Tydzień w gospodarce

Category: Trendy gospodarcze

In developed countries, it is broadly agreed that the right to have a roof over head is one of the indefeasible human rights. Lack of it makes impossible to satisfy basic needs, degrades an individual in the community. Poland has for years had a serious housing shortage.

Poland’s abysmal situation in this respect compared to other European countries is best illustrated by several economic indicators. Number of dwellings per 1000 persons in Poland is ca. 350, while in Germany this relation is 480/1000 and in France ca. 500/1000. So we have one of the last places in Europe, together with e.g. Romania, whose situation is nevertheless better than ours (380 dwellings/1000 persons).

Another method of comparing housing conditions can be the overcrowding rate, which in simple terms presents the percentage of population living in overcrowded households. For Poland, this index amounts to 45%, which gives us the fifth worst place in Europe (after Serbia, Romania, Macedonia, and Hungary). Almost half of the population in Poland live in dwellings inadequate to their family size/situation, while in the European Union (EU) it is only 17%, in the Eurozone 12%, and in Germany and France only ca. 7-8%.

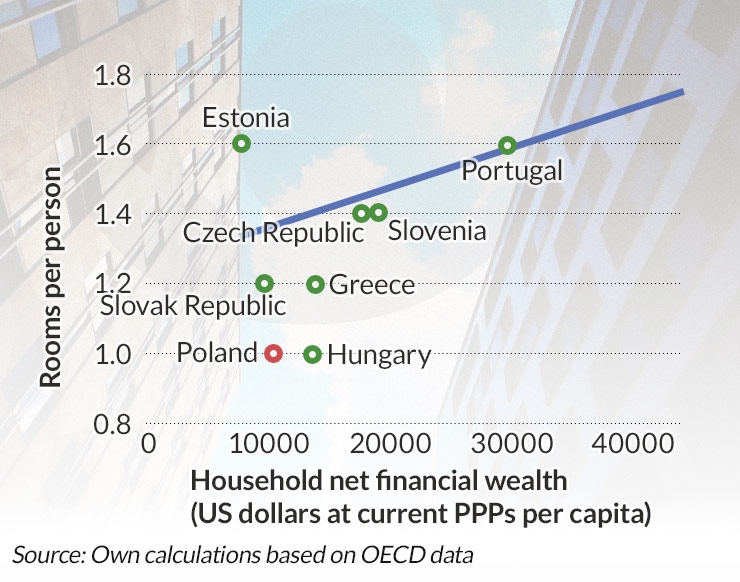

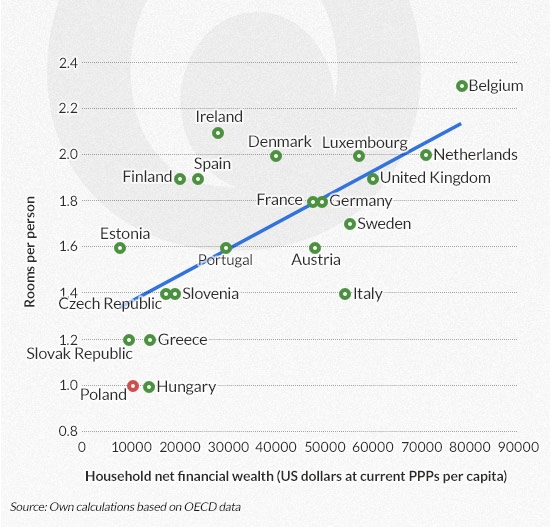

It seems that Poland’s poor situation in terms of housing conditions cannot be attributed only to the income gap, compared to wealthier EU members. The chart above compares the household net financial wealth per capita in respective EU member countries and average number of rooms per person in a household. The curve illustrates the interdependence between these two values using a linear trend. In simple terms, points/countries above this line have better (above average) housing conditions in relation to the wealth of the society while countries below the curve have worse than average conditions. Poland is one of the countries situated the furthest down below the line. This means that, given the present level of the household wealth, Poles should have much better housing conditions.

The Polish housing market is facing many problems, which it would take long time to enumerate. The major one is a relatively high housing price whose relation to households’ income is among the least favourable in Europe. Secondly, rents are also among the highest in the EU. According to the estimates of the Lion’s Bank, the current purchase value of a dwelling in Poland is enough to cover the rent for only 15 years, namely 10 years less than the EU average and 15 years less than in Germany. The disproportion between the rent and the purchase price is one of the reasons for the marked imbalance between the market of owned and rented housing, as dwellings owned by tenants represent in Poland ca. 82% of total housing stock, while in Germany it is only 45%, in France 58% and in Great Britain 64%.

Due to low income, the Polish housing problems are the most acute for young people. The problems with obtaining own accommodation are reflected by the high percentage of young Poles (25-34 years of age) still living with their parents – 44% in Poland vs. 29% on the average in the EU and 17% in Germany. For many young people to purchasing a dwelling is an extremely difficult task, practically bordering on the Mission Impossible. For many years, the government has not presented a definitive solution to this problem.

If it were up to me, I would implement several measures both in the market of owned and rented dwellings that would make it easier for the young people to obtain their first home.

There are 10 specific solutions that could be relatively easily implemented in short/medium term. They do not require any significant increase in the state budget expenditures for housing policy, but are a more efficient way of allocating the current measures or an introduction of other regulations that would improve the existing situation.

The MdM project, currently implemented by the Bank Gospodarstwa Krajowego (BGK), and the conditions of benefitting from this program are far from ideal. It is best illustrated by the fact that only 34% of the allocated resources were actually used in 2014. If it were up to me, I would first of all include the secondary market into the program. Now the program permits subsidizing only purchasing the apartments from the primary market. This change would certainly be beneficial for people from small towns with no new housing projects and the only available dwellings are on the secondary market. In turn, in big cities the limit on the price per square meter combined with the requirement of buying in the primary market means that flats can be purchased mainly in peripheral areas that are not attractive for the young beneficiaries, due to underdeveloped infrastructure and long commute time. Including secondary market into the scheme would enable the purchase of flats in much better locations e.g. in blocks of flats from 70ties that are close to the city centre. Their value is within the program requirements. Opinion polls have confirmed that such accommodation would be in line with what young people would prefer.

At the same time including secondary market into the program would allow limiting the size of large agglomerations (“mushrooming cities”) which would reduce the municipalities’ budgets expenditures for media supply, garbage disposal, and construction of infrastructure. In addition, due to the ageing population, the purchase of flats by young people in the already existing residential estates would, in longer term, permit to avoid “elderly enclaves”.

To include the secondary market would not mean (as the program’s authors seem to fear) an outflow of investments from the primary market. Most families in Poland from the middle class own only one flat. This means that a person selling a flat to the scheme beneficiary will have to look for a new home and will often decide to buy on the primary market. Such trend could be observed during the program “Rodzina na Swoim” (Family on its own).

Currently the reference point for the maximum price per square meter for apartments that can be purchased with MdM subsidy is the average GUS-estimated (GUS – Central Statistical Office of Poland) cost of house construction in the respective location times 1.1. This formula was supposed to enable having different maximum unit price for different regions and consequently to better adjust the program to market conditions.

It seems however, that in practice the so-formulated limit is unfair at national level. Compared to transactional prices (according to the National Bank of Poland real estate market surveys) this limit is equal to the average property price in a given location only in the case of seven district capitals. On the other hand, in Olsztyn and Zielona Góra it is more than 110% of the market price, while in the remaining seven district capitals it is below 90% of the average market price (including less than 80% in Poznań). The absence of a uniform price limit matching local market conditions prevents optimal use of the available funds in most cities and reduces potential resources of eligible housing.

If it were up to me I would introduce a new limit depending on the real average transactional price in the respective region calculated e.g. based on the NBP surveys instead of GUS-estimated construction cost which remains far from the market reality.

The MdM program has already roughly planned the amount of the resources to be allocated by BGK in the respective years between 2014 and 2018. At the same time, the authors of the program have decided that the resources unused in a given year cannot be used in the following years. This is a tremendous waste. As I said earlier, for instance in 2014 more than 65% of program funds, namely PLN 400 million, went unused. If it were up to me, I would modify the MdM program to enable the use of unused resources also in subsequent years.

27% of people working in Poland are employed under temporary contracts. In this respect, Poland takes the worst position in the EU. For comparison, the median for this index in the EU is 10%, Germany 13%, France 17%, and in the United Kingdom 6%. Until the problem of dualism in the labour market is solved, the negative consequences of this phenomenon should be minimized. Persons not having permanent employment contracts are now (to a smaller or bigger extent) discriminated against by banks when applying for mortgage loans.

If it were up to me, I would order the Polish Financial Supervision Authority to issue a recommendation imposing conditions of granting loans to persons employed under temporary contracts, aimed at giving them equal opportunities compared to people employed under permanent contracts. This would make it possible to solve the key problem of mortgages availability, which often prevents young people from buying their first flat.

When buying a property, in addition to the purchase price the buyer must pay numerous additional fees, such as notarial charges, taxes, court fees. Only the tax on civil law transactions against purchase of real property in the secondary market amounts to 2% of the property market value. When buying a property at PLN 300 thousand tax duties add up to nearly PLN 10 thousand, namely 3% of the property value.

If it were up to me, I would exempt young first time home buyers from these tax duties.

In 2012, Nysa powiat launched a program of building social housing through training courses for the unemployed. Under the program, social houses were built by several dozens of unemployed who, having undergone theoretical courses and under professional supervision, were building the dwellings themselves. The project improved the housing supply in the area, reduced cost of construction (down to PLN 800 per square meter), and equipped the unemployed with specific skills.

If it were up to me, I would extend this project to other regions of Poland. The trained persons do not have to build new houses only for the young. The project could also cover renovations of vacant buildings. According to the surveys by Wielkopolskie Stowarzyszenie Lokatorów (a Wielkopolska’s Tenants’ Association) vacant buildings in Poland are estimated to have more than 1 million apartments. This number shows how big is the potential to increase housing resources by extending the territorial range of the Nysa project. If implemented, the project would also have a positive side effect – increasing the supply of skilled construction workers whose shortage has been observed after the economic emigration of these workers.

The rental market is also in need for improvements

Measures limited to the ownership housing market will certainly not solve the problem of availability of housing for the young people. I believe that the rental market should also be covered by several initiatives that will help to eliminate the existing imbalances.

As I have already mentioned rented accommodation is not too popular in Poland, i.a. due to relatively high rents. If it were up to me, I would introduce tax reliefs for young people who decide to live in rented apartments. This could be in the form of making a part/full cost of rent tax deductible. Of course only for apartments rented legally, under lease contracts, declared to the revenue office. If rent was tax deductible in full, the cost of renting accommodation would be reduced by ca. 20%, which would be a considerable relief for young people.

Some will protest straight away that the need to declare rental income by the landlord (so far operating within the grey economy) would result in higher rents, so as to compensate for higher tax. This negative effect of higher rent could be limited by introducing tax reliefs for landlords renting to young people.

The tax reliefs for landlords and tenants would not have to involve significant burden for the state budget. To benefit from the reliefs the rented property would have to be declared and thus the state budget would obtain additional revenue from the taxation of the so-far grey economy activity. Adequate adjustment of tax relief parameters would enable to optimize the burden to public expenditure while providing the best housing solution for young people.

Fundusz Mieszkań na Wynajem (FMnW) is an initiative taken by BGK and under which BGK is buying standard- and location-wise attractive homes in Poland’s largest cities and then leases them out. According to the latest information, FMnW is to have at its disposal an amount of PLN 5bn for which it will purchase ca. 20 thousand apartments.

Although at first glance the project seems to be a perfect solution, it is not without flaws. The rent for first apartments available under the program (in Poznań) is significantly higher than the market average. This situation contradicts the earlier information about preferential terms of rent under FMnW, promising that the rent would be even 20-30% lower than the market average. The relatively high rent is due to the fact that BGK treats FMnW as an investment project, expecting ca. 4% of yearly profit.

BGK is a state-owned company (or rather institution) so its social activity should be oriented towards helping the citizen instead of towards making profit. If it were up to me, I would modify FMnF activity so that it operates at (or even slightly below) the break-even point. The rent for apartments available under the project should be below market rates. Only then the program will have a positive impact on the rental market in Poland.

In addition to extending the offer of attractive apartments for rent, the entry of a new, price competitive player, such as FMnW, would indirectly result in a decrease in the prices of rent on the whole rental market.

A large number of young people decide to rent apartments for financial reasons; at the beginning of their professional career they cannot afford to buy their own place and they plan to become owners at a later stage. Therefore, if it were up to me, I would extend the FMnW program by introducing a possibility of buying the rented apartment (e.g. after 10 years), not necessarily on preferential terms. Considering that BGK is implementing its project in attractive locations, the tenants can be expected to be interested in purchasing such apartments.

Till recently, under the binding law, the landlord was unable to throw out a tenant who did not want to move out, despite the fact that the lease contract was terminated. Eviction orders were often ineffective, as the tenant had to be offered a social accommodation to be evicted. New regulations on occasional rental solve this problem, and owners more interested in renting their property. Now, when signing a contract including the occasional rental clause, the tenant indicates another accommodation where he/she could live if legally forced to vacate the rented apartment.

Only landlords being natural persons may benefit from the occasional rental clause. The fact that legal persons may not benefit from such contracts limits the economic activity of enterprises in the area of home rental due to the difficulties in evicting non-paying tenants.

If it were up to me, I would introduce the possibility of occasional rental also for legal persons, which would contribute towards a rebound in the rental market at national level. The profitability of home rental is estimated at 4-5% p.a., so a large number of entrepreneurs would be interested in conducting such activity, especially taking into consideration the currently record low level of interest rates. Such change in legislation can be expected to contribute towards the establishment of private flat for rent funds, modelled after the current activity of BGK, which would deal in renting apartments at a large scale. This would contribute towards extending the housing supply and reducing the price of rent across the country.

One of the unfavourable consequences of the decision to buy a home, in particular by taking a mortgage loan, is the limitation of the homeowner’s mobility, which becomes an increasingly important issue in the labour market. In practice, buying property reduces the possibilities of employment to one city or means the necessity of extended commuting. On the other hand, renting gives nearly full freedom in choosing the place to live.

If it were up to me, I would focus on promoting this way of living by supporting people migrating between cities, providing state assistance in finding adequate accommodation on the market or even direct subsidies towards rent for a short period of time (a month/a quarter). Such campaigns would make large numbers of young people aware that buying a flat at the beginning of professional career is not the only solution. At the same time, increasing labour force mobility would also contribute towards reducing the level of structural unemployment in Poland.

The implementation of the 10 solutions I have proposed would contribute towards reducing the current imbalances in the housing market and would make it easier for young people to have their own home.

However, the above initiatives are only a part of a complex solution. Without long-term actions consisting of higher budgetary expenditures for a well-planned housing policy and influencing social awareness by promoting the rental market as an alternative to ownership housing, no ideas, no matter how innovative, will solve the problems of the Polish housing market and young individuals will forever suffer the negative consequences of this situation.