How can monetary policy be made more efficient?

Category: Macroeconomics

ECB headquarters, Frankfurt, Germany (©Jurjen van Enter, CC BY-NC-ND)

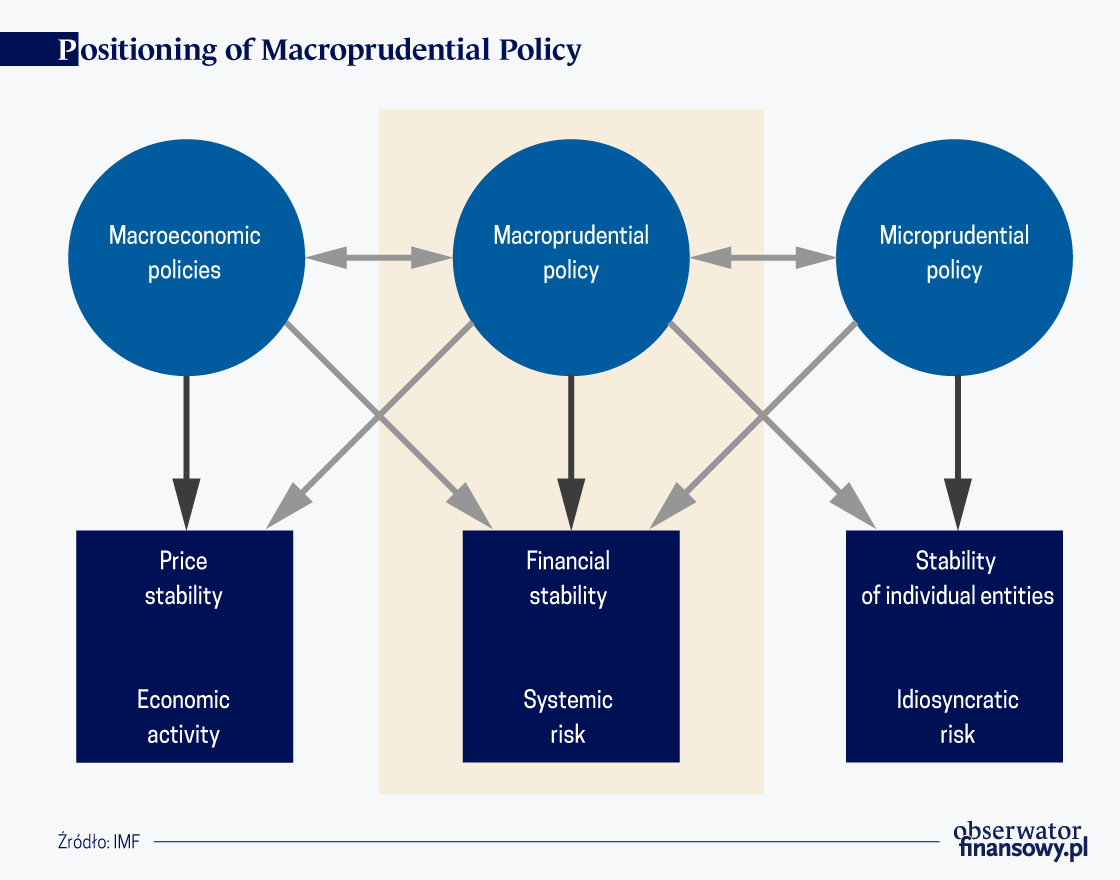

Once José Viñals, when he worked for IMF, said that it is necessary to see both the forest (the financial system) and the trees (individual financial institutions). Macroprudential policy is just designed to taking a bird’s eye view of the financial system to be able to identify systemic risk in time.

There is no single commonly accepted definition of a systemic risk. Nevertheless, the essence of the systemic risk is that it triggers significant turmoil in the financial system or in its part, which means that the system is not able to perform its functions effectively or at all. The effects of materialisation of systemic risk pertain not only to the functioning of the financial system but they also spread to the real economy via the contagion mechanism. An economist, Xavier Freixas believes that the financial system turmoil which does not cause disruptions in the economy is not the systemic risk.

The overarching objective of macroprudential policy is to ensure that the financial system as a whole is stable. By taking a holistic view of the financial system and considering the interconnectedness of the financial system and interlinkages between the financial system and the economy, macroprudential policy sees phenomena taking place both in the real economy and in the financial sphere.

Macroprudential policy is of a precautionary nature, as it uses various instruments to strengthen the financial system or reduce the likelihood of a financial crisis.

There is a three-level macroprudential policy in the European Union. The European Systemic Risk Board (ESRB), established in 2011, is a top-level body responsible for macroprudential oversight of the financial system in the EU. The ESRB has a broad responsibility that includes all EU Member States and all financial system sectors.

The European Central Bank (ECB) is a second-level body which applies to countries participating in the banking union only. The ECB has performed a supervisory function since 2014, and has also competence in the area of macroprudential policy under the Single Supervisory Mechanism (SSM). Not only is the ECB notified in advance of any macroprudential instruments to be implemented at the national level, but it can also tighten the macroprudential capital requirements set by a national authority.

National macroprudential authority, which de facto is the most essential for effective macroprudential policy, is a third-level body.

Introducing a new regulatory area, i.e. macroprudential policy, made it necessary to define the unit responsible for this policy implementation at the national level. In this respect, many international organisations, including the IMF, the Bank for International Settlements, the ESRB and the ECB delivered a number of recommendations about the institutional organisation of macroprudential policy. One of the main recommendations indicated that the central bank should play a leading role in shaping macroprudential policy.

A number of arguments were put forward in this regard, i.e. existing tasks of the central bank in the area of financial stability, its high degree of independence and credibility, the interaction with monetary policy and also an appropriate analytical background and highly-skilled staff.

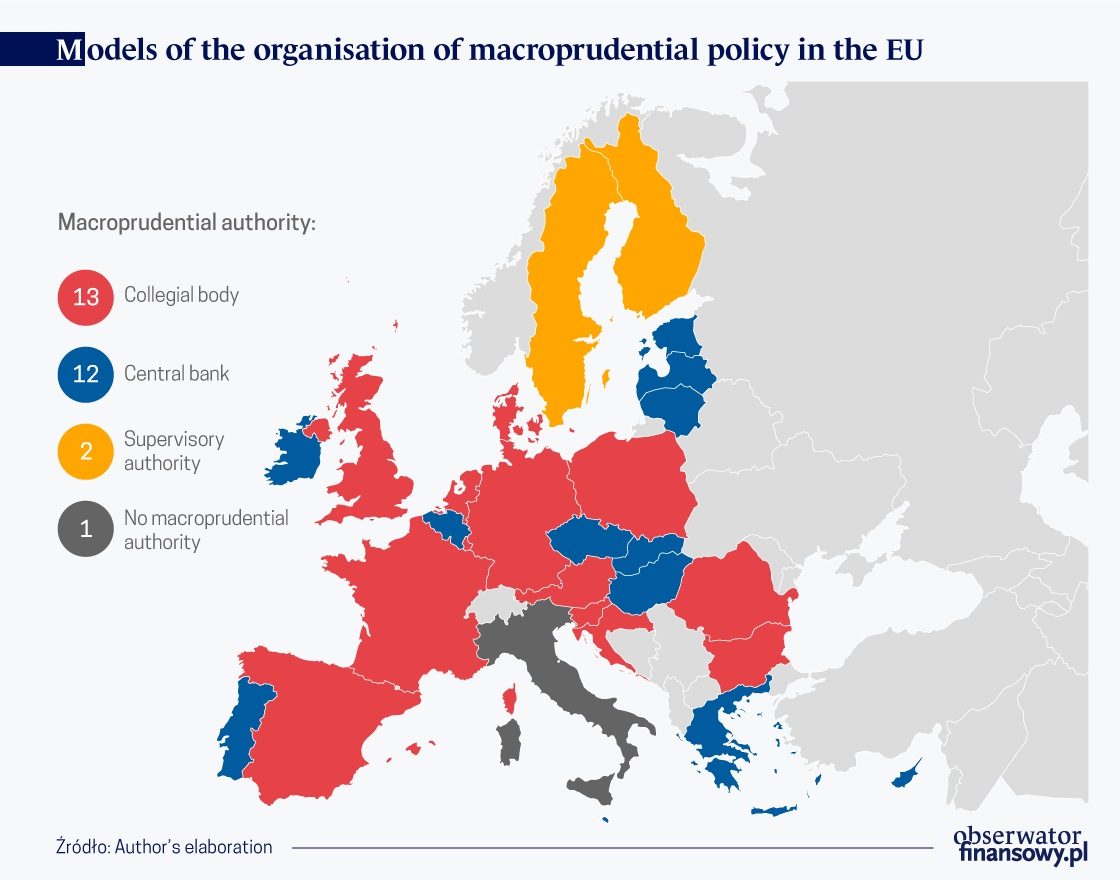

First of all, it should be noted that the ESRB recommendation as of December 2011 on the macroprudential mandate of national authorities gave rise to the creation of macroprudential authorities. According to the recommendation, macroprudential policy can be pursued either by a single institution or a board composed of several institutions (collegial body). Thus, no specific organisation model was recommended for the Member States as the recommendation left room for much flexibility in terms of the creation of macroprudential authorities.

At the current juncture it is possible to say that macroprudential authorities were established in all the UE Member States (except Italy), where work on designating an authority entrusted with the conduct of macroprudential policy has not been completed.

Most the UE Member States decided to entrust the function of a macroprudential authority to central banks (12) or to establish a collegial body, i.e. a board or a macroprudential committee (13), composed of high-level representatives of major institutions of the financial safety net, i.e. the central bank, supervisory authority or authorities and the Ministry of Finance. This model is in place in Poland, where the Financial Stability Committee, chaired by the central bank’s Governor, is responsible for shaping Poland’s macroprudential policy.

Has the recommendation which grants the central bank a leading role in the macroprudential policy been implemented? In order to answer that question, one has to take a closer look at the rules governing the functioning of collegial bodies. An in-depth analysis of this structure leads to the following conclusions.

All collegial macroprudential bodies are composed of representatives of the central bank, which means that they are involved in the debate on macroprudential policy and have an impact on decisions taken by the body. Moreover, in more than half of cases the body is chaired by a central bank governor, which additionally increases the impact of that institution on the shaping of macroprudential policy.

Almost in all cases, central banks were assigned the task of providing services to the macroprudential authority, which means that they run its secretariat as well as provide analytical and research support for the authority. Therefore, one can say that central banks have a fairly large impact on designing macroprudential policy at the national level, irrespective of the fact that the macroprudential authority is a collegial body.

However, it needs to be made clear that collegial macroprudential bodies have a major weakness, as they have no competence to issue binding decisions. They mostly issue recommendations or warnings addressed to specific entities. Thus, they have no direct influence on the application of macroprudential instruments.

In view of the above, it seems that what matters most is a smooth cooperation of all institutions represented in the collegial body to ensure that its recommendations are fully implemented.

Anna Dobrzańska, PhD, is a staff member of the Financial Stability Department of Poland’s central bank, NBP.

The views expressed in this article are the private views of the author and are not an expression of the official position of the NBP.