There are, however, small signs of optimism. In addition to the continuous increase in capital, there was a slight improvement in the quality of assets and in the ratio of non-performing loan coverage ratio.

The European Banking Authority (EBA) has published an updated „risk map” for the European banking sector for the third quarter of 2016. The vast majority of risk factors are at the highest possible level, and some still display an upward trend. The warning lights are glowing red, and the situation with profitability is the worst. The reason for that is the deepening decline of both net interest income and net commission income, and the additional pressure of rising costs.

The data of the Polish Financial Supervision Authority (KNF) on the Polish banking sector show that it is in a much better condition than the European average, but it is subjected to the same risks as banks in other countries. We should also add that during the December 2016 meeting the Financial Stability Committee listed the decreasing resilience of Polish banks associated with their declining profitability as one of the potential sources of systemic risk.

In the case of banks in the European Union, in the third quarter of 2016 the risks associated with the sector’s poor profitability grew even stronger. The average annual rate of return on equity (ROE) for the group of 198 surveyed banks decreased to 5.4 per cent, i.e. by one percentage point y/y, and by 30 bps compared to the previous quarter. According to the data of the KNF, the average ROE for the entire Polish banking sector at the end of the Q3’2016 reached 8.6 per cent, after decreasing by 90 bps during the year.

The percentage of banks in the European Union with a ROE below 6 per cent in the entire sample increased from 44.1 per cent in the Q2’2016 to 56.3 per cent in the Q3. The already very large differences in the profitability of banks between the individual member states of the European Union are further deepening. The ROE of Hungarian banks is 19.1 per cent, and that of Romanian banks is 17.3 per cent, while the ROE of Greek banks is -10.1 per cent, and that of Portuguese banks is -2.4 per cent.

Despite the banks’ reduction of risk-weighted assets (RWA), which was noted by the EBA, the average return on assets (ROA) fell in the Q3’2016 to 0.34 per cent, i.e. by 2 bps q/q and 4 bps y/y. In Poland, at the end of the Q3 the ROA was 0.9 per cent, after a decrease of 10 bps in the course of the year.

At the same time, there was also a decrease in another measure of effectiveness ‒ the cost to income ratio. For EU banks, the C/I ratio increased by 30 bps to 63.0 per cent in the Q3’16. This ratio increased by 310 bps y/y. According to the KNF report, in the Polish banking sector the ratio reached 55.2 per cent at the end of the Q3 and was one percentage point higher than a year before.

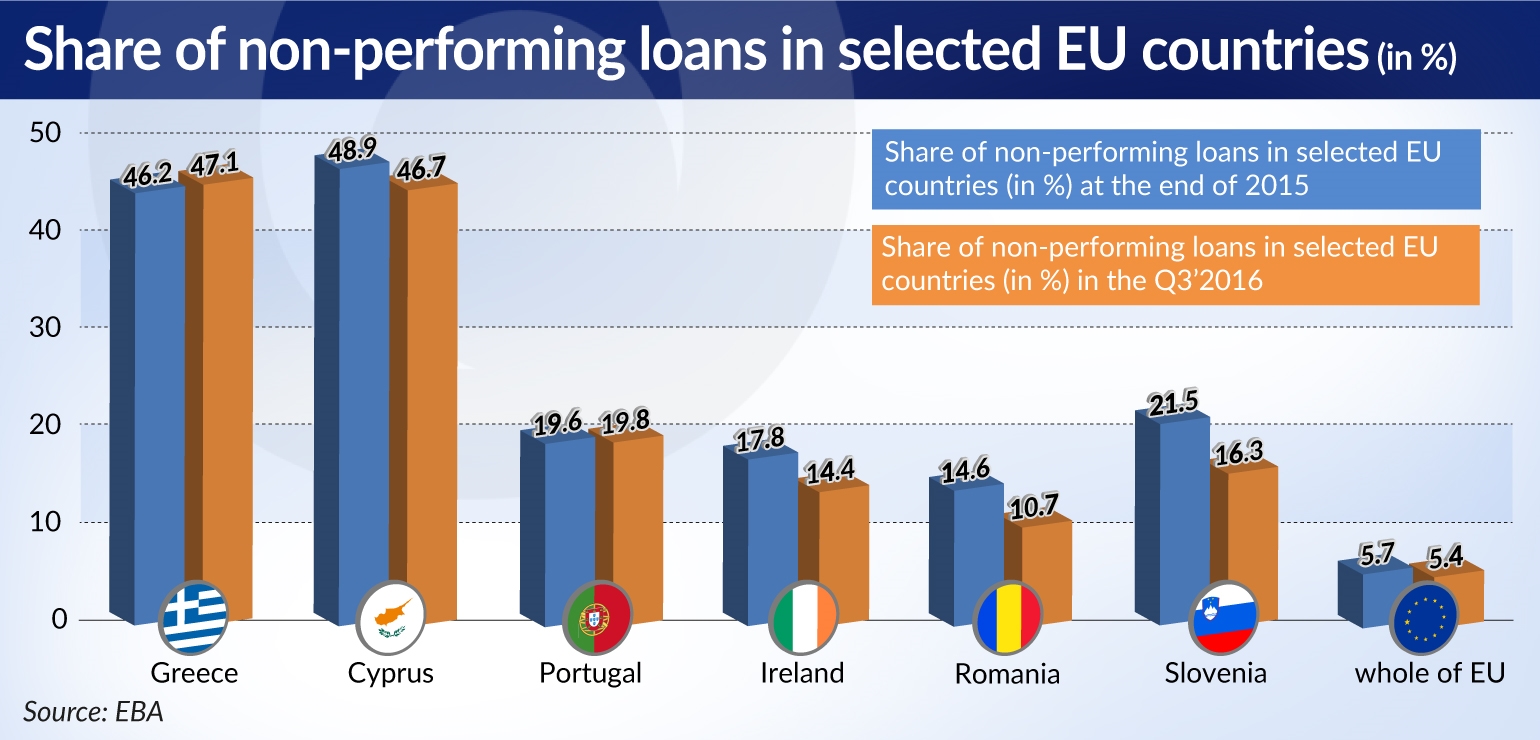

Despite the deterioration of profitability and other measures of efficiency, there are also some (albeit tentative) positive signs. The capital of EU banks is constantly increasing. There is a decrease ‒ although it is slow and does not occur in all of the countries ‒ in the share of non-performing loans, the coverage of non-performing exposure is improving, and the loan to deposit ratio (LTD) declined slightly.

In the Q3, the CET1 core tier capital reached the level of 14.1 per cent of RWAs, which is 50 bps more than in the previous quarter and about 110 bps more than in the previous year. Because the banks’ ROE is significantly lower than the cost of capital, the increase of capital ratios is driven by retained earnings or a decrease of RWAs.

The decrease of RWAs is accompanied by a decline in the LTD ratio, which has continued its downward trend for several quarters. In the third quarter of 2016, the LTD was 120.1 per cent, while a year and a half ago it was 5 percentage points higher. As a result, some banks indicate the possibility of resuming lending. For the time being, new lending brings in assets of a much better quality than old pre-crisis lending.

The banks are slowly reducing the share of non-performing loans (NPL), but it is still high at 5.4 per cent, i.e. 10 bps less than in the previous quarter. The reduction in NPL runs at a varying pace in individual countries. Progress is seen in Cyprus, but not in Greece. A decline was recorded in Croatia, Romania, Hungary and Slovenia, and was the fastest in Ireland, while the reduction in Portugal and Italy was minimal.

The main obstacles in the reduction of the share of non-performing exposure in the banks’ portfolios include a slow judiciary, protracted debt collection procedures and inefficient secondary markets. In addition, market prices for bad debts are often below their net book values, so the banks are not in a hurry to sell them. The large share of non-performing loans remains – along with the high operating costs – the main reason for the sector’s low profitability.

Meanwhile, there is a marked increase in the coverage of non-performing loans with provisions ‒ up to 44.3 per cent in the Q3’2016. However, this value also varies greatly between individual countries – it is the lowest in Finland, where it amounts to 26.6 per cent, and the highest in Slovenia – 66.7 per cent. In general, along with the varied profitability rates and quality of assets, it shows the continuing fragmentation of the European banking sector. It is further enhanced by political uncertainty and the potential risks associated with sovereign debt.

The European Banking Authority points out that some of the banks declare the possibility of an increase in lending. In the December 2016 report, the EBA said that banks forecast a rise in lending to the non-financial sector by 1-5 per cent per year over the next three years and a corresponding increase in deposits and debt financing. The EBA questions these plans, stating that in 2016 the inflow of deposits stopped, and it does not believe that – given the current environment – banks will be able to raise sufficiently large financing from other sources.The question is whether an increase in interest rates ‒ which is not yet on the horizon in Europe and in Poland, although everyone already knows that it will come ‒ could improve banks’ profitability. These are market expectations in the United States, where another increase in interest rates took place in December 2016. The share prices of banks increased strongly in anticipation of the December and future decisions. The EBA claims that this does not have to be repeated in Europe.

Firstly, with still high LTD ratios, which mean a constant need for refinancing, an increase in interest rates could mean ‒ at least in the short term ‒ that the growth in refinancing costs will be higher than the growth of interest income. And that would be another blow for the sector’s profitability. Secondly, the environment of low interest rates encourages banks to increase credit risk, and when interest rates increase, this risk may materialize.