(©GotCredit, CC BY 2.0)

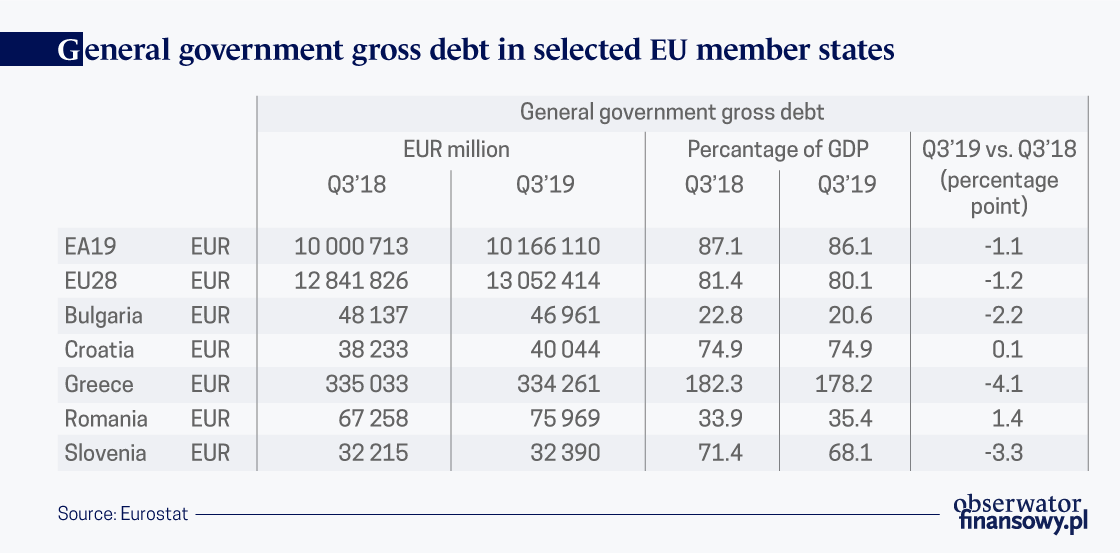

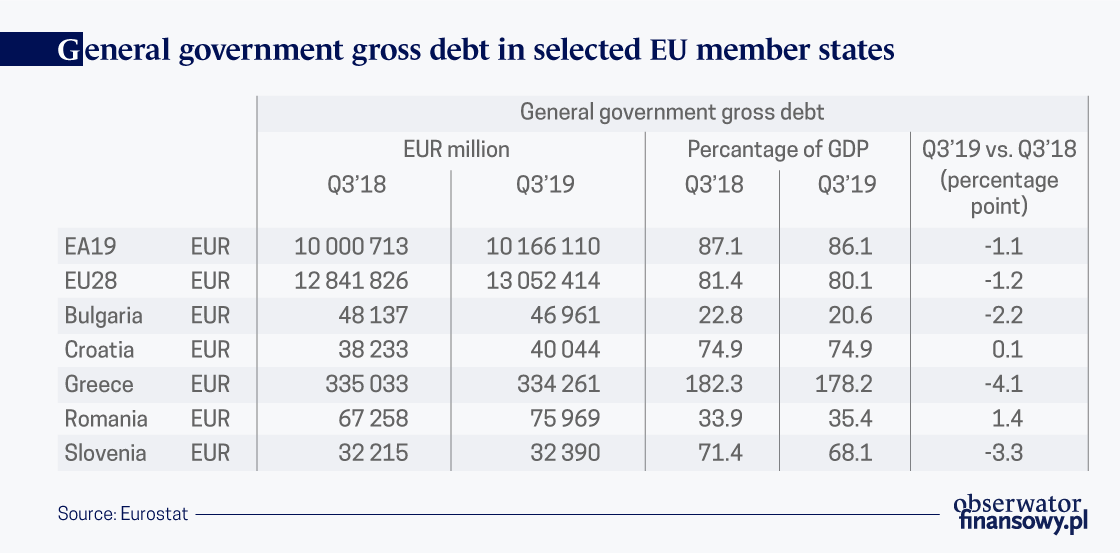

At the end of the Q3’19, general government gross debt at the EU level, as a share of GDP, stood at 80.1 per cent, which is 0.3 percentage points less than in the previous quarter. It has been reduced equally in the Eurozone, sliding to 86.1 per cent of GDP, according to calculations by the Eurostat.

By far the largest decline in debt as a share of GDP was recorded in Cyprus, by 9.2 percentage points. This is followed by Malta, with a 2.3 percentage point decline in its debt-to-GDP ratio, the Netherlands with 1.7 percentage points, Ireland, and Finland, with a decrease of 1.3 to 1.5 percentage points. Debt share in GDP remained unchanged in Germany.

At the end of the Q3’19, Greece had the highest debt-to-GDP ratio, at 178.2 per cent. Italy followed with 137.3 percent, Portugal with 120.5 per cent, Belgium with 102.3 and France with 100.5 per cent. By far the lowest share of debt in GDP was Estonia, at 9.2 percent.

According to the latest Eurostat data, Croatia had a public debt of 74.9 per cent of GDP at the end of the Q3’19, down 1.2 percentage points q/q. With that, along with eight more countries, it was singled out as one of the largest ones with a q/q fall in the debt-to-GDP ratio. Greece noted 1.4 percentage points decrease of public debt, despite its general extremely high debt-to-GDP ratio.

In general, government q/q debt share in GDP increased only in four countries. Except of France, where it increased by 0.9 percentage points, it increased the most in Romania — by 1.4 percentage points (from 33.9 to 35.4 percent of GDP), followed by Slovenia and Bulgaria, with debt and GDP increases by 0.4 (from 67.7 to 68.1 per cent of GDP) and 0.2 percentage points (20.4 to 20.6 per cent of GDP), respectively.

Compared to the Q3’18, the debt share of GDP at the EU level decreased by 1.2 percentage points. In the Eurzone it fell by 1.1 percentage points. In Croatia, the debt-to-GDP ratio increased by just 0.1 percentage points compared to the Q3’18 and it remained at the level of 74.9 per cent of GDP, as the Eurostat data showed. In addition to Croatia, a further increase in debt share of GDP compared to the same period last year was recorded by six EU countries, among them Romania — by 1.4 percentage points in annualized debt growth (from 33.9 to 35.4 per cent of GDP), followed by Lithuania, France and Italy, with the increase in debt as a share of GDP in the range of 1 to 1.2 percentage points.

Slovenian debt-to-GDP ratio fell, comparing to the Q3’18 by 3.3 percentage points (from 71.4 to 68.1 per cent of GDP), and Bulgaria had the share lower by 2.2 percentage points (from 22.8 to 20.6 per cent of GDP). The lowest decrease y/y among the SEE countries was noted in Greece, where the debt fell by 4.1 percentage points.

However, the amount of the debt, expressed in real numbers, increases everywhere but in Bulgaria and Greece. In Bulgaria it fell from BGN24.612m to BGN24.011m, while in Greece from EUR335.033m to EUR334.261m. Between the Q3’18 and Q3’19 it rose from HRK284.261m to HRK296.840m in Croatia; from RON313.412m to RON360.898m in Romania; and from EUR32.215m to EUR32.390m in Slovenia.

Jan Muś is an analyst in the Balkan Department at the Institute of Central Europe in Lublin, Poland.