LOT is like hard coal mining in Silesia which, despite numerous attempts at restructuring the sector and providing it with hundreds of millions of zloty by the state, finds it difficult to earn profits. In an interview for Obserwator finansowy a few weeks ago, the then company’s Chairman Marcin Piróg admitted that since the early 1990s, and therefore for over 20 years, LOT had not been generating profit through the sale of tickets, which is its core business.

If the company does not make money, it means that its activities must be subsidized. In 2011 the company recorded an operating loss of PLN 146 million, in 2010 – PLN 163 million, in 2009 – as much as PLN 335 million and in 2008 – PLN 232 million. How come that the company has survived until today, being unable to make money from air travel services and incurring such heavy losses? It has been sustained thanks to financial injections provided by the government (which consisted i.a. in transferring to LOT large blocks of shares of companies with the State Treasury shareholding, for example, 1.4 million of shares of Bank Pekao, which the carrier sold in 2009) and the selling-off of redundant assets, such as the LIM high-rise building, which is the location of the Marriott Hotel in the center of Warsaw.

Last year, the airline took recourse to the sale of LOT Services and LOT Catering (the former was sold to LOT Cargo and the latter to Regionalny Fundusz Gospodarczy [Regional Economic Fund] whose 100 percent of shares are held by the State Treasury. In 2012 the company sold its stake in LOT Aircraft Maintenance Services (to the state-run Agencja Rozwoju Przemysłu [Industrial Development Agency]) and in Petrolot (to Orlen). It also decided to leaseback the office building where its headquarters are located – this operation which provided it with a financial injection of several hundred million zloty.

Everything that was easy to sell has already been sold

LOT’s recent decision to apply for state aid (the first tranche amounting to PLN 400 million, but eventually totalling about PLN 1 billion) is due mainly to the fact that it has been left with very limited assets that are not necessary for the company to continue its operations as an air carrier. What is more, the remaining assets will be difficult to sell: 33.3-percent stake in Casinos Poland (the company running seven casinos), 38-percent stake in Eurolot, ground handling companies and a 10-hectare parcel of land at Okęcie [Warsaw Chopin] Airport, suitable for the construction of office buildings and hotels. Apart from the shares in Casinos Poland, given the current poor condition of European aviation and of the real estate market, LOT’s assets will prove difficult to sell at a price that will be acceptable for the owner.

LOT’s current situation is also due to several factors: its outstanding debts (a substantial part of the cash generated from the sale of LOT Aircraft Maintenance Services company was used to cover them), prices of aviation fuel which have remained high over the past several months, the overly ambitious decision about a rapid replacement of the old fleet, several months of OLT Express’s presence in the Polish market of and the ongoing expansion of low-cost airlines, which was further enhanced by the recent opening of a new airport in Modlin – Okęcie’s main competitor.

The opening of the new airport adversely affected not only Okecie, but also LOT itself, as flights to and from the Warsaw airport constitute the core of its business. The extent to which Modlin compromised the position of Okęcie and of LOT is evidenced by a sudden and significant drop in the Warsaw airport’s share in the so-called offering (the number of flights and seats for passengers in a given period of time). According to the industry’s Internet portal, PRTL.pl, Okecie’s share in offering in winter 2012/2013 in Poland dropped to 38.5 percent, as compared to 47.4 percent in winter 2011/2012.

Situation worsened by the restructuring process

Paradoxically, the company’s latest and ongoing restructuring program, which began in 2010 and was to have been completed by 2013, has largely contributed to LOT’s current problems. The company’s Management Board designed the programme and embarked upon its implementation in response to the company’s record loss on its core business activity in 2009 which amounted to PLN 220 million. It was mainly triggered by the soaring oil prices (and therefore also the prices of aviation fuel), the weakening of the zloty (which has an upward impact on both fuel prices and the costs of aircraft lease payments that are settled by LOT in dollars) and a general drop in demand for LOT’s services due to the economic crisis.

Fuel constitutes up 30 percent of the carrier’s total costs (whereas payroll costs account only for 10 percent of them) and this year, LOT’s fuel expenditure will amount to approx. PLN 1 billion, and therefore twice as much as 2-3 years ago. The amount of lease receivables is similar, which means that even a 10-percent drop in the value of the zloty would increase the air carrier’s costs by PLN 100 million.

LOT’s restructuring program of 2010 provided first and foremost for an increase of sales and profit margins, better quality of passenger service (which was supposed to boost sales), a more appropriate cost management, ensuring the company’s liquidity, i.a. through the sale of redundant assets and the replacement of the fleet with newer and more fuel-efficient aircraft, which would in turn lower maintenance costs and improve passengers’ comfort.

The recovery programme culminated in the hire purchase of five Dreamliners by March 2013. This acquisition, as well as the fact that for a few years now, LOT has been systematically purchasing other new aircraft, including Embraer used on shorter routes, would mean that LOT would boast the youngest fleet and the lowest unit costs among European airlines by 2013.

The company’s places its highest expectations on the purchase of Dreamliners. They consume about 13 percent less fuel than Boeings 767, thus far used by LOT, and their technical maintenance is considerably cheaper. These, however, were not the most important aspects. Our national carrier’s earnings are generated first and foremost by long-haul flights, intercontinental flights and the sale of business class tickets. However, it operated such connections only with North America. The standard of its business class and economy class lagged far behind the conditions provided by LOT’s Western competitors, which prevented it from pursuing a more expansive marketing and pricing policy.

Dreamliners were supposed to change it. They were expected to enable LOT to create a network of connections with Asia and significantly improve the standard of long-haul flights. LOT’s business class in Dreamliners would be no worse than the conditions provided by Western carriers. The comfort of traveling economy class was also to improve significantly. In addition, a new class would be introduced, the so-called premium club, so far inexistent in LOT’s aircraft, and whose standard would correspond to the current business class. At the same time, the airline would offer a 5-10 percent price advantage over its competitors. Dreamliners were to ensure that LOT’s revenue generated by each long-haul flight would increase by an average of 20 percent.

Achievements at high costs

The plan seemed consistent and logical. The first positive results have already been observed. The punctuality and regularity of flights improved so much that in the first half of 2012, LOT was rated the most punctual European airline according to data published by AEA – Association of European Airlines. A standard of airport services improved (for instance, in the past three years, the share of flights in which passengers board the aircraft through a jet bridge instead of a bus transfer increased from 17 to 65 percent).

In 2011, the number of LOT’s passengers was 9 percent higher as compared to the previous year. In the first half of 2012, the number of its passengers increased by 13 percent (the best result among all European airlines, who jointly recorded a 3.9-percent total increase in the number of passengers over that period). Since April 2012, LOT’s aircraft occupancy rate has exceeded the European average of 75 percent. This year, only two airlines of Star Alliance, an association of 28 airlines, have met 100 percent of the organisation’s requirements, namely LOT and the Japanese ANA (All Nippon Airways).

However, all of the above mentioned achievements require substantial expenditure, just like the replacement of the old fleet and the acquisition of Dreamliners. LOT overestimated its own possibilities and embarked upon a project that – as has occurred recently – has exceeded its financial capabilities. Even the decision to rationalize expenditure, i.a. through reducing the costs incurred for the purchase of spare parts, did not save the company. Thanks to the restructuring programme the company increased its operating profit in 2010-2011 by PLN 470 million. Unfortunately, all the savings have been lost to higher oil prices and the weak zloty, which resulted in a PLN 400 million annual increase of fuel costs. Oil prices have remained high throughout the year, and therefore instead of the expected operating profit, the company continued to generate losses on the sale of tickets in 2012.

Critical cash shortage

What does the future hold for LOT? The Ministry of the Treasury wants to grant financial aid to the company, but this will require a consent of the European Commission. The process usually takes up to a year. This may be too long, because LOT is already on its last legs and in a desperate need of a cash injection – for instance, in order to pay off the installments for the Dreamliners that have been ordered. An even more dramatic scenario can be foreseen. The European Commission has recently announced that it would check whether the public aid previously granted to LOT was not in breach with the provisions of the EU law. If it deems that the EU laws have been breached, our national airline will share the fate of our shipyards.

Further government support may help LOT, but only for a while. The position of traditional European air carriers has been undermined by low-cost airlines (which, for instance, reduce their profitability and steal their passengers). On the other hand, the market of long-haul flights has been taken over by airlines which are far larger and stronger than LOT.

– We are like an ant next to an elephant – says Marek Serafin, the head of the aviation portal PRTL.pl and a former manager of LOT. – It is therefore rather unlikely that LOT will be able to conquer this market. The result may be just the opposite: the development and focus on long-haul connections could make the company sink even further.

This was the case of Austrian Airlines. In order to create more long-haul connections and maintain them, LOT would have to invest more at the start and for a while. How could that be possible given that today the company is on the verge of bankruptcy?

No partners to choose from

The competition in the European aviation market remains fierce. Cards are dealt by three major players (Lufthansa, Air France / KLM and British Airways with Iberia, that is IAG), and respectively a number of smaller air carriers are facing huge problems. Some go bankrupt, others are saved by national governments and a number of airlines have been taken over by their stronger competitors. In order to survive, LOT would have to be acquired by a powerful airline. However, the company’s rapid privatization is out of the question, even though Turkish Airlines and Air China seek to take over our national air carrier.

Monika Trappmann, aviation expert with the consulting firm Frost & Sullivan, adds to this list Singapore Airlines and two Middle East airlines: Etihad Airways from Abu Dhabi and Qatar Airways. The problem is that the provisions of the EU laws prevent the acquisition of a majority stake in an airline by an investor from outside the EU. A company registered outside of the European Community is allowed to purchase or control an airline from the European Union only under a bilateral agreement concluded between the third country and the EU authorities. For this reason, Turkish Airlines withdrew from negotiations on the company’s privatization a few months ago.

And what about the potential investors from the EU countries? The German Lufthansa expressed its interest in acquiring LOT. – The government knew that if a privatization tender for the sale of our national carrier was announced, Lufthansa would come up with the best bid – says Marek Serafin, an expert on aviation market. – The government was afraid of the political consequences of selling the airline to a German company. Hence, a privatization tender was not announced and only unofficial consultations with potential investors from outside the EU were conducted. Even a public tender for the selection of a privatization advisor has not been held.

According to Serafin, Lufthansa is now LOT’s biggest international competitor. For this reason, in his opinion, neither Air France/KLM or IAG, that is British Airways and Iberia, would not wish to acquire LOT. – If they bought it, they would have to start a trade war for the Polish market with Lufthansa; they would not be able to win it with LOT – says Serafin. – The worst part is the fact that Lufthansa is not really interested in acquiring LOT any more, as the company has recently acquired a large stake in Brussels Airlines, SwissAir and Austrian Airlines. The latter could potentially replace LOT in the Central European market. In addition, Lufthansa had to invest a lot of money in order to resurrect that airline. It is unlikely that the company will decide to incur further costs for the restructuring of another carrier.

This opinion is shared by Professor Elżbieta Marciszewska, Ph.D., Head of The Department of Transport Policy Theory of the Warsaw School of Economics. – LOT does not stand a chance to go through a rapid privatization process, because given the present condition of the airline industry in Europe, nobody will be willing to take on the huge costs of the company’s restructuring process – said Professor Marciszewska.

Olympic Airways, Sabena, Malev

Given the situation, LOT’s bankruptcy scenario seems now very likely. What would be the consequences of its bankruptcy? Let us start by recalling the aftermath of the collapse of other national carriers in Europe. For example, the Hungarian Malev, the Belgian Sabena and the Greek Olympic Airways, known for the fact that for many years, Greek politicians could fly with this airline free of charge. Olympic Airways was bringing losses already back in the 1980s. In the next decade, the Greek government took over the company’s debt to help it out. This did not, however, prove to be a good solution, as the carrier continued to generate heavy losses and new debts.

Consequently, the government liquidated the airline, but established a new company, Olympic Airlines, on the basis of one of the previous carrier’s subsidiary companies (and not laden with the group’s debt). This company was to have been privatized. The process was, however, prevented because the potential investor would need to reimburse EUR 700 million of public aid granted to the carrier by the Greek government (the European Commission found the aid to be illegal). Ultimately, Olympic Airlines were successfully privatized, but the process took several years. In 2009 the company was acquired by the largest Greek investment fund, Marfin. For Greeks, the most important consequence of this acquisition was the fact that many flights (the least profitable connections), were eliminated, i.a. direct flights to Germany. The privatized airline now operates 51 routes, which is 18 fewer than before.

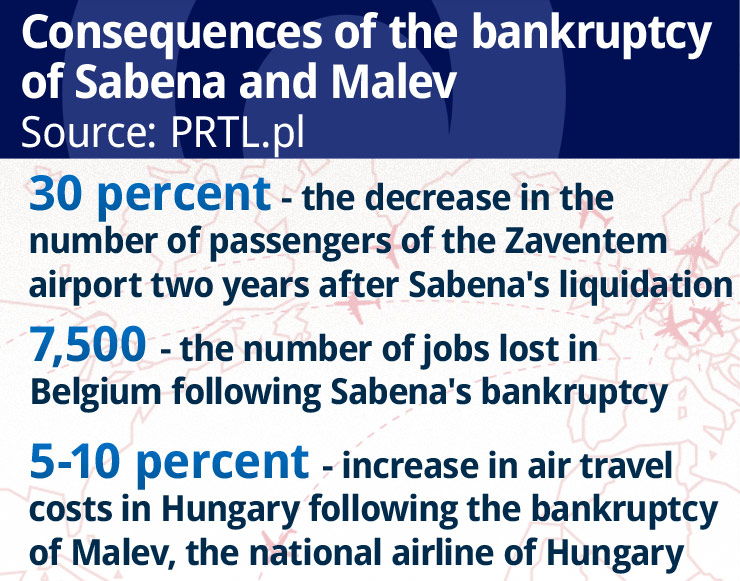

The aftermath of the bankruptcy of the Belgian Sabena was much more dramatic. It was liquidated as the first European national carrier in 2001. Consequently, 7,500 jobs were lost in the airline itself and in companies that supported it, especially at the Zaventem airport in Brussels – the city’s main airport and the largest one in Belgium.

In 1993-2000, Sabena was rapidly growing together with Zaventem. Sabena’s flights accounted for almost half of the airport’s total passenger traffic. Thanks to the cooperation with SwissAir, which in 1995 purchased 49 percent of Sabena’s shares, the company turned Zaventem into an important connection airport, which rapidly increased the number of passengers. Zaventem’s growth outpaced the development of its competitors: 217 percent in 1991-1998 (at the same time, Amsterdam’s Schiphol grew by 208 percent, Frankfurt by 158 percent, Paris Orly by 106 percent, Paris Charles de Gaulle Airport by 178 percent and London Heathrow by 149 percent).

In 1993, Zaventem handled 10 million passengers, and in 2000 – as many as 21.6 million. However, since the bankruptcy of Sabena in 2001, the airport started to record dramatic declines. In 2002 the number of passengers at Zaventem dropped to mere 14.4 million, which constituted a 30-percent decline as compared to 2000. Even today, the number of passengers is lower than in the period prior to Sabena’s bankruptcy (18.8 million passengers in 2011). This significant decrease was largely due to a dramatic decrease in transfer traffic which used to be ensured by Sabena. The traffic, which the airport referred to as „overseas” (outside Europe) dropped from 4.1 million passengers in 2000 to 1.9 million two years later.

The gap that appeared in this segment after the liquidation of the Belgian national carrier has not been filled by any airline, which regarded the Brussels’s airport not as a transfer airport (hub), but as a regular airport, servicing „point to point” flights. This meant that a number of previous connections were cancelled and, consequently, the annual number of takeoffs and landings at Zaventem decreased from 326,000 (in 2000) to 257,000 in 2002. The performance did not improve, and in 2007 it began to decline again. In 2011 it was no more than 234,000.

The only consolation was the fact that Sabena’s bankruptcy did not lead to an increase in ticket prices in Belgium. SN Brussels Airlines (owned today by the Lufthansa group) was established on the ruins of Sabena after it received a bridging loan from the Belgian government in order to restore air connections with major European cities. Thanks to this and following an agreement concluded with Virgin Express, the airline could provide tickets at very competitive prices in order to establish itself on the market and provide services to former Sabena’s clients.

A slightly different scenario is currently being observed at the airport in Budapest, whose main client, Malev, went bankrupt in February 2012 (the direct cause of the airline’s bankruptcy was the fact that the European Commission declared the public aid it received in the amount of EUR 130 million illegal and ordered the airline to return it). In the first month after the Malev’s bankruptcy, passenger traffic at Budapest Airport decreased by as much as 22 percent. However, after a few months, it returned to its previous level (Hungarians fly as much as before). In September, it was only 6.1 percent lower than in the same month last year.

Malev’s customers were soon taken over by other carriers, mostly by two low-cost airlines, Wizzair and Ryanair, who launched numerous new flights from the airport, including flights to new destinations, to which Malev never flew. Last year, the airport in Budapest serviced flights to 92 cities internationally, whereas this year the number went down to 88. The difference is therefore insignificant (interestingly, one of Malev’s connections – to Zagreb, Croatia, has been taken over by Qatar Airways).

On the other hand, ticket prices soared by 5-10 percent (depending on the air carrier and the destination). Another problem is the fact that, following Malev’s bankruptcy, transfer connections disappeared from the airport in Budapest, which enabled quick and easy connections (used by 1.5 million passengers per year). These included flights connecting Budapest with neighboring countries, transferring to the Hungarian capital passengers from Sofia, Tirana, Skopje, Split, Dubrovnik, Pristina, Podgorica, Cluj Napoca in Romania, Ukrainian Odessa, Podgorica and Sarajevo, who used Budapest as a connecting airport. There has been a significant drop in the number of connections with other continents; these were being cut by Malev even before its bankruptcy. For instance, in 2008 the company cancelled its direct flights to North America.

What could happen in Poland

What would happen in Poland following the collapse of LOT? First of all, several thousand people would be left jobless. The carrier itself employs two thousand people, and another several thousand are working for companies that support it. For many of them, LOT is the major client (it is the case of LOT AMS – company servicing LOT’s fleet).

– It would certainly result in a poorer international and domestic network of connections, because many domestic connections, provided by Eurolot, are used by passengers of LOT’s international flights – says Marek Serafin from PRTL.pl. – Nevertheless, our situation would be different from that observed in Budapest with only one airport which leaves no freedom of choice for low-cost airlines. In Warsaw, these carriers can also use the Modlin airport. It would also be different from the situation in Belgium following Sabena’s bankruptcy, because that airline provided more transfer flights than LOT.

Should LOT go bankrupt, Polish airports would probably lose direct connections with North America and Asia, as Lufthansa and other Western carriers may consider such flights from Poland as not profitable enough and decide that it would be better to transfer Polish passengers to larger airports, such as the new airport in Berlin, whose opening is planned for 2013.

It is also important to note that the bankruptcy of LOT would mean less competition in the Polish market, and carriers from other countries would certainly take advantage of this situation by raising ticket prices for flights to and from Poland. At the moment, it is difficult to assess the potential difference in prices. Regional airports will take the heaviest blow as, in many cases, apart from LOT they service flights of only one other traditional carrier. This is, for instance, the case of Rzeszów (Lufthansa). One thing is certain: the collapse of our national carrier would slow down the development of the Polish aviation market.

OF