(By D.Gaszczyk/CC BY by lydia_shiningbrightly)

According to representatives of the greatest providers of energy generated from coal and gas and in nuclear plants, the days of the idea of creating a European market based on the principle of the so-called copper plate, that is without any restrictions to the flow of electricity, are numbered. As a result of the economic crisis both demand for and prices of energy declined. Alongside, the share of generously subsidized „green” electricity from wind turbines and solar panels is growing in the European energy mix. It ousts conventional energy sources that do not benefit from subsidies.

Consequently, we can expect the advent of the so-called “power market” era. Today, as a result of the interplay between demand and supply, power plants receive money for the generated electricity; they would also like to be paid for their willingness to generate it. The majority would also be willing to sign long-term contracts for the delivery of energy at a guaranteed rate.

Marek Woszczyk, president of the Energy Regulatory Office, notes signs of resentment among energy providers in relation to long-term contracts (LTC) that guarantee to power plants the sale of the generated energy. In the 1990s, this solution was applied to provide power plants with supplementary financial tools that they may take out loans for modernization.

- It is evident in a number of European countries that have already made decisions in this respect, although not yet in Poland. These solutions are often described today as the „power market” or “generating capacity compensation mechanism”. They do not, of course, have the same legal structure as Polish LTCs, but their function is quite similar – they seek to guarantee a stable and long-term source of income for power generating companies. The concept of power market often boils down to paying not only for electricity, but also for a company’s maintained production capability – says Marek Woszczyk.

Lobbying of energy providers

According to Marek Woszczyk, this kind of power market has one drawback.

- It restricts and distorts competition in the market and this is generally not beneficial to the public. We must therefore adopt an extremely prudent approach. An ill-advised decision to support the energy sector in its present form with such mechanism would enhance the industry’s existing inefficiencies – says the President of the URE.

Poland’s largest energy providers, namely i.e. PGE and Tauron (both controlled by the State Treasury), have been advocating this kind of support. They can rely on significant support from foreign investors, such as EDF and GDF Suez from France, which also have a considerable share in the Polish market.

Contractors are also lobbying for solutions that are beneficial to energy companies, as for them the collapse of a large part of investment projects in Europe means the threat of financial losses and layoffs. One of them, GE, published a report which calls for providing special support to energy companies planning to build new power plants.

Americans, assisted by E3G think-tank, suggest the introduction of long-term contracts concluded between energy consumers and suppliers, as well as fixed and guaranteed prices for the purchase of energy generated in low-carbon power plants. In their opinion, the failure to meet these demands will result in a stagnation of the European energy sector.

Companies that have cancelled further investments (since 2012, over 30 GW of power has been foregone in Europe; in Poland, the most dramatic decisions concerned Rybnik (EdF) and Opole (PGE), with a total value of nearly PLN 20 billion) are supported by powerful Polish organizations, the Employers of the Republic of Poland; during the last Polish Economic Congress, President Andrzej Malinowski called for assistance on behalf of energy companies.

Prospective prices are difficult to predict

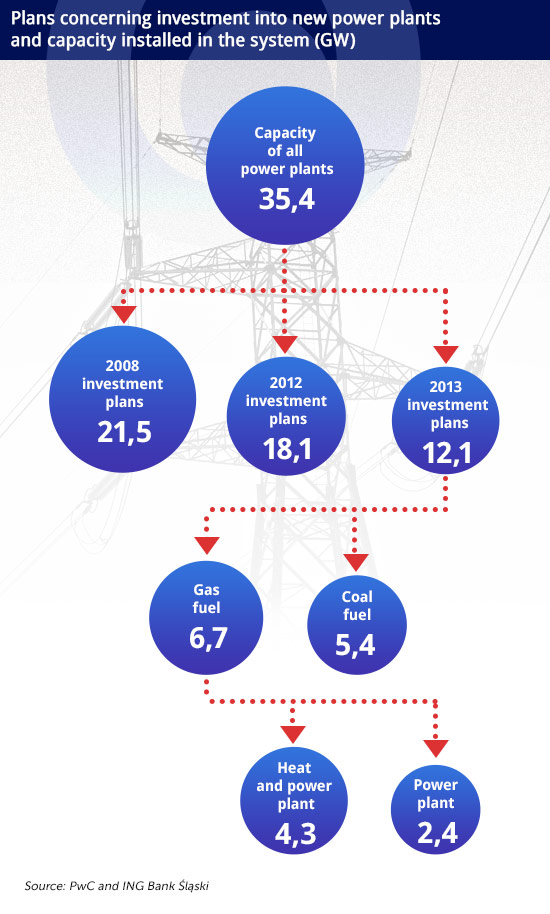

According to all energy providers, the fall in energy prices makes it impossible today to invest in expensive power units (construction of a unit with a capacity of 900 MW costs approximately PLN 5 billion). According to PwC and ING, authors of the third edition of the report on the financing of energy entitled „Not only production„, given today’s prices of CO2 emission allowances (European plants have to pay for „polluting” the atmosphere) and of coal, the profitability threshold of an investment involves electricity prices being set at the level of at least PLN 200 per MWh.

According to the analysts of Espirito Santo, any return on investment is possible only at the level of PLN 222/MWh for coal and PLN 173/MWh for lignite. An analysis of data from the Polish Power Exchange indicates that these prices are unattainable today, as energy providers make PLN 150-160/ MWh and there is no indication that the rate could go up.

According to Ireneusza Łazor, President of TGE, any attempts at predicting the price of energy are like looking into a crystal ball.

- Banks want to know energy prices in a few decades, as future cash flows depend on it. Nobody can predict it today; in fact, it has never been possible. There is no crystal ball. Even if today’s prices were high, who can guarantee that they will remain so over the next three decades? Nobody can – says Łazor.

The president of TGE is of the opinion that today’s GDP growth is not enough to guarantee a rise in prices.

- We must remember that the economic slowdown will not last forever. It’s cliché, but we must bear in mind that a downturn will be followed by a recovery – says Łazor.

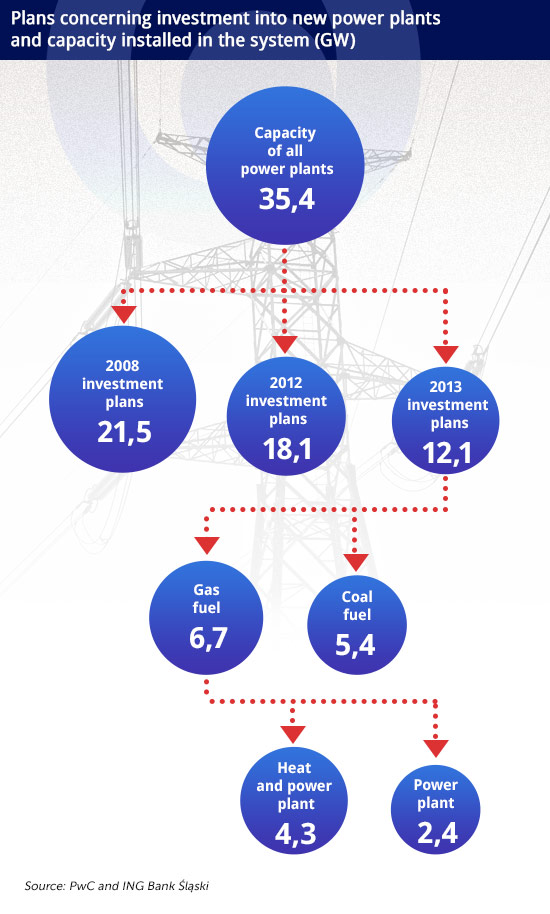

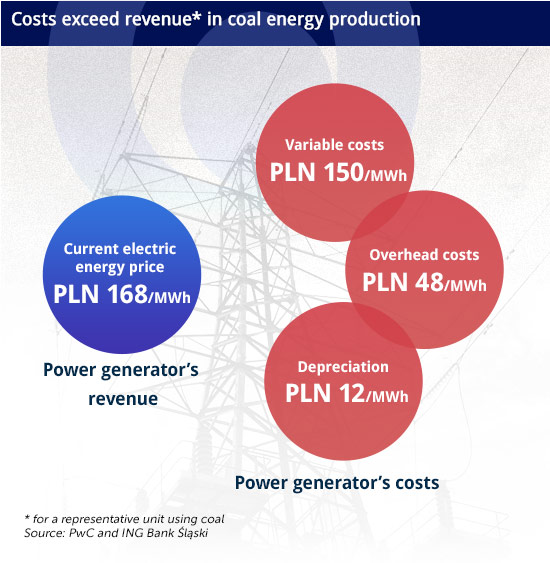

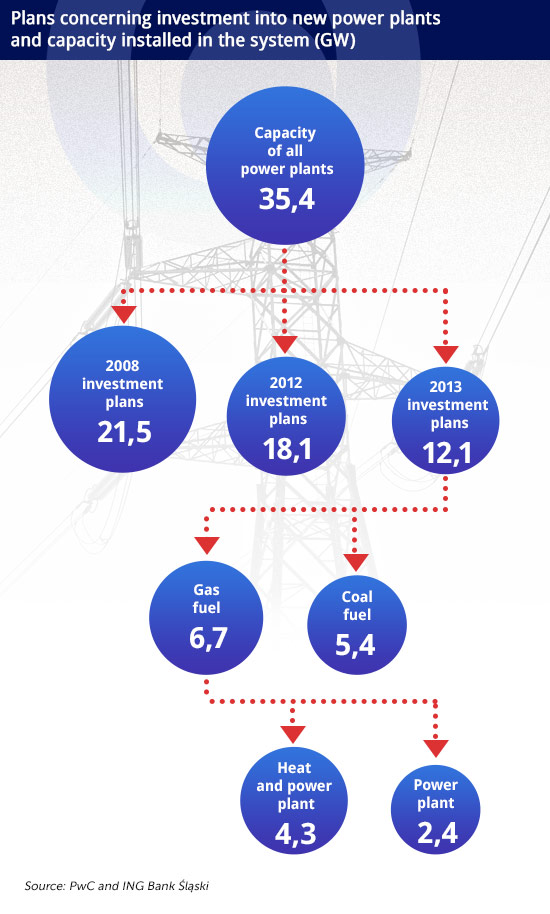

At present, however, the price has been falling; consequently, in early April, PGE withdrew from its plan to construct a new 1800 MW power plant in Opole. However, according to the Ministry of Treasury, which is supervising the company, and the Ministry of Economy, which is watching over the expansion of the sector, the construction of this power plant was important for the country’s energy security. Simply put, when in 2016-2019 the oldest Polish power plants with a total capacity of 6500 MW will close, Poland may start running out of energy. Earlier, EdF, Fortum and RWE decided to put their projects on hold, while the profitability of other investments is extremely uncertain. Consequently, future plans of Polish companies, providing for the capacity of 21.5 GW, as declared in 2008, had to be revised and reevaluated to 12.1 GW.

- I do not know the specific reasons for PGE’s decision, so I cannot comment on it. The role of the market regulator does not involve taking a stance on the investment decision of a particular energy provider. Such decision can be made by the management board of a company, and it is the board that takes responsibility for it. However, the regulator’s role involves monitoring the operation of the power system in terms of energy security. In this context, I am interested in the consequences of all investment decisions taken in the energy sector.

For several years now, it has been clear that the situation in the medium-term power balance of the power system – i.e. the ratio of power supply and peak demand – is tense; it has become even more problematic following Opole’s decision – says Marek Woszczyk.

According to PwC and ING, comparing even a modified energy demand forecast with the scheduled closure of old and the creation of new units allows one to conclude that by 2020, 6-9 new units with a capacity of approximately 900 MW will be needed.

”Given that only three projects of constructing new coal-fired units are highly advanced, there is still room for the implementation of several more” – wrote Piotr Łuba from PwC and Kazimierz Rajczyk from ING.

Risk can be reduced

Where to look for directions for their implementation? The President of the Polish Power Exchange believes that the investment stalemate can be cracked with the so-called power market, based on a price corridor.

- It could help to invest in capacity building. A bank would get a tool allowing for the calculation of the minimum and maximum cash flow for a particular unit. This can be achieved by concluding a contract for difference. In this scenario, the maximum and minimum price of energy is fixed. If the market price exceeds the upper limit, the energy provider gives back the surplus amount. If it falls below the minimum rate, the difference is reimbursed. For reference, look at the long-term bond market. In order to calculate the interest, a formula is set and the bonds are indexed according to it. This solution eliminates long-term risks – says Ireneusz Łazor.

- This formula means security. The same rule should be applied to the energy sector. Thus, market liquidity is preserved, as energy remains on the market and, in addition, we use a financial instrument. Any other solution would be detrimental to market liquidity and, instead of the necessary market liberalization, we would go back to the situation from the mid-1990s – says the President of the PPE.

According to the President, the oldest power plants should not benefit from support. He points at the observed tendency to return to long-term contracts. In 2008-2012, over a dozen power plants received over PLN 8 billion following the termination of LTC under the pressure from the European Commission (unlawful public aid). At that time, only one large and low-emission coal-fired unit was constructed in Bełchatów.

The remaining financial resources disappeared in power companies. Contracts were signed in the 1990s, as they were necessary for these plants to contract loans in order to upgrade and modernize power plants; this in turn was necessary for energy generation to be pursued. According to Łazor, the reintroduction of LTCs would not be a good solution.

- Restructuring and privatization of the energy sector have not been completed. Any support for the power sector should encourage investment and improve liquidity. You cannot stop changes in the sector. Even regardless of the European Commission’s approval of such aid, new LTCs would undermine the achievements of the several years of market liberalization – says the head of the PPE.

The above view is shared by the President of URE.

- Polish energy sector has yet to complete the restructuring process, and therefore the introduction of new LTCs would slow down, or even stop the marketization of energy. This is not to say that all segments of the energy sectors or all of its operators are at the same stage of adaptation to the rules of effective competition, but I fear that the sector as a whole is still rather at the beginning of the journey than approaching its end – says Marek Woszczyk.

He notes the melting funds transferred annually in the energy sector to energy providers in order to cover the costs that remain following the termination of long-term contracts; this may generate pressure to replace this form of state aid with another form of support.

- The energy sector is aware of its strategic importance for the economy. It is therefore tempting to use this position at the expense of other segments of the economy, including end users. If it was not for Poland’s membership in the EU and the requirements stemming from the EU directives, the industry would have probably never undergone the reforms that are being implemented. Therefore, the discussion on the so-called power market cannot possibly lead to the establishment of new LCTs. If we really need a mechanism to support investments necessary to balance the demand and supply of power, we must first of all create a transparent and efficient mechanism, dedicated only to new investments, and secondly a mechanism with the least possible negative impact on the development of competition, using solutions that are adapted to the needs of the market – says Woszczyk.

Excessive labor costs in the energy sector

The authors of the GE study note that the introduction of assistance mechanisms is indeed a difficult task. ”It requires the involvement of the European Commission and national governments or, in fact, a significant policy shift in the EC, which has regarded long-term contracts as unauthorized state aid. When Poland joined the European Union, at the request of the European Commission, the state had to terminate all long-term contracts concluded with energy providers; compensation costs for the termination of contracts were borne by consumers (in the form of the so-called transition fee) „- note GE experts.

Experts’ disapproval of support for a wide range of energy providers is due to the important overemployment in Polish power plants, amounting to thousands of power engineers. The majority of power plants and distribution companies must understand the necessity and convince its employees to resign with redundancy packages worth hundreds of thousands of zlotys, as power engineers managed to enforce job security in the middle of the last decade. They will only start to expire in 2014.

According to DM BZ WBK analysts, Tauron is most overstaffed of all energy companies in Poland, and the planned restructuring worth PLN 1 billion will not involve even a half of the possible savings. Analysts of this brokerage office took a closer look at three Polish energy groups (PGE, Tauron and Enea) and compared them with eight European companies, including RWE in Germany and the UK, E.ON Russia, CEZ in the Czech Republic and Bulgaria.

- The results are shocking – sums up Paul Puchalski, head of the analysis department of DM BZ WBK. – The average number of employees in all of the companies surveyed is 0.45 worker per one megawatt of installed capacity; in Poland, it is twice as high. This situation severely affects the operating results of PGE, Tauron and Enea – notes Pawel Puchalski.

According to the report of the brokerage house, the number of jobs in the Polish plants can be reduced by 10,000 (5,300 in PGE, 3,700 in Tauron and 1,000 in Enea) without prejudice to the day-to-day operation of these plants.

- If you add to it the overstaffing in other segments of the energy sector, we can say that the results of PGE and Enea are still underestimated by 36 and 44 percent respectively. Tauron is capable of doubling its current results with an optimal level of employment – estimates Paweł Puchalski.

It will not, however, be done, as the company is planning to reduce the number of staff only by approximately 10 percent. Industry experts believe that overstaffing in Polish public sector companies is 20-25%.

Władyslaw Mielczarski, energy expert and co-author of the consolidation of the power sector, does not agree with the opinion on the overstaffing of the sector.

- The number of employees could be reduced, but the shocking difference of power indicator per employee in the Polish power sector is overestimated, as Western power companies have reduced their employment in groups of workers. In theory, they are not employed, but the company pays for their services, which are now outsourced – notes the expert.

The industry has come in for severe criticism even from some of its members.

- It is not the first nor even the second time when the power sector demand money from the Minister rather than come up with a valid idea – it was a current practice in Communist times and still constitutes to be the norm – says one of the managers of a large power plant.

- The introduction of a power market is, in most cases, an attempt to guarantee employment in power plats that are redundant and old. This solution will be strongly espoused, because it is simply more convenient. The closure of power plants is a political risk and may result in a few managers getting the sack. However, only a few among the oldest power plants are in fact necessary for the proper operation of the power system. Support should be targeted at new projects, provided that they are necessary for the country’s energy security – says our source.

The author is a journalist of Dziennik Gazeta Prawna