUR1b spent by the public sector.

However, the authors of the report point out that certain conditions would have to be met for such effects to be achieved. This would include changes in the country’s fiscal policy. Although the government’s recent medium-term investment plans (an amount of EUR159bn was allocated for investment scheduled until 2023, including infrastructure investment) are already going in the right direction, experience shows that investment backlogs can still arise even when financial resources are available.

Therefore, it is necessary to eliminate the unnecessary regulations and to provide less bureaucratic procedures for obtaining funding, especially by local authorities. The German balanced budget rules impose an excessively tight corset that makes it difficult for the state to react when challenges arise for the economy.