The European legislation introduced in 2013, known as CRD IV, imposed a limitation on bonuses in banks preventing them from exceeding 100 per cent of the basic salary. They may exceed it two-fold only with the consent of the general meeting of shareholders. These rules were enacted in order to reduce the incentives for bankers to undertake short-term risks that could jeopardize the long-term sustainability of the banking institutions.

These rules were also the aftermath of numerous cases enraging public opinion which occurred after the outbreak of the global crisis, when banks were collapsing and were rescued at the expense of the taxpayers, while the offenders – at least in the sense of the responsibility that t hey bore – received multi-million severance packages. The most spectacular example was the 2008 collapse of the Royal Bank of Scotland, which happened as a result of the earlier aggressive expansion policies managed by the CEO Fred Goodwin. In order for the global giant not to collapse and not to take many other institutions with it, the state had to raise its capital by 84 per cent. Goodwin was let go and received a multi-million severance payment.

The limitation on bonuses and the identification of the so-called risk-takers has been in force since 2014. Bankers’ remuneration exceeding EUR1m per year and the salaries of risk-takers are monitored by the European Banking Authority (EBA). The EBA published its second report showing the trends in the remuneration of this group. It contains data for the year 2015.

The introduction of new rules starting from 2014 resulted in a significant increase in basic salaries of high-level staff, which the EBA already noted in last year’s report. Its results showed that the banks had identified a much broader group of people responsible for their risk profile, that is, the risk-takers. Just one year earlier this group included 59 per cent of the well-paid workers, and in 2014 this figure reached 87 per cent. The latest report shows that, while there has been a significant increase in the numbers of top earners, the percentage of risk-takers has not increased and amounts to 86 per cent of bankers with salaries above EUR1m per year. The EBA has concluded that the principles of identifying people responsible for the risk profile are transparent and stable.

After the decline in the ratio of bonuses in relation to fixed remuneration in 2014, one year later we can see that old habits are starting to come back. In 2015 this ratio increased to 147 per cent. This trend, however, is due to the fact that several states are applying derogations from the CRD IV with regard to salaries in the field of asset management, where the ratio of the bonuses to salaries is 468 per cent. In several other countries there are also derogations covering other lines of business, as a result of which the average bonuses amount to 219 per cent of the basic salary.

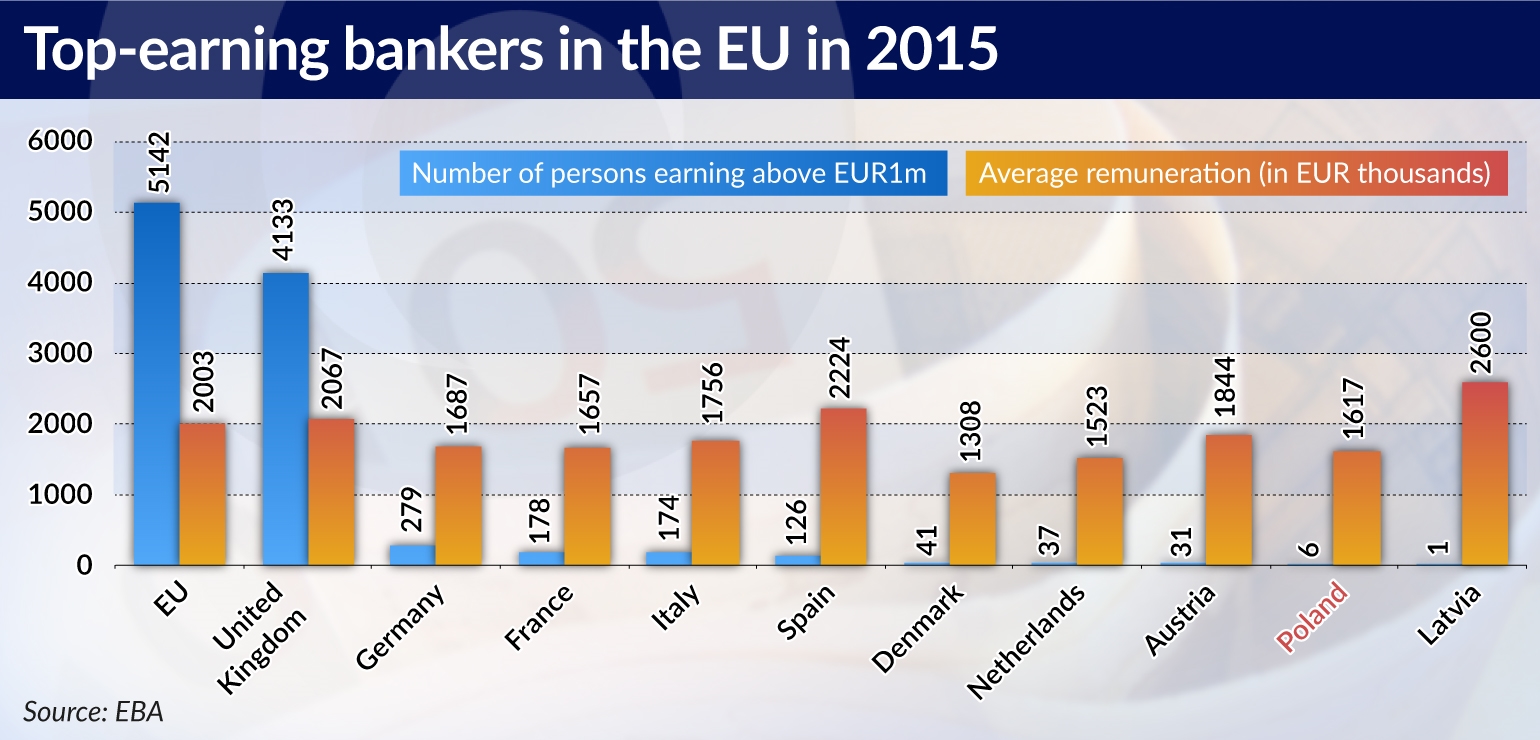

Of course the largest numbers of the highest-paid bankers work in London. These are 4,133 people making over EUR1m per year, which accounts for more than 80 per cent of the entire surveyed population. In 2015 their number increased by 41.25 per cent. The EBA points out that this is in part the result of an increase in the value of the GBP in relation to the euro in 2015. Most top-earning bankers (more than half) work in investment banking, but the highest salaries are found in asset management.

Outside of the London City, top-earning bankers work in Germany (279 people), in France (178), in Italy (174) and in Spain (126). In general, the number of highly paid bankers increased significantly in almost all the countries of the European Union. The exceptions are Hungary, Luxembourg, Finland, Norway, the Netherlands and Poland. In Poland, just six people earned more than EUR1m per year in 2015, and the average among that group was EUR1.6m. Two years earlier nine people earned over EUR1m per year. The best-paid banker in Poland is the CEO of Pekao S.A.(formerly part of the UniCredit Group) Luigi Lovaglio with EUR2.8m of an annual income in 2016. His salary was EUR1.03m, bonus EUR918,232, and additional income was EUR310,083. The second best-paid is the CEO of Millennium Bank (owned by Banco Comercial Português) Joao Bras Jorge with annual total income (salary and bonuses) of EUR1.1m.

How much money are the top-earning bankers making? In 2015, the average fixed salary in this population amounted to EUR2m. The top-earning asset manager in London received EUR33.7m in 2015, with only EUR200,000 in the form of salary. The second person on this list earned EUR28.4m and was also an asset manager. The highest salary of a CEO amounted to EUR26.2m, and six people from the City earned more than EUR20m. Because some financial institutions have already announced that they will move their operations from Britain in connection with Brexit, it can be expected that this trend will be reversed.

Right now in the continental Europe even the highest salaries are much lower than in London. In Germany, the record remuneration was EUR13.9m, out of which EUR5.7m was paid in the form of salary, while the bonus amounted to EUR8.2m. In Spain one bank paid its CEO EUR10.2m, and another EUR9.6m. In Italy, the CEO of one of the banks was able to earn EUR5.1m.

For this year, the EBA announced the publication of an analysis of the remunerations in European banks in the years 2015-16. Such analyses will then be published every two years, and a cumulative report on remunerations will be published each year.

The full EBA’s report can be found here.