Tydzień w gospodarce

Category: Trendy gospodarcze

Eastern Poland (peterolthof, CC BY-ND 2.0)

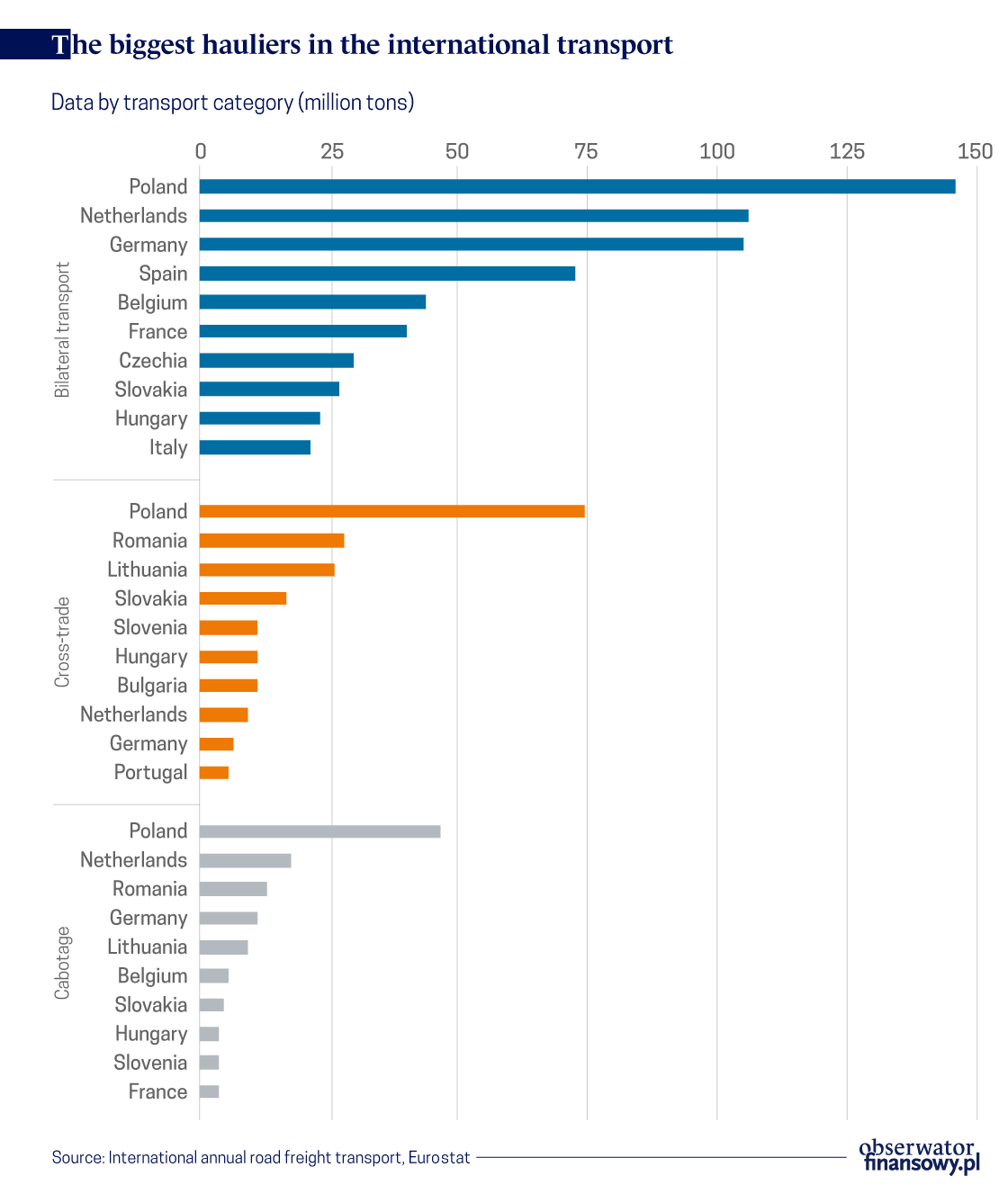

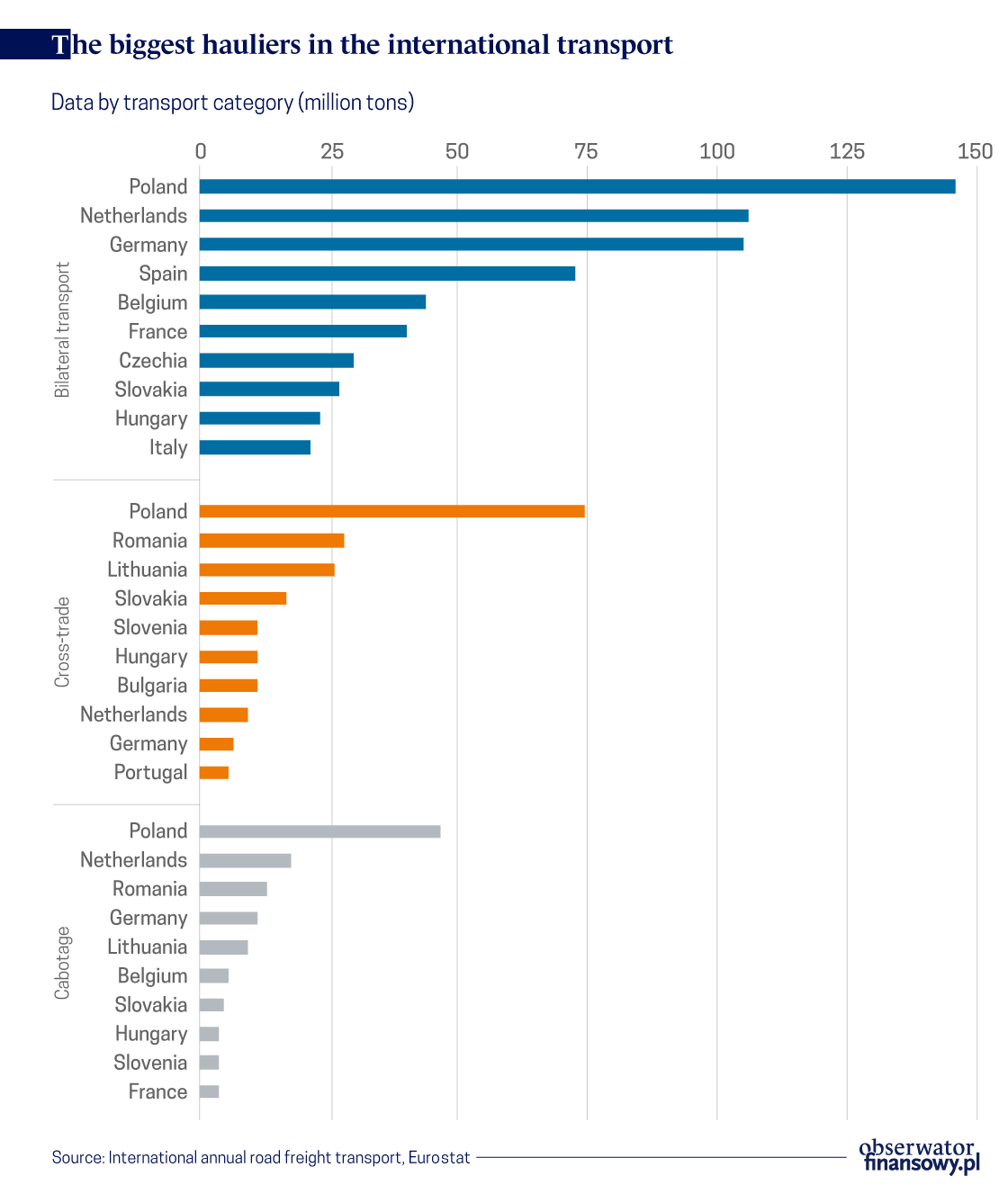

According to Eurostat data, in 2018, Polish companies transported nearly 270 million tons of freight, which accounted for 23 per cent of the EU road transport freight. The volume of carriage of goods by road has been growing continuously since Poland’s accession to the EU. In this period, the weight of freight carried by Polish companies increased more than six times. Since 2006, the transportation work measured in ton-kilometers (tkm) performed by Polish transport companies in the international carriage of goods has been higher compared to domestic transport. In 2018, international carriage of goods accounted for 64 per cent of the transport work of Polish companies.

Carriage of goods by road plays a key role in the Polish exchange with foreign countries. According to foreign trade statistics published by Eurostat, in 2018 road transport accounted for 72 per cent of exports and 45 per cent of imports. The spectacular growth of freight carried by Polish haulers did not only result from an increase in foreign trade turnover. Owing to the liberalization of access to the EU market of carriage of goods by road which followed Poland’s accession to the EU and the high price competitiveness of Polish transport companies, their role in the carriage of goods between foreign countries (cross-trade) and the carriage of goods within the boundaries of other EU countries (cabotage) was gradually increasing.

The competitiveness of Polish transport companies in international carriage of goods has led to a gradual change in the structure of carriage by main categories. Immediately after Poland’s accession to the EU, the growth in the carriage of goods was based on the transport of exported and imported freight which constituted 87 per cent of international carriage of goods. Fifteen years later, in 2018, the share of bilateral carriage of goods related to exports and imports decreased to 55 per cent, while cross-trade and cabotage constituted the remaining 45 per cent.

Trends in international freight transport in the EU countries have been highly diversified over recent years. On the one hand, the rapid growth in the carriage of goods was recorded by the countries of Central and Southeast Europe (CSE), mainly Poland, Romania and Lithuania. On the other hand, stagnation occurred in Western Europe. After the decline in 2008-2009, the volume of carried freight did not recover to its pre-crisis levels. This was partly due to the high activity of haulers from the new EU Member States in cross-trade and cabotage operations. In 2018, transport companies registered in the CSE countries carried out more than 80 per cent of the overall cross-trade between European Union countries and almost 60 per cent of cabotage transport.

Polish haulers clearly dominate in bilateral carriage of goods between Poland and other European Union countries. The share of domestic transport companies in relations between Poland and other EU countries amounted to nearly 93 per cent in 2018, which was definitely the highest share of domestic carriers in the transport of EU countries. Haulers from countries of trading partners (countries of loading or unloading of goods) accounted for less than 6 per cent of freight carried to and from Poland, while haulers from other EU countries accounted for only 1.6 per cent of freight.

The majority of freight is transported between Poland and Germany. It is currently the second most important direction for the carriage of goods by road in the European Union. In 2018, 60.4 million tons were transported between Poland and Germany, more freight was carried only under the relationship between the Netherlands and Germany (89.9 million tons). The national structure of haulers indicates a strong domination of Polish transport companies. Polish haulers carried 95 per cent of freight transported between Poland and Germany, German haulers — 4.2 per cent and the remaining 0.8 per cent of freight was carried by haulers from other EU countries, mainly from Lithuania. Polish haulers play even more important role in the carriage of goods to and from the Netherlands, Italy and France, where their share amounts to 97 per cent.

Polish transport companies play a slightly less important role in the carriage of goods between Poland and other countries of CSE. In 2018, Polish carriers accounted for almost 90 per cent of freight transported between Poland and the Czech Republic, 87 per cent between Poland and Slovakia and 74 per cent between Poland and Lithuania.

The dominance of Polish companies in the carriage of goods with EU countries has been visible practically since the beginning of Poland’s accession to the EU. In 2004, Polish haulers carried 82 per cent of freight related to exports and imports, transport companies from trading partner countries — 15 per cent and haulers from third countries 3 per cent. In the transport to and from new Member States, the share of Polish haulers was slightly over 50 per cent.

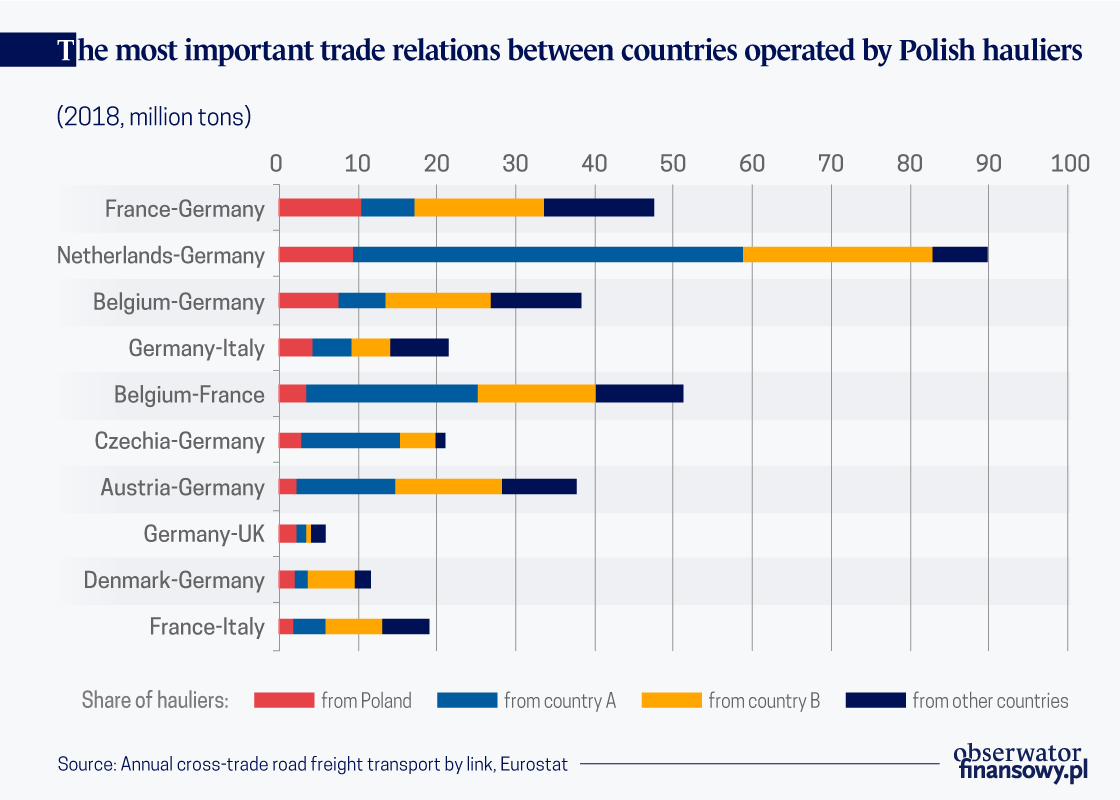

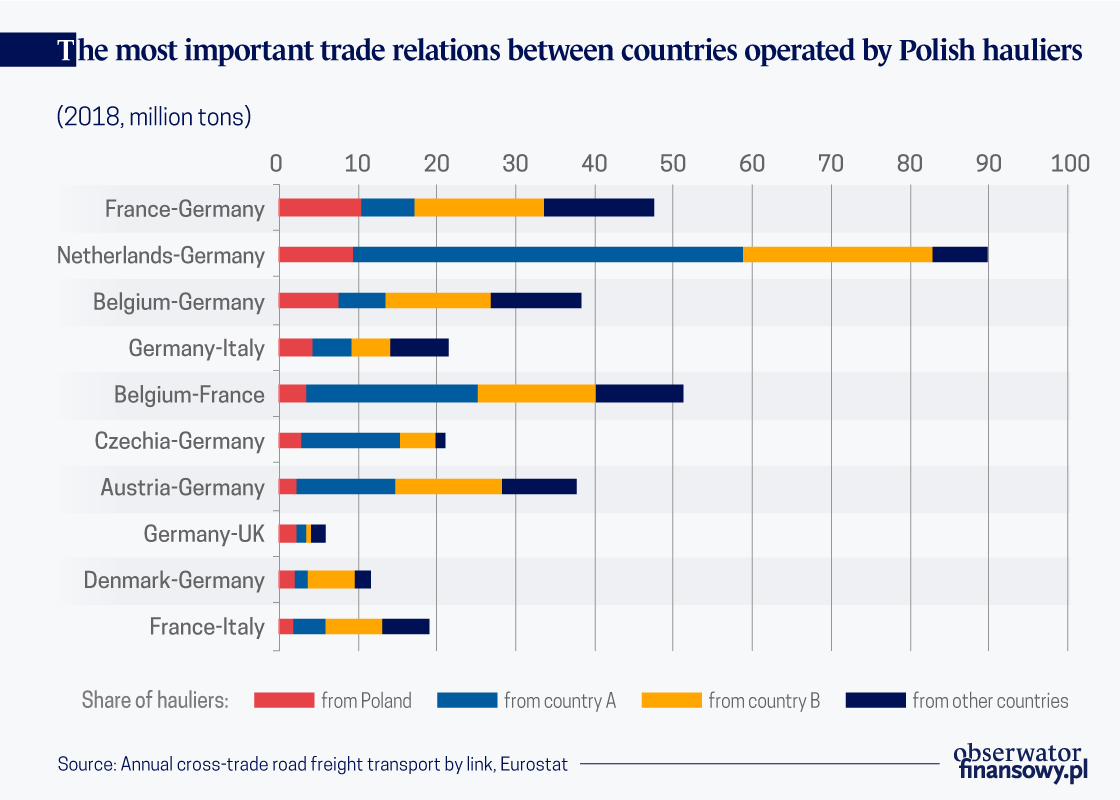

Cross-trade is the fastest growing segment of international road transport in the European Union. In 2018, 22 per cent of the volume of freight between EU countries was carried by transport companies from countries other than the country of loading or unloading. Following the accession of the some of the CSE countries to the EU, competition in the international market of the carriage of goods from haulers registered in new Member States has increased significantly. At present, the CSE countries account for more than 80 per cent of the carriage of goods between third countries. Transport companies from Poland are the most active haulers in relations between EU countries. Polish haulers account for over 33 per cent of all cross-trade operations performed in the EU. The fact that in the case of ten main destinations in the carriage of goods between EU countries (except for transport between Germany and Poland), six Polish transport companies were the most important “foreign” haulers, confirms the position of Polish haulers.

In 2018, Polish transport companies transported 74 million tons (including 70 million tons between EU countries) between third countries. Due to the size of the transport market and the geographical proximity, Polish cross-trade carriage of goods is mainly concentrated on the German market. In 2018, the carriage of goods between Germany and the remaining EU countries accounted for 64 per cent of cross-trade operations carried out by Polish transport companies. It is also reflected by the fact that among ten most important cross-trade destinations of Polish haulers, eight are related to the carriage of goods from and to Germany. In total, in 2018, Polish transport companies transported 13 per cent of freight in bilateral transport between Germany and other EU countries.

In 2018, the most important direction for Polish haulers was the transport of freight between France and Germany. Polish companies transported the total of 10.5 million tons, which accounted for 22 per cent of the freight transported between these countries. This means that Polish lorries transported more freight on routes between France and Germany than lorries belonging to French haulers. Similarly, Polish companies carry out large transports on the routes between the Netherlands and Germany — the largest transport relationship in the European Union.

Polish haulers are also present on routes between countries other than the neighbors of Poland. In 2018, the largest carriage operations took place between Belgium and France and France and Italy. Poland is also the largest hauler connecting the United Kingdom with other EU countries. In 2018, transport companies carried the total of 5 million tons of freight between the United Kingdom and the EU – most of it to and from Germany and the Netherlands.

Poland is the largest haulers providing cabotage services in the European Union. In 2018, domestic companies carried 46.6 million tons of freight as part of the cabotage, which constituted 17 per cent of all freight carried by Polish haulers in international transport (compared to 1.6 million tons in 2004).

Cabotage remains the smallest category of the international carriage of goods in the European Union, however, in 2013-2017 this this was the fastest growing category. Across the European Union, cabotage has so far accounted for only 4 per cent of domestic transport. Services of foreign haulers are most commonly used in Belgium, where the cabotage penetration rate reached 14 per cent; this rate has exceeded the average also in France (9 per cent), Austria (8 per cent) and Germany (8 per cent). On the other hand, the lowest cabotage penetration rate was recorded in Poland and Bulgaria (0.1 per cent each) and in Latvia (0.3 per cent).

Due to the size of domestic carriage of goods by road, Germany and France are the largest markets where cabotage services are provided. In 2018, 40 per cent of the cabotage operations within the European Union were performed in Germany and 17 per cent in France.

As in the to cross-trade, also in cabotage the German market is the most important for Polish haulers. In 2018, 70 per cent of the cabotage operations were carried out between the sender and the consignee of freight in Germany. At the same time, the share of Polish transport companies in the cabotage on the German market reached 55 per cent. The remaining part of the cabotage transport operations in Germany is performed by haulers from the Netherlands, Romania and Lithuania. Poland is also the main hauler providing cabotage services in France and Italy.

In 2018, the first in 15 years decline in international road freight transport was recorded. Compared to 2017, the carriage of goods performed by Polish transport companies decreased by 6.4 per cent in terms of the freight volume. On the basis of the available data, it is difficult to assess the extent to which this was a correction after the strong growth in 2016 and 2017, or the impact of the economic downturn in Europe and the introduction of restrictions in the international carriage of goods in some countries. In 2018, a decline in the domestic carriage of goods was also seen. The volume of freight carried in Poland decreased by 7.7 per cent (after an increase of 13.6 per cent in 2017), i.e. even more than in international transport. A decline in the carriage of goods in 2018 also occurred in other EU countries. Considering Polish haulers, the highest drops occurred in the cross-trade transport. The carriage of goods between the Netherlands and Germany recorded the strongest decline, although at the same time an increase was seen in the carriage of goods between France and Germany. The volume of freight in cabotage services provided in Belgium and the Netherlands has also decreased.

Wojciech Mroczek is an economic expert in the Department of Statistics in Poland’s central bank, NBP.

The views and opinions expressed here reflect the point of view of the author and do not represent the official position of NBP.