Russia is too small to win the war in Ukraine

Category: Macroeconomics

(Darek Gaszczyk/CC BY-SA Ed Yourdon)

Russia’s GDP growth rate is declining, all its macroeconomic parameters are deteriorating. The question is whether the Russian economy is already in deepening recession or if it faces prolonged stagnation. Economists involved in the discussion about economic prospects are eager to point to short and long-term circumstances and their impact, they are also making rather similar diagnoses. Yet, they find it difficult to come up with ideas on how to remedy the situation and what exactly should the necessary reforms consist in.

Between the beginning of the 21st century and the economic crisis of 2008/2009, Russian economy developed very dynamically with strong support from extremely favourable external conditions, i.e. high prices of oil, natural gas and other natural resources. Annual average prices of Ural oil exported by Russia increased from USD 21.4 per barrel in 2001 to USD 95.3 per barrel in 2008, i.e. almost 4.5 times.

In the same period, the price of gas increased from USD 98.3 per 1,000 cubic metres to USD 353.7 per 1,000 cubic metres, i.e. nearly fourfold. With such stimuli, in the years 2001-2008 Russia’s GDP increased by more than 66.3%, which translates into annual average development rate of 6.6%. The record year was 2007, with an increase of 8.5%, while the weakest year was 2002 that saw an increase of 4.7% and the “crisis” year was 2008 when the increase amounted to 5.2%. Other macroeconomic indicators characterising the economy, such as investments, income and real wages of the population, industrial output and currency reserves increased as dynamically.

Contrary to the 1990s, when Russia’s budget was characterised by chronic deficit (3.4% of GDP in 1995, 5.4% of GDP in 1997, 5.9% in 1998), in 2000 Russia has entered a period of fast increasing budget surplus, ranging between 4.5 and 7.5% of GDP. Abundant budget, with dynamically increasing expenditure for the real economy and a broadly understood budget sphere (wages, pensions, scholarships, etc.), has become a significant economic growth factor along a favourable external economic situation.

The economic crisis of 2008/2009 highlighted the structural weaknesses of the Russian economy. Russia recorded the greatest GDP decline of all countries (7.8%), coupled with the transformation of high budget surplus into equally high deficit (5.9% in 2009, 4% in 2010).

The revival of favourable economic situation following the recent crisis, and rapidly increasing prices on the international market of fuels and natural resources, primarily oil, warranted the assumption that Russia would return to the path of economic development soon, with expected GDP increase of 5-6% a year. Instead, in recent years, in the period of potential post-crisis revival, the Russian economy recorded not only a much more modest GDP increase (4.5% in 2010), but to cap it all the pace decelerated visibly in the following years: to 4.3% in 2011, 3.4% in 2012 and to a wee 1.4% in the first half of 2013.

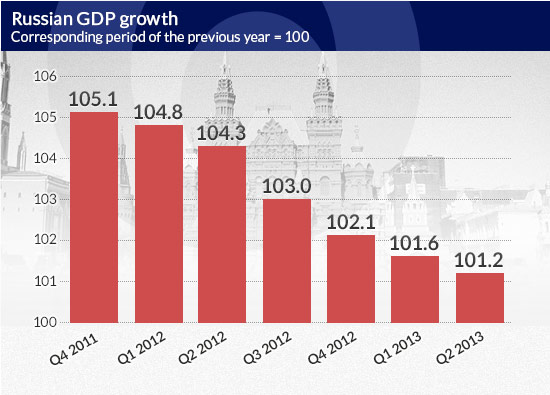

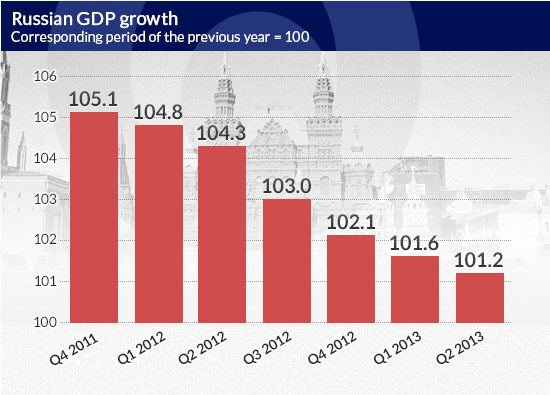

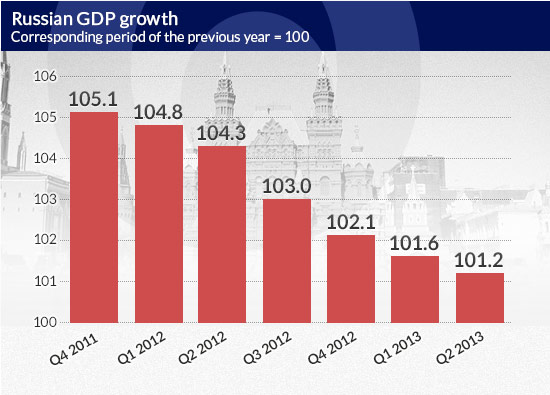

Russia’s fading growth is particularly visible in quarterly data. The economy has gone through seven subsequent quarters of GDP growth deceleration, from 5.1% in Q4 of 2011 to 1.6% in Q1 and 1.2% in Q2 of 2013.

Analysts agree that the condition of the Russian economy is not the best, but there is no consensus on whether Russia is facing recession or long-term economic stagnation. Advocates of the former diagnosis invoke international norms (two subsequent quarters with a GDP decline) to claim that Russia is already in recession as, according to estimates, GDP decreased by 0.1% in Q1 of 2013 as compared to Q4 of 2012, and in Q2 of 2013 – by 0.2-0.4% compared to Q1 of 2013. Yet, they argue that shallow recession is much less vexing than prolonged stagnation with an increase below 1% this year and 1-2% in the following years. Yet, the majority of independent analysts opt for the latter scenario.

Citing the most recent estimates (GDP increase of 0.2% in Q1 of 2013 as compared to Q1 of 2012 and of 0.1% in Q2) and changing its previous assessments, the Russian government claims that the country managed to avoid recession. It is however aware of the need to revise economic growth projections that assumed 2.4% for 2013. The same will most likely be necessary for subsequent years as well, as it was assumed that between 2014 and 2016 economic growth will amount to 3.7-4.2%.

The deceleration is the effect of “upsetting” the current economic growth mechanism in Russia affecting its two basic factors at the same time. On the one hand, a very strong positive correlation between the pace of growth and prices on the international market of fuels and natural resources has disappeared. On the other hand, the same happened to budget expenditure that largely creates domestic demand. In the years before the 2008/2009 crisis, fast increase in prices of oil and gas and in budget expenditure (in the years 2001-2008 they increased 2.25 times in real terms) was the driving force of Russia’s dynamic economic growth.

Depletion of potential in this respect is proven by comparing the effects and circumstances of Russia’s revival from the crisis in 1998 and in 2008/2009. After the economic breakdown of 1998, GDP decline was 5.3%. Following the crisis which Russia faced a decade later, the rate of decline stood at 7.8%. With prices of exported oil at the level of USD 15-24.5 per barrel, of gas at USD 55-98 per 1,000 m3 and budget expenditure at 14-15% of GDP, Russia managed to rebuild its potential after the crisis at the end of the 1990s. In three years, Russia achieved a GDP increase of 23%: 6.4% in 1999, 10% in 2000 and 5.1% in 2001.

After the recent breakdown, Russian economy recorded much poorer results than a decade earlier, although in much better conditions, i.e. with considerably higher oil prices – USD 76 per barrel in 2010 and record high USD 107-110 per barrel in 2011-2012, natural gas prices at the level of USD 270-350 per 1,000 m3 and with budget expenditure at 19.6-22.4% of GDP. The GDP increased by 4.5% in 2010, 4.3% in 2011 and 3.4% in 2012, i.e. by 12.7% in three years, or half the figure for the previous post-crisis period.

Despite favourable external conditions, economic growth deceleration shows that the process has some autonomous domestic determinants and is loosely related to the condition of the global economy. Moreover, it proves that the possibilities for continuing economic development on the basis of the current model relying on natural resource-based export, with increasing involvement of the state as the factor generating real economic processes, primarily through budget expenditure, have been exhausted.

Ongoing discussions show that Russia is not only unprepared for the new situation, but also that it has no ideas for necessary changes and steering its economy out of the woods.

Economists engaged in this debate consider that the main reason behind economic slowdown is an insufficient level of investments, which decreased by 1.4% in the first half of 2013 and by 3.7% in June alone – compared to the corresponding period of the previous year. They argue that with the deteriorating condition of the budget, the major entity that may influence the situation and, in a wider context, create conditions for stable economic growth is the Central Bank of Russia (CBR).

They postulate that the Bank should pursue an adequate interest rate policy, by de facto cutting them, with a view to reducing credit costs and, in effect, stimulating lending by commercial banks, especially to investors and consumers.

In reply to such proposals, in its report published in mid-August the CBR claims that monetary factors are not, in fact, responsible for economic growth deceleration. Russia’s economic growth model is so inadequate that its economy is not responsive to stimulation with traditional monetary policy instruments, especially easing the policy. Invoking reports and analyses by research centres which show that domestic production capacity has been used virtually to the fullest (to 95%) and unemployment is low (5.5%), the CBR concluded that under the present circumstances easing monetary policy would not bring about the desired increase, but it would strongly stimulate inflation.

Practice proves high inertia of domestic output, which is unable to capitalize on the effects of rapidly increasing demand, stimulated largely by budget funds. In effect, in recent years 70-85% of demand increase has been seized by imports, thanks to which their value has been one of the fastest increasing macroeconomic indicators in Russia.

The CBR, representatives of research centres and analysts agree it is essential to modernise Russia’s economy, i.e. to introduce deep institutional and political reforms. In their view, this is the only way to prevent long-term economic stagnation of the country. According to the CBR, “any attempt on the part of Russian authorities to ease monetary policy is a gift to profiteers and an additional incentive to transfer capital out of the country, and attempts at making monetary policy more stringent would lead us straight into recession. Hence, the basic strategy of Russian authorities in this situation is to do no harm.”

The above CBR reasoning seems to correspond to estimates according to which capital export from Russia exceeded USD 47 billion in the first seven months of 2013. In the first half of the year, the figure was USD 38 billion (official CBR data) and USD 9 billion in July alone. The data show that the level of USD 50 billion assumed for this year would be exceeded considerably. Last year, capital export totalled USD 54 billion.

It seems that Russian authorities, including President Vladimir Putin, are aware of the increasing shortcomings of the current policy model, but are unprepared to change it. The principles of “more state in the economy” and of appointing buddies as leaders of the largest businesses seem unmovable. In the past, the largest businesses, concentrated primarily in the oil and gas sector, used to secure smooth operation of the state in terms of finance and allowed oligarchs, officials and military structures personnel to gather considerable amounts of money in private accounts abroad. The relationship between the authorities and the elite running the economy followed a simple model: riches and impunity in return for loyalty. As over USD 400 billion has flown out of Russia in the past five years, it seems that the elites have made excellent use of the opportunity.

Currently decreasing inflow of capital to Russia proves that the model’s potential has been exhausted. Loyalty is not enough anymore. The new formula is: riches and impunity in return for patriotism, which means: earn and invest in Russia, i.e. new money should not be transferred out of Russia and old money should be brought back as soon as possible. The question whether the authorities would be determined enough to introduce the necessary reforms and deep structural changes in the economy remains open. The time is running out.

OF