Tydzień w gospodarce

Category: Raporty

They have proved that they are able to sell in other markets and the closure of exports to Russia did not result in them going bankrupt.

When almost exactly two years ago the European Union countries, the United States, Canada, Australia and Japan decided to impose sanctions against the Russian Federation (in response to its support of the rebels in Eastern Ukraine), enterprises in Poland tore their hair out over how they would cope without access to such a large market.

This was even more the case since Russia responded to the sanctions by implementing an embargo which covered a large part of the agricultural imports from these countries. For years, Russia was a traditional market for Polish agricultural products, so both producers and observers expected this would be a big blow.

However, this did not happen. On the one hand, thanks to the rapid response of the government which decided to support the most afflicted producers, and on the other hand, the reaction of the producers themselves who quickly redirected sales to new markets and established new trade contacts.

The government allocated PLN500m on assistance for companies that had been affected by the sanctions. At the time it was estimated that exporters accounting for approximately 15 per cent of Polish exports would need assistance.

The apple – one of the main goods exported to Russia – became the symbol of the embargo. The European Union allocated EUR5m for promoting apples in new markets (to be used within 5 years).

This assistance was supposed to minimise the losses but obviously it did not free the producers and sellers from the obligation of establishing new trade relations. One of the biggest groups of beneficiaries was the fruit growers of Grójec. The money was allocated for promotional activities, above all in the United Arab Emirates and China.

Immediately after the borders were closed for the fruits, Belarus became the biggest importer, buying huge quantities of fruits, not for its own consumption but to resell to Russia. Due to irregularities in the trade documentation, Polish, German and French products which were covered by sanctions found their way to Russia but with new Belarussian or Kazakh labels. Without any problems their products could be sold on the territory of the whole of the Eurasian Economic Union, which is governed by Russia.

The Ministry of Agriculture and associations of fruit growers immediately began talks with new potential clients. It was mainly customers from North Africa and Arab countries (UAE, Kuwait) who showed interest in Polish apples. While in 2014 annual exports did not exceed 3,000 tonnes, in the 2014/2015 season they reached 20,000 tonnes (data from Prof. Eberhardt Makosz).

This does not mean that fruit growers coped with all the consequences of the Russian embargo. In 2015 they managed to sell only half of the country’s apple production, and this year they will also not manage to sell everything. Mirosław Malinowski, the President of the Fruit Growers Union, points out that there are no reasons for optimism. “In fact, there were no problems with the sale of apples only because we withdrew a huge quantity thanks to the special assistance mechanism of the European Union, the so-called food banks, the increase in the price of apple concentrate as a result of huge exports to the United States and the Russian Federation, and shipments to the countries of Eastern Europe. Also, thanks to selling at very low prices in other markets.”

Poland is today the third largest producer of apples in the world (after China and the USA) and it cannot be ruled out that it will soon occupy second place, so it must guarantee for itself new places where it can sell the fruit. The best prospects seem to be the rapidly growing Asian market.

Despite the involvement of representatives of the Ministry of Agriculture in the negotiation process, giving credibility to Polish fruit growers, it is not at all an easy task to convince new clients to buy large quantities of Polish fruit.

A change of direction of exports requires adjustment of the existing infrastructure and sometimes the purchase of new equipment (e.g. for fruit waxing or to ensure longer life of the fruit so that it will survive the long journey by ship), but also adjustment to the tastes of clients in what are sometimes exotic countries.

Not every sector which had to reduce its exports to Russia reduced them due to the sanctions. Often there were purely market reasons for this – there was a decline in the financial possibilities of Russians, whose purchasing power fell dramatically in the ailing economy.

Before 2014, furniture exports to Russia rose by as much as 40 per cent annually. In 2013 the value of exports reached EUR169m. Although furniture produced in the EU was not the subject to sanctions, sales income is nevertheless falling. At the beginning of 2015 it fell by 20.4 per cent and in the following months it declined even more.

However, this did not prevent Polish furniture producers from achieving further record exports. Experts of Credit Agricole Bank, who analysed the potential of the sector, forecast a 10.2 per cent increase in Polish furniture exports to the European Union countries in 2016.

Sales are boosted by the low exchange rate of the zloty against the euro and the rising needs of these countries’ households. Although the EU remains the largest market for Polish furniture, producers are increasing boldly searching for new clients – above all in Africa, Asia and the Middle East.

According to the authors of the report prepared by analysts of Atradius, the world’s largest credit insurer, although the Russian embargo was a blow to firms operating in Europe, it most severely hit Russia, and mainly its exporters.

The special nature of the Polish food market, where domestic demand constitutes almost 70 per cent of total sales, allowed producers to compensate for losses resulting from the closure of the Russian market. The inability to sell to Russia did not lead to worse sales results abroad. In 2015 food exports exceeded the value of the previous year (EUR25bn compared to EUR21bn), while the most exports went to the European Union. What was new was the high share of exports to African and Asian countries.

“The Polish economy practically did not notice the Russian embargo,” Yevgeny Gontmakher and Ernest Wyciszkiewicz rather provocatively remarked in an article in the Russian newspaper “Vedomosti”. To support their words, they cited data comparing Polish exports in 2014 and 2015. In 2014 Polish exports stood at EUR165bn, and the main recipients were Germany (26.3 per cent), the Czech Republic and the United Kingdom (both 6.4 per cent), France (5.6 per cent), and Italy (4.5 per cent). Russia was only in the fifth place (4.2 per cent).

In the first half of 2015, exports to Russia fell by 30 per cent, however, the total value of Polish foreign sales rose in this period by 7.2 per cent. In the period between January and April 2016, Russia was in the ninth place among Poland’s export markets, according to the Central Statistical Office (GUS). In this period, exports of Polish goods fell by 3.3 per cent y/y (to USD1,714m). According to Russian data, from January to May, Polish exports to Russia fell by as much as 12.7 per cent.

Gontmakher and Wyciszkiewicz conclude that the Russian authorities were wrong to assume that the sanctions would harm the economy of its biggest partners and lead to unrest instigated by the social groups most affected by the embargo. This did not happen, because the situation clearly shows that the fate of Polish producers does not depend on orders from Russia. Thus, according to the authors, the conviction of the “limitlessly absorbent and irreplaceable Russian market” has taken a blow.

Quoted in the Financial Times , Balazs Jarábik, expert of the Carnegie Center, shows that the existing situation, in other words the introduction of sanctions and the accompanying fall in interest of the countries of the European Union in exporting to Russia, has only accelerated the trends which appeared immediately after the collapse of the Soviet Union.

“Reducing Russia’s economic footprint in Central and Eastern Europe has been an ongoing trend for a longer period of time and the sanctions and oil price slump is only helping to move this forward again. Some of the old links could be rebuilt, but I believe politics will keep poisoning or interfering with trade relations in the Baltics and Poland.”

The decision to extend the sanctions required a unanimous vote of all the Member States. It was not clear whether such agreement would be achieved, because some of the Member States were in favour of lifting sanctions, or at least loosening them.

The French are against maintaining the sanctions. In April, the French National Assembly adopted a resolution (non-binding) in which it appealed for the lifting of the sanctions, arguing that they excessively damage the French economy and are ineffective. Similarly, Germany would like to strengthen cooperation – and trade – with Russia. Italy, Greece, Cyprus and Hungary are also calling for a rethink on the merits of continuing the sanctions. A huge question mark hangs over the further extension of the sanctions to future months.

The effectiveness of sanctions as a means of exerting pressure has long been questioned by science. Some researchers are of the opinion that among all the sanctions imposed in recent history, only in 30 per cent of the cases did they bring the desired effect.

For sanctions to be effective, they have to be introduced in a well-thought out way, so that the consequences hit the authorities and motivate them to change their behaviour and not so that only the citizens feel the effects. Moreover, the cooperation of many states is needed, because economic sanctions will not have any effect if the isolated state can buy the specific group of goods elsewhere.

It is estimated that in 2015 Western sanctions (and the Russian counter-sanctions that accompanied them) accounted for a fall in Russian GDP of 1-1.5 per cent. The slump in oil prices and the piling up of the consequences of mismanagement of the country proved to be far more detrimental. At the same time, to a certain extent the situation turned out to be beneficial for Russia, since it had to find a way to increase food production and establish new trade contracts.

Who does Russia cooperate with?

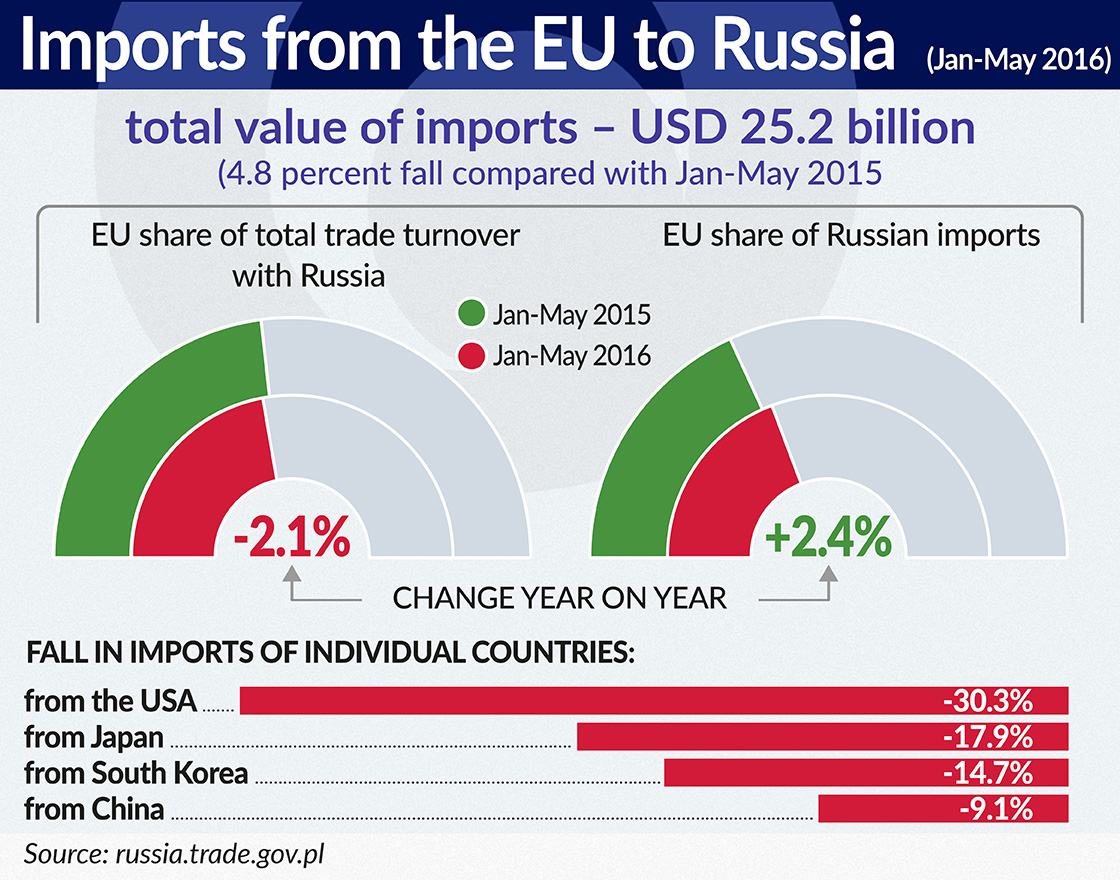

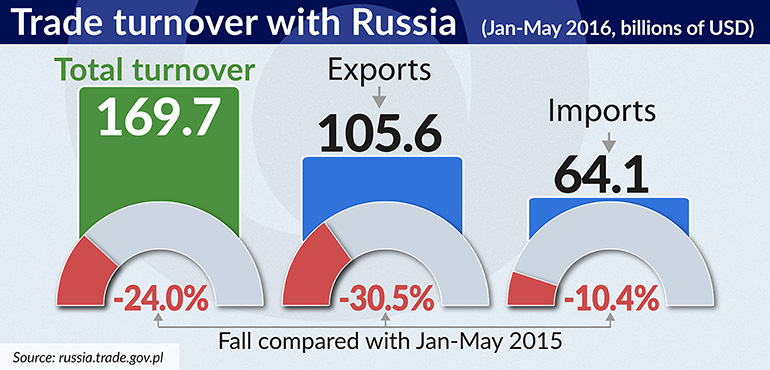

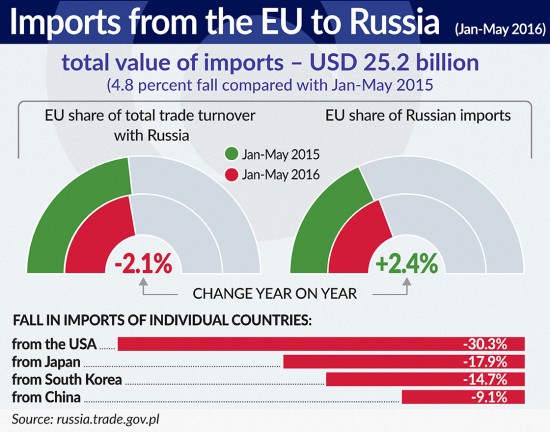

In the first five months of 2016, Russia’s total foreign trade turnover fell by 24 per cent compared to the corresponding period the previous year. Above all, exports fell (by 30.5 per cent) while imports fell by 10 per cent (all data from russia.trade.gov.pl).

Countries that exported less to Russia include the following: Poland (12.7 per cent less), the United Kingdom (22.2 per cent less), Germany (6.8 percent less) and Italy (5.7 per cent less). But some European countries have increased their sales, despite the sanctions. These include France (by as much as 42 per cent), Estonia (by almost as much), Luxembourg (by 27.5 per cent), and Malta (by 24.5 per cent).

However, foreign trade cooperation is shrinking not only due to sanctions. China, Japan and South Korea have also recorded a fall in exports to Russia (by 9.1 per cent, 17.9 per cent and 14.7 per cent accordingly).

In the face of constantly shrinking imports, the Russian authorities have declared the greatest possible openness to foreign investors who want to operate in Russia. Whether more companies join the almost 13,000 European firms already operating in Russia depends to a large extent on the political atmosphere surrounding Russia.