Tydzień w gospodarce

Category: Raporty

(GotCredit, CC BY)

At the same time they are afraid of negative changes but do not declare a reduction of their operations. “After the elections the number of investments did not fall, on the contrary, increased by 20 per cent. The Polish Information and Foreign Investment Agency is currently carrying out 179 projects. That translates to 40,000 jobs,” said Sławomir Majman, the President of the Polish Information and Foreign Investment Agency, commenting on the results of the study “Poland in the assessment of foreign investors”.

Poland leads the ranking of CEE countries preferred as locations for FDI, and despite much better international ratings the Czech Republic, Slovakia and Hungary are behind Poland. Poland was rated 4.8 out of the maximum of 6 points. The Czech Republic was ranked 2nd, Slovakia 3rd and Estonia moved up to 4th place.

Almost all entrepreneurs participating in the survey positively assessed the Polish economy (only 6.3 per cent expressed a negative opinion), but more than 36 per cent of respondents believed that the prospects were worse than in 2015. Fewer entrepreneurs also believed that the situation of their company or the industry in which they operate would improve. They were more optimistic regarding an increase in exports.

43 per cent of the investors predicted an increase in the number of employees in the next year, but the percentage of those who say that the number of persons employed will drop has also risen from 8 to 9.4. Fewer companies have also declared an increase in investment expenditures (36 per cent compared with 39 per cent in 2015).

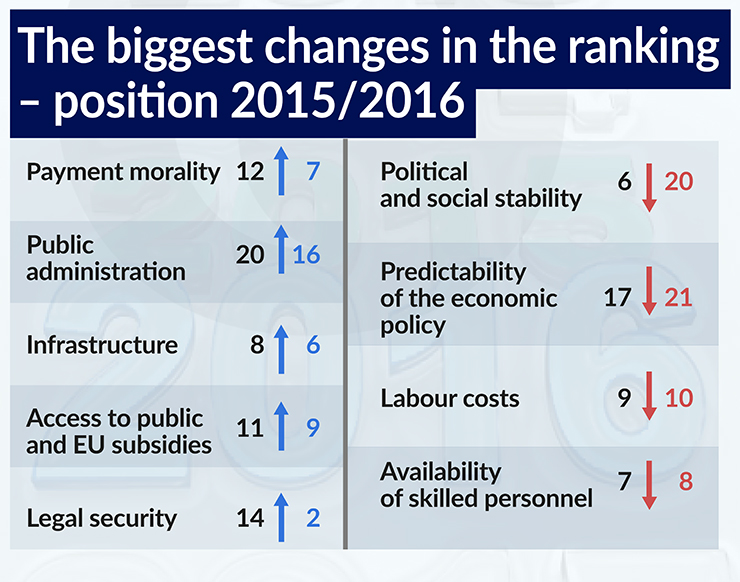

The assessment of countries was carried out on the basis of 21 factors determining investment attractiveness:

Besides membership in the European Union (the most important factor), for foreign companies other important factors in Poland included the quality of the staff, along with the infrastructure, which has finally started working in Poland’s favor. “For the first time in years, investors also praise Poland for the development of vocational education. This is a good trend,” says Sławomir Majman.

(infographics: Bogusław Rzepczak)

However, the predictability of economic policy has fallen to last place. Although no one is panicking, many companies are applying the “wait and see” approach, according to chambers of commerce representing investors from various countries.

“Investors from France are refraining from new investments in Poland,” says Monika Constant, the CEO of the French Chamber of Industry and Commerce in Poland. “Investors from the United Kingdom are cautious, but they are beginning to look for locations for new investments. However, instead of Kraków or Wrocław, where the employer has to chase after employees, they are now choosing Lublin, Radom or Rzeszów,” says Michael Dembiński from the British-Polish Chamber of Commerce.

“The effects of investors refraining from decisions will be seen in the fourth quarter or the first quarter of 2017 at the earliest, if at all, because it is not certain that investors will give up on some of their projects during that time,” says Marcin Petrykowski, the Regional Head for Central and Eastern Europe at the credit rating agency Standard & Poor’s.

The survey was carried out by the Polish-German Chamber of Industry and Commerce (AHK Polska), in cooperation with 12 bilateral chambers of commerce operating in Poland, affiliated in the International Group of Chambers of Commerce (IGCC): the American, Belgian, British, French, Spanish, Irish, Canadian, Dutch, Portuguese, Scandinavian, Swiss, and Italian chambers of commerce. The survey was conducted among companies with foreign capital in Poland in February 2016. The survey respondents included 351 foreign companies ‒ 52.7 per cent of investors came from Germany, 5.4 per cent from the United States, 4.6 per cent were Scandinavian companies, 4.3 per cent came from Switzerland, 4 per cent were from the Netherlands, while companies from France and the United Kingdom had a share of 3.1 per cent each.