Polish Deputy PM, Mateusz Morawiecki (©PAP)

However, such a significant increase in the total investment rate will be difficult to achieve for several years to come, given the modest investment plans of local governments.

(Infographics Bogusław Rzepczak)

The success of the plan will therefore depend on a possible reversal of investment trends by local governments or, alternatively, on a potential substantial increase in the investment rate in other segments of the economy.

The Plan for Responsible Development presented by Morawiecki identifies key threats to long-term economic growth and suggests solutions to these problems. The main risk factors to long-term growth include falling into the middle income trap, lack of balance (excessive foreign involvement in the Polish economy), insufficient investment of businesses, unfavorable demographic trends and weak institutions (low VAT and CIT collection rates, lack of coordination of public policies).

Investment – focus of the program

These problems are to be solved through activities described as “ 5 pillars”.

- Reindustrialization – i.e. focusing on industries in which Poland can gain competitive advantage and attract foreign investment.

- Development of innovative companies, which involves, among others, drawing up a Business Constitution to simplify regulations, helping develop and launch innovative products, and higher spending on research and development.

- Capital for development – aiming for a significant increase in capital expenditure, and an improved efficiency of institutions supporting investment; the establishment of the Polish Development Fund.

- Foreign expansion – support for Polish exports aimed at new markets, conducting foreign trade missions and developing a network of economic diplomacy posts.

- Social and regional development – a proposal of a comprehensive demographic program, the reform of the education system and support for the development of Polish regions.

The Plan for Responsible Development is a framework document that contains only outlines of possible solutions. We have to wait until the draft laws are submitted for the details of the initiatives and their implementation.

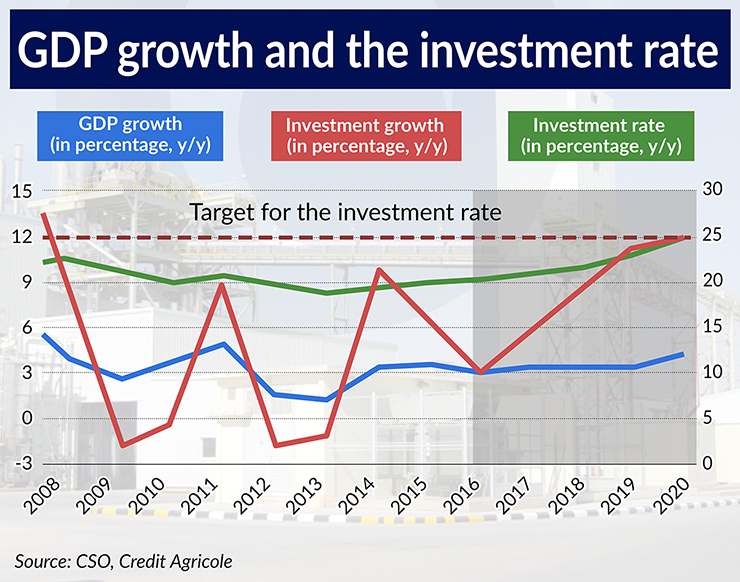

The plan sets out several objectives to be met by the year 2020. These include industrial output and export growth that is faster than GDP growth, a rise in R&D spending to 2 per cent of GDP, a reduction in the at-risk-of-poverty rate below 15.5 per cent of the population and an increase in per capita GDP to 79 per cent of the EU average. In our assessment, the key objective of the program is to raise the investment rate (capital expenditure in relation to GDP) to 25 per cent from the 20 per cent observed in 2015.

Stumbling block of local government

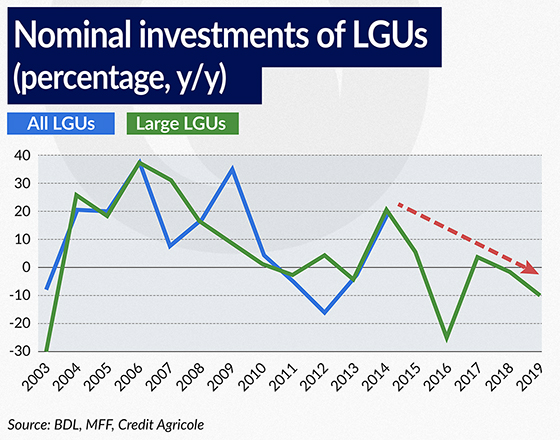

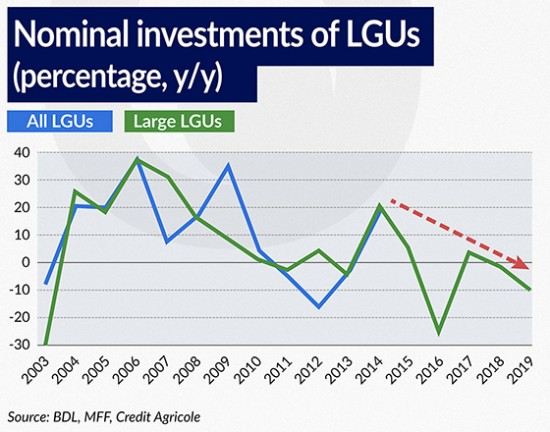

In our assessment, a significant increase in total investment growth will be difficult to achieve over the next few years, given the current investment plans of Local Government Units (LGUs). In 2014, investments by LGUs represented 52.1 per cent of the public sector’s total expenditure on fixed assets and 11.8 per cent of investment in the economy as a whole. At the same time, in 2014 capital expenditure by LGUs recorded a nominal increase of 19.2 per cent y/y, which is significantly higher than the fixed-asset expenditure of other public sector entities (5.5 per cent) and the investment expenditure in the economy as a whole (8.3 per cent). Thus, LGUs accounted for a major part of the change in the investment rate.

Based on the Multiannual Financial Forecasts (MFF) of the individual LGUs, we can estimate the level of their future investment. To determine the total outlays on fixed assets of all the LGUs, one needs to add up the investment plans from the individual MFF documents, which, given the number of LGUs (16 voivodeships, 314 counties and 2,478 communes), would be a time-consuming task.

That is why in this analysis we have used the value of investment for the 27 largest cities with county rights (hereinafter: large LGUs) that jointly account for about 30 per cent of capital expenditure of all the LGUs. The linear correlation between the value of investments of large LGUs and all the LGUs was 96 per cent in the years 2000-2014, and the correlation between their annual growth rates was 64 per cent. Thus, we believe it is possible to infer trends for capital expenditure of all LGUs based on the investments of large LGUs. According to the data we gathered on the implementation of budgets or expenditure forecasts, investment growth by large LGUs in 2015 slowed to 4.9 per cent y/y, from 21.1 per cent in 2014. According to the estimates contained in the Multiannual Financial Forecasts, large LGUs are projecting a 25 per cent drop in expenditures on fixed assets in 2016, which would be the lowest investment growth since 2003.

Detailed information contained in the budgets of the LGUs confirms that the slowdown is partly associated with a weaker inflow of funds from the European Union at the beginning of the 2014-2020 financial framework. Assuming that all LGUs experience a similar drop in capital expenditure as the large LGUs, a reduction of 16 percentage points in the annual public investment growth rate can be expected in 2016 compared to 2015, and hence a drop of 3.6 percentage points in total investment growth. Our estimates may not capture the full change due to the potential discrepancy between the investment growth of large LGUs and all LGUs.

(Infographics Bogusław Rzepczak)

The negative effect associated with the EU’s the new financial framework will only affect investment growth only in 2016. By 2017 investment growth by large LGUs, supported by the low base effect, is expected to see a sharp rise, to a level close to that of 2015 (+3.9 per cent y/y), according to MFF documents.

Assuming a similar percentage increase in the capital expenditure of all LGUs, it will boost total investment growth by about 3.5 percentage points. In accordance with the MFF, in the 2018-2019 the growth of investment in fixed assets in large LGUs will once again drop off, to –10.0 per cent y/y in 2019. In 2016-2019 (most LGUs do not publish forecasts for 2020) capital expenditure growth will be persistently lower than GDP growth, detracting from total investment growth. In addition, there are significant risk factors for the implementation of the investment projects, including uncertainty over an increase in the tax-free amount of income taxes, which would diminish the incomes of the LGUs, as well as the launch of the 500+ child benefits program and the possible decision of the government on the liquidation of middle schools, which will stretch the budgets of LGUs.

At the same time, given that the government aims to keep the public finance deficit close to 3 per cent of GDP, it is difficult to expect the government to loosen statutory restrictions on the deficits and debt of the LGUs. The success of the Morawiecki plan will therefore depend in part on a possible reversal of trends in local government investment or a dramatic increase in the investment rates in other segments of the economy.

It could work, but what next?

For the purpose of further analysis we implicitly assume that the government will manage to take the investment rate up to 25 per cent of GDP by 2020. We do have doubts as to this assumption, but they can only be dispelled once concrete draft laws are submitted. Below we present the expected impact of a significant increase in capital expenditures on Poland’s economic situation. The Plan for Responsible Development will be launched in 2017.

Increasing the investment rate to 25 per cent requires a substantial acceleration in capital spending. In our simulation, we assume that total investment growth will gradually increase from 3.0 per cent y/y in 2016 to 12.1 per cent in 2020. According to our calculations based on the Cobb–Douglas production function, such activities will lead to a gradual increase in potential GDP growth from 3 per cent in 2016 to 4.3 per cent in 2020. This scenario requires an increase in investment spending in the 2017-2020 by a total of 11.9 per cent of GDP (for 2015) compared to a scenario in which the investment rate would remain unchanged.

These expenditures can be financed in two ways – either by increasing external debt, or by increasing the domestic savings rate.

We believe that a significant increase in the domestic savings rate is unlikely. In accordance with the declarations of government representatives, we expect that the fiscal policy implemented by the government in the coming years will be carried out with a public finance deficit close to 3 per cent of GDP, which will make it impossible to increase public savings.

An increase in the profits (savings) of public companies is unlikely in light of the government’s policy of supporting certain industries (e.g. mining) and striving to increase workers’ salaries. Thus implementing a strategy oriented towards increased efficiency in public enterprises, which would allow for an increase in savings, seems unlikely. In turn, the household saving rate is countercyclical. The expected acceleration of economic growth, better prospects in the labor market and an increase in disposable income due to the transfer of funds under the 500+ program will put downward pressure on household savings. One reservoir for savings could be the profits of private companies. That growth, however, will be slow and largely dependent on the total factor productivity.

The implementation of the plan means higher foreign debt

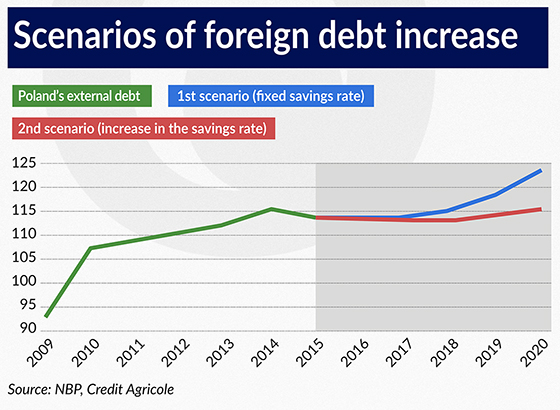

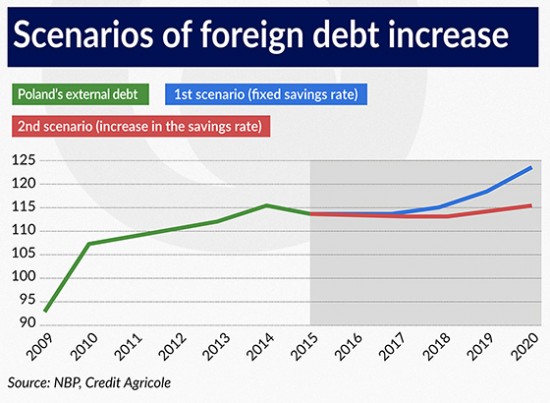

We conducted two simulations, which differ in the method of financing increased investments. In the first scenario, we assume that the savings rate remains unchanged, which means that higher investment spending will trigger a deterioration in Poland’s international investment position. The international investment position is a statement of the external financial assets and liabilities of the domestic economic agents at a specific point in time. The difference between the size of foreign assets and liabilities is the net international investment position, which indicates whether a given country is a net debtor or a net creditor in relation to foreign countries.

In our analysis we assume that the stock of Polish foreign assets will not change, and thus we only consider the change in foreign liabilities (external debt). In the first scenario, a considerable rise in fixed asset expenditure will cause an increase in foreign debt from 114 per cent of GDP in 2015 to 123 per cent of GDP.

In the second scenario, we assume that the increase in the investment rate will be partly balanced by an increase in the savings rate. In this variant of the simulation we assumed that by 2020 the domestic savings rate will increase gradually by 3 percentage points compared to its current level (19.6 per cent). As a result, foreign debt would increase only slightly, to 116 per cent of GDP in 2020.

(Infographics Bogusław Rzepczak)

In both cases, the ratio of external debt to GDP would still be relatively low in comparison to other countries of the region. At the end of 2014 this ratio was as follows: 92.5 per cent for Romania, 97.6 per cent for Lithuania, 131.7 per cent for the Czech Republic, 141.4 per cent for Slovakia, 149.4 per cent for Slovenia, 156.6 per cent for Bulgaria, 175.8 per cent for Latvia, 183.6 per cent for Estonia and 322.5 per cent for Hungary. Therefore, the increase in external debt alone should not have a negative impact on foreign investors’ assessment of Poland’s financial situation. However, the imbalance in savings and investment will work towards a significant decrease in the current account balance.

In the first scenario, the need to use external financing would contribute to a gradual increase in the current account deficit (from 0.4 per cent of GDP in 2017 to 4.8 per cent in 2020). In the second scenario, a partial increase in the domestic savings rate would help to curb the scale of the increase in the current account deficit – which would grow to 1.8 per cent in 2020.

The first scenario would render the Polish economy vulnerable to a boom-bust phenomenon. In case of a severe slowdown abroad, an increase in global risk aversion and an outflow of capital from emerging markets, Poland would experience a weakening of the PLN coupled with heightened volatility, as well as an increase in real interest rates. The tangible current account deficit (4.8 per cent of GDP) would aggravate these negative effects. As to the second scenario, we believe it is not impossible; however, it would require the introduction of measures allowing for a permanent increase in the domestic savings rate, especially private savings.

Given the current state of knowledge about the government’s economic strategy, the first scenario is more likely. However, until the government presents proposals aimed at increasing the investment rate, the plan announced by Morawiecki does not, in our assessment, constitute a convincing argument in favor of a significant acceleration of economic growth in the coming years.