Tydzień w gospodarce

Category: Raporty

When the standard measures to prevent the entry of „undesirable goods” failed and Belarus continued to introduce to the Russian market seafood of alleged domestic production, and the Serbian producers flooded the market with the variety of apples – whose leading exporter until recently was Poland, and which Serbia itself never produced in large quantities – Putin decided to add a dramatic element to the blockade.

In accordance with his decree, suspect fruit and vegetables are to be disposed of at landfills, whereas meat will be burned due to the biological threat. On the first day after the introduction of the new regulations, some 100 tons of French cheese, shrimps, Polish apples, tomatoes and meat were destroyed. All items from the list, originating from the European Union, USA, Canada, Australia, Norway, Switzerland and Japan, are treated as contraband and are to be destroyed.

The protests of social organizations and citizens who urged the authorities to agree for the food to be handed out to the needy instead of being destroyed, proved unsuccessful. Activists are pointing out that the quality of life of many people deteriorated when the prices increased, due to the introduction of sanctions, therefore handing out food would constitute a certain kind of compensation. When this initiative failed, a local news portal from Smolensk reported that after the bulldozers crushed hundreds of kilograms of food at a military training ground outside the city, local residents began to scour the area in search of food still suitable for use.

What should we expect to see on the shelves of Russian stores in the near future if these spectacular actions are not only a demonstration but in fact foreshadow the regular verification of goods imported to Russia? Thus far a common situation was that a producer from a country covered by the sanctions would sell the goods to a company from Belarus or Serbia, which would then sell it as its own. The authorities assure the population that the country is not threatened by a crash on the food market. The TASS news agency quoted the Agriculture Minister Alexander Tkachev, who concluded that the import of food products for the amount of USD45bn, in the years 2013-2014, constituted a real loss of potential of domestic producers. Over the past year this amount decreased to approx. USD25bn. “We have replaced the imports not only with our own production, but also with supplies from the countries of the Commonwealth of Independent States, Latin America and Asia”, said Tkachev.

And so, if meat is imported, it most likely came from Brazil, Belarus, Paraguay or Argentina. Norwegian fish has been replaced by fish coming from Iceland, China and Chile. Belarus has been able to almost entirely replace dairy products previously imported mainly from Poland, Lithuania and Germany. The Ministry of Agriculture maintains that agricultural production increased by about 3.3 per cent in the last year, and that it is possible to maintain growth even at 3.7per cent. Agricultural production is in fact the only sector of the Russian economy which recorded steady growth in the first half of 2015.

In the calculations of the Ministry everything is all right and the country managed to cope without Spanish ham and Polish meat. The Russians themselves have a different opinion on the matter. KermlinRussia, a popular profile on Twitter, whose authors ridicule the actions of the presidential administration, is making fun of the fact that the restrictions only apply to ordinary Russians, while the elite can easily buy goods abroad: „Russia will create special diversion groups formed by the children of the Members of the Duma and other officials, which will destroy the goods covered by sanctions on enemy territory”.

Prices in the country have risen by 20% on average in relation to the previous year, and inflation stood at 15.6% in July.

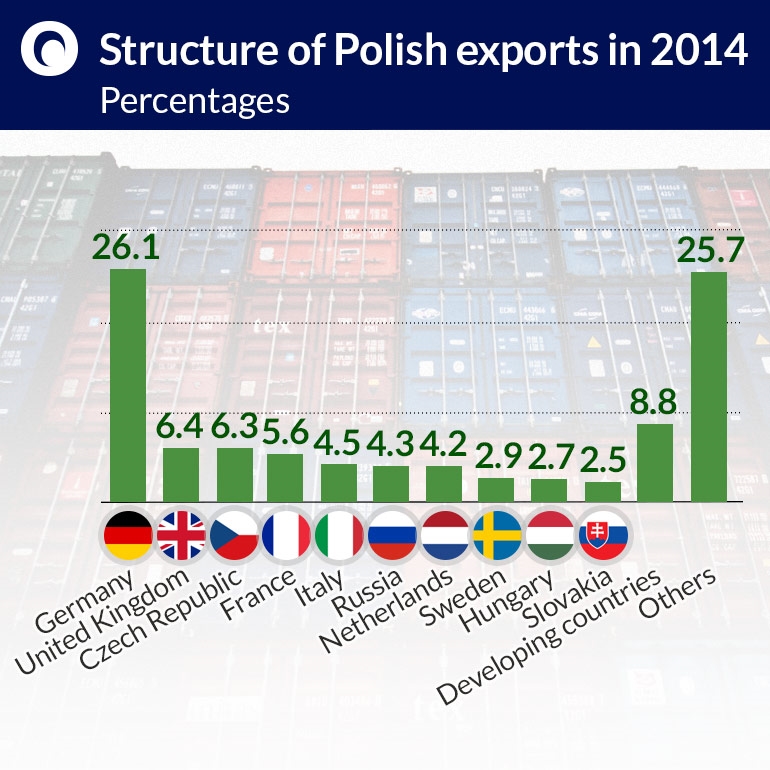

Poland has coped well in this new trade environment. Although Russia was not the main direction of exports of Polish goods (6th place), many manufacturers had specialized in the manufacture of goods for that market and their situation was the most dramatic after the sanctions were imposed. Analysts of the Polish Institute of international Affairs, Artur Gradziuk and Damian Wnukowski, presented not so long ago an analysis entitled „Russia – an irreplaceable market? In search of alternatives for Polish exports”. The authors state that in 2014 more than 9,000 Polish companies carried out exports to Russia. These included both small producers of fruit and vegetables, as well as powerful operators such as the Bydgoszcz-based PESA (manufacturer of trams), Zelmer and Huta Stalowa Wola, which sells machines under the brand name Dressta.

(infographics Dariusz Gąszczyk)

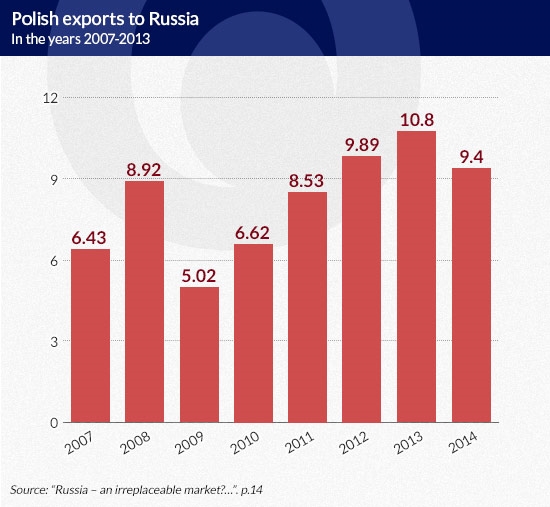

The volume of sales to Russia has varied greatly over time. The period of prolonged growth from the beginning of the first decade of the 21st century was interrupted by the economic crisis (the value of sales of Polish companies to the Russian market reached USD9bn in 2008, and fell to only USD5bn in 2009, which was the worst year for Polish exporters to the East). In 2010, however, exports began to bounce back. Polish exports achieved the best results in 2013 (USD10.8bn). In 2014, there was a decline of 14% compared to the previous year. Such a significant decline was caused not only by the sanctions, but also by the general weakening of the Russian economy and the depreciation of the ruble, which contributed to a reduction in the purchasing power of Russian consumers.

Polish exporters are devoting more attention to the opportunities on the EU market. Despite the fact that sales to Russia decreased by 14 per cent in 2014, the total value of Polish exports was approx. 5.2 per cent higher than the year before, and reached a total of EUR163.1bn. The majority (53 per cent) of the exports went to the markets of the euro area countries (an increase by 9.4per cent).

2014 was a difficult year for exporters selling goods to the East, because the supplies to other countries of the Commonwealth of Independent States also declined (exports to Belarus fell by 11.9 per cent and exports to Ukraine declined by as much as 27 per cent). On the other hand, there was a dynamic growth in exports to Algeria (a two-fold increase), United Arab Emirates (by 48 per cent), Saudi Arabia (by 36.7 per cent), Hong Kong (by 17.1 per cent), Singapore (by about 12 per cent) and India (by 11.3 per cent). Due to the constantly increasing population and its rising affluence, the East Asian market could be the most attractive for Polish producers.

(infographics Dariusz Gąszczyk/ CC by Håkan Dahlström)

„The advantage of the Polish offer is the high quality of products, which are also associated with the European Union, and in turn considered to be safe and of good quality”, claim the analysts of the Polish Institute of international Affairs. Researchers from the Wrocław University of Economics have identified 12 industries which in their assessment constitute niches and could ensure the success of our producers on the Chinese market. These are, among others, the supply of medical equipment, systems for air quality monitoring, and the wood industry. Luxury goods (a category in which the authors also include high quality alcohol) are also such a niche – in 2010 China became the second largest market for the sale of luxury goods.

In theory, the market of the United States (a society with a high purchasing power) provides good prospects, but the import of goods is hampered by the necessity of submitting various certificates and attestations. If the free trade agreement (TTIP) enters into force these procedures will be simplified. The European Union has already concluded such an agreement with Canada (CETA), and as a result the introduction of goods to the Canadian market is much easier.

China would be an ideal market for the sale of meat. Germany has fully seized its opportunity, quickly reoriented its exports to China and as a result has not suffered a stagnation because of the Russian restrictions. The Chinese most frequently opt for pork, and Poland could provide it (in 2013, Polish companies exported to China pork for the amount of almost EUR70m). However, it is currently unable to do so, because after the first cases of African Swine Fever (ASF) were detected in our country, some of the non-EU countries, including Korea, Japan and China, immediately closed their borders to Polish pork. Until it is confirmed that ASF has been eliminated in Poland, China will not open its borders to our pork. The fact that the Chinese do not recognize regionalization and impose embargoes on products from the entire territory of the given country, and not only from the region in which ASF was found (i.e. the Podlaskie Voivodeship) also works against us.

The Agricultural Market Agency is encouraging manufacturers to look for opportunities in the countries of North Africa. This year, representatives of the Agency, along with the Minister of Agriculture, visited Algeria for the fifth time. The tangible effect of these efforts is a three-fold increase in the value of exports in 2014 as compared to the previous year.

Let us conclude with optimistic data. According to the report of the consulting company Grant Thornton, by 2020 Polish foreign sales are supposed to increase by 35.6 per cent, which ties into the general growth trends. Over the past 25 years, Polish exports have increased 21 times (by 2,069 per cent) and an increasing share in the sales abroad is attributed not to raw materials but to finished products.

In 2014 Polish goods were sold in 218 countries of the world and even reached exotic locations, such as Oceania or the equatorial countries. There could be even more not-so-obvious directions for our trade expansion – the authors of the report are convinced that in the coming years we will be seeing a deep geographical reorientation, resulting from the fact that manufacturers will be even more determined to be present on new, previously unexplored markets.

“The phenomenon of the geographical reorientation of exports has been clearly visible in the Polish economy for several years, especially since the outbreak of the crisis in the euro area. It made Polish businesses realize that they should not focus on a single affluent but low-growth market, namely the euro zone, and that it is worth expanding internationally to new, less obvious markets”, said Tomasz Wróblewski of the Grant Thornton company in an interview with the Polish Press Agency.