Narodowy Bank Polski (©NBP)

This leads us to raise the obvious question of whether these two anniversaries have something in common with each other? Paradoxically, the answer is “yes”. Although quantitative easing was initially designed in order to combat deflation, analyses indicate that it is much more effective in supporting economic growth than in fighting the deflationary threat. The Bank of Japan, which was the pioneer of quantitative easing, learned this first hand. As Kenneth Kuttner points out in his numerous works, during the first wave of quantitative easing in 2001-2006, the Bank of Japan was able to achieve a decent rate of economic growth. However, the situation was much worse with regard to inflation, which continued to fluctuate around 0 per cent despite the central bank’s efforts. Moreover, this was happening in spite of the unprecedented increase in the prices of oil and other raw materials on global markets.

The authorship of the concept of quantitative easing should also be attributed to Ben Bernanke. At the end of the 20th century he used to travel to Tokyo – still in his capacity as a member of the scientific community – in an attempt to encourage the very cautious Japanese to act more boldly in the area of monetary policy. It was not until the Great Financial Crisis of 2008, however, that Bernanke was able to apply these concepts in his own country. The Bank of England started following the example set by the Federal Reserve in March 2009. In April 2013 quantitative easing – this time on an incomparably greater scale – was resumed in Japan, and starting from 2015 central bank purchases of government securities were also launched in the euro area and in Sweden.

In many countries quantitative easing was initially accompanied by uncertainty, which was in part due to the media coverage of this policy. As a result, quantitative easing started being equated – for whatever reason – with “printing money.” Additionally, in 2009 there were cartoon parodies depicting Ben Bernanke eating a hamburger. In the cartoons Bernanke wants to add a little ketchup to his burger. Although he opens the bottle, nothing is pouring out, so Bernanke bangs against the bottom of the bottle several times. This doesn’t help. Finally, in desperation, Bernanke decides to bang the bottle once again. This time, to his surprise and dismay, almost the entire content of the bottle pours out onto his hamburger. Although the strong growth of monetary aggregates in the world after March 2020 means the possible materialization of the outcome presented in the cartoon cannot be excluded, for the time being – despite all the fears – the policy of monetary easing hasn’t caused inflation. Bernanke himself described quantitative easing as a solution that doesn’t work in theory, but works in practice. This is very important considering that quantitative easing has become the main weapon of many central banks in the age of one of the biggest challenges that humanity has ever faced.

The COVID-19 pandemic is an enormous catastrophe for the entire planet and no central bank is able to simply ignore it. Since the introduction of interventionist measures, the main purpose behind the activities of the economic authorities was to stimulate production. COVID-19 has altered this rationale. For the first time ever, the authorities were forced to encourage people to suspend their professional activities in the name of saving lives (that is, for a broadly understood higher purpose). The effects of such actions go far beyond the decline in GDP and the associated rise in unemployment.

From the point of view of monetary policy, the pandemic caught NBP at a very difficult time. The inflation rate was above the established inflation target, and although many analyses indicated the temporary nature of the inflationary pressures, the condition of the Polish economy certainly did not justify in any way the necessity of resorting to unconventional monetary policy. The situation at that time could be described as a traditional wait and see approach. Besides, it is accepted that the central bank should attach more importance to inflation forecasts than current inflation figures. One cautionary tale in this regard is the experience of the ECB in July 2008 (that is, right before the outbreak of the crisis), when the bank decided to raise interest rates under the pressure of a high inflation reading. Less than three months later, the ECB was forced to backtrack and pursue drastic interest rate cuts. But getting back to Poland, at the turn of 2019 and 2020, there were many opinions in the market that the current Monetary Policy Council would go down in history as one which did not have to change the interest rates in force in Poland even once. This view seems to confirm the temporary nature of the inflationary pressures observed at the time.

In light of the outbreak of the pandemic in March of last year NBP could no longer stick to the “wait and see” approach. The central bank had to act as quickly as possible. The thing is that the initial reports about the spreading pandemic forced the authorities to extend their thinking beyond the real economy. At that point the pandemic also started paralyzing the financial markets. Suddenly, the interest rates of short-term securities became higher than bond yields at the long end of the curve. Transactions in the market were becoming increasingly difficult. The vision of piling up bankruptcies and disappearing liquidity forced the central bank to undertake emergency actions. In the words of one observer, when the train driver suddenly notices an oncoming train on the same track, he cannot think about what the priority would be in normal circumstances – that is, reaching the destination on time. He only thinks about stopping the train he is driving, regardless of the side effects of using the emergency brakes.

It’s worth noting that this is not the first time when NBP found itself in a situation similar to the one described above. The conditions of March 2020 resemble the circumstances observed in September 1998: the debut and “baptism of fire” for the Monetary Policy Council of the first term (1998-2004), which was marked by the economic consequences of the Russian crisis. One of the most important parameters of monetary policy at that time was the exchange rate. Poland’s proximity to Russia exposed the Polish złoty to significant losses. It would seem that raising the interest rates should calm down the fluctuations in the value of the Polish currency. However, the first Monetary Policy Council exhibited great foresight: instead of focusing on the short-term fluctuations of the Polish złoty, the MPC primarily attempted to mitigate the effects of the aforementioned crisis for the Polish economy. As a result, the monetary policy was loosened, and the Polish central bank gained praise from international observers for its ability to keep a cool head in a difficult situation.

In conditions of uncertainty and incoming information concerning the potential impact of the pandemic on economic activity, the Monetary Policy Council took a number of swift actions. During its three meetings between 17 March and 28 May 2020, the MPC lowered the NBP reference rate three times – by a total of 1.4 percentage points – to the level of 0.10 per cent. During this period, the Monetary Policy Council also lowered the required reserve ratio. After the interest rate was brought down to almost 0 per cent, NBP started buying Treasury securities and debt securities guaranteed by the State Treasury in the secondary market. Importantly, the scale of NBP’s securities purchases was not specified ex-ante, which allowed the bank to remain flexible and react to changes in market conditions. Such actions had a calming effect on the markets.

In turn, at the end of last year NBP carried out its first interventions on the foreign exchange market since June 2013. At the same time, a number of other countries took various actions aimed at weakening their national currencies. In this regard we can refer to the experience of Israel, Sweden, Chile, and even Australia.

It is difficult to evaluate NBP’s activities, and especially the impact of the securities purchase programme, before their conclusion. Therefore, the conclusions presented here should be treated with caution. However, while the assessment of NBP’s actions through the prism of their impact on the real economy remains outside the interest of this article – also due to the fact that their full effect most likely hasn’t materialized yet – we can focus on the effects assessed through the prism of the central bank’s balance sheet (as the direct consequences) as well as the monetary aggregates.

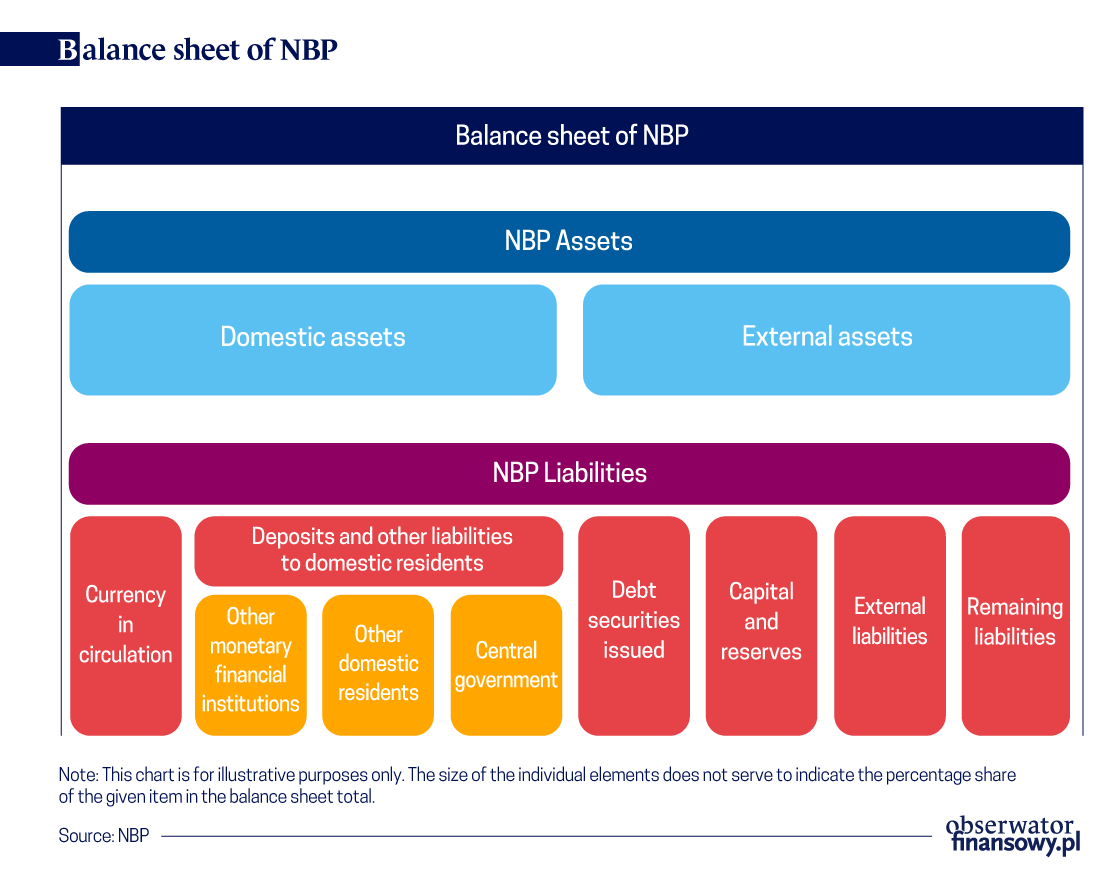

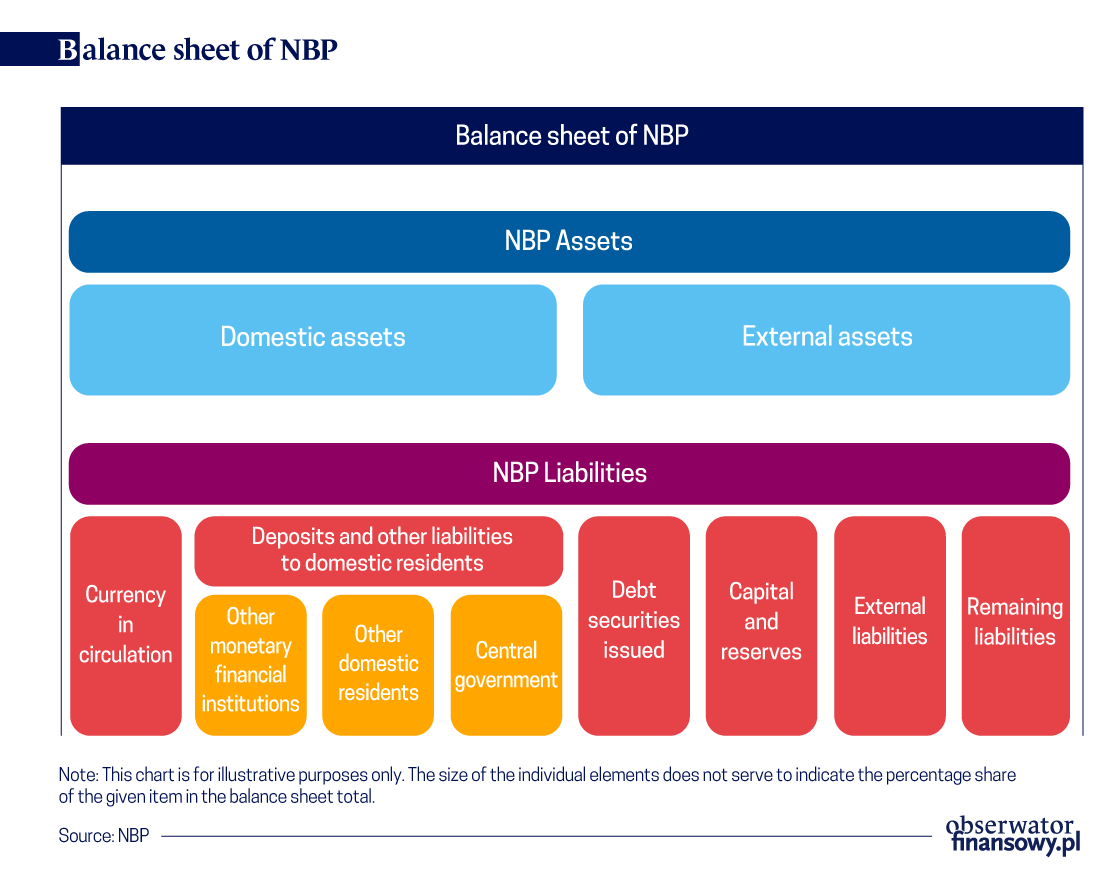

Since the launch of the quantitative easing programme the balance sheet total of NBP has increased by about 37 per cent, from slightly more than PLN 527 billion at the end of February 2020 to nearly PLN 724 billion in January 2021. In relation to GDP, the balance sheet total at the end of 2020 amounted to approximately 30.8 per cent. Meanwhile, a year earlier it amounted to 22.2 per cent of the country’s GDP. The operations carried out by NBP had an impact on the structure of its assets. Initially, the main component in the Bank’s assets were foreign exchange reserves, whose share in the balance sheet total reached 99 per cent. However, at the end of last year, the share of foreign assets fell to less than 84 per cent. Thus, the share of securities purchased under the quantitative easing programme (which include State Treasury bonds, and securities issued by the Polish National Economy Bank and the Polish Development Fund) amounted to over 16 per cent of NBP’s balance sheet total. Meanwhile, the share of these securities in relation to GDP reached approximately 5 per cent. Thus, there was a change in the counterparts of money supply in our country. Until the beginning of March 2020, these were EU funds (exchanged by the Bank into the national currency, which in turn led to an increase in our country’s foreign exchange reserves). The purchase of securities launched in March contributed to the development of a system in which assistance for the economy has become a new counterpart of money supply.

Upon an analysis of NBP’s liabilities, we notice several factors. These include a rise in the issuance of debt securities (which are derived from increased open market operations), and an increase in deposits at the central bank, especially on the part of central government institutions. However, the most interesting item on the list is an increase in the value of cash, which is only indirectly related to quantitative easing.

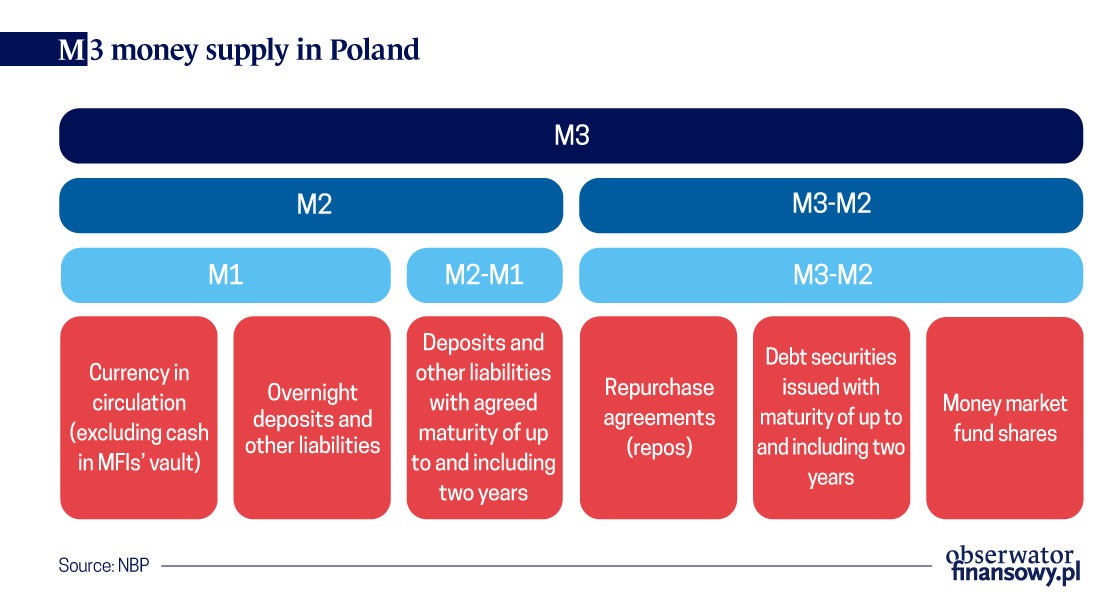

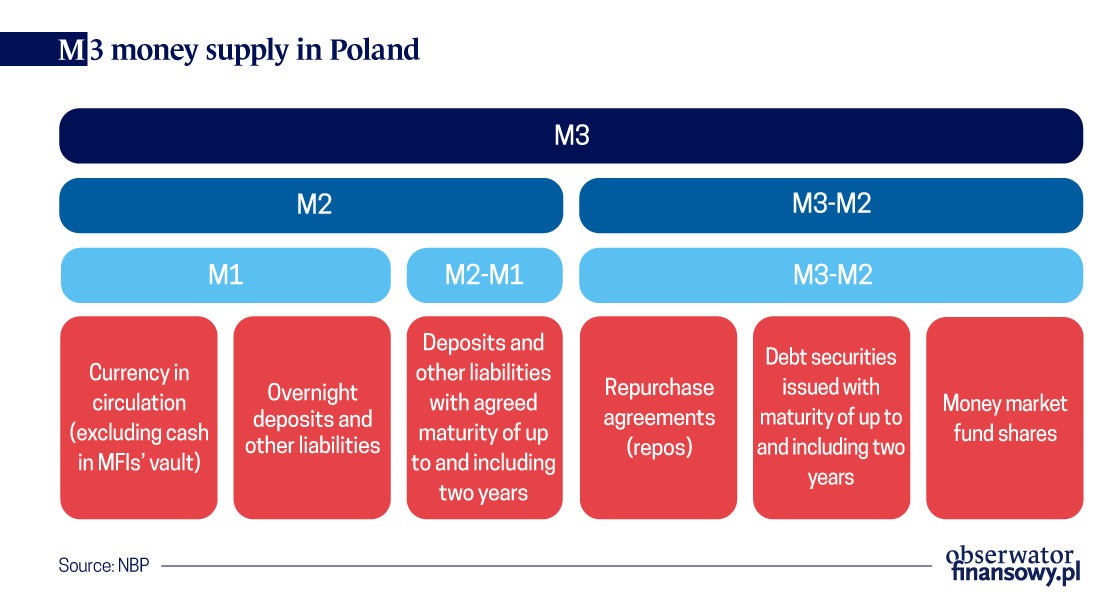

While at the beginning of 2020 the value of currency in circulation amounted to about PLN 230 billion, by the end of 2020 it had increased to over PLN 320 billion. An increase in the value of currency in circulation was also recorded in many other countries, but the rate of growth wasn’t as high. We can already say, however, that the increase of cash in circulation eased the still strong growth in the volume of open market operations. In order to keep the POLONIA rate close to the reference rate, NBP has to withdraw from the system the funds previously introduced to this system as part of the quantitative easing programme. While prior to the pandemic the volume of these operations was about PLN 80-90 billion, after the pandemic it reached PLN 180 billion. Although the demand for cash can influence the volume of open market operations, the impact of cash on money supply (as measured by the M3 aggregate) is non-existent. Indeed, the M3 is growing very fast, but the rate of its growth is in fact lower than that observed at the same time in the euro area. It’s worth taking a look at this factor.

Whereas in the twelve months prior to the pandemic crisis the rate of growth of the M3 aggregate in Poland ranged from 9 to 10 per cent, after the outbreak of the pandemic this rate rose to just over 16 per cent. In turn, in the euro area these rates amounted to approximately 5 per cent and 12 per cent, respectively. This shows that the scale of increase in the euro area was much greater than in Poland. However, most of the domestic observers are focusing on the strong increase in currency in circulation, and many of them see it as a potential source of future inflation.

It would be foolish to ignore any fears regarding inflation. Nevertheless, how can we explain the fact that despite such a strong increase in the value of currency in circulation the rate of increase in money supply in Poland is much lower than in the euro area? Of course, we must not forget that in the euro area the scope of quantitative easing is much greater than in Poland. However, this fact still does not explain the exceptionally strong increase in currency in circulation alongside the simultaneous relatively modest increase in the money supply. The logic of monetary aggregates suggests that exceptionally strong growth in one of its components (that is, currency in circulation) must be offset by a decrease in another component part of the same M3 aggregate.

As a reminder – the components of the M3 aggregate include M1, M2-M1 and M2-M3. Today the M1 aggregate is definitely the most important component. In Poland and in the euro area its share amounts to approximately 84 and 71 per cent of the entire M3, respectively. Until the outbreak of the pandemic the share of M1 in the M3 aggregate in Poland was comparable to the share recorded in the euro area. The increase of its share in Poland is, among others, the result of the increase in the value of currency in circulation. The latter doesn’t account for all of the changes, however, as in addition to currency in circulation the M1 also includes funds held in current accounts. Meanwhile, an analysis of the latter shows that the share of cash in the M1 aggregate in Poland is slightly decreasing (in January 2021 it amounted to less than 21 per cent, and, for comparison, in 2018 it amounted to more than 22 per cent). This means that it was in fact not the currency in circulation, but the funds deposited in the current accounts, that were driving the increase in M1. This is largely due to the activity of the business sector, where the rate of growth of funds held in current accounts reached up to 50 per cent in the second half of the year.

The increase in the M1 component, driven by funds held in the current accounts, is a reflection of a decrease in the M2-M1 component. Still in 2019, the share of M2-M1 in M3 amounted to more than 30 per cent, and the rate of growth was positive. In January 2021, the share of M2-M1 decreased to less than 15 per cent, and the annual rate of decline amounted to about 35 per cent. In other words, a drastic reduction in interest rates discouraged Poles from putting their funds on term deposits. And as a result, there was a migration of funds from the M1-M2 component towards the M1 aggregate. Is this kind of migration of funds a strictly Polish phenomenon? No.

“In the euro area the process of interest rate reduction towards 0 per cent was much more spread out over time than in Poland.”

Similar phenomena occurred in the euro area, with one major difference. In the euro area the process of interest rate reduction towards 0 per cent was much more spread out over time. In the case of Poland, only a year passed from the moment when the reference rate was at 1.5 per cent. In the euro area – apart from a brief episode from July 2011 to November 2011 – it took more than twelve years for the ECB reference rate to descend below 1.5 per cent. This makes a huge difference. Between September 2013 and March 2019, the rate of growth of M2-M1 in the euro area was continuously negative (!!!). In March 2009, the share of the M2-M1 component in the general M3 aggregate in the euro area was over 42 per cent. Still in March 2013, its share was over 40 per cent. Today, the share of M2-M1 is less than 24 percent of the M3 monetary aggregate in the euro area.

In other words, the analysis of both the balance sheet total, and especially the monetary aggregates, points to the proverbial hoarding of unused funds by private entities as well as public institutions. Nobody knows what will happen when people start spending these accumulated funds. However, before this scenario materializes, it is necessary to overcome the pandemic. This is in everyone’s best interests and it’s not surprising that the monetary authorities of most countries are now focusing on this particular task.

To sum up, the practice of quantitative easing initiated by the Bank of Japan 20 years ago started spreading to other countries. As a result of the Great Financial Crisis of 2008, the concepts of quantitative easing were put into practice by institutions such as the Fed, the Bank of England, the ECB, and the Swedish Riksbank. Only after the outbreak of the pandemic, did the idea of quantitative easing become more widely used by a growing number of central banks across the world. Therefore, the actions taken by Narodowy Bank Polski in 2020 did not differ much from the activities of other central banks. Preliminary analyses point to the high effectiveness of these measures. However, it is still far too early to provide a final assessment.

The views expressed in the article are the private views of the author and are not an expression of the official position of NBP.