Tydzień w gospodarce

Category: Raporty

(©Shutterstock)

The gas market in Europe is becoming increasingly competitive but changes in the region of Central and Eastern Europe are occurring at a slower pace. Nord Stream 2 is tripping us up.

Nord Stream 2, presented in June 2015, is a project for the expansion of the existing Baltic gas pipeline from Russia to Germany with two new pipelines, increasing its capacity by 55 billion cubic metres – up to 110 billion cubic metres per year. The shareholders of the consortium under the same name include Gazprom, Wintershall, E.ON, OMV, Shell and Engie. Currently the selection of one of the three possible routes is underway.

The European Commission, like Poland, opposes the construction. Meeting the current and future gas demand in Europe through the supply of gas from Gazprom contradicts the objective of diversification of supply sources established by the European Union. Brussels, however, has not decided to completely block the project, as in was the case of South Stream, i.e. the southern link which was to encircle CEE region through the Balkans. It wants to ensure that the project complies with EU legislation. It is not clear how Brussels will ultimately react under pressure from the supporters – led by Berlin – of the development of gas imports from Russia to Western Europe, and those who would like to return to the traditional business style in relations with the Russian Gazprom.

Nord Stream 2 is a threat to Poland. Why is it seen this way, even though it bypasses Poland? Because it threatens Polish plans to diversify the sources of gas supply and thus the plans to increase competitiveness on the Polish market. In order to achieve that goal Poland must have an open access to gas trade in other European countries. Cheap gas from Russia will block this access in two ways.

Nord Stream 2 will fill the German market with gas from Russia. Cheap gas is desired by many customers. For Germany, which has a fully diversified market for this raw material, an increase in the supplies from Gazprom and thus a (temporary) increase in dependence on the Russian company is not a problem. Germany has one of the most developed gas exchanges in Europe, an excellent transmission infrastructure, an energy mix with a balanced share of natural gas and contracts which allow purchases almost anywhere in the world. Therefore, it already has everything that Poland is trying to achieve. For Germany, Nord Stream 2 is simply one more supplier, which can always be abandoned once a better deal comes along. The same applies to the British, who have access to raw materials from around the world thanks to a well-developed market. From their perspective, the Nord Stream 2 pipeline is not an instrument of repression, but an interesting option for cheap supplies from Russia.

For Poland and other countries that are fighting against Nord Stream 2 this pipeline is an obstacle to the development of the gas market in Central and Eastern Europe. That is because the European market would obtain access to large quantities of cheap gas, but not to new sources of supply. That would lead to Gazprom maintaining its dominant position in this part of Europe for many years and would therefore consolidate Russia’s advantage in price negotiations. This is pointed out not only by all the nations striving to convince the European Council to block or at least delay the construction of new lines of the Nord Stream.

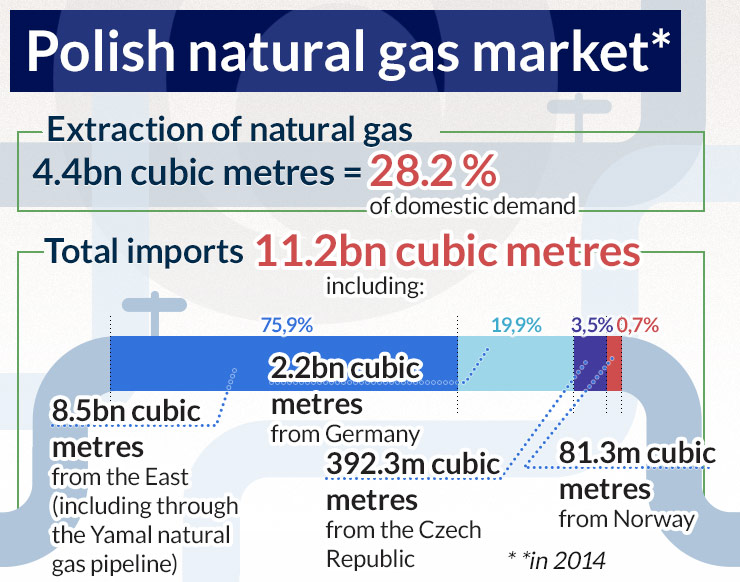

(infographics Darek Gąszczyk)

In order to utilize the capacity of this line, Germany has to be granted an exemption from the liberalization limitations of the Third Energy Package by the European Commission which will allow Gazprom to monopolize the transmission capacity of these pipelines. Such exemption has already been supported by the German regulatory authority which sees no problem in the Russian domination over the transmission infrastructure in the German Federal Republic. For Poland this is an important aspect, as the German gas pipelines are supposed to be a guarantee of secure supplies from the West, in the event that Russia turns off the tap. Warsaw intervened in Brussels demanding that the German regulatory authority ensure the availability of uninterrupted reverse gas supplies from Germany.

The saturation of the European market with gas from Gazprom would also block the activities of the Polish LNG terminal. LNG imports were supposed to be an answer to the first Nord Stream line. The commercial operation of the LNG terminal is expected to begin in June 2016. The government of Beata Szydło declared its readiness to expand the capacity of the LNG terminal in Świnoujście from 5 to 7.5 billion cubic metres per year and to assess the economic viability of the construction of another facility in the vicinity of the Tricity region. Thanks to the LNG supplies, Poland could neutralize the influence of Gazprom, but the possible flooding of the German market with gas from Russia would deprive the gas terminal of one of its potential markets.

So far, the LNG terminal has not concluded any foreign contracts for the sale of gas. Many customers in Poland may also choose supplies from the operators of the Nord Stream instead of importing gas through the Świnoujście terminal.

For the time being, the economic viability of the gas terminal is questionable. Due to the higher transportation costs of LNG compared to pipelines, it has a disadvantage from the start. The terminal will operate but we have to be prepared for an increase of tariffs. Poland will partly diversify its market but will have to pay extra for that process – the costs of maintaining an LNG terminal that will only sell gas on the domestic market will be much higher.

The future of the contract for gas supplies from Qatar to Poland is still unknown. The value of negotiated 1.5 billion cubic metres per year from Qatargas has decreased due to the oil prices decline. As the contract is confidential comparing the prices of supplies with the European average is impossible, and thus it’s impossible to properly assess its cost-effectiveness. Poland certainly need new contracts for the supply of LNG which may in the future prove competitive even to Russian supplies due to the sharply falling prices of this raw material on world markets. Supplies from subsequent countries of the Caspian region, the Mediterranean, the United States and other parts of the world are also possible.

As reported by the wysokienapiecie.pl website, the Lithuanian state-owned company Litgas has just negotiated new, much lower LNG prices with the Norwegian Statoil, while the Lithuanian company Achema, the largest consumer of gas in the region, is also conducting separate negotiations.

Regardless of the fate of Nord Stream 2 Poland has no intention of giving up on diversification. The new management of PGNiG has announced a return to a concept of a gas pipeline to Norway, previously abandoned by the government of Leszek Miller. A few days ago, PGNiG Upstream International obtained shares in four exploration and extraction licenses, including one where it will act as an operator. Two of these concern deposits in the Norwegian Sea while the remaining ones concern the North Sea and the Barents Sea. PGNiG also plans to build a pipeline to Norway before 2022.

Reaching for gas from Norway could be an effective counterattack. Control over the entire supply chain – extraction, transport, sale – would give the supplier the potential to offer lower prices to customers. However, in order for the Norwegian gas pipeline to neutralize the effect of Nord Stream, the supplied volume should be two to three times larger than in the original agreement of 2001 (which assumed supplies of 5 billion cubic metres per year).

The government is also continuing Donald Tusk’s initiative to launch joint gas purchasing in the region of Central and Eastern Europe. For the time being Warsaw is talking of possible interest in Vilnius. Prague, which had expressed interest in Iranian gas, could also turn its attention to supplies from Norway. Thanks to joint purchases Poland could raise the volumes necessary to render the Norwegian pipeline profitable.

Poland’s ability to form a coalition against the Nord Stream 2 will therefore be stronger, if it is able to provide the countries of the region with an alternative to Russian gas. However, not all EU member states support a reduction of supplies from that direction. Slovakia and Italy will be happy to join a Russian project that suits their interests. The biggest argument supporting the Polish negotiators is therefore the necessity of continuing the policy of diversification confirmed in the European Energy Security Strategy and the concept of the Energy Union. The European Commission is working on a package of solutions increasing the security of supplies to the EU states, including Poland. It is supposed to address Poland’s postulates of joint gas purchases, present a plan for the development of the LNG sector and the improvement of the solidarity mechanisms in the event of disruptions in supplies to individual countries.

The point of investing in a diversification is to provide Polish customers with freedom of choice, i.e. access to alternative suppliers at any time. That in turn will allow for comfortable negotiations with each individual supplier, including Gazprom. Under such circumstances Russian gas would no longer be perceived as a political tool, and would simply become yet another offer in the basket. If Poland obtains the ability to purchase gas freely, it will also see cheaper counteroffers on the part of Gazprom, which will not allow a situation in which it loses the Central European market. Polish policy can therefore evolve through changes in the models of supply contracts, the models of gas infrastructure management, etc.

From the Polish perspective, it is the mere ability to cope without Russian gas, and not the actual abandonment of this source of supplies, that will enable Polish market to be recognized as a developed one.

The author is the editor of the BiznesAlert.pl website and an analyst of the Jagiellonian Institute.