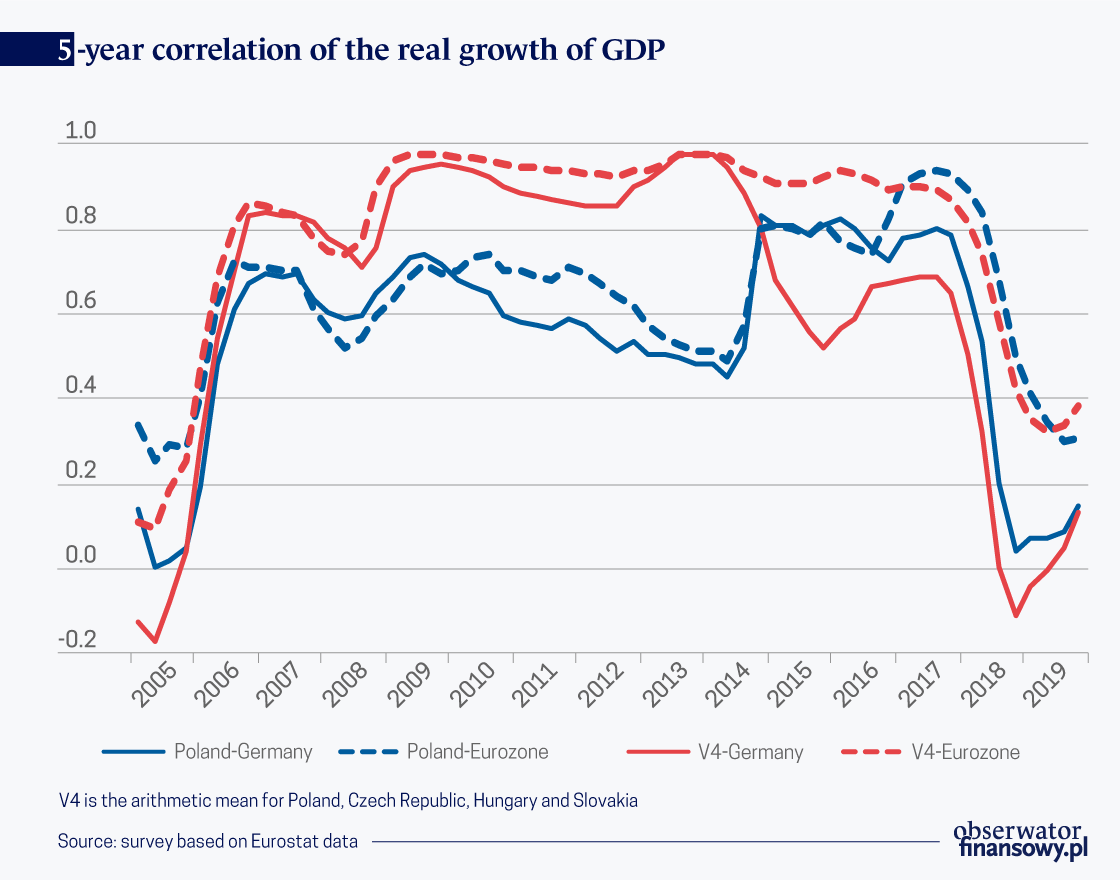

This divergence in economic growth is illustrated by the fall in the value of the five-year rolling correlation coefficients between real GDP growth in Poland and the V4 and the EA12 countries (the founders of the Eurozone and Greece) and Germany, observed in 2017-2018. This is a change when comparing to the previous period, i.e. 2007-2017. Then the correlations of changes in real GDP remained high, simultaneously indicating a high level of synchronization of the economic situation in the V4 with the economies of Western Europe. The recent decline in correlation coefficients confirms that while Germany and the Eurozone economy were experiencing an economic slowdown even before the pandemic, the Visegrad countries remained, to a large extent, resilient. Poland’s relative resilience to the spread of external shocks can be linked to the characteristics of foreign exchange which are largely common to the economies of the country’s region.

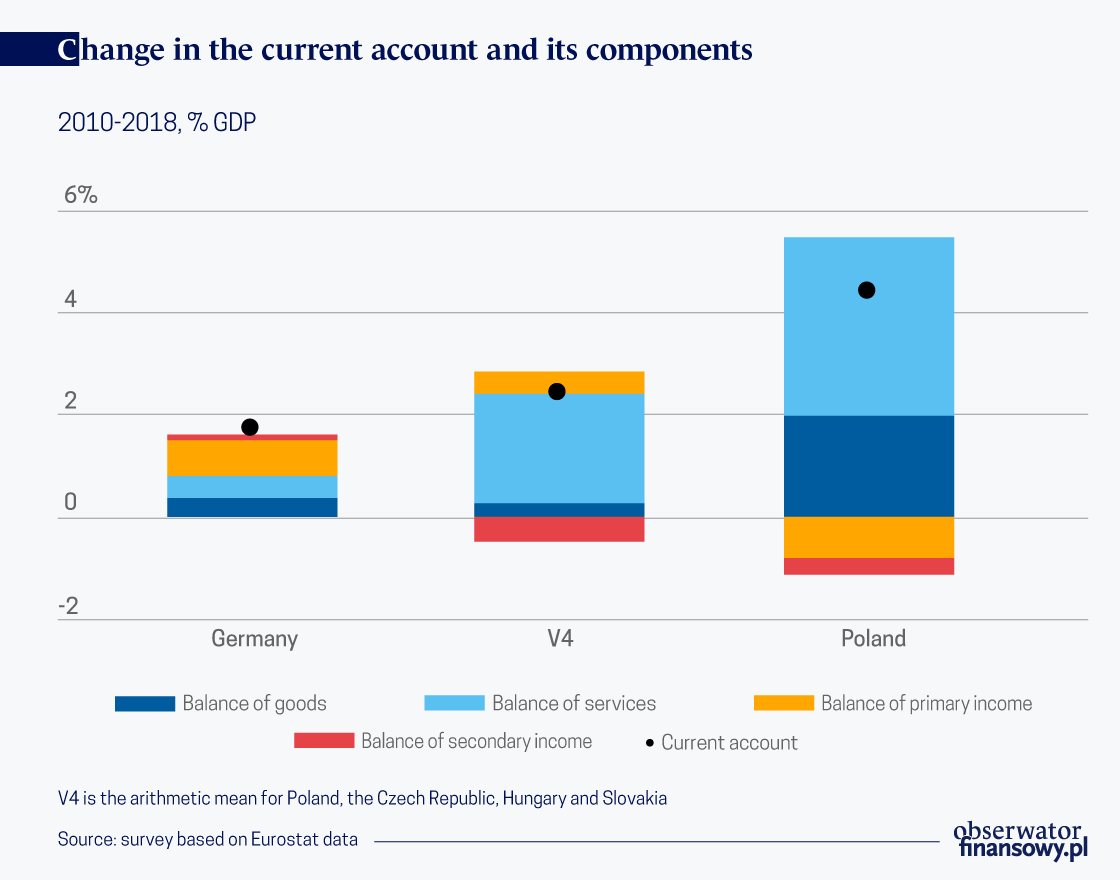

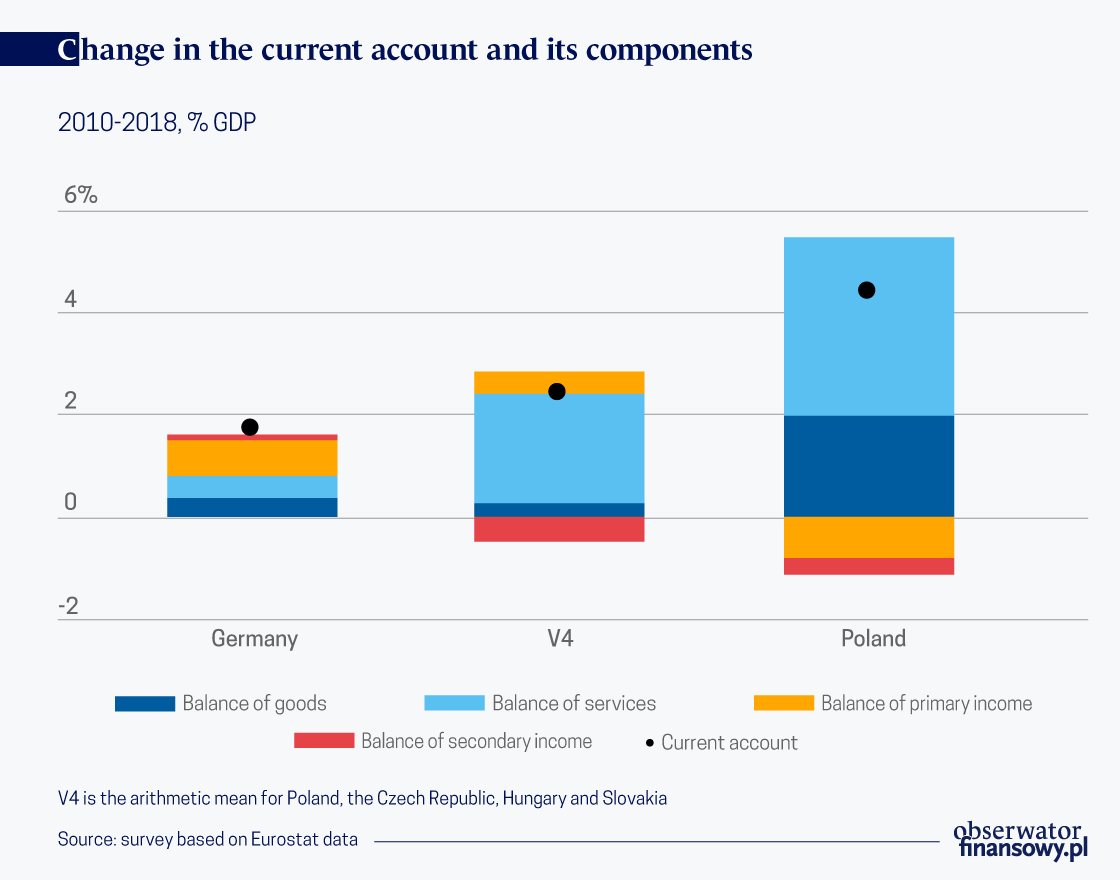

Firstly, the economies of the V4 have experienced a long-term significant improvement in the current account. From a historical perspective, long-term persistence of current account deficits, which closed around 2013, was characteristic of these economies. The improvement of the current account in the V4 countries was a consequence of the real convergence process. Initially, with low per capita income and limited possibilities of financing investments with domestic savings, the four countries were forced to import capital from abroad, which resulted in continuing current account deficits. Subsequently, an increase in wealth and a slower capital inflow were conducive to improving the current account. These changes were also supported by the close integration with global, especially European value added chains, and the continuing high cost competitiveness of the region’s economies.

Secondly, the resilience of the countries in the region to external shocks was supported by a relatively high degree of specialization in the production of consumer goods. The final and intermediate goods exported by the countries of the region are relatively more likely to satisfy foreign consumer demand than investment demand. The share of final consumer demand in the value added exported in the countries of the region ranges from 60 per cent in Poland to 54 per cent in the Czech Republic, against 50 per cent in Germany. Since consumer demand is less sensitive to economic changes than investment demand, the structure of the external demand of the countries in the region helps to stabilize their exports.

Thirdly, the expansion of exports of services is an important factor underlying the improvement of the current account. The current account balance in the V4 in 2010-2018 improved by 2.4 percentage points of GDP (non-weighted average), of which 2.2 percentage points can be attributed to the improvement in the balance of services.

The data for Poland indicate an even greater improvement in the balance of services which increased from 0.9 per cent of GDP in 2010 to 4.4 per cent of GDP in 2018. The expansion of Polish foreign trade in services was also reflected in an increase in Poland’s share in the global exports of services from 0.9 per cent to 1.2 per cent.

The growing importance of services in foreign trade helps stabilize the external situation of the economy. Studies show that trade in services responds to negative shocks to a lesser extent than trade in goods. Moreover, trade in services is less affected by the fragmentation processes taking place in the global economy than trade in goods.

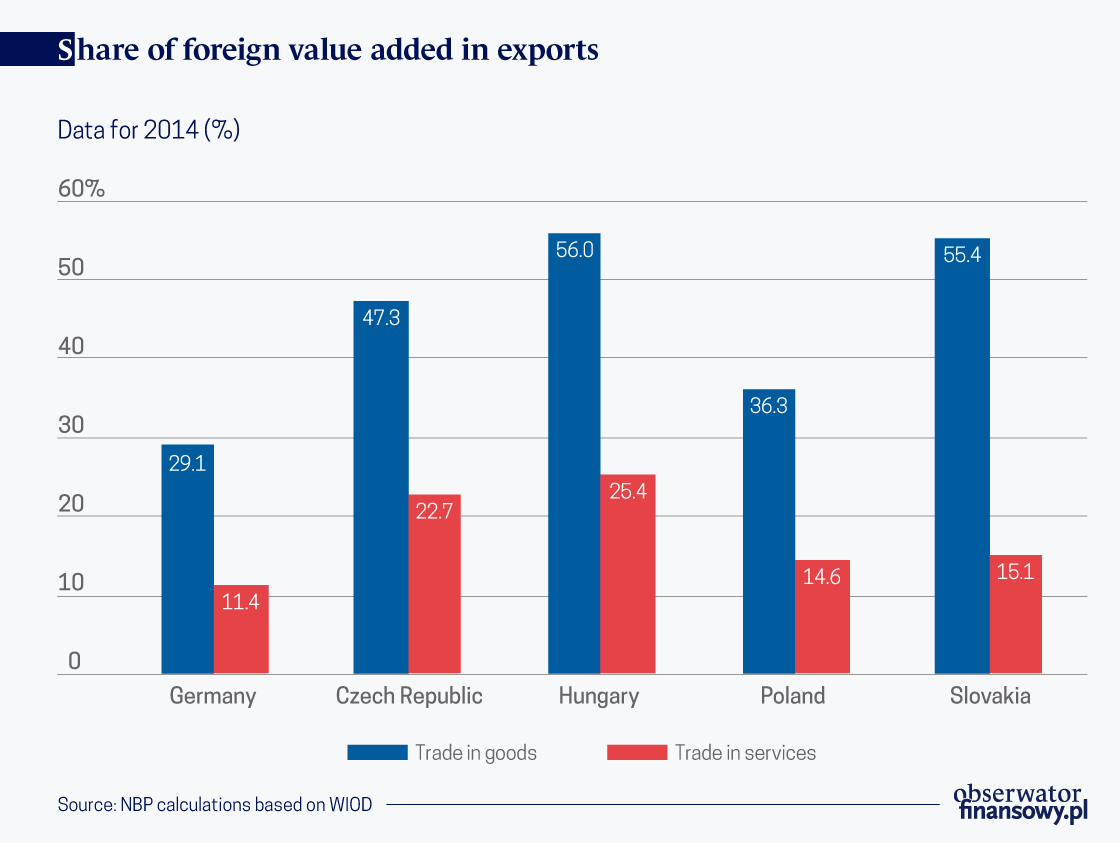

In the case of trade in goods, the expansion of exports was largely linked to the intensification of participation in vertically integrated value added chains. Export production in this case requires producers to use specific intermediate goods, often supplied by foreign operators. Consequently, strong integration within regional value added chains resulted in an increase in the share of foreign value added in exports (FVAX) of the countries in the region. Although imports of intermediate goods make it possible, among others, to reduce the technological distance in terms of produced goods, thus encouraging the expansion of exports, they undoubtedly increase the economy’s exposure to shocks emerging from the global economy.

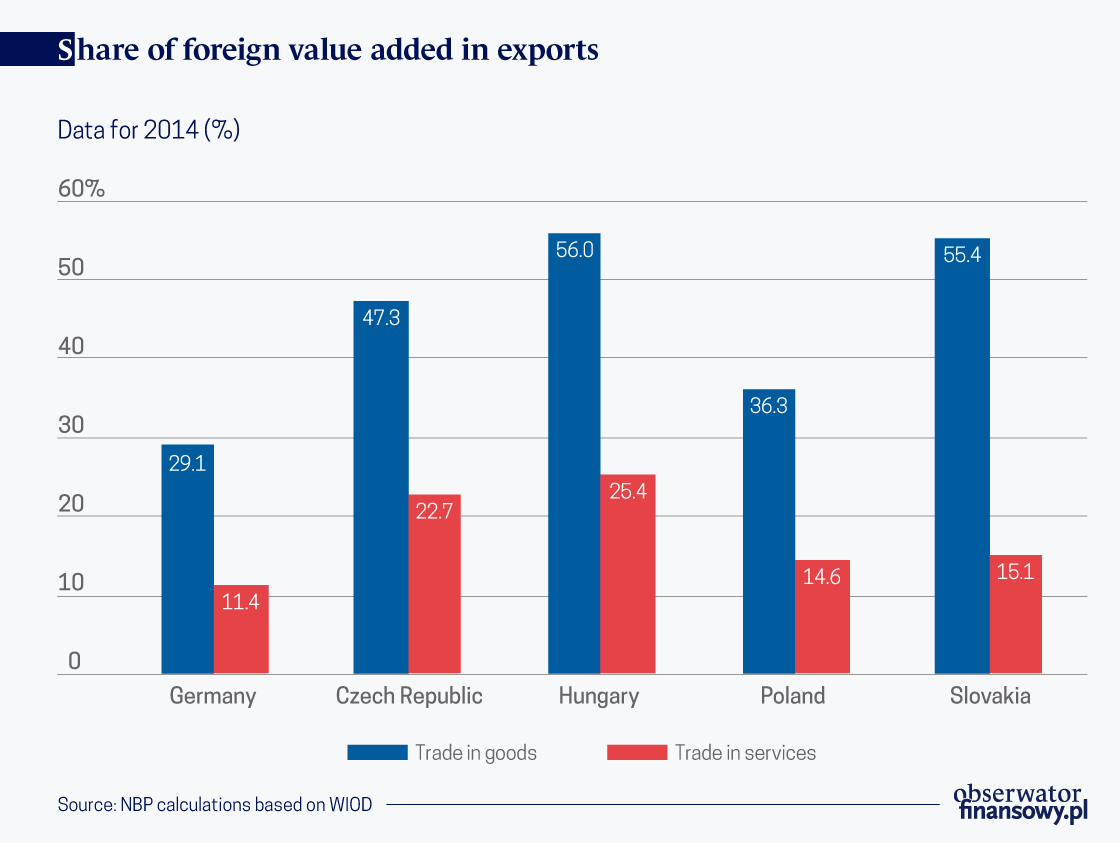

Due to the fact that foreign trade in services is less integrated within transnational value added chains, the increase in the relative importance of services in foreign trade is an important factor stabilizing the external situation of economies. In the V4 countries, the share of foreign value added in the export of goods ranges from 36 per cent for Poland to 56 per cent for Hungary (data for 2014). By comparison, the share of foreign value added in exports of services is much lower, ranging from 15 per cent for Poland to 25 per cent for Hungary. Consequently, trade in services represents a weaker channel for the transmission of external shocks to the domestic economy than trade in goods.

The expansion of the exports of services was supported by high cost competitiveness of the countries of the region, and its effects partly result also from the earlier accumulation of human capital. This is illustrated by the structure of exports of services and its changes. The services which demonstrate the strongest comparative advantage in Poland (transport services and construction services) and in the remaining countries of the region (refining services) build their advantage largely on relatively low labor costs, despite the gradual narrowing of the wage gap between the countries of the region and Western Europe. Moreover, clear signs are observed showing that the earlier intensive accumulation of human capital affects the structure of exports of services. In particular, this is exemplified by the expansion of Polish exports of ICT services which require a highly educated workforce. The deep reasons for these changes include the expansion of higher education and the improvement of the quality of teaching, which is reflected by the good results of student competence tests.

The global slowdown in the automotive sector is a non-negligible risk factor for the countries of the region but its importance for Poland is lower than for the other countries of the region. The proximity of Germany and relatively low labor costs stimulated the integration of the region within the value added chains of the automotive industry. The importance of the automotive sector in the V4 increased in 2010-2018. The share in employment rose from 2.0 per cent to 2.6 per cent, the share in the creation of value added — from 2.7 per cent to 3.8 per cent, while the share in the total exports of goods — from 15 per cent to 19 per cent (non-weighted averages). The decline in global car production in 2018 and 2019 and the poor outlook for the coming period make the automotive sector a source of risk.

Nevertheless, the scale of the risk varies between countries depending on the size of the automotive sector. In this respect, the Polish economy seems to be the least exposed due to the smaller size of the sector (the automotive sector accounts for 1.3 per cent of the employment and 1.7 per cent of the added value creation). Furthermore, the Polish automotive sector is less vertically integrated within global value added chains, which is reflected by a smaller share of foreign value added in Polish exports of this sector, i.e. 44 per cent in 2014, compared to the other countries of the region where it amounted from 54 per cent to 63 per cent. This, in turn, suggests that the decline in foreign demand in the automotive industry will be transferred to a lesser extent to the Polish economy than to the economies of the other countries in the region.

The weaker translation of the slowdown in Western Europe into growth rate in Poland and other V4 countries could have been partly explained by the characteristics of foreign exchange. The relative specialization in the exports of goods intended to satisfy consumer demand, the expansion of the exports of services and the lower importance of the automotive sector have supported the stabilization of the external situation of the Polish economy.

The views expressed in this article are the private views of the author and are not an expression of the official position of the NBP.