Tydzień w gospodarce

Category: Raporty

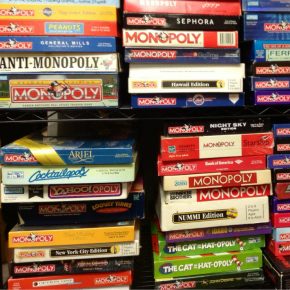

(Mike Mozart, CC BY 2.0)

CE Financial Observer: Evil, giant monopolies, from Google to Facebook — do we really have a reason to fear them?

Jonathan B. Baker: The threat of market power abuse by monopolistic companies is a real problem. I suggest we consider the beer industry instead of new technology companies as, according to recent research, in the case of the former the problem is equally as pronounced. I don’t know about Europe, but in the USA we have two big brewers and hundreds of smaller ones, but the two big ones account for two thirds of total beer sales in the country. They take advantage of their position and charge higher prices. In a competitive market, customers would pay much less for a beer. But that’s not all. A competitive market would turn out more beer, selling it to a larger number of consumers who currently can’t afford it. As it is, the market is simply less effective.

What prevents the hundreds of smaller players from squeezing the giants out of the market by price competitiveness?

The largest breweries spend vast amounts on preserving their market power, as opposed to product improvement.

Could you explain on this?

They may lobby with the government to introduce regulations in favour of themselves, making it impossible for their competitors to cut prices. They may also exert pressure on their suppliers, getting them to sign exclusivity agreements or impose higher supply prices on competitors. There are many ways. If this happens within one industry, the impact on the economy as a whole is limited. Yet when observed across various industries, the phenomenon causes productivity to fall and, ultimately, GDP to slow down. At the moment we have good reason to think, at least in the United States, that abuse of market power causes damage as serious as bad macroeconomic policy would.

But perhaps companies which abuse their market power do so because they offer the best products?

No, they don’t. If a lot of firms compete for consumers, their market power is small or null. They have to fulfil consumers’ needs and cannot impose anything on them. Prices fall and quality improves. If the market is catered for by one firm, or a few firms that act, in a manner of speaking, as one, prices rise and quality decreases. I have already mentioned a decline in GDP, but that’s not all. The innovativeness of the economy also decreases for lack of incentives to invent new products. Another adverse effect is growing inequality. Firm owners and shareholders are usually more affluent than their customers. If they are able to impose prices on customers, capital accumulation by the richest accelerates.

So, what is the source of market power?

Firstly, the government. As a result of lobbying, legislation may favour some at the expense of others. The argument for such legislative moves typically invokes the need for protection, e.g. from foreign competition, or to keep quality standards. Secondly, market power may stem from the natural features of a given market. In some markets, patterns such as network effects are observed which attract customers to existing firms along the principle “I buy from them, because others do; I use their service, because others do.” Facebook is an example. Also, market entry requires amounts of capital so big that only a few can afford it. This is the case of banking. Thirdly, sometimes companies seek to build up their market power, combatting competition with unfair measures, as described by me in the context of the brewing market, or by forming cartels which can dictate minimum prices to the market.

Which of these causes prevails? The government? Natural market processes? Intentional activity?

It is difficult to answer the question in these terms. Everything depends on the industry.

Some economists, especially free marketeers, argue that the theory of monopolies and market power does not make sense. Let’s take cartels. If a number of companies make a deal about a minimum price, each of them faces very strong temptation to quietly renege on that deal and gain more clients. Hence, cartels are short-lived and not dangerous. What do you think?

Rather — what does experience show us? Of course, some cartels fail naturally, but this isn’t a reason to stand with folded arms and wait for them to collapse. Research shows that cartels usually fail not because someone reneges on the deal, but rather as a result of intervention. The average life of a cartel is 8 years, but there are some that last 40 years.

There are similar arguments in the case of monopolies — if a company is one, there is a huge incentive for others to take from it a slice of the cake. Provided the monopolist doesn’t receive government prerogatives, it will finally lose its status.

The answer is very similar. Some monopolies fail of their own accord, but a significant part do not. Some monopolies have a long life. Kodak, Xerox, US steel — while they are no longer super powerful, they had monopoly power once and wielded their market clout for many decades. It wasn’t until the advent of the great technological shift that they lost that power. It is worth remembering that the sheer size of a company does not make it a monopoly: it is a question of practices. Research shows unequivocally that in many industries large firms indeed often act in an unfair manner. This is the point at which the antimonopoly law should step in and block dangerous mergers and acquisitions, or break cartels up.

This, however, is where the question emerges about the knowledge of what may actually be dangerous competition, and what only seems to be. When Facebook was taking over Instagram, the goal was to neutralize competition. And later it turned out to be a brilliant investment. If capitalists are surprised by the market, what makes us think that officials will be any different?

Let’s consider this case from a different angle. After all it’s not impossible that if Facebook hadn’t acquired Instagram, the latter would have become even more innovative and would have grown even faster. Perhaps it would be a good idea for anti-trust agencies in USA to have a close look at this deal and consider its revocation.

After 7 years? Surely the law cannot be retroactive.

In the US retroactive interventions are admissible in the case of mergers and acquisitions if the court deems them to have had negative consequences. It doesn’t happen often, but it does happen. Sometimes an apparently innocuous transaction generates considerable market power, but only after a while. The possibility of retroactive interventions stems from the history of American legislation. Until the 1970s, there did not even exist an obligation to inform government bodies about intended M&A. Under such circumstances, only retroactive interventions were possible.

But how can we prove that a given transaction had a negative impact on consumers. Is it possible to calculate the loss?

This would require the construction of counterfactual scenarios, which is very tricky. It makes more sense to view it from the point of view of competition. If a transaction has had a hampering effect on competition, then it has harmed consumers. As I said earlier, there is evidence of less competition translating into higher prices and lower quality. Then there is the loss of innovation. To go back to your example, perhaps Instagram and Facebook would have produced more innovations separately than under the umbrella of one owner.

Economic theory is one thing, practice is another. Have anti-monopoly interventions carried out to date really had positive effects?

In my opinion, the balance is positive, even though some of them have not been successful. The mere awareness that a company may be held accountable for its dishonest activities inclines companies to avoid abuse. Besides, antimonopoly interventions have had many spectacular successes. Let’s take Standard Oil, for example: the giant was successfully disarmed.

At the request of its competitors and not consumers. Owing to Standard Oil’s innovations, consumers could enjoy lower prices.

That may be, but Rockefeller fought with the competition not only with quality and prices, but also with other methods. At a certain point, Rockefeller got involved in the railway business and eliminated competitors by limiting their access to the refineries he owned.

Surely he could do what he wanted with his own property?

By treating private property in absolute terms, we embark on a very slippery patch in the landscape of competitive processes. “This is our product and we can do what we want with it,” was Microsoft’s line of defense when it had been charged with monopolistic practices in operation systems. Yet, the Supreme Court judges [unlike in Europe, anti-trust trials in the United States are conducted by courts and not dedicated bodies — editors’ note] gave a unanimous opinion emphasizing the significance of limiting private property: The fact that you own a baseball bat does not mean that you can use it to hit others. The matter was settled amicably and Microsoft made a commitment to give up certain practices.

Is the current antitrust law constructed in the optimum way, in line with our knowledge of economics, or does it perhaps need to be revised?

Antitrust law needs to be enforced consistently and fairly and needs to be tightened when this is required. In my opinion, it became too liberal in the 1980s, when the representatives of the Chicago school had a major say in economics and law making. Judge Richard Posner, for example, argued that companies should be freed of the old rules which constrained them, which was supposed to have translated into greater effectiveness and more innovation. People like him thought deregulation did not involve a threat of market power abuse. Today, we know that the concentration of market power progressed faster in a deregulated environment, at least in the United States. Often Europe reacts to abuse earlier, as in the cases against Google and Facebook. The world has moved on, especially in terms of new technologies, and for anti-trust law to be effective in this area, it has to be aligned with those changes.

Jonathan B. Baker is a lawyer specializing in antitrust law with the American University Washington College of Law. He is the author of “The Antitrust Paradigm”.