Polish budget for 2017 will be surely a tight one. If Poland wants to meet the European Union-required limit of the public finance deficit of 3 per cent, the government will have to adopt a few optimistic assumptions:

- GDP growth and inflation will be markedly higher than presently;

- tax income will grow substantially higher than nominal domestic demand; and

- local governments will post a budget surplus when spending new EU funds.

Let’s pose a question: why should the EU limit of 3 per cent of GDP be relevant to the deficit at all?

Brussels itself often turns a blind eye to the rule, for instance the European Commission has recently refrained from imposing a fine on Spain and Portugal for exceeding the limit. Financial investors also do not care about the rule, as they care more about the nominal growth outlook (tax base), debt servicing costs and general macroeconomic stability (inflation, current account balance and external borrowing needs). In their communications, rating agencies sometimes highlight the 3 per cent limit, however, this is more of a credibility test than an indication of a real macroeconomic problem.

If we cannot use the 3 per cent rule to assess the major budget parameters, how can we do it then? In other words, how can we answer a simple question: is it a good or a bad budget?

There are opinions that for the budget to be optimal, its primary balance (deficit) should amount to zero – after subtracting debt servicing costs, that is after repaying the interest, the government’s income and expenditures should be balanced. However, this is not a groundless suggestion, because financing, let’s say, investment partly with additional debt is worth a try. Besides, a country with a permanently higher pace of economic growth than the real effective interest rate (this is the case of Poland) can have a primary deficit without increasing debt.

Others point out that when economic growth is good, the government should save big to make room for bigger spending in a period of crisis. They are quite correct. Giving up this rule temporarily, for instance to implement a strategic social program (child benefits “500+”), does not have to carry negative consequences.

To say whether the budget has been designed well or not requires a look into it from a longer than one year perspective. The trend and the decision making system matter, not just a one-time budget. The key problem with the Polish budget and the entire public finance lies in the fact that the incapability of saving in good times is a permanent feature.

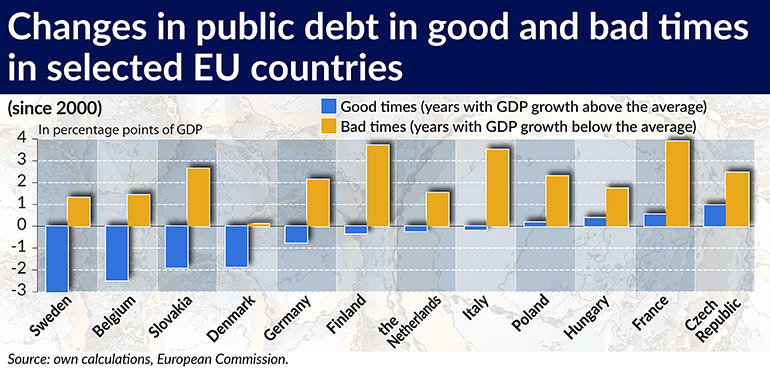

The chart illustrating this analysis shows the changes in the public debt (in percentage points) in bad times and in good times in selected EU countries since 2000. Good times have been defined here as the years when GDP was above the long-term trend. In bad times all countries increase their debt but in good times some countries reduce it and others keep it stable. In Poland political decision making has been set apart from the concept that good times should be used for saving. Even if politicians formulate such plans, ultimately they give them up as the nature of the stimulus is such that it pays off to spend the surplus arising in good times.

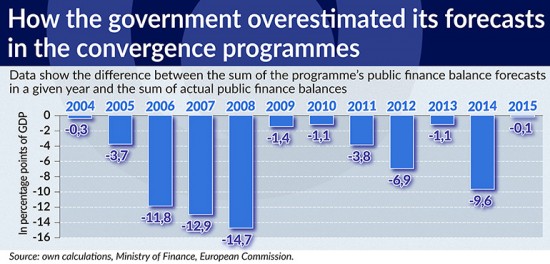

Since 2004 the public finance deficit has always exceeded the targets set in government-prepared strategic documents. Every spring, the government releases a convergence program containing forecasts of key economic and public finance indicators for the next four years. Each time, the cumulated deficit value in the four years was higher than planned.

This can be explained only in two ways: either the strategic documents had been served to play a game with Brussels and had tried to make the EU believe that Poland shall be abiding the fiscal rules or the Polish decision makers had been incapable of assessing the government’s real financial capabilities.

For the time being, there is no reason to panic – contrary to warnings voiced by some politicians. Poland’s debt is relatively low, its economic growth is high and macroeconomic indicators are stable (low inflation and current account deficit).

However, Poland is facing a few challenges that will weigh heavily on the budget:

- the economic growth is likely to be lower than in the past and lower than indicated by the government long-term forecasts;

- an ageing society will lead to a sharp rise in the costs of health care;

- military spending is likely to grow.

If the budget and the entire public finance are not prepared for the challenges in advance, someday this will have to be done abruptly. The process will be painful and result in an unnecessary social harm.

Ignacy Morawski is an economist in the Warsaw Institute for Economic Studies, WiseEurope.