The political climate and fears about the growing role of the state in Polish companies and institutions have also had a strong impact on investors. All this together undermines the confidence of investors in Poland as a good place to invest capital. Those in power have the means to change these opinions and they should definitely use them.

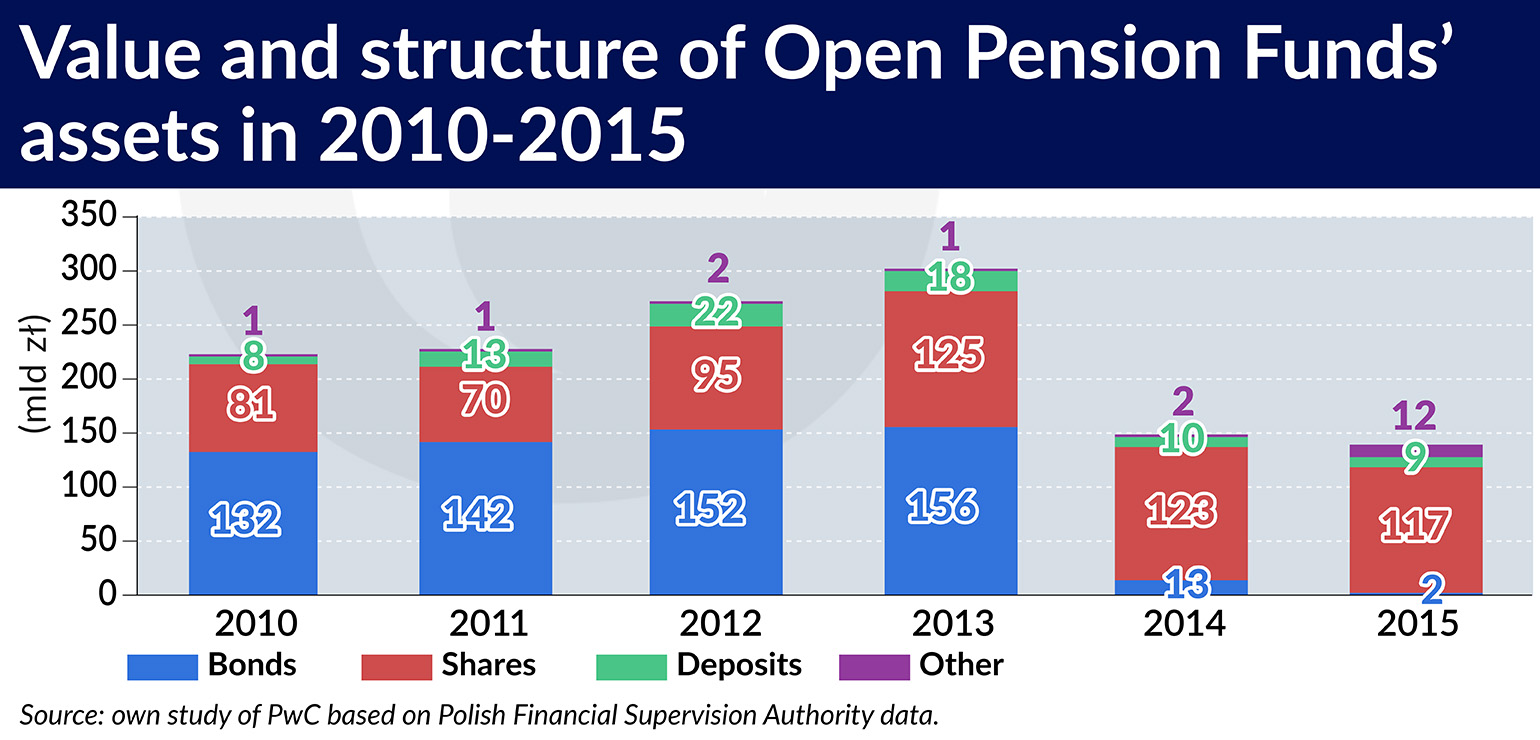

A negative narrative dominates in the public debate on the economic changes in the country. This is strengthened by the actions of politicians at an EU level (the Venice Convention and European Commission). Meanwhile, the majority of key issues for the government’s economic program can be considered in two ways – optimistically and pessimistically: the banking tax and retailer tax (increasing the tax burden, but also increasing funding for development projects), the Family 500+ program (posing threats to the budget but at the same time supporting consumption and demographic change), assistance for holders of Swiss Franc-denominated loans (a risk to the banking sector but at the same time the prospect of unblocking the housing market), or the possible total liquidation of the Open Pension Funds – OFE (a threat to future pensioners but a chance to lighten the burden on the state budget and reduce systemic costs).

The biggest excitement and fear among investors is triggered by the possible reform of Open Pension Funds (OFE) or the possible transformation of the third pillar of the pension system with the use of the state fund created from savings voluntarily deposited by Poles. In the opinion of the financial community, the current conception for reforming the system is tantamount to marginalizing the stock exchange and losing credibility of the authorities in the eyes of foreign investors.

Overestimated role of Open Pension Funds

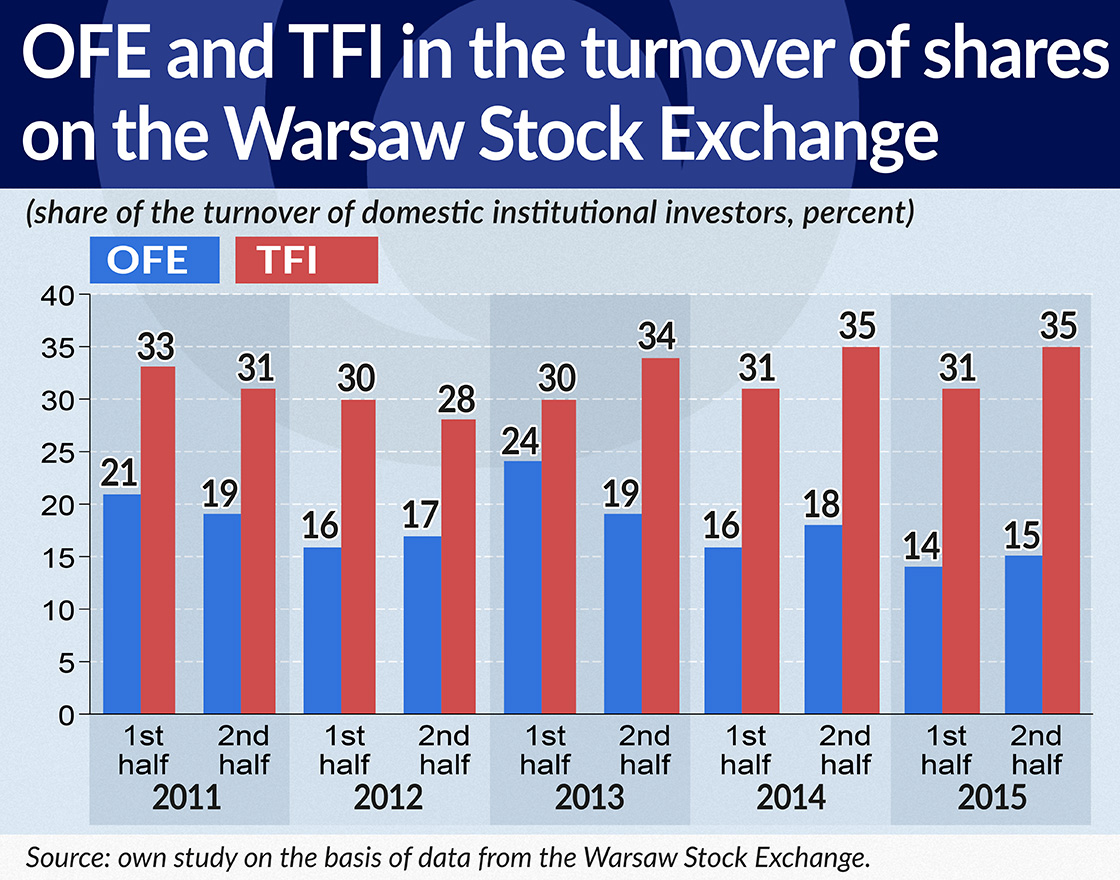

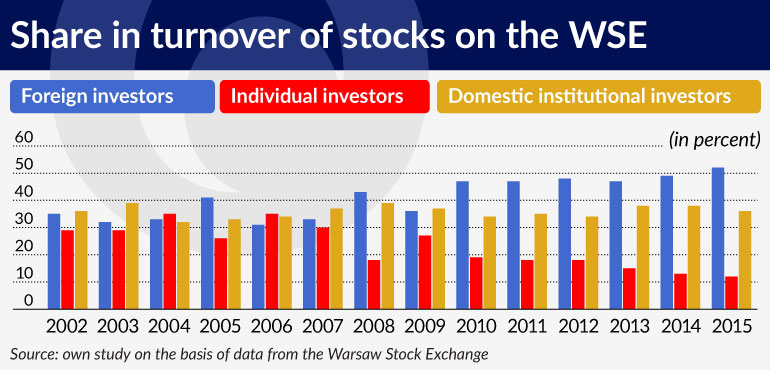

One of the arguments most often raised against limiting or liquidating OFEs is the fear of the negative impact of such a move on the stock exchange and financial market. These fears may be exaggerated. In 2015, the share of this group of investors in the turnover of shares in the Warsaw Stock Exchange’s main market did not exceed 15 per cent. In other words, it was almost half the size of the investment fund management companies (TFIs) and market makers. At their peak in the first half of 2013, the OFEs generated 24 per cent of the stock exchange turnover. At the same time, the OFEs held an almost 25 per cent stake in 70 companies listed on the Warsaw stock exchange, and in 9 of them they held a stake exceeding 50 per cent at the end of 2015.

In the whole of 2015, OFEs sold shares of Polish companies to a value of PLN1.8bn and spent PLN4.7bn on foreign shares. In that period, the inflow of funds from the Social Insurance Fund (ZUS) reached PLN2.258bn, and transfers under the slider (the gradual transfer of older OFE members to ZUS) stood at PLN4.1bn. In the current situation, OFEs no longer play a key role in the stock exchange and neither do they have the possibility to fulfil the role of a market stabilizer, a role which was attributed to them and was highly exaggerated. It was believed that they would be able to buy shares at a time when their prices were falling too much and did not reflect their intrinsic value, and to sell shares in the opposite case.

The consolidated assets of OFEs under the umbrella of the state fund or also the use of a state vehicle to get the third pillar of the pension system off the ground will raise fears related to ownership issues and the risk of the “nationalization” of some of the firms listed on the stock exchange. In many cases, a majority at the AGM is not needed to decide their fate; it is enough to have a significant stake if the remaining shareholders are passive. However, it is possible to imagine regulations forming a kind of code of good practice of the State Treasury in public limited companies that would limit the possibility of the state to make decisions against the remaining shareholders.

Credibility of the market

One of the most accurate market maxims is that the thing that investors dislike the most is uncertainty. It is during periods of uncertainty that they make the least rational decisions, because they exaggerate the threats. However, they are capable of “evaluating” even the worst news and realistically taking it into account in the prices of assets. Therefore, the inability of those that govern to conduct a dialogue with investors and the lack of awareness of how important the fulfilment of every word is can be fatal. In the long term, fulfilling these two tasks is the best way to build market credibility.

In this context, Poland is currently dealing with extremely unfavorable circumstances, since the level of uncertainty is very high, and the skills required to obtain the favor of investors are rather limited, as evidenced by the example of the ratings agencies. It can be assumed that one of the key factors determining confidence in the Polish economy and Poland’s assets will be the state budget for 2017, which will fully take into account the spending projects of the new government and to a limited extent will benefit from measures that increase revenues.

Activities of companies by order

The possibility to exert influence inside companies through a majority stake which may be held, for example, by the state, is an illness of the capital market, which has a wider dimension and is not only related to the question of solutions to the pension system. Poland will continue to struggle, as long as the State Treasury is a significant shareholder of companies listed on the stock exchange or until private companies start dominating the Warsaw Stock Exchange. Meanwhile, for years the debuts of state companies were the motors driving the development of the stock exchange. However, Poland failed to simultaneously create incentives for the largest private enterprises to have a presence in the public market.

The wider dimension is that the problem of owner interference in the actions of the boards affects not only companies where the State Treasury has a significant stake, but also private firms in which the main shareholder does not care much about the opinions of the minority and demands that the company realizes certain projects. This is a question of compliance with good rules of practice in the capital market. Failure to comply with them scares off new potential investors.

The list of companies with a majority stake held by the State Treasury in which the Minister of the State Treasury exercises shareholder rights currently covers almost 50 entities, but when we add to this the minority shareholdings, there are almost 400 companies. In the first case, the value of the share capital of these companies reaches almost PLN 37 billion, of which one company, the power company PGE, accounts for roughly PLN19bn. In the second case, the value is even higher, reaching PLN44bn, but of this PKP Polskie Linie Kolejowe accounts for almost PLN17bn.

Capital for firms

Poland’s stock exchange plays only a small role in the financing of the economy anyway, both in the time of the flourishing of the OFE’s and in the time of winding them down. The overwhelming majority of the debuts have the character of disinvestment, in other words, the sale of shares by the current owner. This is not connected with the issue of new shares, from which the funds obtained would be assigned for the development of the enterprise. In recent years just under 20 per cent of the value of IPOs resulted from the offer of new shares. At the same time, very few companies currently listed on the stock exchange decide to raise capital in order to finance their operations. A diagnosis of the reasons why this is the case will definitely not boil down to a lack of capital willing to be invested.

An ambitious program of reindustrialization, connected with the activation of domestic capital, creates new opportunities for the development of the Polish financial market. In this regard, the decisions of Poles regarding the funds obtained under the Family 500+ program could turn out to be crucial. Putting aside for the future of their children as little as 5-10 per cent of this amount would create an impulse for saving-investment products. Małgorzata Zaleska, the CEO of the Warsaw Stock Exchange, who saw the possibility of paying part of the child benefit in the form of bonds, recently spoke about ideas for such use of the money.

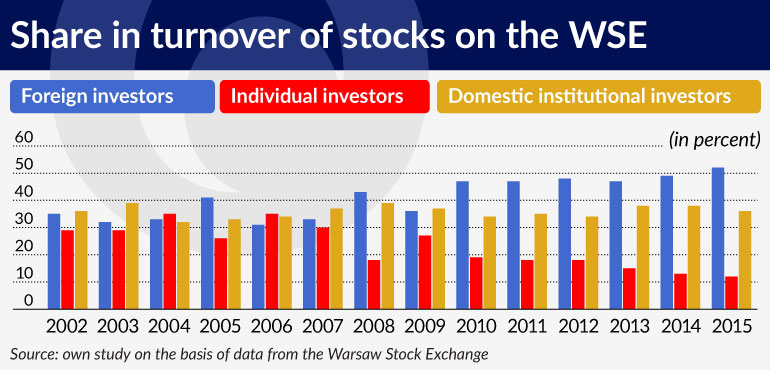

Marginalization of the stock exchange

According to the World Bank, the ratio of capital of Poland’s stock exchange to GDP reached 31 per cent in 2014. This is a very mediocre result, although in Europe there are cases where the stock market is much less significant. These same data reveal that in Austria the ratio is only 22.2 per cent, in Greece 23.4 per cent, in Portugal 25.1 per cent, and in Italy it is 27.4 per cent. On the other hand, the stock exchanges of France, the United Kingdom, Holland, Belgium and Spain have greater importance. The share of individual investors in the turnover of shares in Poland has fallen to a record low level of 12 per cent.

Therefore, it is difficult to speak of a significant position of Poland’s stock exchange. It should be much more important and the path to this certainly is not the compulsory allocation of part of the pension contributions for investment in shares, as it was in previous years, or an increase in capitalization by the introduction of state companies on the stock exchange. Currently, the share of the State Treasury in the shareholdings of listed companies is estimated at around 16 per cent. To the largest extent, these constitute the shares of two large power companies – PGNiG and PGE, worth a total of PLN37bn.

The share of individual sectors on the Warsaw Stock Exchange, which is inadequate to the structure of the Polish economy, is also a problem. The financial sector and the power sector are dominant, representing almost 40 per cent of the changes in the main index. A new opening in the Polish economy creates the opportunity to increase the sectoral diversity of the Polish stock exchange. Plans to create sectoral “valleys”, such as rail or shipbuilding “valleys”, represent such an opportunity.

Market competition

The form of local markets, particularly the most sensitive of these – the power, fuel and telecommunications markets – is to a greater degree dependent on regulatory decisions than on ownership structures of the enterprises. However, without a doubt, both of these issues are related to one another, because the liberalization of the market goes hand in hand with its privatization. A good example of this is the telecommunications sector.

At the same time, increased consolidation activities can be expected so that firms in which the State Treasury has a stake will have the capacity to expand abroad and occupy the position of regional leaders. In this context, the food industry is most often mentioned, which after consolidation could have a greater presence in the region. However, on the local backyard, the current authorities are trying to help smaller companies of a Polish origin. A prime example in this respect is to be the retailer tax, which favors small businesses.

The strong influence of politics on financial markets is a characteristic of not only the last several months, but has been noticeable for several years. Suffice to mention that the previous government engaged power companies in unprofitable investments, burdened mining companies with a tax on deposits, limited the functioning of the OFEs and was passive in the face of the deteriorating condition of mining, which led the largest companies of the sector to the edge of bankruptcy, and then destabilized the coal market, causing problems also for the mines that were functioning relatively well. Under the pressure of the upcoming elections, promises to help holders of Swiss Franc-denominated loans appeared from various quarters.

When assessing the situation today, it is necessary to be aware that the Polish economy has faced the greatest changes for over a decade and perhaps even longer. For this reason, the issues that appear cannot be analyzed individually, but as an element of a whole. This is why the public concerns should be considered in the context of the most important elements of the plan presented by Deputy Prime Minister, Mateusz Morawiecki, which boils down to 5 key ideas: reindustrialization, development of innovative firms, capital for development, foreign expansion and social and territorial development. The balance of forces in the Polish economy in the coming years will depend on the scale and pace that the plan will be implemented.

In all the discussions on the impact of ownership changes on the Polish financial market, the most crucial is a transparent policy of the government regarding state enterprises, a closed catalogue of strategic interest companies, which is a result of a cross-party consensus, a clear policy on “residual” stakes in companies that have already been privatized, and strict observance of the interests of minority shareholders and corporate governance rules, as well as an open information policy. The boards of all the companies should be aware that for the financial investors it is crucial to have a clear development strategy, transparent finances and a competent and trustworthy board giving an assurance that it will be able to take advantage of opportunities in favorable economic conditions and face up to adversity during economic downturns.

A clear outline of the role of the capital market in the realization of the country’s development program would boost investor confidence. Today, the stock exchange is drifting without a good idea for its future. One of the aims of the Morawiecki plan, which is to increase the share of investment in GDP, obviously creates opportunities for the capital market. In a similar way, the driving force for the development of smaller firms could be the investments of large enterprises. However, this would mean not only construction of infrastructure, but above all development investment, which is characterized by its long-term support of economic growth.

The recently announced program Start in Poland, which is to comprehensively support innovative firms that are at the start of their development, could be a good example of this. It involves finding innovative products, developing them and ensuring markets at home and abroad. All this with the help of not only public funds, but also thanks to the involvement of large enterprises, which share their knowledge and experience.

A challenge is to ensure funding for the ambitious plans of economic development. So far, foreign capital has played first fiddle in this respect, but now it may be necessary to boost the involvement of domestic funds. However, there is a limited amount of domestic funds, because for years the creation of long-term savings in Poland was neglected. Suffice to say that the bank deposits of Polish citizens is only double the funds that will flow to Poland from the European Union in the coming years. Corporate deposits of this type are half the figure for households.

The state doesn’t have to be bad

Even in the opinion of the bosses of private firms, the state acting as owner can give an enterprise an advantage. A survey done by PwC indicates such areas as supporting social projects, building infrastructure, and strengthening stability in times of crisis. However, respondents mainly fear the destruction of the value of firms when best practices are not observed and when corruption, inefficiency and theft occur.

At the same time, this same research shows a deterioration in the perception of the state as owner in recent years. As many as 87 per cent of respondents agreed that this type of property creates a conflict with the regulatory role of the state, 86 per cent were of the opinion that it leads to political intervention in the market, 83 per cent were convinced that it disrupts competition, and 72 per cent that it discourages foreign competition from entering the market. In all these cases, there was an increase in the percentage of such responses by a dozen or so percentage points compared to the survey in 2010.

One should also be aware that the recent years, marked by crisis phenomena, have been conducive to the growth in importance of the state as owner. It is estimated that among the world’s largest enterprises in 2014, almost 23 per cent were precisely such type of firms, while in 2006 there were only 8 per cent. However, this statistic is somewhat misleading, because in the majority of cases these were Chinese companies. Without these, state-owned companies accounted for 8 per cent, compared to 5 per cent in 2006. No less interesting is the fact that the companies in this group were characterized by higher than average profits.

Global implications

Since the end of 2014, the yields on Polish 10-year bonds rose from 2.53 per cent to almost 3.2 per cent, which means a fall in prices and losses for bondholders. At the same time, the value of the basket of currencies, half of which is made up of euros and the other half – of dollars, has increased from PLN2.89 to over PLN4.11, while the main index of the Warsaw Stock Exchange, the WIG, has gone down from 51,400 points to 45,300 points.

The simplest statistics of Polish markets are therefore performing very badly, because all their elements of assessment have lost value since the prospect of a change of government in Poland appeared on the horizon. Unquestionably, both these facts can be linked, but it would be unfair to be content with such a one-sided explanation for the weakness of Polish assets.

In order to understand it well, it is necessary to look at the global context. During this period there was a general aversion to assets from emerging markets, which had its source mainly in the ultra-liberal monetary policy of the central banks of developed countries (the USA, euro area, United Kingdom and Japan). This, on the one hand, attracted capital to developed markets, because there was the greatest potential for earnings on the low interest rates (it was possible to borrow money cheaply, so it was easy to earn even on small market movements), and on the other hand, it was perceived as confirmation of the weakness of the world economy (otherwise, the central banks would not have had to resort to extraordinary measures).

At the same time, the slump in the commodities markets was a consequence of the miserable condition of the global economy, rocked for a long time by a variety of problems (from the collapse of the US housing market, the debt crisis in the euro area, the slowdown in China, to the current Brexit) and the related disinflation. This traditionally has an adverse effect on the perception of emerging markets, for whom income from the export of commodities is a significant part of GDP. However, Poland continues to be associated with this group.

Whether Poland wants it or not, it has to contend with global phenomena. Meanwhile, for a long time they have not been favorable for Poland. However, rebuilding the confidence of investors in such a difficult period may repay twofold when conditions once more become favorable.