Tydzień w gospodarce

Category: Raporty

This is not due to financial reasons — what they really lack is a genuine ecosystem for the fintech industry. Legal, administrative and financial cooperation between the world of business, science and money within the country increases the chance of international success.

The fact that the fintech revolution is breaking into the world of finance has been known for several years. It is also no secret that online commerce is rapidly expanding, as a result of which Amazon and Alibaba have grown to gigantic sizes and are valued at hundreds of billions of USD.

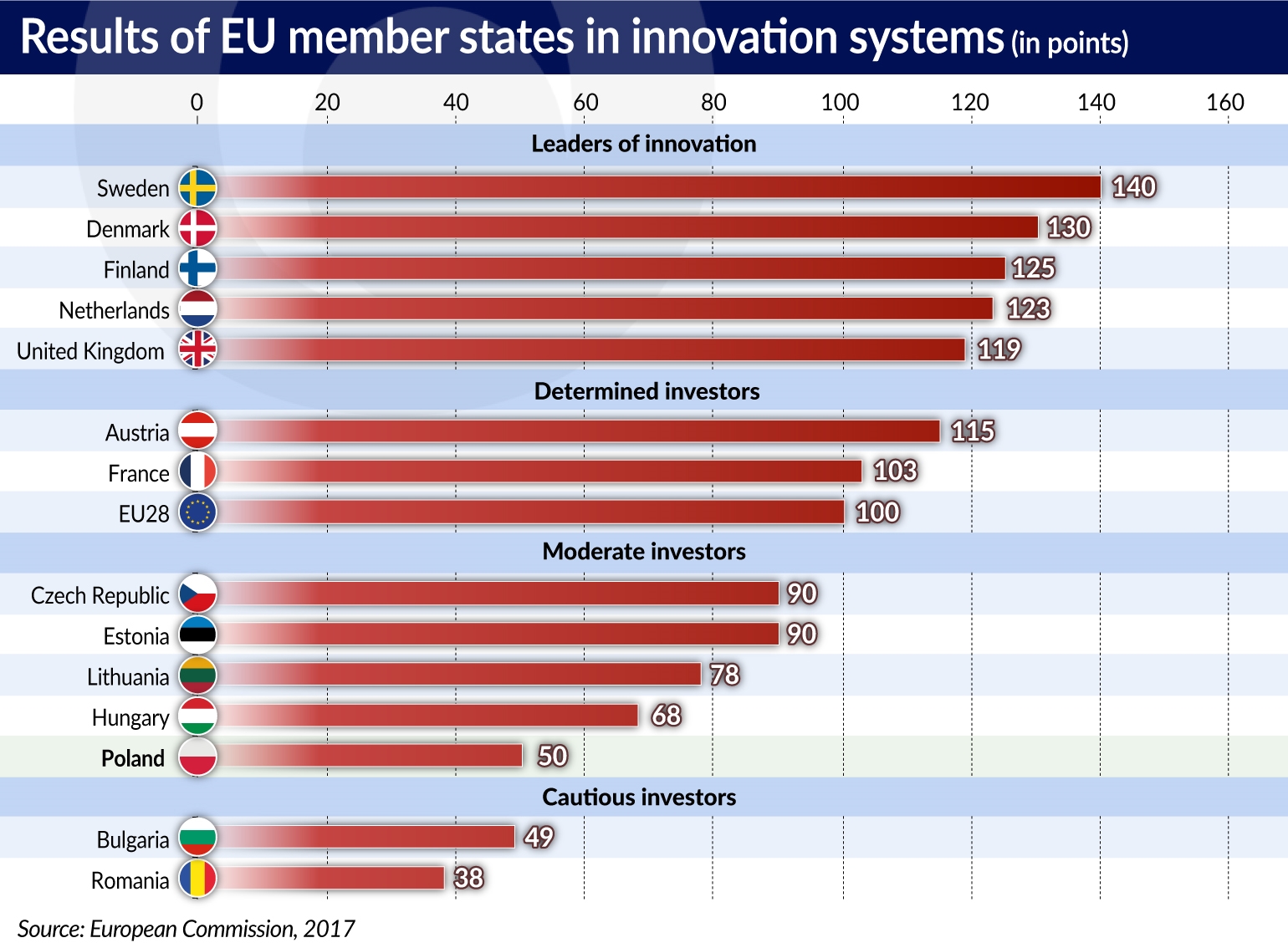

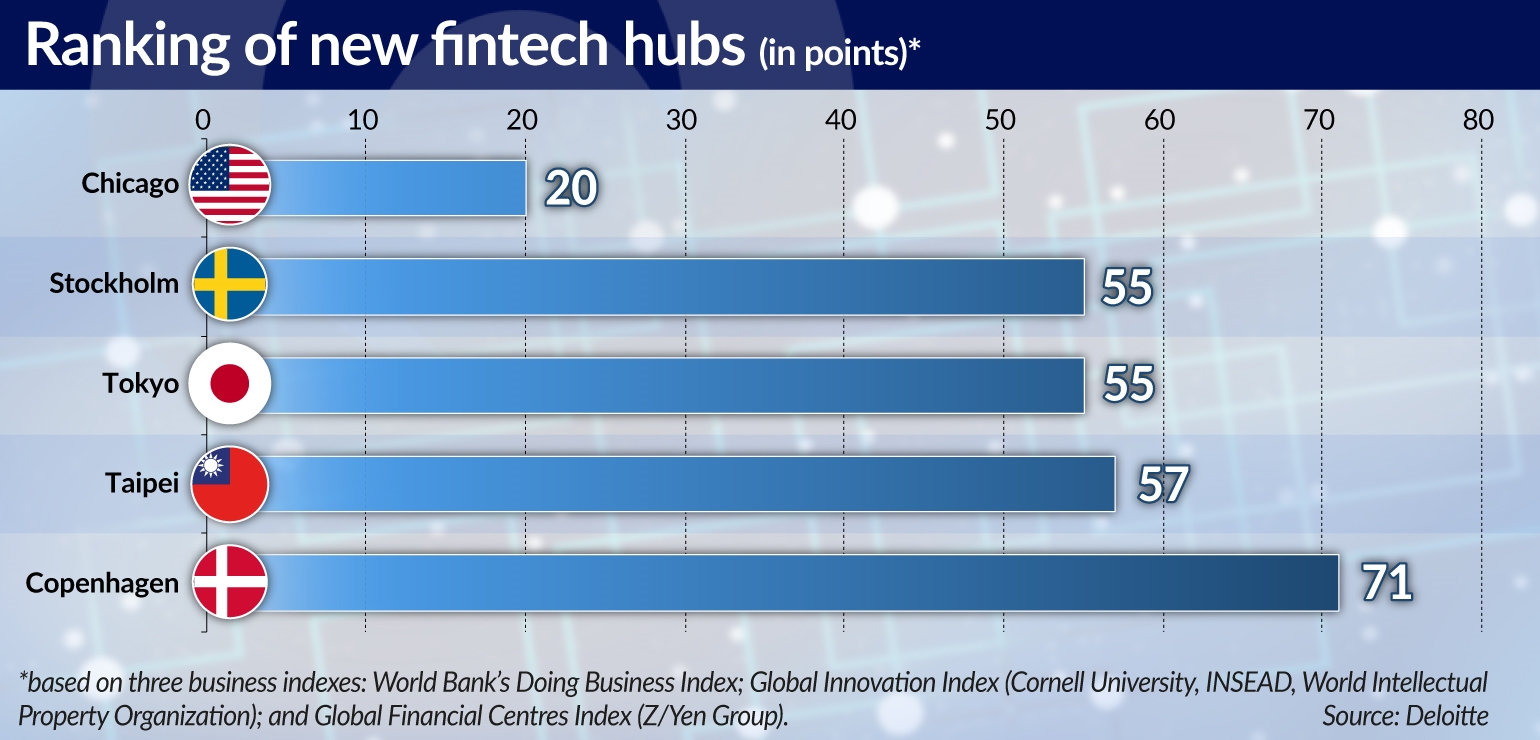

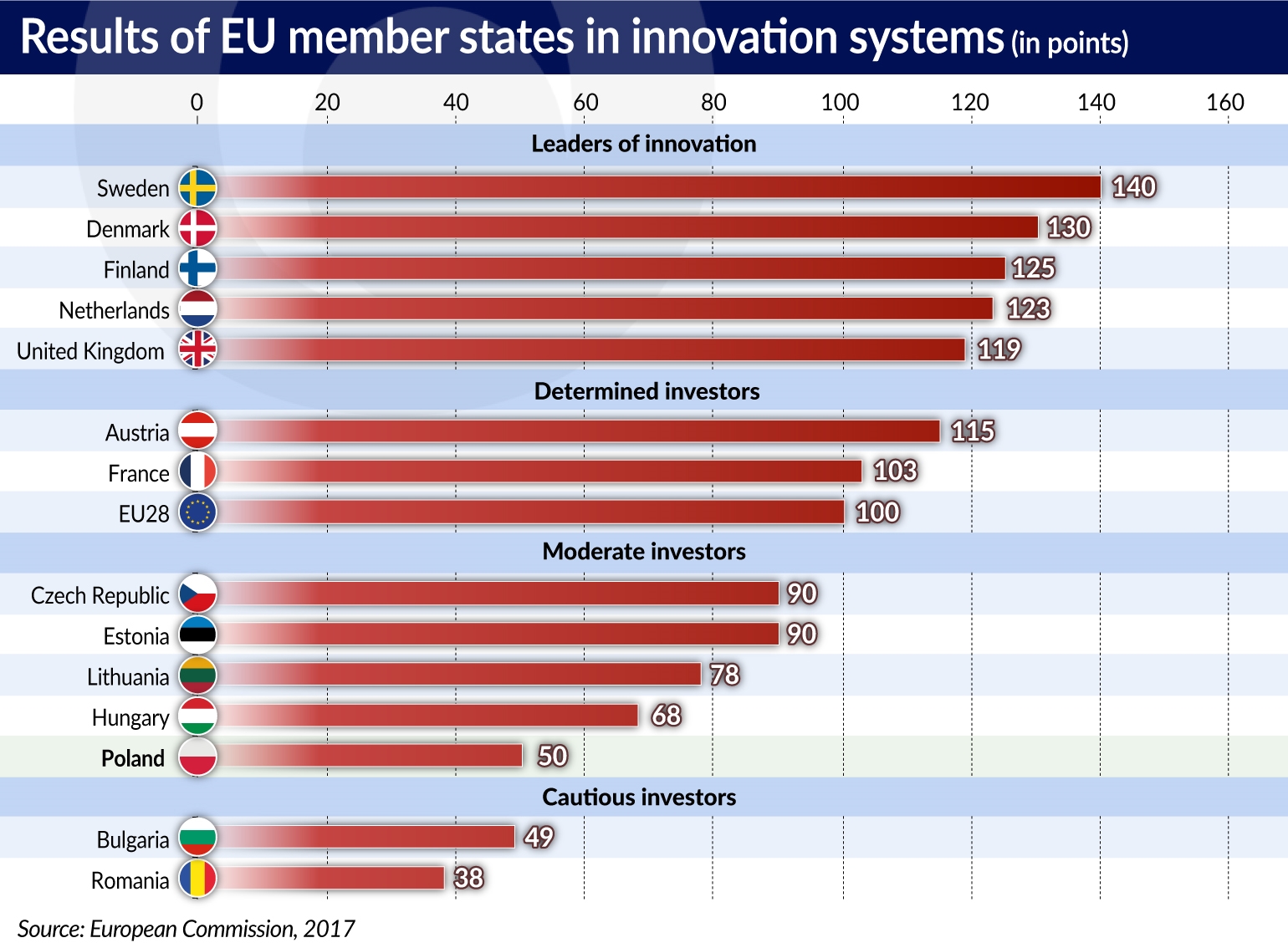

For the time being, Poland doesn’t mean much on the fintech map of the world. According to a report prepared by Deloitte, Warsaw — the only Polish city that matters as a fintech hub — is not included among the top cities in the category of the so-called new hubs, i.e. those located in developing markets. While Polish fintechs (there are more than 100 such companies) are worth about EUR900m (according to Deloitte’s estimates from a few quarters ago), they are not popular with investors. In 2016, on the Polish fintech market only a few acquisitions of negligible value took place. During the same time, transactions with a value of USD62m were concluded in Sweden. In the United Kingdom, which is one of the largest fintech hubs in the world, the value of such transactions reached nearly USD800m. This means that foreign investors still do not see in Polish fintech companies any ideas with a value that could be easily multiplied.

“ING has already bought about 140 fintechs around the world, but not a single one in Poland. We have tried six times to develop a fintech on a global scale in Poland but it did not work out. A fintech guaranteeing the servicing of deferred payments at a high level, which met our expectations, was found in the Czech Republic,” stressed Michał Bolesławski, the Vice President of the Management Board at ING BSK, during the European Financial Congress in Sopot.

The Polish government’s Strategy for Responsible Development lists fintech companies as one of the strategic sectors that should be supported due to their potential. “The problem is that for the time being, beyond general political statements, we’ve failed to develop a comprehensive strategy that could turn this vision into reality,” stated Paweł Widawski, PhD, in the report entitled “FinTech Hub Poland. How to successfully build a new generation financial center in Poland”.

There are some activities, such as the establishment of the Financial Innovation Department (FinTech) under the Polish Financial Supervision Authority (KNF), but the world is rushing forward at a rapid pace. It’s hard not to get the impression that the Polish start-ups from the fintech industry are missing big opportunities. And this is despite the fact that access to capital for development is easier than ever before. There are at least several support programs available, including Go_Global.pl (National Centre for Research and Development), #StartinPoland (Ministry of Development), Starter (Polish Development Fund), and ScaleUP (Polish Agency for Enterprise Development). Support — for a fee — is also offered by local public entities in many other countries, including the largest fintech markets in Europe, i.e. the United Kingdom (Bank of England FinTech Accelerator, TechCity UK) and Germany (EXIST-Gründerstipendium, EXIST-Forschungstransfer, Mikromezzaninfonds Deutschland).

“The potential market for fintechs is enormous. About one third of the global market still remains unbanked. Over the last 4 years, the fintech market has grown at a rate four times faster than the venture capital investment market,” noted Krzysztof Konopiński, a partner at MCI Capital, during the European Financial Congress.

As the FinTech Poland foundation points out, success in the fintech sector is determined by several factors, and Poland fulfils all of them. These include geopolitical location (very good in Poland’s case), financial infrastructure (also very good), human resources (Poles are well educated and willing to work), and the ability to conduct research and to use outsourcing (there are over 450 outsourcing companies operating on the Polish market).

Why, then, are Polish fintech companies not achieving global success? Why it is the Russians who are conquering the world with Revolut (ePayments)? Why has the successful company Adyen (ePayments) emerged in tiny Netherlands, and iZettle in Sweden (also ePayments)? In Israel innovative financial companies seem to appear on the market all the time, such as BlueVine (eFactoring), which raised USD60m from investors in financing for development.

Experts are pointing out the main problem — Poland is not building a coherent ecosystem, in which fintechs could grow and fully develop. The term “ecosystem” means a legal, administrative and financial environment that connects the world of business, science and finance in a quick and smooth way in order to increase development opportunities. The examples of countries that have successfully developed such ecosystems include Sweden and Finland. Sometimes the ecosystems acquire a tangible form — such as Berlin’s city of science and technology Adlershof.

“The ecosystem is the key to the successful development of Polish fintech companies abroad. The period of dynamic development of large corporations has ended. They require good ideas, and such ideas cannot be developed in a vacuum,” said Jarosław Mastalerz, partner at mAccelerator.

One of the important elements of the fintech ecosystem in many countries is the so-called regulatory “sandboxes”, allowing companies to test different projects without incurring the risk resulting from the effects of a failed attempt. The first place of this kind was the British sandbox, which was created as part of the Project Innovate initiative.

How does a sandbox work? It is an environment designed for the testing of innovative products and services on real clients, but on a limited scale. They involve the participation of public administration representatives, who pay attention to the effective adaptation of projects to the applicable law. A sandbox therefore eliminates the legal uncertainty already at the initial stage of the fintech’s formation.

“In the years 2005-2015, the Finnish government supported the development of a modern technology sector in place of Nokia. It managed the human capital which remained after that company. It created an ecosystem for which it provided financing, and which gave rise to some interesting global businesses, including Rovio,” pointed out Jacek Figuła, the head of strategy and sales at Billon.

According to experts, support from state can be useful for fintech companies. “Institutions such as the Polish Development Fund are necessary, and they can provide sensible help in the development of fintechs. It’s just that they need to quickly find an effective key for this, because time is running out,” said Krzysztof Konopiński.

Mr. Figuła also stressed the important role of commercial banks in the development of an ecosystem for fintechs. “The banks should slightly loosen the rules for investing and cooperating with fintechs. Banks have the potential and the ability to create ecosystems for the development of fintech companies and to support them with their credibility. They need to create such corporate sandboxes, where young people with good ideas can almost play with these ideas at ease,” he said.

Poland has one of the most technologically advanced banking sectors in the world — this is confirmed by the reports of many analytical companies. Specialists indicate that in a certain sense this innovative banking sector inhibits the development of Polish fintechs, as it constitutes excessively strong competition on the local market. 6 entities from Poland were nominated for the European Fintech Awards 2017 and two of them were banks (Alior Bank and Idea Bank).

“For now, the fintechs are targeting the piece of the financial market pie which is not regulated. In Poland it is difficult to become a fintech that takes over the market share of the banks. It’s easier to succeed in the United Kingdom. That is because the Polish banking market is small but advanced. The British market is large, but not so technically advanced, and access to capital and know-how is much easier there than in Poland,” explained Mr. Mastalerz from mAccelerator. In his opinion, however, there is still a lot of room for fintechs, because they are simply cheaper in terms of operating costs. “For example, 70 per cent of the costs on the part of banks are personnel costs, like in some traditional, declining industries,” he argued.

“In this context, it is true that innovative banks are in a way a curse of the Polish market. They developed modern solutions, and this means, that there is not much room left for fintechs,” admits Michał Bolesławski, the Vice President of the Management Board at ING BSK.

Nevertheless, Polish fintechs are still trying to expand primarily within the domestic market. Small economies push entrepreneurs to immediately try their luck outside their own market. “In Poland there is a lack of global thinking. Israeli fintechs have no other choice, they have to immediately enter the American market, or even the global market, because their domestic market is simply too small. The same situation is true in the case of the Czech Republic, Estonia or Sweden,” explained Mr. Konopiński. “The Polish banking sector needs to define what should be the core of its operations. Everything that goes beyond this definition should be let go, leaving this piece of the pie to the fintechs,” he added.

According to Mr. Figuła, Polish fintechs must exhibit greater confidence in pursuing foreign expansion, even if their projects are only at the stage of the idea. “There are fantastic accelerators in the West, where a good project is almost taken by the hand and led towards the goal,” he emphasized.

Specialists who are close to the financial market point out that the Polish fintech industry often simply lacks good ideas. Good ones, that is, ideas that are not a copy of an existing solution, are easy to implement and are easy to monetize. “Polish fintechs sometimes approach investors or advisers with solutions that are simply copies of ideas from developed markets. This way, no fintech will ever grow on the global scale,” argues Jerzy Kalinowski, an advisor to the management board of KPMG in Poland.

“A good idea for a fintech is an idea that can easily be monetized, whereas the ideas of the Polish industry often do not respond to specific market needs. As a result, there are problems with their monetization,” emphasized Mr. Bolesławski.

Mr. Mastalerz pointed out yet another issue. “Plug&play solutions, that is, the ones that are easy to implement, appear on the Polish fintech market very rarely. Meanwhile, products offered to the banks have to be simple, and their implementation should take up to 1-3 months at the most. Fintech entrepreneurs have to look for niche solutions, and not systemic solutions, which are expensive and complicated, and which have to be developed over a long period of time,” he stated.

There is also another problem in the context of fintech start-ups, which may have cultural roots. According to Adam Niewiński, the managing partner at OTB Ventures, Polish scientists are characterized by insufficient entrepreneurial activity and appetite for risk. “There is a Polish branch of a large foreign corporation in which about 3,000 scientists are employed, most of them with PhD degrees. And yet they are not eager to launch their own start-ups, although they have the potential, as well as favorable circumstances, because there is a lot of money available on the market. Polish scientists have no self-confidence. In Israel scientists are certain that they will succeed in business, while in Poland they are very cautious,” noted Mr. Niewiński.

There is a similar situation in the eCommerce market. There are many such projects on a local scale, but none of them has ever set sail for international waters. The size of the market pie that could be acquired is shown by the data from Eurostat. In 2017, only 57 per cent of European Union citizens made any purchases online (while 85 per cent used the internet). The European markets in which customers like to shop online include Denmark, Germany, France, the Netherlands, Finland, Sweden and United Kingdom. Eurostat estimates that in the last year 45 per cent of Poles made online purchases (while 78 per cent used the internet).

According to experts, the owners of companies from the eCommerce sector make a similar mistake as the fintech entrepreneurs: they first set their sights on success in the local market (it is already worth almost EUR10bn) instead of immediately targeting the global market. Additionally, if they do make an attempt to venture beyond Polish borders, they often make various errors, including the basic one: at the outset, they are not prepared for a complex business operation.

“When we talk with an entrepreneur who approaches us in order to obtain financing, we expect answers to the basic questions: what sort of international experience does the company have, which markets does it want to operate in? And we very often cannot receive clear answers to these questions,” emphasized Maciej Żurawek, the director of the Product Development and Sales Support Department at the City Handlowy Bank.

He adds that Polish eCommerce industry is not successful abroad, because Polish entrepreneurs do not operate in a comprehensive manner. “Business of this kind needs to be developed simultaneously in many areas. For example, the issues of promotion and marketing cannot be ignored. It is a mistake to focus solely on the technological or legal issues,” he pointed out.

Jarosław Sokolnicki, the head of industry solutions at Microsoft, points out that the development of an e-commerce business on a global scale is an extremely difficult task. “In order for a small eCommerce company to achieve global success, various factors must be combined. Not only you need capital, but you also need a manager’s charisma. You need a good team. You also need to understand your client’s needs. And that is just the beginning,” emphasized Mr. Sokolnicki and pointed out that global success in eCommerce is determined by three things: delivery time, delivery cost and good after-sales service. “Germans put great importance to how they can return a purchased product. If a company from the eCommerce sector wants to succeed on that market, it must have good solutions in this area,” he added.

“The key is to understand your target market. In each of them there are certain nuances that may seem surprising, for example, the customers’ preferences in the area of electronic payments can vary significantly, even within Europe. Customers are no longer willing to forgive errors and shortcomings,” notes Jan Michalski from Deloitte.

“Polish entrepreneurs have to start believing more in themselves and their strengths, and need to start thinking globally. In Poland people often operate according to the following assumption: let’s first test our product or service here. The problem is that usually after these tests are completed it is already too late to expand beyond Poland, because the foreign competition has already introduced very similar solutions to the global market,” warns Małgorzata Walczak, the investment director at PFR Ventures.

Meanwhile, the pilot program Startup Nation Central is to be launched in Poland. This is a project of an Israeli organization supporting the development of technological start-ups. An agreement in this matter was signed in mid-June by Startup Nation, Bank Gospodarstwa Krajowego and Creators Ideation Lab.

Experts admit that eCommerce is currently a difficult business, because the market is dominated by two powerful players (Amazon and AliExpress — a company from the Alibaba group). Things will get even more difficult, because manufacturers will increasingly communicate with the customers directly, e.g. via devices equipped with technology allowing to connect to the “Internet of Things”.

This, however, does not mean that there are no opportunities available. According to Mr. Sokolnicki, a perfect example is the Tesco network’s project in South Korea. “The company installed virtual stores in public places, including the metro, that allow people to order groceries which are delivered to their home. In this way, it acquired a large part of the Korean market and additionally boosted its brand recognition. This was a double success, pointed out the expert from Microsoft. “Limiting eCommerce to the borders of your own country is not reasonable. Taking a risk of going beyond the national borders is the right way to go” he said.

CE Financial Observer was a media partner of this discussion panel that took place during the European Financial Congress in Sopot, Poland.