Tydzień w gospodarce

Category: Raporty

Governments that understand the laws governing global markets and are aware of the strength of their own markets are able to place even a small country in the position of European and even global leader of food production and exports. This is exactly what happened in the case of the Netherlands, which was the number one in the European Union in food exports in 2016. Last year, the country of windmills and tulips exported food outside the European Union worth EUR13bn, which accounted for 16 per cent of total food exports to third-country markets. The Netherlands beat Germany and France (EUR11bn each) as well as Italy and Spain (around EUR8bn each).

On the other hand, Poland is the undisputed European leader in poultry production (3.2 million tons in 2016 worth EUR2.1bn). Polish companies have pushed French, British and German producers out of the market. This result was achieved in just three years due to the high quality of the product and its low prices. The example of the Netherlands, however, shows that low prices are not always a condition for foreign expansion. So what is the deciding factor?

It is not easy for companies to gain ground on the Polish agricultural and food market, because even though companies are eager to grow, most often there are no institutional mechanisms at a national level.

The pig population at the level of over 11 million gives Poland the third place in the European Union. However, the developments on the pork market in Poland do not depend on domestic breeders and farmers or meat plants. That is because the price of pork in Poland is determined on the German commodity exchange and on the ZMP (Zentrale Markt-und Preisinformationen) futures market. Once a week, every Wednesday at 13:30 pm, a reading of the ZMP index for pork is announced. The provided value is a determinant of the purchase prices of pig livestock and pig meat in Poland, and then it may (although not necessarily) be reflected in the final price for consumers.

The situation is no better for the grain and feed market. Two exchanges – the French MATIF and the American CBOT – determine the opening prices for the export of Polish grain and the prices of imported cereals and animal feeds. As a result, in both cases the ultimate costs, profits and losses of Polish producers and farmers depend entirely on the buyers and sellers, as well as brokers in Paris and Chicago.

While there are agricultural commodity exchanges in Poland, they only have a local and indirect significance in relation to the ZMP, MATIF and CBOT. In addition, Polish exchanges have only modest financial and transaction tools at their disposal. The lack of a single commodity market with futures contracts in Poland’s economic reality means that Polish agriculture and the agricultural, food and processing sectors depend on what is happening on the meat retail (consumer sentiments) and wholesale market in Germany, or on the wheat contract bids made in Paris and in Chicago.

In addition, the meat industry and the cereal and feed industry do not fully utilize their production and market capabilities. For example, the meat sector imports genetic material from abroad. Only last year, Poland imported over five million piglets from Denmark and Germany, which means that with a pig population of over 11 million, almost every other pig is not really “Polish” (at least in terms of genetics). With each passing year this trend is strengthening to the disadvantage of Polish farms, gradually deepening the dependency of Poland’s agriculture on Danish and German breeders.

The global milk market is controlled by ten and a half thousand New Zealand farmers who founded the dairy cooperative Fonterra in 2001. Since then, the company has been growing intensively through conquests, acquisitions and takeovers. It currently controls 25 per cent of the global dairy market. Its biggest business success was gaining a strong position on the Chinese and Asian markets.

In order to consolidate its global position, in 2008 Fonterra established a capital market for dairy – Global Dairy Trade (GDT). Today, this online trading platform dictates the prices of dairy products on a global scale, although there are markets – such as Poland – where its impact is not as strong as one would think.

Although Poland’s dairy cooperatives are very strong in light of Polish or even EU conditions, it is a small (but very attractive) market when confronted by Fonterra. The abolition of milk quotas in the European Union on April 2015 attracted the attention of Fonterra and GDT. For two years they have been making efforts to increase their presence in the EU, and above all to take over a part of the EU milk market. Due to the lack of institutional organization, Poland is an obvious target for them (and they are also interested in other countries of Central and Southeast Europe, CSE). In 2016, Poland produced 13.2 million tons of milk, which ranked it 13th in the world. Poland is also an important exporter of milk. In 2016, it sold 3.3 million tons abroad, and in 2015 – 3.04 million tons.

The size of the Polish dairy industry in the context of the complete lack of any institutional framework makes the Polish dairy market an easy target for expansion, and this process is already taking place. The Global Dairy Trade exchange intends to control the European milk market (and also – or rather primarily – the profitable Polish market) together with the German exchange operating under the name European Energy Exchange (EEX). Both companies have recently signed an agreement in this regard.

This development is supported by the fact that although on the Polish market there are entities offering milk price quotations, in practice their ability to shape the domestic dairy market is insignificant. The lack of a single cohesive institution means that the large Polish market may in the future be dependent on the exchange fluctuations taking place outside the country.

In addition, a weakness of Polish dairy companies (and also many EU companies) is the fact that they use outdated marketing content in their commercial activities. For example, the New Zealand farmers in Fonterra do not sell milk, cheese or butter, they simply promote high-quality protein (which happens to take the form of milk, cheese, butter) necessary for healthy and proper human development. A promotional campaign structured in this way has been enormously successful in China and other Asian countries and has turned the Anchor brand of milk with the inscription “Kia ora Milk” (Good morning milk) into a paragon of quality and innovation.

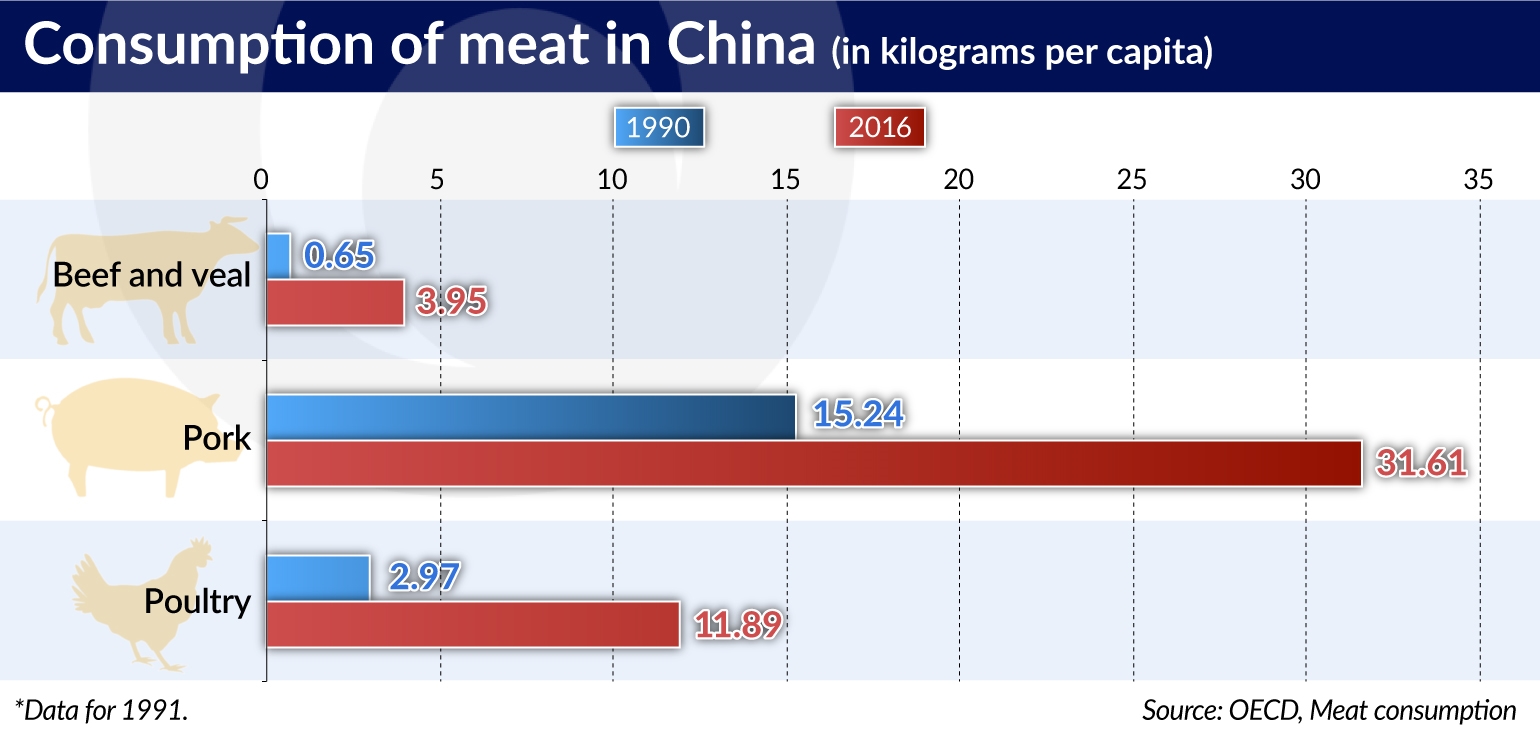

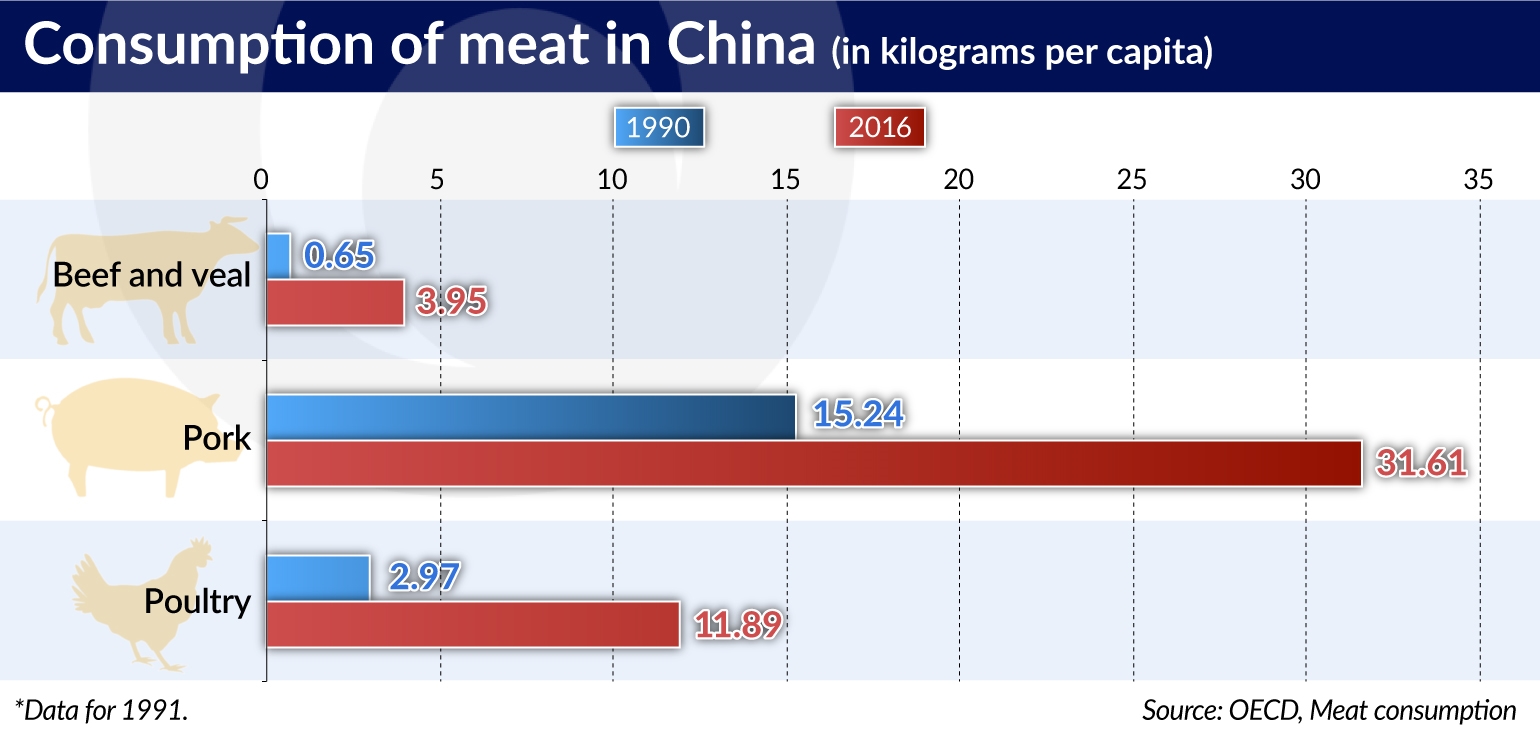

Due to China’s economic development, Chinese are becoming more affluent. According to the National Bureau of Statistics of China, in 2015 the average annual salary in China was CNY62,029 (about EUR8,014). Higher income translate into increased consumption of food, including meat, which was a rarely consumed product in the past. It is worth mentioning that the consumption of beef in China increased by 1,600 per cent in the period from 2010 to 2015 alone.

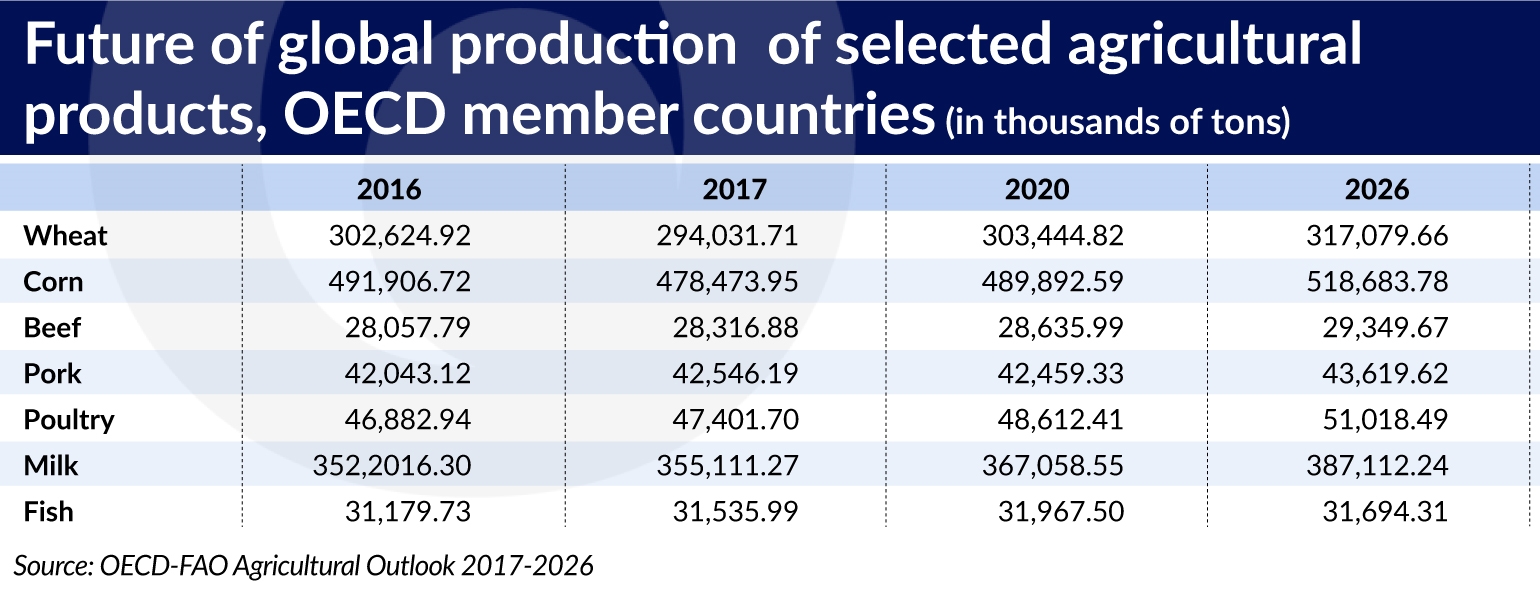

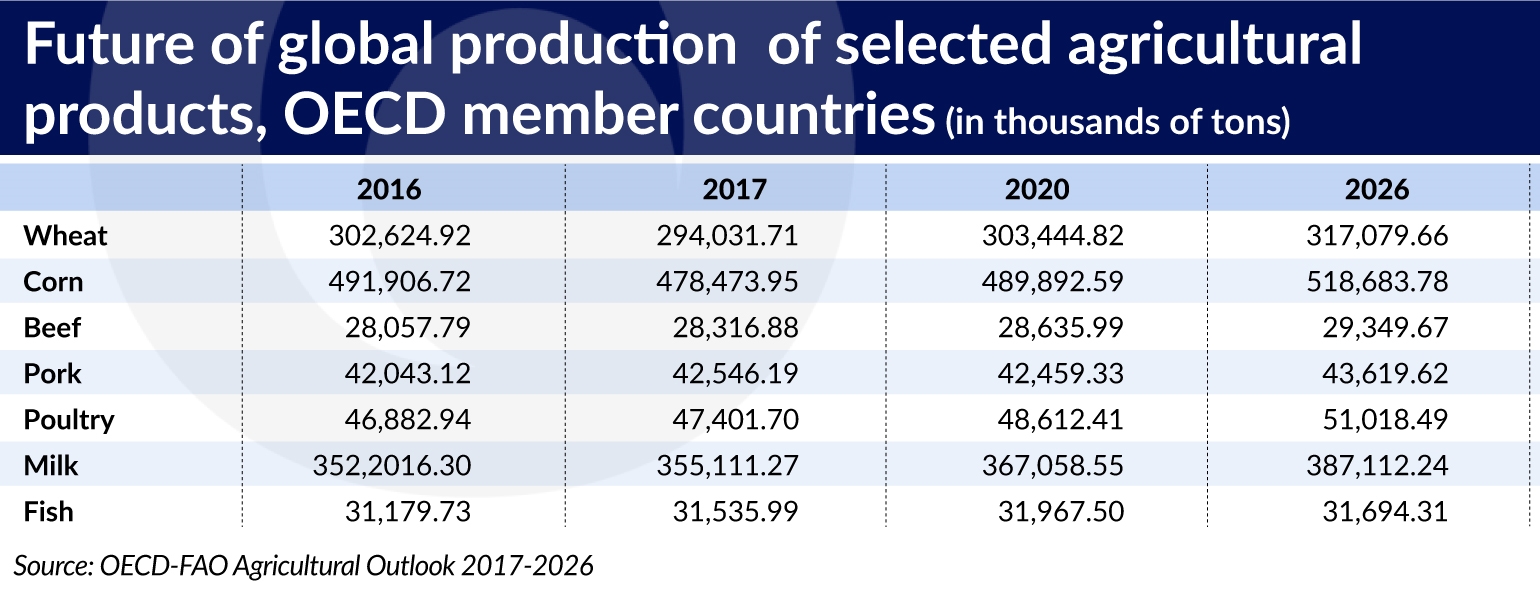

This shows the possibilities for exporters sending products to the Chinese market, because – despite its production potential – China is not able to satisfy its animal protein needs with domestic production. In an analysis entitled “China’s Animal Protein Outlook to 2020: Growth in Demand, Supply and Trade” Rabobank estimates that in 2020 China will import 6 million tons (currently it is 5 million tons) of animal protein in the form of meat (pork, poultry, beef and mutton). Rabobank predicts that Chinese imports of pork and beef will reach the highest volumes. Imports of the latter will increase by as much as 20 percent in 2020.

The problem of China’s domestic meat market lies not only in the production shortages, but also in the quality of the meat produced. Chinese meat is not standardized or identifiable, and breeding and production are not carried out according to the principles of animal welfare because the latter is not known in Chinese meat production. As a result, the quality of meat is low.

This will soon change, though. In a speech given at the 19th Congress of the Communist Party of China, President Xi Jinping set out the directions of development of the agricultural and food sector in China. Food security remains a priority, but a new trend in the Chinese government’s food policy is to take care of the high quality of food, animal welfare, ecology and green agriculture.

Experts on the Chinese agricultural market are currently engaged in a big debate on the issue of animal welfare. In order to explore this issue, an international conference was held last October in Hangzhou, under the auspices of the Chinese Ministry of Agriculture, with the participation of 32 countries (Poland was not present). The conference presented all the most important models of animal welfare at every stage of production.

The guidelines of President Xi Jinping and the Hangzhou conference should be seen in a broad context, including through the prism of the One Belt, One Road. China is building strong links in every segment of the agricultural and food industry in various parts of the world, which will enable quick imports and exports of food. In September 2017 the news spread across the world that the Chinese company Ningxia Forward Fund Management Company was investing USD367m in Dubai Park Food. As a result, a Chinese-Emirati food cluster was established, and it will operate on the halal food segment, which is growing fast on the global scale. There are 28 million Muslims in China alone, making up two per cent of the entire population. The halal food market in China is currently valued at USD20bn. The Chinese investment in Dubai is undoubtedly aimed at beating the foreign competitors.

Another example of Chinese pragmatic thinking and building of foundations for their own interests was the purchase of the American global company Smithfield by the Chinese company WH Group for over USD4bn. Incidentally, WH Group is also the owner of the Polish company Animex.

It is clear from the words of President Xi Jinping that China is supposed to be present in the agricultural and food sector wherever possible. Food – of all sorts – is and will be the priority of the Chinese government. For the time being, however, the Chinese are aiming to leave the competitors behind or to gain control of them. In addition, through acquisitions they are learning about the local markets.

Being a leader of countries on the agricultural and food market does not come out of nowhere and is not only the result of business decisions of management boards. Effective expansion is the result of prior in-depth analysis of a specific market, focused on one’s own needs and capabilities. An equally important part of a country’s export policy is anticipating trends and coming up with ways of reacting to the ongoing fluctuations in the economic conditions in the short, medium and even long-term.

The countries that are the best organized in terms of economics have an effective analytical apparatus for the needs of the agricultural and food sector. For example, the United States government has the Office of the Chief Economist in the Department of Agriculture (USDA), the Department of Commerce it has the Economics & Statistics Administration, and the Department of State it has the Office of the Chief Economist, which are an important part of the United States’ economic diplomacy. The analyses of the agricultural Chief Economist can shake up the global market, and his reports constitute a compendium of knowledge about American and global agriculture. Based on them, companies can build their own individual market strategies.

The government of the United Kingdom also has a specialized analytical office – the Government Economic Service. The European Commission also uses such tools. A team of economists works in the office of the Chief Competition Economist.

Business practice in the agricultural and food sector shows that this dynamic market requires properly prepared people and appropriate tools. And only those countries and those companies that can notice trends in time have a chance not only to grow, but also to conquer and shape other markets according to their preferences. That is what American, Canadian and European companies are doing. New Zealand’s farmers have shown that this is possible. This is the path taken by the Chinese, because they want to follow the best examples and become the best. Let’s hope that Polish companies will follow their footsteps.

Jacek Strzelecki is a lawyer and the author of many publications on the Chinese economy.