Tydzień w gospodarce

Category: Trendy gospodarcze

(Dr JohnBullas, CC BY-NC-ND 2.0)

In line with Russia’s digital strategy, the network will be based on Russian made technology. The initial plan is to deploy the network over the period of the next five years (2020-2024). According to the company’s presentation, reviewed by the daily RBK, the network will enable controling energy consumption (water, electricity, gas), stability of buildings, security systems (access to doors and windows), as well as will collect data on human behavior in public places, and monitor waste and utilization systems.

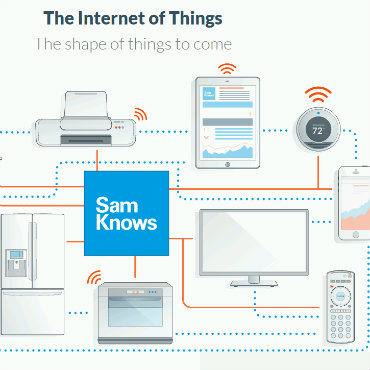

The IoT enables various devices to communicate and interact over the internet, allowing for remote control and monitoring. An example of such technology are lights in household connected to a mobile device.

Glonass Telematika is co-owned by the defense conglomerate Rostec; JSC Glonass, which operates Russia’s domestic alternative to GPS – ERA-Glonass; and IT Invest Transport Systems, a company responsible for Russia’s electronic toll collection infrastructure.

According to RBK, Russia’s State Commission for Radio Frequencies allocated a range of frequencies to the company, following the state orders to create a federal network for the IoT. The overall cost of the project is expected to reach RUB53bn (EUR726m) and is supposed to be carried out without the government’s participation.

The network will include more than 34,000 base stations located all over Russia and will be based on the XNB protocol.

The XNB protocol (narrowband) is a low power, wide area network (LPWAN) radio technology standard developed to enable a wide range of cellular devices and services. The particular XNB protocol, chosen for the network, was developed by the Russian company Modern Radio Technologies.

According to Glonass Telematika, the protocol favored for the project is better in comparison to other, more popular LPWAN protocols, as it has a larger radius of data transmission and a better signal penetration through concrete walls.

Furthermore, and perhaps more importantly, the protocol is a fully Russian-made technology, using the Russian “Grasshopper” algorithm to encrypt user data. “Since we are dealing with a critical digital infrastructure, the domestic origin of the protocol, technology and equipment used for the project is an absolute must,” Denis Simakin, the CEO of Glonass Telematika, told RBK, adding that they views information as a strategic resource “access to which should not be allowed to third parties.”

In the framework of the government program “Digital Economy”, Russia intends to use IoT technology in smart cities, construction, energy, agriculture and other industries.

Russia is certainly not the only country taking a protectionist/nationalist approach to building the technology of the future. One obvious example of a country pursuing clear geopolitical interest while advancing its technological capabilities is China.

According to a research report “China’s Internet of Things” prepared by an open source and cultural intelligence company, Sosi, China is committed to becoming a leader in IoT development. “Chinese leadership believes that their country’s security requires it to become a technological power, particularly in emerging technologies that the country considers strategically vital,” says Sosi

According to the report, China recognized IoT as a crucial technology with a tremendous impact on the global economy already back in 2009. Since then, the Chinese government invested heavily in domestic IoT research and development and offered extensive financial support to domestic companies. The idea was that by the time the technology becomes omnipresent on the global market, Chinese companies will be one step ahead of their international competition.

“Chinese experts anticipate that an ‘Internet of Everything’ era will arrive once IoT is adopted widely in developed countries, and some assess that China has already developed, such as IoT supply chain, including chips, components, devices, software, systems integration, operators, and applied services,” the report says.

To become a global leader in IoT-related technologies, the Chinese government has introduced a set of measures designed to put China ahead of their global technological competitors. Those measure have included the creation of IoT industrial clusters and demonstration bases, extensive financial support for research and development, restrictions on foreign investment, etc.

Unlike China, Russia has not demonstrated a strategic foresight that would equal that of its neighbor. However, after the annexation of Crimea and the imposition of western sanctions in 2014, it has been forced by external circumstances to develop its own “made in Russia” technological solutions.

Russian companies have been developing technological products primarily for the needs of its military-industrial complex. But, more recently, increasing amount of IT products are developed by Russian companies. This is in line with Russia’s plan to achieve “internet sovereignty”, to become technologically independent of foreign companies. Similar to China, Russia views technological independence, particularly in cyberspace, a matter of national security.

Filip Brokeš is an analyst and a journalist specializing in international relations.