Tydzień w gospodarce

Category: Raporty

(infographics Dariusz Gąszczyk)

Analysts have long held that the exchange rate of the PLN to the EUR will rebound to its long-term trend even after a period of temporary turmoil given the robust macroeconomic foundations of the Polish economy. However, there are many indications that the PLN exchange rate assumed in the government budget is overly optimistic.

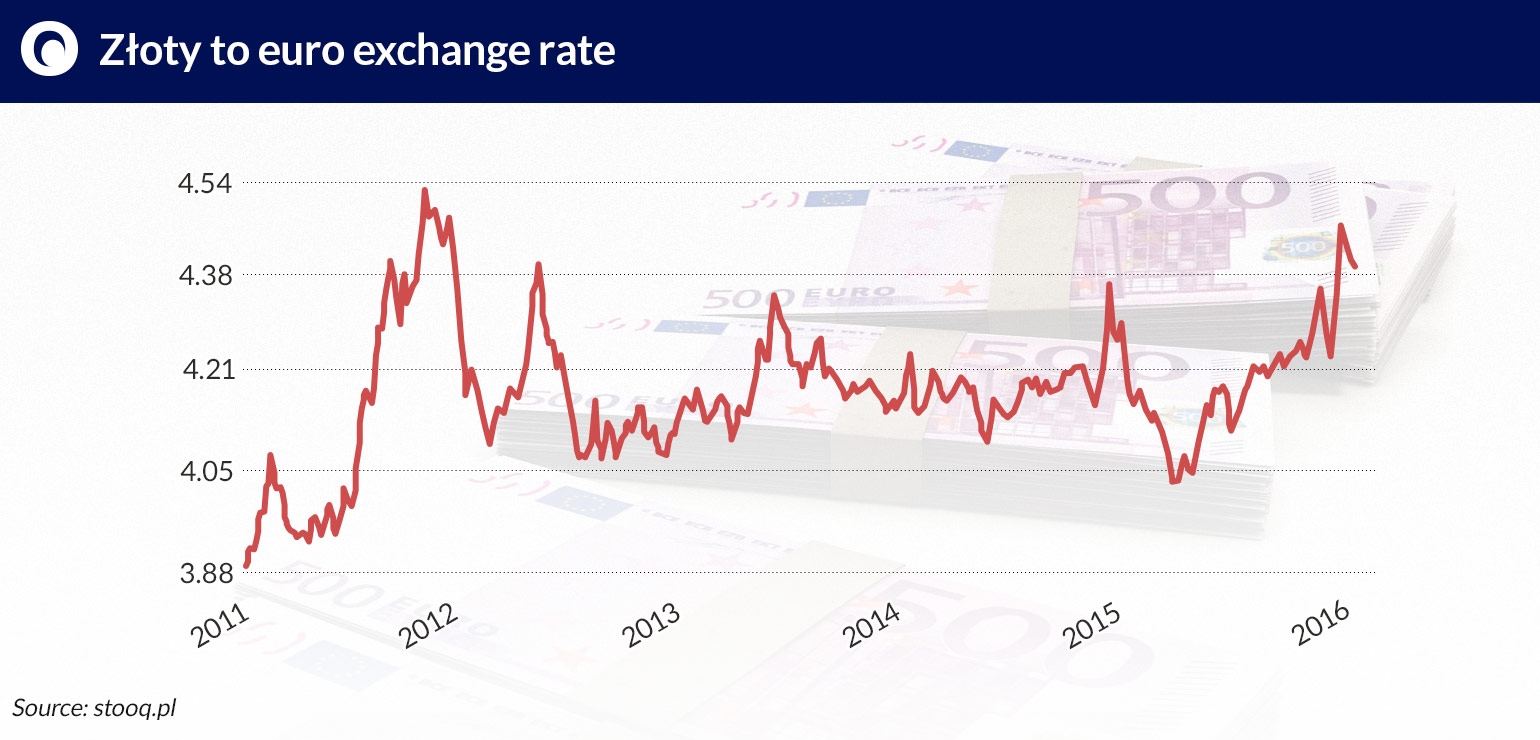

Over the last 15 years, the average annual exchange rate of the PLN against the EUR has changed in an irregular manner. It reached its highest value of PLN4.53 per EUR in 2004, and its lowest value of PLN3.52 per EUR in 2008. The average annual exchange rate has fallen below PLN4 six times, with the last instance in 2010. It was only between 2006 and 2008 that the average annual exchange rate of the EUR stayed below PLN4 for three consecutive years. In the last four years the average annual exchange rate remained “anchored” within a surprisingly narrow range of PLN4.18 to 4.20 per EUR.

For some time now there has been a popular and theoretically justified consensus among researchers and analysts that the sound macroeconomic foundations of the Polish economy, the high economic growth in relation to the countries of the EU and Central and Eastern Europe, and the avoidance of a recession in 2009, are all important factors strengthening the PLN against the EUR and other currencies.

Other factors also strengthened Poland’s credibility, which had a positive impact on the PLN exchange rate:

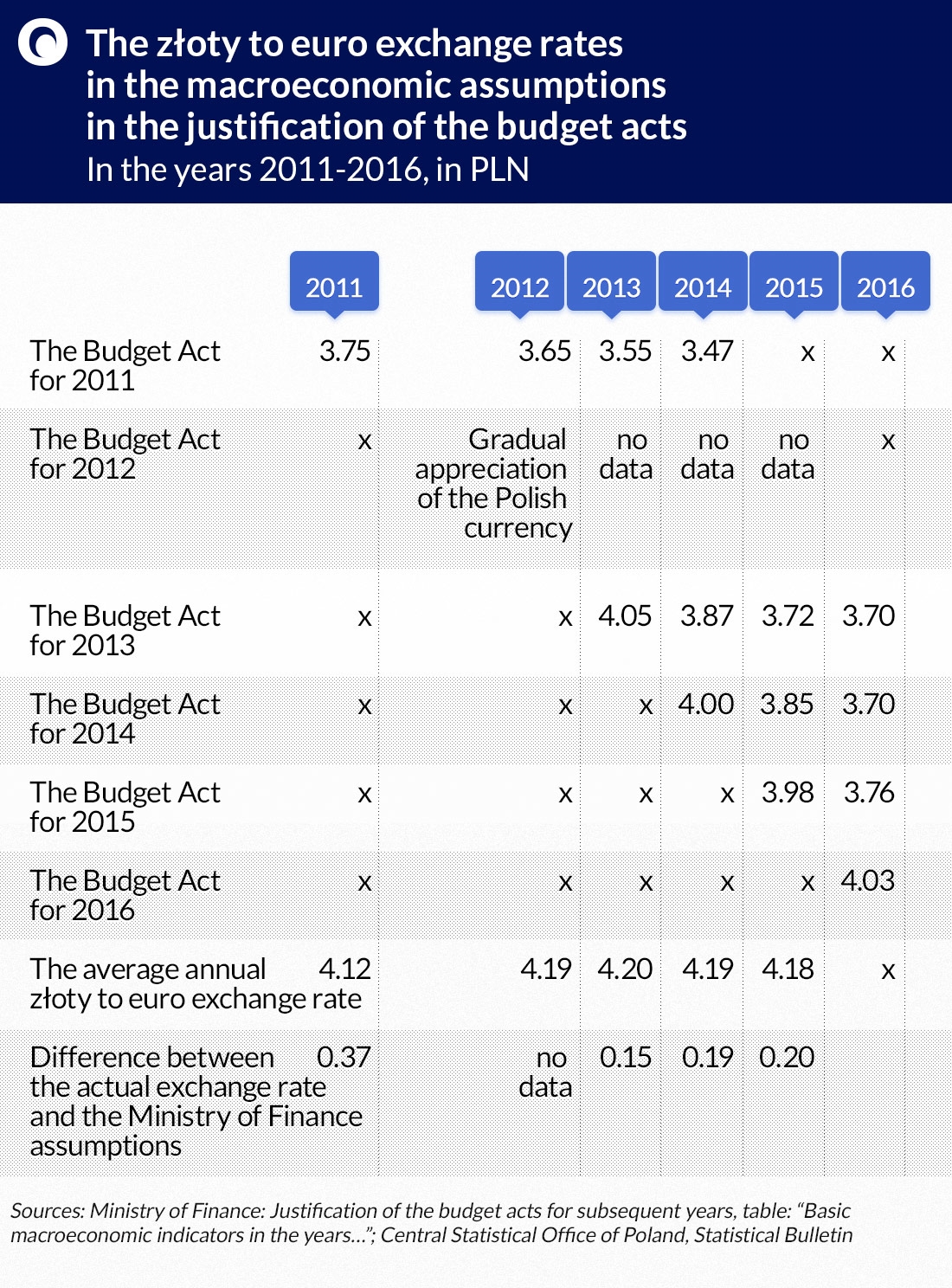

Those factors led to the premise in the annual assumptions for the budget law that the PLN would strengthen. Meanwhile, contrary to expectations, 2006-2008 the PLN was stronger against the EUR than in 2012-2015. We could therefore conclude that in the last decade the PLN has exhibited a tendency to depreciate rather than appreciate.

(infographics Dariusz Gąszczyk)

The data presented in the table show that the assumptions adopted in the budget acts concerning the strengthening of the PLN against the EUR were inconsistent with the actual exchange rates calculated after the fact. In the last two years this difference amounted to approx. 20 grosze (PLN0.2) and there are plenty of indications that it will be even greater in 2016.

Monitoring the changes in the exchange rate of the PLN against the EUR in the long run shows a frequently repeated pattern. It involves fairly large depreciations of the PLN resulting from various, mainly external, economic developments, and a slow and arduous appreciation, which does not always fully make up for the declines. The basic explanation for this mechanism lies in Poland’s inclusion in the group of so-called emerging economies, which puts all of them in a single basket. That means financial problems in China, Russia, or even Hungary cause an immediate loss of international investors’ confidence in all other emerging economies.

Regardless of whether such an approach makes sense, the fact is that international financial investors often treat emerging markets as a single unit. This often leads to the withdrawal of capital from these markets, translating into a weakening of the currency. Finally, financial markets typically react much more strongly and abruptly to negative signals and information than to good news.

The changes in the PLN exchange rate are also influenced by domestic events, which are closely observed by financial markets. While reckless statements by influential politicians may sometimes cause slight exchange rate fluctuations, it is the assessment of the effect of the government’s economic policies and the statistics presenting the main macroeconomic indicators that matter the most in the end.

The exchange rate is of great significance for the Polish economy. A weak PLN means higher costs of servicing the foreign currency debt (33.9 per cent of the public debt at the end of the third quarter of 2015 according to the place of issue criterion), a growing inclination for economic migration, expensive imports, low purchasing power of Poles travelling abroad and less pressure on the efficiency of exporters. With a strong PLN, debt servicing becomes cheaper, the motivation to emigrate decreases, citizens can afford more abroad and exporters are forced to improve their efficiency. The PLN-EUR exchange rate also affects Poland’s treaty obligation to eventually adopt the common currency.

The short- and medium-term prospects for the strengthening of the PLN are not good. The sentiment on European and global financial markets is worse than in previous years. Uncertainty associated with low prices of oil and other commodities caused by China’s slowdown, the refugee crisis and armed conflicts in the Middle East, is reflected in the cautious attitudes of investors. They are now more reluctant to put their money into emerging markets, including Poland.

The eight-year-long rule of the PO-PSL coalition, which was in general well regarded abroad, had a small influence on the PLN’s strength. However, the changes being introduced by the new government, such as a bank tax and taxation of retail stores, increases insecurity among foreign investors who are bracing for further surprises. The recent controversial downgrading of Poland’s rating by Standard & Poor’s was just one manifestation of such uncertainty.

The combined impact of these fears will most likely outweigh the effect of the numerous factors arguing for an appreciation of our currency. There is much evidence that the PLN to EUR exchange rate assumed in the budget will once again prove overly optimistic.