Tydzień w gospodarce

Category: Trendy gospodarcze

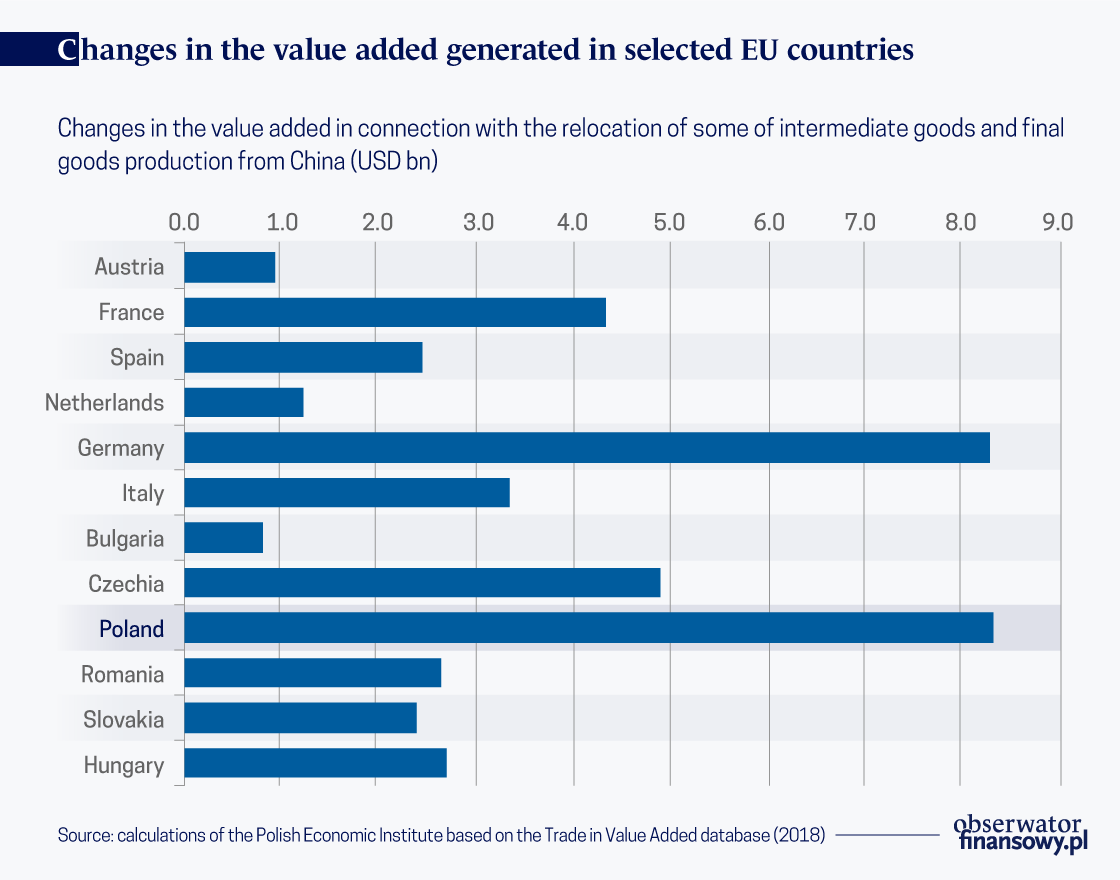

PIE estimates that China’s GDP could decrease by as much as 1.64 per cent due to the relocation of production to other parts of the world. In such a case the value added generated in Poland could increase by up to USD8.3bn annually (in relative terms this would translate to a 1.87 per cent annual increase in the value added generated in Poland).

What are some other possible changes in China’s future position within the global supply chains? According to calculations presented by the World Trade Organization, as a result of the pandemic the volume of global trade is expected to decrease by 13 to 32 per cent in 2020. It can be expected that previously visible trends in the international trade will accelerate and intensify.

“We can expect a decline in the volume of international trade, as well as its growing regionalization, the rise of protectionism, and the diversification of supply chains,” Jan Strzelecki, analyst at the foreign trade team of the Polish Economic Institute, said. “Another natural step is a stronger emphasis on supply chain security in the strategic sectors within the individual countries’ trade policies. China’s significance in the global supply chains will also decrease,” he added.

In 2019, Asia accounted for 35.3 per cent of global exports and 33.8 per cent of global imports, which is respectively 8.8 percentage points and 9.4 percentage points higher than in 2001. European countries still remain the biggest global exporters and importers (with a 36.7 per cent and 35.7 per cent share, respectively), but intra-EU turnover accounts for more than half of this trade.

Chinese semi-finished products are important for global manufacturing. This is because materials originating from China accounted for 3.5 per cent of the materials consumed worldwide for the production of industrial goods. Production inputs imported from China were the most important in the countries of Southeast Asia, East Asia, and North America. The sectors most dependent on Chinese supplies included the global production of computers, electronic and optical products, textile and clothing products, as well as electric and non-electric devices, and household appliances.

These industries were also the most dependent on Chinese material inputs in Poland. In 2015, 16 per cent of material consumption in the computer, electronic and optical products manufacturing sector in Poland originated from China.

“The relocation of some part of the production of semi-finished goods and final goods from China would mean a loss of value added for that economy, which could range from USD22.4bn to USD172bn annually, depending on the scenario,” explains Łukasz Ambroziak from the foreign trade team of the Polish Economic Institute. “This would reduce China’s GDP by 0.21 per cent to 1.64 per cent compared with the baseline situation.”

The ranking of countries benefiting the most from the relocation of production from China depends on the assumptions made in the individual scenarios. According to the PIE, the most favorable scenario for the EU member states would include a combination of economic patriotism and the strengthening of the “new” member states from Central and southeast Europe (Czech Republic, Poland, Slovakia, Hungary, Romania and Bulgaria) in the role of a “manufacturing hub” for the other EU countries. Outside of Poland, other countries of the region which may gain the most include the Czech Republic (USD4.9bn), Hungary (USD2.7bn) and Romania (USD2.6bn).

In a scenario which includes a reduction in the supplies of semi-finished and finished goods from China by 10 per cent, and their substitution with domestic production, the greatest benefits in absolute terms would be achieved by the countries of North America, followed by the EU-14 (that is, the “old” EU member states, excluding the United Kingdom) and the countries of East and South-East Asia.

Depending on the region, this would translate into an increase in the value added generated in the given country by 0.2 to 0.48 per cent annually. The PIE’s analysts point out that among European countries this effect would be markedly stronger in the “new” EU member states (EU-13) than in the “old” member states (EU-14), reaching 0.31 per cent and 0.20 per cent, respectively.