Tydzień w gospodarce

Category: Raporty

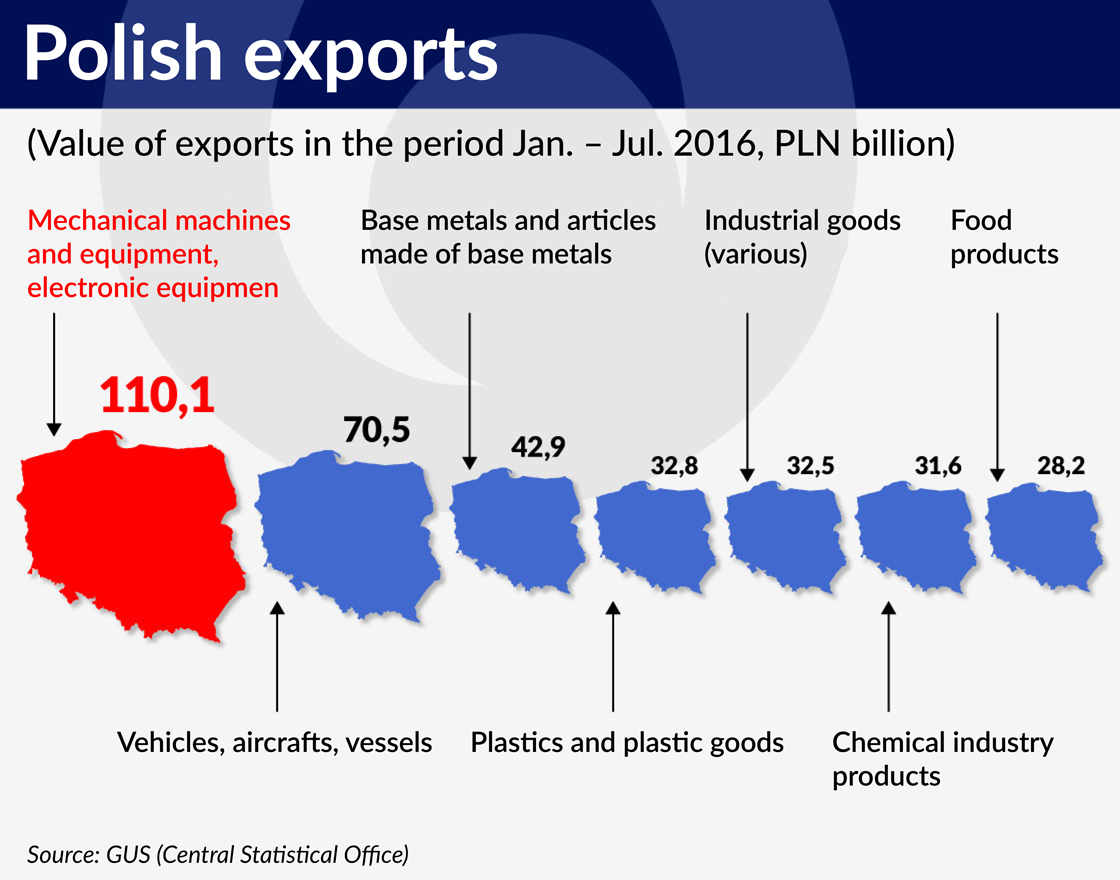

The data shows systematic growth of Polish exports. The value within the last ten years, till 2015, increased 2.5-fold – from EUR71.4bn to EUR178.7bn. Except for the crisis year of 2009, the good fortune of Polish exporters, more and more confidently extending their presence in foreign markets, has been continued uninterruptedly.

The recent data by Polish Central Statistical Office (GUS) support this picture. During eight months of 2016 (January-August) the value of exports amounted to almost EUR118.9bn and was 1.5 per cent higher compared to the corresponding period of the previous year. Exports to EU member states increased by 1.8 per cent, to approximately EUR94.8bn. Among the most important EU markets, sales to Slovenia, Ireland, Romania, Portugal, Finland, Spain and Sweden increased at the fastest pace. As far as other markets are concerned, Polish sales to Switzerland, Canada, the United States and Israel increased.

Compared to the corresponding period of 2015, exports to India rose by as much as 32 per cent, exports to Singapore – by 30 per cent and to South Korea – by 10.1 per cent. The Ministry of Development estimates that this year will close with foreign sales at a level of approximately EUR185bn, which means an increase of EUR6bn compared to the previous year.

“We can see that the number of inquiries from our clients in relation to activity in foreign markets is successively increasing and Poles can be proud of the growing number of cases of effective implementation of our solutions abroad. It is significant that the growth rate of revenues obtained by clients operating abroad is often a two-digit figure. It certainly results from increased access to foreign markets and higher margins gained on business activity outside Poland,” claims Piotr Tymiński, director in the corporate banking division of CitiHandlowy.

The Kronenberg Foundation, acting at CitiHandlowy, carried out the third issue of a survey entitled “How Polish companies sell in foreign markets”. None of the inquired companies intends to resign or reduce the scale of its activity outside the country and as many as 84 per cent are willing to enter even more markets. 73 per cent of companies found that activity abroad ensures a higher rate of return. Polish entrepreneurs classified production and retail businesses as the most profitable.

The survey confirmed the unbeatable position of the food, construction and furniture sectors (respectively, 38, 21 and 18 per cent of foreign clients value these sectors the most). However, experts stress that Polish niche sectors targeted at a specific, sometimes narrow, group of recipients are becoming more and more visible abroad.

The search for niches has been applied by Polish producers of games (mainly computer games) and toys. They analyzed the global market – in Poland today it is worth over PLN1.5bn (EUR336.9m), worldwide over USD90bn, in terms of demand for specific products, and moved to corner the market.

In 2015 unquestionable record-breaking figures were recorded in the export of games and toys from Poland. In this period Poland sent abroad products worth almost PLN4.6bn (EUR1.03bn), i.e. almost 60 per cent more than a year earlier (in 2010 it was only PLN763.5m, EUR171.5m). Exporters of classic toys, such as dolls, cars and triple-wheeled bicycles, recorded turnover at a level of PLN1.5bn (EUR336.9m). However, in this segment classic toys do not constitute a leader, exports of equipment for video and computer games have the highest value – in 2015 Polish exporters sent equipment to the value of EUR2.1bn to other countries. Germany is the largest customer, with as much as one third of these exports.

Polish games have been extremely successful abroad for several years. At this year’s Gamescom fair in Cologne, Polish game producers, for the first time, appeared with their own hall. “The Witcher” largely contributed to the success of the entire sector. In the ranking of the ITwiz trade magazine, the company CD Projekt, which produced the game, was ranked first in the list of exporters of IT products and services in Poland in 2015. The company has not provided detailed data; however, it is estimated that CD Projekt achieves as much as 95 per cent of sales outside Poland, and the value of exports – which above all consist of “The Witcher 3” – reached PLN665m (EUR149.4m).

Also the history of Polish cosmetics is well-known. They took markets by storm several years ago and are currently consolidating their position in the Middle East and North Africa. Polish companies from this sector accurately assessed the huge demand for make-up cosmetics among Arabic women.

The value of export of Polish cosmetics to the United Arab Emirates amounts to approximately PLN20m (EUR4.5m), but Polish producers have already found importers also in Egypt, Morocco, Saudi Arabia and Algeria, where growth in the value of exports amount to EUR2-3m per year on average.

The biggest Polish players on those markets include Vipera Cosmetics, the producer of colour cosmetics (mainly nail polishes) and Inglot, which has already opened about 40 stores in the region and plans fast expansion – 200 shops will operate in the Persian Gulf region by 2020. Inglot introduced, as the first in the world, nail polish permeable for steam, thanks to which Muslim women do not have to rinse it during ablution.

Experts expect maintaining such a growth rate in export in the nearest years. “Poles are very creative and diversified, they specialize in exports of different products. In the period of the communism it was said that Poland exported coal, sulphur and ships. Currently, Poland has thousands of product groups which uses to conquer foreign markets,” assesses Piotr Soroczyński, the chief economist of the Export Credit Insurance Corporation (KUKE).

When one analyses maps of export sectors in Poland, prepared on the basis of GUS data and systematically updated by KUKE, two issues are interesting – the high position of computer games and toys, as well as “scientific research and development works in the area of social sciences and humanities”. The share of revenues from exports in the latter sector amounts to almost 80 per cent.

KUKE experts say it is difficult to discuss details, since they do not know those companies. In the opinion of Piotr Soroczyński, the sector probably sells surveys or reports which confirm the thesis of the growing comprehensiveness of Polish exporters.

Knowledge is excellent to sell and already for some time Poles have specialised in developing new smart products, often created from the scratch, which achieve great success abroad. Poles have gained a special reputation in the IT sector in the broad sense of the term and new technologies. They have excellent specialists who often surprise the world with great business ideas.

The British “Forbes” has recently written that in the nearest future Poland will become a European hub in the area of technological start-ups. Among technological gems with great outlook, journalists mention the Brainly portal, which is known in Poland as Zadane.pl, i.e. a network of educational portals, bringing together students exchanging knowledge.

The platform has 12 language versions and users in 35 countries. The Polish version is visited by 7 million people per month, and the global version by 60 million. The biggest markets for Brainly include, among others, Russia, Brazil and Indonesia. In May 2016 Naspers fund invested USD15m in the development of the company.

Another start-up with a worldwide reputation is a film service, filmaster.pl, purchased several months ago for EUR1m by Samba TV. The Doc Planner Group – today the biggest worldwide service for arranging medical appointments online – also occupies the start-up podium.

The company offers services in 25 countries, e.g. Mexico, Brazil, Argentina, Turkey and Italy. On the other hand, Asian markets, including Indonesia with a population of 300 million, are conquered by Brand24, a company monitoring internet and social media, as well as Finspi, a Polish response to Facebook.

“Silicon Valley has no monopoly for innovation,” wrote CB Insights analytical service, emphasizing the opportunities and achievements of markets other than American.

Fintech companies, proposing an innovative approach to financial services to clients, represent a separate category among providers of new solutions. The potential of the sector is huge. According to KPMG, the value of global investments in fintech companies in 2015 exceeded USD20bn, USD18bn more than just five years earlier.

In the list of the “hottest” Polish fintechs, the Polish Agency for Enterprise Development lists, among others, Atsora, a start-up enabling cooperation of small and medium-sized enterprises with banks, and Azimo, offering fast money transfers. Both companies are strongly penetrating the British market and their owners definitely show appetite for more.

“The fintech sector is developing extremely fast owing to the fact that everything takes place online. There are no large investments, no barriers, and no expensive offices or factories are opened. The idea matters, and the skill of efficiently moving across the world of new technologies and finance,” says Mirosław Ciesielski, the economist from WSB University in Gdańsk, specializing in fintechs and start-up problems.

In Poland, compared to Western Europe, banking is more advanced in terms of contact with clients; consequently, a considerable number of fintechs are located there.

“Quite often solutions invented by us are transferred, for instance, to the British market since regulatory and tax incentives to keep business in Poland are missing in Poland,” notes Mirosław Ciesielski.

The data of Start Up Poland indicate that as much as 54 per cent of Polish start-ups are oriented towards export of own services, mainly to the United Kingdom and the United States. A much better developed venture capital market in those countries offers much bigger co-financing and development opportunities. The ratio of venture capital investment to GDP in Poland is unfavorable – the ratio is five times lower than, for instance, in Germany.

This is one of the reasons why economists emphasize the need for greater activity of the state. The Deputy Minister of Economic Development, Radosław Domagalski-Łabędzki (just before he was appointed as the President of KGHM) informed that the Governmental Agency of Trade and Investment (RAHiI) will launch its operations as early as this year. Ultimately, the RAHiI budget will be increased to PLN200m (EUR45m).

“We will create a single entity coordinating export support policy. The aim of the government is to increase the involvement of Polish companies in exports. We want to achieve this both by means of financial instruments (…), and by also changing the institutional model,” Deputy Minister Domagalski-Łabędzki told PAP agency.

The Ministry of Economic Development intends to increase the share of companies with domestic capital in exports.

“Over recent years the upward trend of Polish exports resulted mainly from the share of foreign companies. Almost 2/3 is generated by companies with foreign capital. There is nothing wrong in that, but we want this trend to be generated with the participation of Polish companies. We want to encourage Polish companies to take this risk,” added Domagalski-Łabędzki, announcing the establishment of 69 trade offices with the target of promoting Polish exports worldwide.

In September, the Polish Development Fund, a government’s SPV, also announced that under the International Expansion Program of Polish Enterprises it intends to offer a package of new financial and advisory instruments in the scope of support to exports and foreign investment with the value of PLN60bn (EUR13.5bn).

In October, KUKE offered exporters an initiative to facilitate expansion in some markets – in five countries (Algeria, India, Iran, Mexico, Vietnam – GDP of Vietnam increased by 7 per cent in 2015, Mexico is a market with a population of 120 million and Polish-Indian trade turnover last year exceeded USD2.2bn). Entrepreneurs interested in conducting their activity there will receive more flexible possibilities to secure transactions. KUKE established cooperation with banks which will be actual assistance for the development of Polish companies.

Tomasz Rożek is a communication specialist. He has worked for many years as a journalist in business media, among others, in Newsweek Polska, Polska The Times and Gazeta Wyborcza.