Tydzień w gospodarce

Kategoria: Trendy gospodarcze

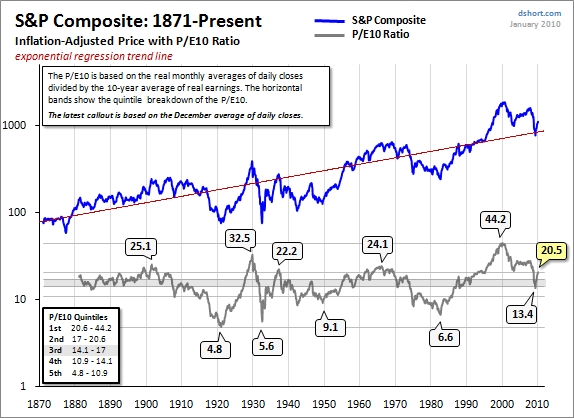

Opierając się na metodzie prof. Roberta Schillera z Yale, autora Irrational Exuberance, ekonomista Doug Short z dshort.com stawia w ciekawym tekście pytanie ignorowane przez wielu obserwatorów „Czy giełda nie jest tania”?

For a more precise view of how today’s P/E10 relates to the past, our chart includes horizontal bands to divide the monthly valuations into quintiles — five groups, each with 20% of the total. Ratios in the top 20% suggest a highly overvalued market, the bottom 20% a highly undervalued market. What can we learn from this analysis? Over the past several months, the decline from the all-time P/E10 high dramatically accelerated toward value territory, with the ratio dropping from the 1st to the upper 4th quintile in March. The price rebound since March has now put the ratio at the top of the 2nd quintile — quite expensive!

A more cautionary observation is that every time the P/E10 has fallen from the first to the fourth quintile, it has ultimately declined to the fifth quintile and bottomed in single digits. Based on the latest 10-year earnings average, to reach a P/E10 in the high single digits would require an S&P 500 price decline below 600. Of course, a happier alternative would be for corporate earnings to make a strong and prolonged surge. When might we see the P/E10 bottom? These secular declines have ranged in length from over 19 years to as few as three. The current decline is now nearing its tenth year.

Michael Panzner dodaje, że jest to cecha charakterystyczna kryzysów

the equity market’s low-valuation extremes were hit during what might be described as „turbulent times,” including World War I, the Great Depression, World War II, and the stagflation of the late-1970s. Except for the most delusional of permabulls, it would be hard for anyone to argue that the unraveling that began more than two years ago doesn’t also fit that bill.

Calculated Risk zwraca uwagę na wzrost liczby bankructw osób fizycznych w USA.

The annual rate is at about the same level as prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

Naked Capitalism zamieszcza ciekawą recenzję książki „Murder of Lehman Brothers” autorstwa Josepha Tibmana. Książkę ocenia Arthur Doyle, były dyrektor ds. zarządzania tego banku.

My real objection to Mr. Tibman’s line of thinking—and this applies equally to the thinking of Lawrence McDonald, whose book, A Colossal Failure of Common Sense, I reviewed several months ago—is that the idea that Lehman was made up of a great collection of businesses but was ruined by a few stupid actors is nonsense. You cannot separate one part from the whole. Without Lehman’s highly leveraged, hugely risk-taking trading operation, Mr. Tibman’s investment banking business could never have existed—certainly not on the scale it grew to in its last several years of existence. Leaving aside the fact that Lehman’s costly distribution (trading) and research operations was a primary reason Tibman and his friends were able to win so much business, there’s also the fact that without the profits from the trading business (well over $4 billion per year in LEH’s last several years, more than 5x the profits of the investment banking business), the company couldn’t have gone on the spending spree which enabled it to poach top bankers from its competition.