As Covid-19 spreads, causing more countries to take counter-measures, Central and Southeast Europe is no exception. ING’s latest report said that collectively it is downgrading the 2020 GDP outlook on the back of virus fears.

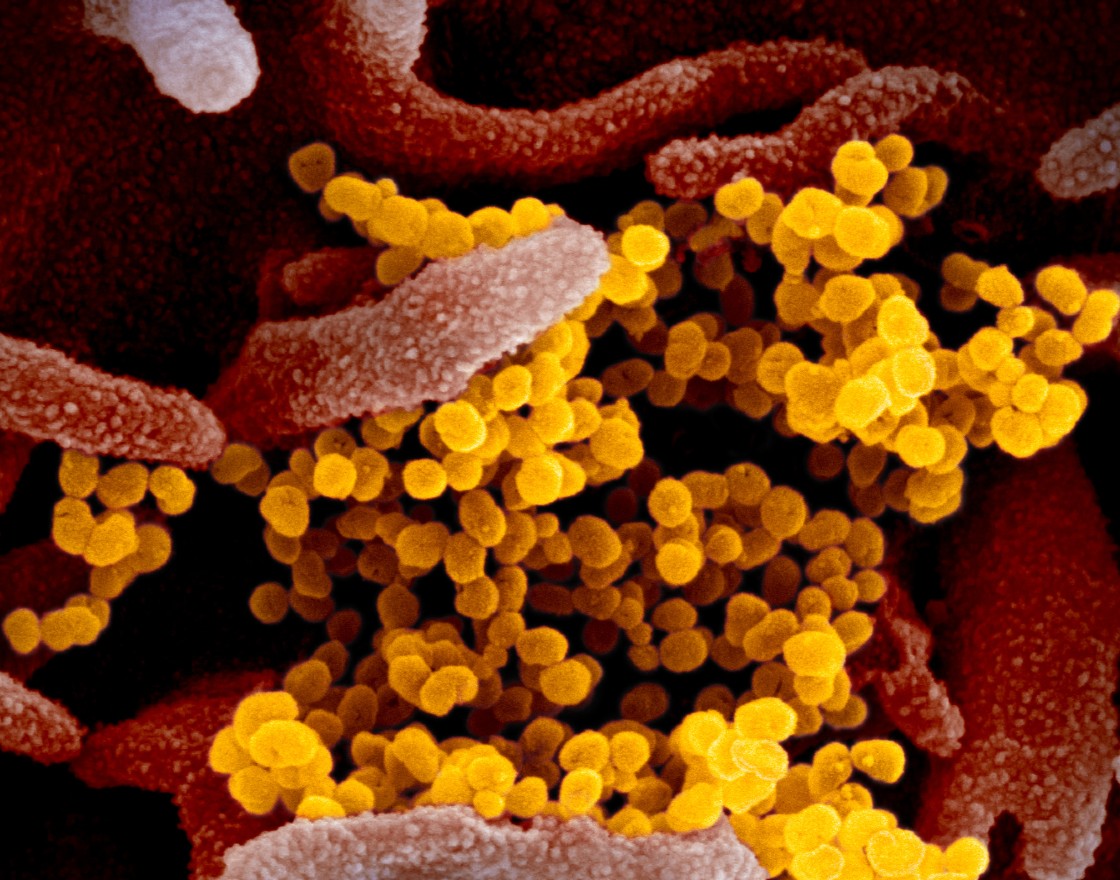

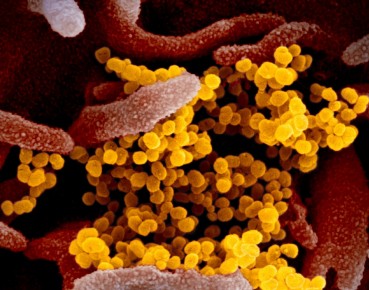

(NIAID, CC BY 2.0)

“We see a lagged effect of falling foreign demand and supply chain disruptions combined with a stockpiling in Q1’20. This results in Q2 being the bottom in the CSE when it comes to GDP levels. Second-round effects in production, limited business and household spending will drag down both investment and consumption. When fear decreases in the second half of the year, we see on average 60 per cent recovery of cumulated GDP drops from the first half of 2020. Nonetheless, both the Czech Republic and Romania should show negative GDP for full 2020,” the report said.

A mix of a supply and a demand-side shock combined with weaker FX results in diverse outcomes when it comes to the inflation outlook, but in general, it seems that central banks in the region don’t need to consider high inflation as a barrier when taking steps, according to ING.

Central banks are preparing or have already decided about emergency measures (rate cuts in the Czech Republic, QE and rate cuts in Poland) to improve the liquidity situation and provide stability in the banking sector. What could be the next step varies from country to country. The National Bank of Hungary may also embark on QE, the National Bank of Romania may focus on liquidity measures while the Czech National Bank is set to cut rates further. The National Bank of Poland is likely done with cuts. The fiscal policy is also a mixed bag with some countries facing mounting problems like Romania, while others can easily afford a 4 per cent of GDP fiscal deficit like Poland.

The upcoming monetary easing coupled with the challenging environment for emerging market FX and risks assets should keep CSE currencies under pressure in coming months, ING said. The tightly managed the RON should continue to be the winner in falling markets while the CZK volatility will remain extra elevated given the positioning-related moves in the currency and the risk of CNB FX interventions (which ING expects to have a smoothing effect only). They also look for more the HUF and the PLN weakness in coming weeks and months.

Poland

ING estimates the coronavirus outbreak should lower 2020 GDP growth by 3pp, „from 2.9 per cent y/y we expected before the outbreak to around 0 per cent y/y. We see the following channels the outbreak affects GDP: shutdown of the services sector, lower propensity to spend by households and very weak investment demand. We also assume supply disruptions. We expect the pandemic will last 1-1.5 months. The bulk of the hit on the Polish GDP is likely to happen in late March and early April”. ING sees a technical recession with negative GDP q/q in Q1-Q2’20. Meanwhile, Morgan Stanley said GDP will shrink 3.6 per cent in an optimistic scenario and 5.6 per cent if things take a wrong turn.

As of March, CPI should subside. If the crude price remains at the USD35/bbl level, Polish inflation should be lower by 0.7pp compared with the previous forecasts. CPI should move back to 3.5-3.6 per cent y/y in April and average 3.5 per cent y/y in 2020. The Covid-19 may cause some short-term rise of prices, but the disinflationary impact should prevail, especially in the case of oil prices. „Some necessity prices (like dry food) may become more expensive, but their weight in CPI is just 8 per cent,” says ING.

Poland’s Monetary Policy Council cut rates (main by 50bp) and introduced Polish QE and TLTRO, which will enable a large-scale fiscal response to the coronavirus. Also, Poland’s central bank, NBP concludes that repo operations increase banks’ liquidity. The first operation has been already conducted (with a maturity of four days and worth PLN7.5bn). The NBP also created a Polish version of a QE program to stabilize the T-bonds secondary market, but the size and length of buying was not specified. It may be either adjusted to current market conditions or set after the fiscal program is released. QE opens the door for the ministry of finance to announce a large anti-crisis policy package. We see limited space for further rate cuts. Expect the MPC to ease via

The NBP monetary easing is PLN negative, EUR/PLN will very likely to top 4.50. Still, the Polish situation is still better compared to CSE counterparts — rates are higher, and the current account showed a high surplus. Also, foreign investors were underweighted in POLGBs. The NBP is very likely to intervene above 4.50. The NBP’s FX interventions will be rather focused on lowering volatility than defending levels. The domestic economy is relatively well suited for the crisis, EUR/PLN should move back to 4.30 in H2’20.

ING expects the 2020 net borrowing needs to increase from PLN15bn to PLN75bn due to the epidemic outbreak (around 3 per cent of GDP). The government won’t cash PLN18bn from OFE pension funds. On top of that there will be the cost of the fiscal impulse, which the government has announced. The size of the fiscal package should reach 1-2 per cent of GDP, but it might be partially funded by a redirection of EU funds. ING expects the deficit to reach 3.6-4.5 per cent of GDP in 2020.

„The government will spend PLN212bn to help the economy,” President Andrzej Duda and Prime Minister Mateusz Morawiecki said in a joint statement on March 18th, 2020. Minister of Development Jadwiga Emilewicz prepared a package of support options for companies from the sectors which had suffered greatest losses due to coronavirus.

The package, equivalent to 9.2 per cent of Poland’s GDP, consists of five elements. The government pledged to cover up to 40 per cent of employees’ wages in companies affected by the crisis to avoid layoffs. Employers would cover 40 per cent as well, a cost of a 20 per cent wage cut for workers.

Companies that suffer a 25 per cent reduction in turnover in 30 days because of the outbreak would qualify for the support. The government also promised payouts of 80 per cent of minimum wages to the self-employed. Businesses will also be entitled to a support such as suspension of social security payments, preferential loans, credit guarantees by the state BGK bank, and the government taking over lease payments of transport companies — one of the most heavily hit by the crisis.

Mr. Duda and Mr. Morawiecki also pledged an extra PLN7.5bn for health care and said there was no danger for the payment of social benefits, including child benefits program, 500+. Up to PLN30bn was pledged for public investments. “We want to apply a classic investment impulse by the state and we are building a fund for local roads, digitalization, protection of environment, and modernization of schools and hospitals,” Mr. Morawiecki said.

Another pillar of the package is aimed to “ensure security of the financial system, including deposits, deposits, payments, deposits and withdrawals,” the PM’s office said in a statement.

The Budget Act adopted in February 2020 will need to be revised and a budget deficit will most likely be necessary. The cuts will mainly affect investments, including in roads, because due to the fact that a large part of the Polish economy will be stopped, tax revenues shall be significantly lower than assumed.

“One important clarification — the government/budget is not planning to spend this amount; rather closer to 1/3 of it. The rest of the money is for very different things — like guarantees, NBP actions, etc. Adding them up does not make any economic sense (like adding apples to oranges), it only makes political sense (and can be seen as a way to boost confidence in general public, etc.),” said economist Wojciech Paczyński. “I think these plans (the same in most countries) have a chance to work if we’re confined to our homes for a relatively short period. If this goes into long months (assuming this is feasible at all), we’ll have a major disaster anyway,” Mr. Paczyński added.

Stagflation?

The employers’ association Lewiatan reported that 69 per cent of Polish firms said they plan to reduce employment. „The worst situation is in small (71 per cent plans reductions) and medium (80 per cent plans reductions). In total, 54 per cent of companies in question plan to lay off 20 to 50 per cent of employees in the next 2 months,” a Lewiathan study says. Some 68 per cent said that lack of state assistance may lead to the closure of the company. 47 per cent said if they don’t get help, they’ll start slowing down within 3 weeks. “The faster and more accessible the well-planned forms of assistance are, the smaller the negative economic and social effects of this unprecedented crisis and scale will be,” Prof. Jacek Męcina, advisor to the board of the Lewiatan Confederation, said.

Food price controls?

Marek Pawlak, adviser in the Grant Thornton law firm, says that due to the sudden, noticeable price increase of many articles, the effects of a coronavirus pandemic are beginning to be felt strongly in household wallets. The Office of Competition and Consumer Protection (UOKiK) has proposed to introduce maximum and regulated prices. According to the UOKiK’s proposal, the minister would have the right to set maximum prices for various levels of trade in goods, indicate the basis for calculating the margin or to set maximum margins. This solution already exists for certain categories of medical products, medical devices and foodstuffs for particular nutritional uses. “It is necessary to introduce legal mechanisms that allow undertaking specific actions towards entrepreneurs using the current situation unjustifiably,” Pawlak said.

Businesses oppose the UOKiK proposal. “We think it is too far-reaching,” says Przemysław Ruchlicki, legal and economic expert of the Polish Chamber of Commerce. “In our opinion, the provision should be removed from the draft on the possibility of regulating the prices of goods that are significant for the cost of household maintenance,” he said. “In the current situation, there is no justification for such broad competences to interfere in the market. Manually controlling the economy can lead to an even deeper disruption of market demand and supply and can apply to virtually every article in the market.”

Inflation has been breaking records monthly since December — at the end of the year it had reached 3.4 per cent, at the beginning already 4.3 per cent, and last month it was 4.7 per cent.

Public onboard?

“There are no easy political decisions in such periods,” Mr. Paczyński says. “Public trust and social dialogue would help. Poland will unfortunately pay a price for what has happened in these areas in recent years. Sadly, it is probably impossible to undo the damage quickly.”

According to a survey conducted by the Social Changes studio, commissioned by wPolityce.pl, Poles increasingly appreciate the government’s actions in fighting the coronavirus epidemic. A large majority of the Civic Coalition’s voters (KO) also speak positively about the government’s actions. In the opinion of as many as 71 per cent of respondents, the government’s actions should be assessed “definitely positive” (29 per cent) or “rather positive” (42 per cent). This means an increase of 23 percentage points in positive ratings over the last week. Importantly, not only 86 per cent of the Law and Justice electorate but also 62 per cent of the Civic Coalition’s voters expressed positive opinions about the government’s actions. In the previous survey this indicator was 37 per cent.

Czech Republic

According to ING the Czech economy falling into recession has become a baseline scenario as Covid-19 measures not only affect domestic but also foreign demand significantly. The Czech economy itself could cope with domestic restrictive measures due to sufficient fiscal space (4th the lowest total debt-to-GDP in the EU — around 32 per cent of GDP). „However, foreign demand might become a bottleneck for a quick recovery in 2H20 though it is too early to estimate the full effect,” ING noted.

While a few weeks back inflation was penciled in go above 3 per cent this year, the significant decline in oil prices brought a turnaround, subtracting broadly 0.6 percentage points from y/y inflation this year. ING will very likely see disinflation pressures due to the weakening economy, though weaker CZK and some supply constraints go in the opposite direction. All in all, ING expects headline CPI to decelerate towards 2.5 per cent this year.

The Czech National Bank delivered a 50bp emergency rate and is very likely to continue lowering borrowing costs to mitigate the coronavirus shock. This means that the main 2-week repo rate is likely to fall significantly in the forthcoming months (towards 0.50 per cent) with the CNB likely delivering rate cuts (25bp or more) in each of the three forthcoming monetary meetings (with a non-negligible risk of another emergency rate cut or a cut being larger than 50bp). This scenario is to a large extent priced in by the market.

The upcoming rate cuts (which will take away the yield advantage — the main CZK anchor) and challenging global environment for EM FX will keep the still overbought the CZK under pressure. Due to the risk of a disorderly sell-off, ING expects the CNB to start one-off FX intervention to smooth the CZK volatility. The first interventions should come around the EUR/CZK 28.00 level. Yet, this will not be a firm ceiling on the EUR/CZK, with FX interventions having a smoothing rather than firming function. This means the EUR/CZK could trade meaningfully above 28.00 should global risk assets remain under pressure.

The Czech government introduced a set of preliminary measures to mitigate short-term negative effects, like tax delays, or providing no interest/fee 2-year loans for the affected SME with a one-year delay in payments. To keep the employment rate, the government will provide CZK100bn in direct support and CZK900bn in indirect in the form of guarantees. The government will pay out 60 per cent of the average contribution base to employees affected by the quarantine. At the same time, it will support employers who continue, despite their businesses being shut down, to pay out 100 per cent of the salary to affected employees by covering 80 per cent of salary costs.

On top of that Czech government released CZK3.3bn for the 2020 Rural Development Program. This funding should help entrepreneurs in agriculture, food and forestry.

More fiscal measures are likely to come. Given the fiscal space available in the Czech economy, more fiscal measures are necessary to counteract adverse developments and support subsequent recovery.

Hungary

Due to the panic buying of non-perishables through February and March, according to ING, economic activity might remain in the expansion territory in Q1 (0.2 per cent q/q). However, as the lockdown of the country and forfeiture of social events kicks in fully in the Q2, ING sees a 2.5 per cent q/q drop in GDP. A rebound in the second half should keep the 2020 growth rate in positive territory, as ING downgraded its GDP forecast from 3.8 per cent to 0.5 per cent.

ING has already updated its CPI outlook based on what is happening in the oil market and the recent shock is having rather a mixed effect on inflation. However, policymakers don’t need to worry about inflation being above the target range for a while. ING sees CPI at 3.0 per cent and 3.1 per cent y/y in 2020-21, respectively.

The Hungarian central bank, NBH has already stepped in to provide extra liquidity via the regular FX swaps and announced a new daily facility, a 1-week FX swap tenders to provide forint liquidity. The change in collaterals also frees up HUF2.5 trillion extra liquidity for the banking sector on demand. But the central bank’s Council kept the base rate on hold at 0.90 per cent and the O/N deposit rate at -0.05 per cent. The NBH also suggested commercial banks suspend collecting loan payments from SMEs. Looking ahead, the next move by the NBH could be expanding its bond-buying program and scrap the related sterilization measure, engaging in a proper quantitative easing.

While the HUF ceased to be the CSE underperformer (and in times of stress did better than the CZK and the PLN) due to the still short positioning and the prior NBH tightening, ING looks for more EUR/HUF upside as (a) the external environment is to remain tricky; (b) the NBH will likely provide further liquidity measures, causing a drop in implied yields and Bubor (in turn following the easing trend of other CSE central banks). This should be modestly HUF negative, sending the EUR/HUF to 352 in the coming months. But as the NBH extraordinary measures will be phased out and the recovery starts, the HUF can go back to 340 levels in early 2021.

The Hungarian government is still working behind the scenes to come up with a fiscal package. In theory, the room for such an easing could be around 2-3 per cent of GDP, but that would mean significantly higher net issuance, maybe including REPHUNs. So far, more than 80,000 small businesses will receive an exemption from tax payments until after the crisis, as will media companies that suffer from falling advertising revenue. The government is also freezing loan repayments until the end of the year for all companies and borrowers. „The more detailed plan should be presented in the first or second week of April,” the Prime Minister Viktor Orbán told public radio on March 27th.

Romania

While no later than last week ING said it was still relatively optimistic, the avalanche of growth revisions and the signals it got from the real economy brought ING to the point where it’s calling for a GDP contraction in 2020. Except for a temporary boost in retail sales activity due to the fear factor (even here it will be interesting to see how much booming food sales make up for the falling non-food sales), there is simply nothing good anyone can expect from the next couple of months. Hence, ING expects a flat Q1’20 vs Q4’19, a terrible Q2’20 and a gradual rebound afterwards, leading to 2020 GDP growth of -0.9 per cent.

As far as the inflation is concerned the story is relatively straight forward — lower oil prices, lower (negative) growth and lower demand (eventually the flip-side of the current sales boom will be visible in Q2) will lower inflation. ING revises the CPI slightly, both the year-end and annual average to 2.5 per cent from 2.8 per cent.

ING believes that monetary policy will remain FX-focused. To the extent the currency can be managed without major problems, it envisages the central bank doing a little bit of everything: leaving the EUR/RON to shift higher earlier in the year rather than later, leaving some carefully monitored surplus liquidity in the market or alternatively provide liquidity through repo operations, further cuts in minimum reserve requirements and even one or two 25bp key rate cut(s) if the economic downturn deepens and only after other CSE central banks have done it. So far, Romania’s National Bank, BNR decided to cut the monetary policy interest rate by 0.5 percentage points (pp) to 2.0 per cent, and narrow the interest rates corridor from 1pp to 0.5pp — therefore lowering the Lombard interest rate by a full percentage point to 2.5 per cent.

ING maintains its 4.85 year-end forecast but see increased chances of going higher than this level during Q2’20. It believes that other CSE currencies underperformance will provide some comfort to the BNR for leaving the EUR/RON as high as 4.86 in the Q2, followed by a quasi-stagnation and a return to 4.85 by the year-end.

The combination of lower growth, lower revenues and higher (or at best constant) spending will – in the ING’s view – push the budget deficit above 5.0 per cent of GDP, even in a scenario where the 40 per cent pension hike is postponed, which is our base case now. ING estimates the budget deficit sensitivity to GDP slowdown to be close to 0.4pp for every one percentage point of lost GDP.

The Romanian government plans to implement a multiannual program to support SMEs. It includes fiscal and budgetary measures to support the economy and companies. Romania’s finance minister Florin Citu claims that the economic stimulus package aimed at mitigating the effects of COVID-19 pandemic measures 3 per cent of GDP (EUR6.6bn). The measures include state guaranteed loans to firms, unemployment benefits paid from the state budget, and the deferral of tax payment.