In the European Union, they are relatively modest, as most of the countries are still experiencing shortages in credit supply. But there are also those that already have to act to cool down the lending activity.

The accelerating and consolidating economic growth, and the situation in which economic cycles are not synchronized throughout the EU, will be very difficult for macro-prudential supervisory authorities. They will have to decide when to impose additional buffers on banks. This could lead to conflicts between the supervisory authorities and the politicians, because – as was proven by the crisis – the latter are never satisfied with the amount of credit provided to the economy.

The problem of excessive supply of credit and excessive household debt is not only limited to the banking sector. In Poland and in many other countries credit institutions are supplanting the banks from certain areas or are finding niches left untapped by the banking sector, and their market share is far greater than in Poland.

“In the Netherlands, more than 50 per cent of loans originate outside the banking sector, as a result of which it is necessary to extend the (macro-prudential) policy beyond banks,” said Francesco Mazzaferro , the Head of the Secretariat of the European Systemic Risk Board, during the European Financial Congress in Sopot.

Buffers to increase resilience

Regulators around the world are moving along a narrow line between the improvement of the resilience of the financial sector (including banks) to possible future shocks, and its ability to supply credit to the economy. In some countries, the compromise is tipped towards security, and burdens on the banks are much higher than in Poland and in many countries of the EU right now. Although the minimum capital requirements introduced by Basel III, and in the EU by the CRR, are not excessively high and amount to 4.5 per cent of the CET 1 core capital in relation to all exposures to risk, they achieve this through capital buffers.

The minimum capital requirement is complemented by the mandatory capital conservation buffer of 2.5 per cent, and the banks from the list of 30 of the world’s largest institutions are gradually burdened with buffers from 1 to (theoretically) 3.5 per cent for global systemically important institutions (G-SIB). Importantly, the imposition of such a buffer on, for example, a Polish subsidiary of a foreign bank is at the discretion of the Polish Financial Supervision Authority, after obtaining the opinion of the Polish macro-prudential supervisory authorities.

The local supervisory authorities of the EU Member States can also identify „other systemically important institutions” and impose on them a buffer of up to 2 per cent of their exposure to risk. This buffer has already been used by the Polish supervisory authorities. The Polish Financial Supervision Authority imposed it on 10 banks in October 2016. The imposed buffer amounts ranged from 0.25 to 0.75 per cent. As a result of this decision, the total consolidated capital ratio of, for example, mBank was 21.59 per cent at the end of the first quarter.

If the regulators from other countries determined that their banks had excessively risky exposures, for example, in Poland, they could impose systemic risk buffers on their subsidiaries. Finally, supervisory authorities can assess the individual risk of a specific bank and impose „additional capital surcharges” through Pillar II. There is also the countercyclical capital buffer of up to 2.5 per cent of all risk exposures.

The regulations diverge

The consensus as to the scale of the banks’ capital burdens is no longer as broad as it was right after the crisis, when the Basel Committee on Banking Supervision (BCBS) published new capital rules, or when the Dodd-Frank Act was adopted in the United States and the CRDIV/CRR package was passed in the EU. Bankers and politicians are increasingly pointing out that banks with excessive capital burdens are not able to supply credit to the economy.

The capital burdens occurred at a time when European banks have low profitability in an environment of low interest rates, high costs and an accumulation of non-performing loans. In turn, many representatives of the supervisory authorities and central banks believe that the process of improving capital adequacy hasn’t been completed yet.

Due to a fear of an increase in the banks’ burdens, in the framework of the planned revision of the CRDIV and the CRR package the European Commission does not take into account the proposal of a new approach to risk weights proposed by the Basel Committee on Banking Supervision. At the same time, the draft amendment raised concerns of the Single Supervisory Mechanism (SSM) at the European Central Bank that it could possibly hamper the activities of the supervisory authorities in the framework of Pillar 2.

“Not all risks can be measured in Pillar 1 (…) and supervisors need to keep an adequate degree of supervisory judgment (…) and the ability to act swiftly when needed (…). Against this background, the proposed legislation on Pillar 2, while rightly seeking to further supervisory convergence, seeks to put a frame around supervisory actions that is much too tight in essential aspects,” believes the head of the SSM Daniele Nouy.

In the United States, President Donald Trump and his advisors have made announcements concerning the deregulation of the banking sector. The House of Representatives has already adopted the Financial Choice Act according to which banks can apply the principles provided by the Dodd-Frank Act, or increase the leverage ratio (LR) to 10 per cent from the current 5 per cent, instead of capital calculated in relation to the exposure to risk. The leverage ratio is the ratio of capital to total assets, and not just risk-weighted assets.

The law still has to be approved by the Senate. For the American giants, a two-fold increase of the LR would not really mean a reduction of capital burdens. According to the recommendation of the BCBS, the leverage ratio should be no less than 3 per cent. In the EU law the leverage ratio does not apply at the moment, but is supposed to be introduced by the current revision of the prudential supervision package.

Where they are already putting out the credit fire

When the credit cycle enters the phase of expansion, macro-prudential supervisory authorities should impose a countercyclical capital buffer on the banks. It is used to reduce the build-up of imbalances and limit excessive expansion. Higher capital strengthens the banks’ resilience to the collapse of the cycle, so that in times of economic downturn and losses the banks are not forced to dramatically limit their lending activity. The purpose of the buffer is therefore to smooth the cycle, so that the phase of the downturn is not excessively deep.

In Europe, there are already countries where the situation on the credit market has forced its supervisory authorities to use a counter-cyclical buffer. One of the countries where it was introduced – and almost in the maximum amount of 2 per cent – is Switzerland. The capital requirements are also much higher there than in the EU, although this increase applies to two giant banks: UBS and Credit Suisse, whose total assets amount to CHF1.87 trillion.

In 2016, Switzerland introduced to its legal system a leverage ratio for the two biggest banks in the amount of at least 5 per cent. In 2015 UBS had an LR of 3.6 per cent, and Credit Suisse had an LR of 3.7 per cent. Both banks must reach the required LR until the end of 2019.

In response to these requirements, UBS announced in the summer of 2015 that it intends to reorganize its structure and set up UBS Switzerland AG. Credit Suisse began to adapt its structure in the fall of 2015. The bank is supposed to be divided into three asset management regions (Asia, Switzerland and other countries) and two segments of investment banking. The Swiss unit is to be transformed into a universal bank, and its share capital will be increased by CHF6bn.

The Swiss Financial Market Supervisory Authority FINMA announced that the two global systemically important banks must also maintain a total loss-absorbing capacity (TLAC), i.e. debt financing intended for covering losses, in the amount of a further 5 per cent of the leverage ratio, or 14.3 per cent of risk-weighted assets, but has announced that a review will be carried out on the basis of a recently adopted law, in order to determine whether these burdens will not prove excessive.

According to the calculations of the Swiss Central Bank (SNB), both of these banks will need approx. CHF10bn in capital by the end of 2019.

Cooling down the Swedish boom

The boom on the credit market continues in some countries, despite the negative interest rates. In many of them it is mostly focused on the real estate market. The macro-prudential supervisory authorities are responding to this by imposing counter-cyclical buffers. Outside the EU, in addition to Switzerland, a countercyclical capital buffer was introduced in Norway, where it has been set at 1.5 per cent since the third quarter of 2016.

“During the crisis there were no buffers. The banking system would be better protected and the monetary policy would be better transmitted, if buffers were put in place,” said Francesco Mazzaferro.

In the EU, an anti-cyclical buffer was introduced by Sweden, where it has been set at 2 per cent since the second quarter of this year, the Czech Republic (since the 1st quarter of this year – 0.5 per cent) and the United Kingdom. The first country in the Eurozone that will use a counter-cyclical buffer will be Slovakia, where it will apply in the amount of 0.5 per cent from the third quarter of this year. If the economic outlook improves, the counter-cyclical buffer will probably be used by other countries as well.

Sweden was prompted to impose a counter-cyclical buffer by the good economic situation in the past three years, the increasing supply of credit to households despite their already high level of debt, and the increase in property prices.

“The property prices are historically high (…) at the same time risk is building up in the financial sector and the real estate market. We have to act through the banking supervisory authorities, the macro-prudential policy, and counter-cyclical buffers. We are discussing a further constraint of the supply of credit, and we expect a reduction in household debt,” said Kerstin af Jochnick, the First Deputy Governor of the Central Bank of Sweden during the European Financial Congress.

The business cycle also encourages the Swedish authorities to increase the capital requirements. A report of the consulting company Oliver Wyman shows that the introduction of TLAC and MREL and minimum risk weights compatible with the provisions of the BCBS by banks using the IRB method (capital floors), as well as, i.a., the additional capital surcharge for mortgages applied there, can result in an increase in the capital requirements by up to 78 per cent.

According to this report, in the biggest four Swedish banks the CET 1 capital would have to increase by between SEK125 and 365bn, depending on the scenario, from the level of SEK467bn in 2016. In the „mid-point” scenario described there (with a capital floor of 75 per cent) the required CET 1 would increase from approx. 17 per cent to 26 per cent.

Escape from the burdens

Unlike many voices pointing to banks’ excessive burdens, the approach of the Swedish regulators to the understanding of the security of the banking sector does not change.

“Our studies show that we should look for even higher capital requirements, and we should also introduce a leverage ratio (…) between 5 and 12 per cent,” argues Kerstin af Jochnick. “Strong banks were able to refinance on the market even during the crisis,” she added.

In Sweden – despite the high capital requirements for banks – lending activity continues, and the growth of the economy is among the fastest in the EU. Thanks to the low cost to income ratio around 40 per cent, the rate of return on equity of the largest banks in Sweden was approx. 12 per cent last year.

“Even though banks have high capital requirements, even above 20 per cent, we have economic growth,” says Kerstin af Jochnick.

This is despite the announcement of the largest Scandinavian bank, Nordea, that it is considering a relocation of its headquarters to another country. The president of that bank Casper von Koskull said that this would happen, if the authorities were to stick to their plans of further increases of the costs burdening the banks, and that he was considering Denmark or Finland. Finland belongs to the euro zone and therefore also to the banking union. In this case Nordea would be subject to the supervision of the SSM. It is the only Swedish bank on the list of thirty global systemically important institutions.

A key issue discussed now are additional burdens. This time it is about the deposit guarantee fund, which would reach SEK 222 billion by 2032. Swedish bankers calculated that this is 10 times more than in the banking union, where the resources are supposed to amount to 1 per cent of the guaranteed deposits by 2024.

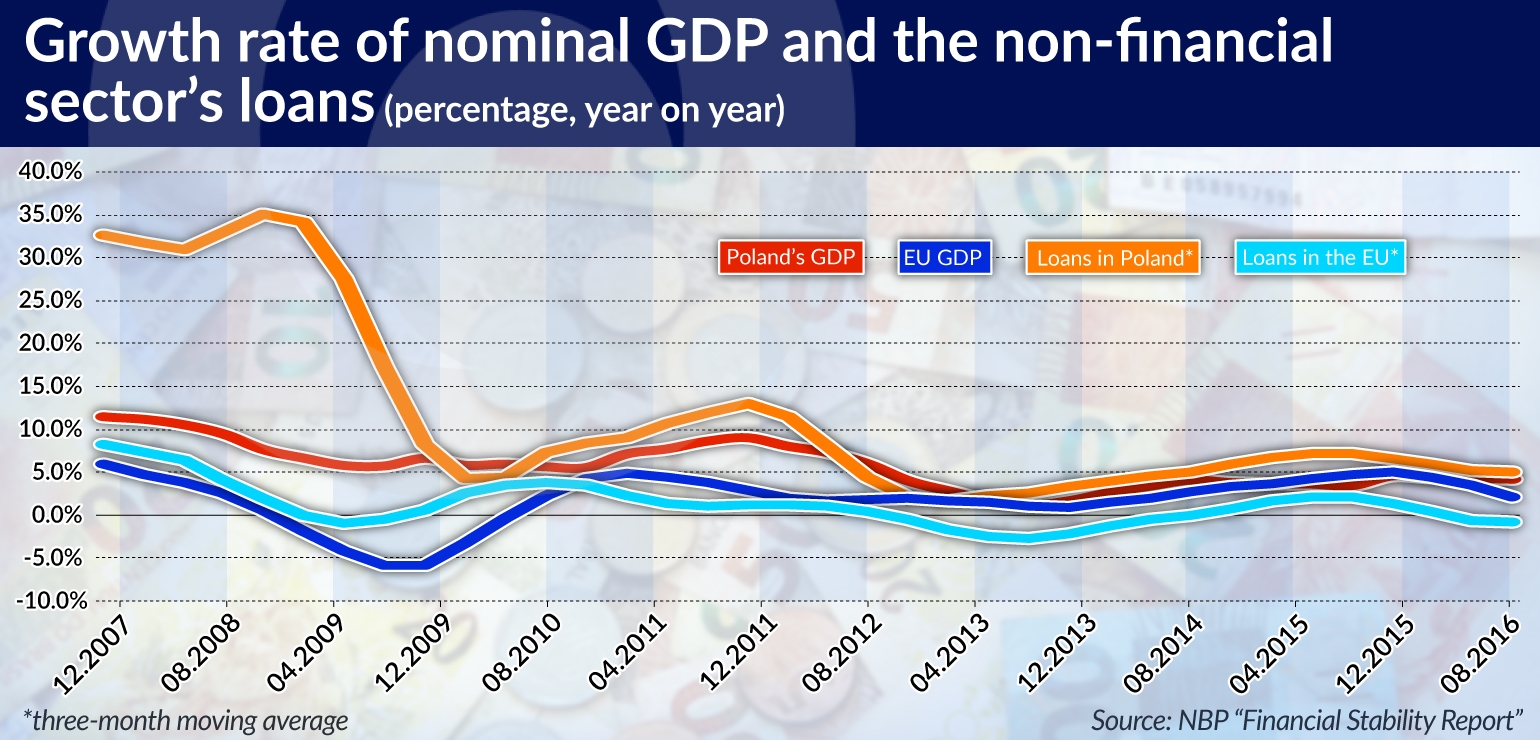

What will happen when the expansion starts

In the last „Financial Stability Report” Poland’s central bank NBP states that the credit cycle is „at the border between the recovery phase and the expansion phase”. For now, expansion is still far away. The Polish Financial Stability Committee has recently said that the credit-to-GDP ratio was 86.6 per cent on June 2nd, compared with 84.4 per cent on March 24th, and still below the long-term trend. However long it takes for the transition from one phase to the other, expansion will begin sooner or later.

The introduction of a counter-cyclical buffer will be a very difficult decision, as banks are already subjected to serious capital burdens, and the average own funds ratio for the sector was 17.7 per cent at the end of 2016. This is due not only to the capital requirements themselves, but also the additional capital surcharges imposed by the Polish Financial Supervision Authority on banks that have large portfolios of mortgages denominated in CHF, and the buffer for systemically important institutions.

Additionally, the Polish banks are not as profitable as in Sweden or Norway, and even in the Czech Republic and Slovakia. Their ROE is currently below the cost of capital, and so they are building buffers from their retained earnings. These are shrinking, however, and the banks are predicting a further decline for this year.

The boundary of the compromise is also determined by the increase in the share of State Treasury capital in the Polish sector. A recovery and entry into a more intense credit cycle could mean that the costs of building up capital buffers will be effectively charged to the taxpayers. The building of buffers from retained earnings means a reduction or the lack of dividends – also for the State Treasury shareholder. The situation in the Polish sector could become more complicated than in countries where the banks exhibit higher profitability and hold more diversified capital.