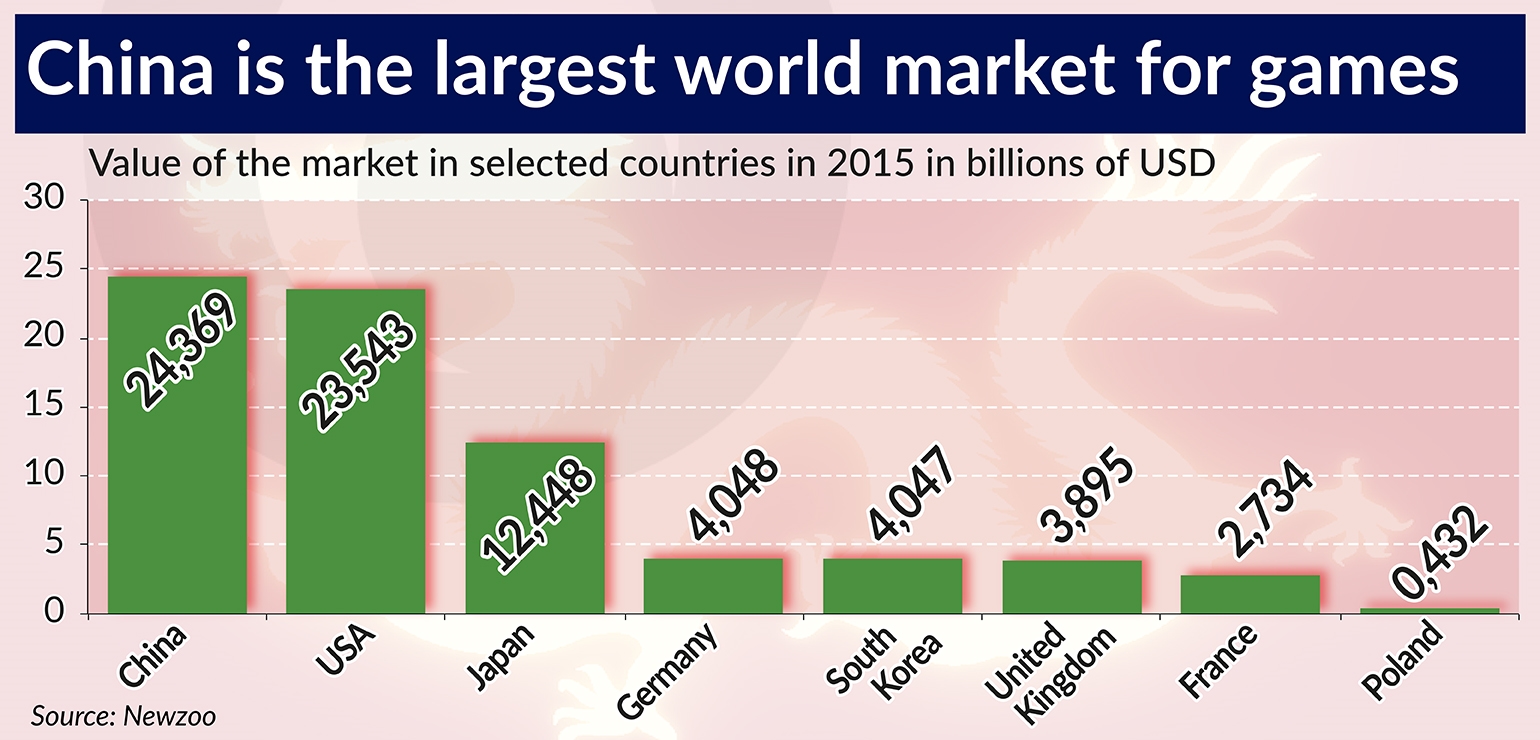

Poland accounts for approximately USD430m, and the sector is so promising that even state funds are involved.

According to the analytical company Newzoo, this year the value of a global gaming market will grow by 8.5 per cent to reach 99.6 billion dollars, and in 2017 it will stand at 106.5 billion dollars. Until 2019 it is supposed to have grown at an average rate of 6.6 per cent per year, and to have reached the level of almost 119 billion dollars. A competing research company DFC Intelligence is more cautious in its forecasts, and claims that the games market will expand to 100 billion dollars only in 2018, and in 2019 its value will be approx. 115 billion dollars.

The main source of income is Asia. It supposedly accounts for 47 per cent of the global revenue figure in that market as anticipated by Newzoo, with China representing 24.5 per cent. The United States are ranked as the second (23.6 per cent). Poland is ranked at the 23rd place.

Smartphones for killing time

The authors of the latest edition of the „Global Games Market Report” issued by Newzoo, as well as the report by DFC Intelligence, point to the market of mobile games, i.e. smartphones and tablets. This year its value as anticipated by Newzoo will be up to USD36.9bn, an approx. 21.3 per cent increase comparing to the 2015 figure. What is more, the coming years are also expected to be a period of double-digit growth and consequently, in 2019, this segment of the market will possibly be valued at USD52.5bn. According to the authors of „The condition of the Polish video game industry – Report 2015”, in 2015 the Polish market of mobile games was worth PLN260m, and its estimated value for 2017 is PLN320m.

Analysts at Newzoo predict that in 2016, the value of the market of games for smartphones will be the same as that of PC games (27 per cent each), and in 2019 games for smartphones will account for 34 per cent, while PC games for 25 per cent of the total market value. This rapid growth is a result of a growing number of smartphones, and – which is not irrelevant – increasingly large screens. It is one thing to play a game on a 3.5-inch screen, which is what the first iPhone had, and an entirely different thing to play on a 5-inch or 6-inch one, a widespread standard today.

In DFC’s assessment, although the popularity of games for mobile devices will grow, the producers will continue to have problems cashing in on this trend. Many users still use them to kill time during commutes or corporate meetings. Such users (in Poland about 72 per cent of mobile gamers) more frequently choose free games, whose producers make a profit from the sale of in-game items or from ads displayed on the screens during the game. This revenue stream often does not compensate for the costs of the development of the game.

Game developers do not agree with DFC’s assessment. Riccardo Zacconi, the CEO of King Digital Entertainment, claims that advertising will be a significant source of revenue for his company, and that the current financial results „are just the beginning”. Some analysts are also enthusiastic about advertising revenues. Mike Olson from Piper Jaffray views this source of revenue as almost free cash.

The market provides opportunities for small players

There are thousands of companies operating on the global games’ market, only a few of which can boast of sales exceeding USD1bn. The largest revenues – USD8.7bn in 2015 – are being made by the Chinese conglomerate Tencent. The second place – with revenues from games estimated at USD6.8bn – is taken by Microsoft, and Sony is ranked third (USD5.8bn). If it included the acquisition of King Digital by Activision Blizzard finalized this year, Sony would have dropped to the forth place, because Activision Blizzard and King Digital had revenues of USD6.7bn in 2015.

In terms of sales Polish game producers are far behind the world leaders. In 2015 the best-known company, CD Projekt, had PLN645m (USD171m) of revenues. This is almost 28 times more than in 2014. This spike was due to the release of „The Witcher 3”. Both CD Projekt and other significant producers, such as Techland or CI Games, earn a large part of their revenues, in the case of CD Projekt up to 95 per cent, outside of Poland. On the one hand this is a result of the nature of the market, which is international, and on the other – of the strategy. In Poland there are about 13.5 million players and all over the world – about 1.7 billion.

DFC emphasizes that the fragmentation of the market creates an opportunity for small producers, or even developers working on their own, to quickly gain popularity. Whether it will be permanent, usually depends on the next product down the line or the update of the one which has sparked that popularity.

A good example are activities of a Swedish manufacturer of on-line games, Star Stable Entertainment, operating since 2011. Its products are targeted at girls aged 9-16. It earned first revenues in 2012, but closed that year with losses of over USD500,000. The first profits were obtained in 2014 and – just like in 2015 – were entirely reinvested in the development of the business. Over the last two years the company’s sales have been doubling every year.

The games market, however, is fickle. This was a lesson learned by the Finnish Rovio, one of the first companies which achieved a notable success in the market of games for mobile devices. Games from the „Angry Birds” series were downloaded more than 4 billion times in total, and the company’s revenues, which amounted to EUR6.5m in 2010, shot up to EUR156m three years later. Over time, the popularity of the games from the flagship series decreased, and as a consequence the financial results have gone down as well. In order to defend the profits, in 2014, for the first time, Rovio decided to carry out big layoffs. Despite the job cuts it incurred losses in 2015. The company hopes that this year – on the back of the movie about Angry Birds and thanks to the change of strategy in the games market, among other things – it will return as a success story again.

As emphasized by the authors of „The condition of the Polish video game industry, Report 2015”, the key to success in the games market is specialization. According to them, the Polish game producing studios are in many cases predisposed to achieve such a success (the management of CD Projekt puts the number of Polish companies in this line of business at about 160 with around 6 thousand employees). Examples of domestic companies that specialize in specific types of games, include e.g. Huuuge Games (social casino type games), Vivid Games (mobile games combining elements of fighting with strategy games), as well as Artflex Mundi (adventure games targeted mainly at women).

Buying games

M&A are not uncommon in the gaming industry, but mostly smaller studios either merge or are taken over. That is why announced in 2015 the acqusition of King Digital Entertainment by Activision Blizzard worth USD5.9bn and caused quite a stir. The acquired company specializes in mobile games. After the announcement of the transaction, there were comments that Activision paid too much, because the results of King Digital were falling with each quarter. However, when the company published consolidated results for the first quarter in May 2016, including King Digital in the statement, the critics toned down their reservations, as the results were better than expected, in large part thanks to the acquired company.

The purchase of King Digital is not the only recent big acquisition. A lot of buzz surrounded the actions of the French media and telecommunications group Vivendi, which is buying out the shares of Ubisoft Entertainment and has announced its intention of a hostile takeover of another French game producer – Gameloft. Three years ago Vivendi sold its stake in Activision in order to reduce debts. It is now trying to get back into a familiar market.

Poland is being appreciated

Due to the successes of games created in Poland – besides „The Witcher”, gamers showed significant interest in „The Vanishing of Ethan Carter” produced by The Astronauts, „This War of Mine” created by 11 bit studios and „Dying Light” from the Wrocław-based Techland – the industry attracted politicians’ attention.

During the election campaign, before the second round of the presidential election, Ewa Kopacz, the Prime Minister of the previous Polish government, visited the headquarters of CD Projekt.“You are doing a really good job for Poland. You are great ambassadors of the modern Polish brand around the world,” she said.

The new Prime Minister, Beata Szydło, mentioned games in her exposé, claiming that their production is among the fields and sectors of the Polish economy, which „have the best development chances, on the scale of our region at the least,” and pledged support for the industry.

The game producing studios have decided to convert this opportunity, i.e. public interest, into real cash from the state coffers. The Polish Games Association applied to the National Centre for Research and Development with a request for a sectoral program for the industry. Its main goal is to increase the competitiveness of the domestic sector of video game producers on the global market by 2023 through an increase of financial expenditures on innovative video game projects and by making full use of the potential of the global market and the Polish scientific facilities.

The lobbying efforts proved effective. The positive recommendation of the National Centre for Research and Development Council issued in 2015 has resulted in this year’s first contest, in which PLN80m have been allocated to the support of companies in the development of game-oriented technologies and solutions. In total, the GameINN program is expected to run with the budget of PLN500m over the next years.

The funds from the National Centre for Research and Development are not the only form of support for the gaming industry. The Industrial Development Agency has its own plans for this sector too. In April, together with the University of Silesia and the Cieszyn County, it announced the signing of a letter of intent concerning the establishment of a pilot accelerator for the video game industry in Cieszyn. This project is supposed to include the creation of a comprehensive model of education for the gaming market, and various support programs for young creators covering game making and sales, production financing, entry on foreign markets and finding investors.

But the impact of public money on the development of the gaming sector will be seen in 2017 at the earliest.