(CC BY Thomas Hawk/DG)

The basic source of information about the realised demand for food in Poland is the data on retail sales published monthly by the Central Statistical Office. The publication presents two categories which directly or indirectly refer to food sales: „food, non-alcoholic beverages and tobacco products” and „retail sales in non-specialised stores”.

The first category covers specialised stores trading exclusively in food. They include, for example, bakeries, butchers’, fish markets and greengrocers’. The second one includes stores of a varied profile where the main part of the goods sold is often constituted by food. The most important group of stores in this category are supermarkets and discount stores; of large importance are also smaller stores (e.g. local ones that apart from food also sell, for example, detergents). According to the survey by Nielsen, despite the growing popularity of food shopping in supermarkets and discount stores, in the case of fresh food (bakery products, meat, fruit and vegetables) Poles prefer to do their shopping in specialised stores (approx. 30 per cent of respondents).

After eliminating the statistical effect arising out of the later date of Easter (in 2013 the Holy Week fell in March, and this year in April), resulting in the purchase of food by households being moved from March to April, we could observe in both categories a mild downward trend in the growth of food retail sales in the first half of 2014 (see chart).

Although July saw an increase in the above-mentioned categories, it was to a large extent due to good weather conditions (a limited number of rainy days) favourable for holiday travels, spending time outdoors and hence increasing expenditure on such activities. An additional factor influencing the growth of food retail sales was the holiday of the Assumption of Mary this year, which fell on Friday, meaning that there was a long three-day weekend in August.

Hence, this temporary increase is not a sign of sustained improvement trends of the demand for food in Poland. Furthermore, its drop is also signalised by research on the economic situation in retail sales. Despite the gradual increase since April 2014, the ratio of the expected quantity of sold goods in the „food” sector calculated with seasonal adjustment has started to gradually decrease, crossing in July the threshold of 0 points (this threshold separates the increase from the decrease in activity), and in August it noted a significant drop to the lowest level since February 2014. Taking into consideration the aforesaid trends in retail trade, we are expecting a slowdown of food consumption in a short period.

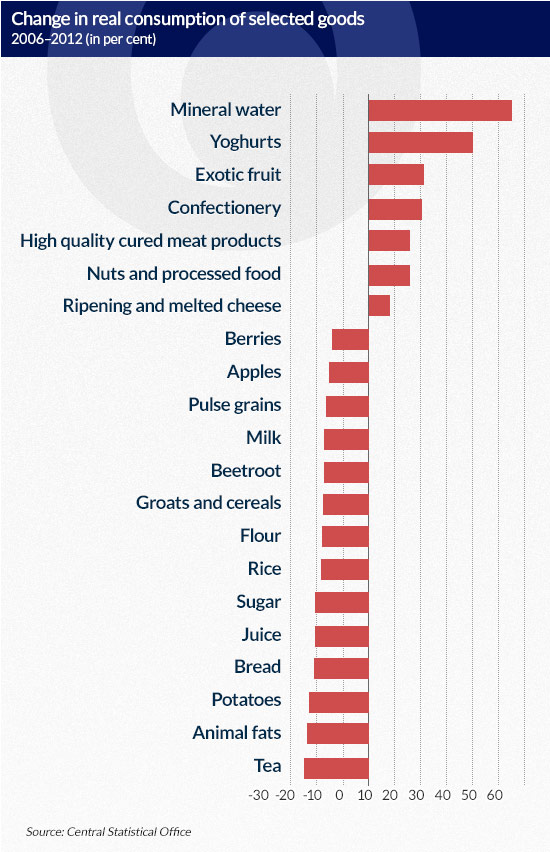

The next stage of analysis was to evaluate the mid-term trends in the consumption of foodstuffs. According to the results of the Household Budget Survey by the Central Statistical Office, in the years 2006-2012 there was a clear change in the structure of food consumption in Poland. In real terms the average monthly consumption of the following goods fell significantly: groats and cereals (by 17.4 per cent), flour (18.0 per cent), rice (18.2 per cent), sugar (20.5 per cent), bread (21.4 per cent), potatoes (23.1 per cent), animal fats (24.0 per cent), and tea (25.0 per cent). On the other hand, a significant increase was observed in the consumption of: mineral water (by 55.3 per cent), yoghurt (40.5 per cent), exotic fruit (21.4 per cent), confectionery (21.1 per cent), high quality cured meat products (15.8 per cent), nuts and processed food (15.4 per cent) and ripening and melted cheese (8.3 per cent).

Hence, the survey on household budgets indicates a growing change of eating habits among Polish society. Along with the growing wealth of Poles, we may also observe increased consumption of luxury goods (ripening and melted cheese, high quality cured meat products, exotic fruit and confectionery), with a simultaneous drop in the consumption of foodstuffs of lower value (potatoes, beetroot, flour, groats and cereals). Furthermore, the data suggest that Poles pay increasingly more attention to a healthy lifestyle, shown by increased consumption of mineral water and dairy products, with a simultaneous drop in the consumption of condiments, animal fats, sugar and bread.

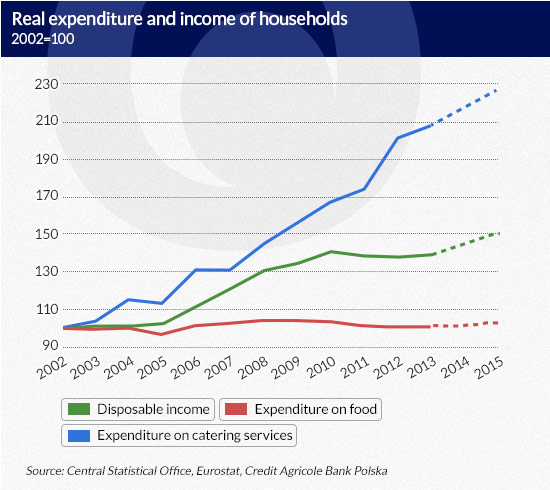

According to the Engel’s law, as a consumer’s income rises, the share of expenditure on food in his total expenditure falls. This means that a certain increase in income is related to a lower relative increment of food expenditure. This theoretical relationship finds confirmation in empirical data. According to the results of regression analysis, in the years 2003-2013 foodstuffs were characterised by an income elasticity of demand of 0.23. This means that an increase in the disposable income of a household by 1 per cent would cause an increase in food expenditure by approximately 0.23 per cent.

Now, using our forecast of the average real disposable income of households (3.9 per cent this year and 2.7 per cent in 2015) and the income elasticity of foodstuffs, we have calculated the expected growth of average real monthly expenditure of households on food. Next, using the demographic forecast of Eurostat, it was possible to specify the real food consumption in Poland for the years 2014-2015. We expect that it will grow by 0.9 per cent in 2014 and by 0.6 per cent in 2015 as against a drop of 0.3 per cent in 2013.

The expected increase in real consumption will not be equal for particular foodstuffs. We believe that the tendencies observed in 2006-2012 will be continued. Thus, we expect a faster growth of consumption of luxury goods and of so-called healthy products. On the other hand, the consumption of lower value food (potatoes, groats, rice) or high calorie food will continue to drop.

An interesting phenomenon is the gradual growth of real expenditure of households on catering services. Between 2003 and 2013 this grew at a pace exceeding the real growth of disposable income. This means that the income elasticity of this expenditure is above 1 (luxury goods). Taking into consideration the assumed growth of disposable income, we assume that consumption in this category will grow by 4.3 per cent in 2014 and by 2.9 per cent in 2015. Catering services are a substitute of food consumption. Thus, their higher consumption will cause an additional increase in the domestic demand for food, which will not be directly reflected in the growth of real expenditure on foodstuffs by households.

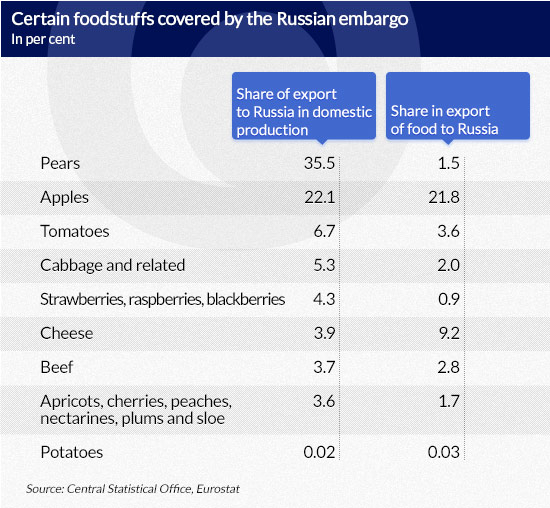

Finally, we made an abridged analysis of the impact that the Russian embargo has on domestic food prices. The restrained demand for Polish food in Russia will cause a drop in prices of Polish foodstuffs (Polish producers will not be able to find an alternative outlet market for their products and therefore they will be forced to lower their prices). This effect will be enhanced by this year’s particularly abundant harvest of fruit and vegetables.

Taking into account the share of exports of particular foodstuffs to Russia in the total domestic production, we expect that the greatest price shock will be experienced in the case of pears, apples, tomatoes, cabbage, vegetables, cheese and beef. Considering the weight of meat, fish, vegetables, fruit and dairy in the inflation basket of goods and the experience from the previous years, when a strong growth of food supply was noted, we expect that the embargo will contribute to lowering the inflation path by 0.4-0.5 pp. on a yearly basis.

In a short term, the price decrease will be most visible in the case of beef and cheese. In the case of fruit and vegetables on the other hand, the drop in prices will take place particularly at harvest time. Thus, we expect that the impact of the embargo on inflation will reach its peak in the 3rd and 4th quarter, i.e. in the period when its impact on the price of meat and dairy will fully materialise and the harvest of apples and pears will be completed. According to the data on prices of agricultural products, made available by the Ministry of Agriculture, the drop in prices of certain foodstuffs as a result of the embargo was already partially visible in August. Compared to the records from the beginning of August, i.e. the last records before the embargo was introduced, the wholesale marketplace price of apples decreased (by approx. 25 per cent), as did those of cabbage and potatoes (by approx. 14 per cent each).

We estimate that the export to Russia of food affected by the embargo constitutes approximately 3.2 per cent of the food consumption of households in Poland (excluding expenditure on catering services). Thus, the growth of domestic food consumption expected by us in 2014-2015 will not be able to fully counterbalance the lower demand for Polish food in Russia. This is the case especially since the goods exported to Russia belong to a large extent to the group of foodstuffs the real consumption of which has been dropping in Poland in recent years (apples, cabbage, tomatoes, potatoes, milk, cream, juice and unprocessed meat).

Krystian Jaworski is an economist of the Credit Agricole Bank in Poland

Jakub Olipra is a student of the Warsaw Schools of Economics and an intern at Credit Agricole

Tomasz Hueckel is a student of the University of Warsaw and a trainee at Credit Agricole