Pension reform is overdue in Belarus following worldwide demographic and fiscal challenges. Economic theory suggests that extra labor from delayed retirement plan and fiscal savings from reduced pension payments will contribute to economic growth. It works well from a theoretical point of view of course, but one should remember that there are different conditions when GDP will be influenced positively. At least three of them are flexible labor market, growing investment demand to create new jobs, and productivity growth. Are those in Belarus?

Is Belarusian labour market flexible?

Flexibility means that supply and demand of labour are automatically and continuously adjusted in different sectors by wages level. In our context, this continuous process stimulates or prevents late retirement depending on the sector effectiveness and employees productivity. Despite the formal flexibility of labor contracts duration in Belarus, the supply and demand of employees do not match because of wage targets and overemployment in state-controlled companies producing over 50 per cent of GDP.

Labour hoarding has been an essence of Belarusian socio-economic model and, as argued by economists, comes out of a “social contract” between citizens and authorities, i.e. political support in exchange for more jobs and higher wages. Although the overemployment has been going down since recently, one still has to admit that raising the retirement age and having more people employed than needed in economy is a dangerous thing. It might either retain the overemployment or fuel unemployment for both younger and older Belarusians during the pension reform implementation.

A sinking investment efficiency

The investment demand in Belarus has been shrinking in 2015-2016. This is evidenced by the contracting amount of capital invested into the economy, the falling foreign investment into Belarus over the last years, as well as the decreasing value of outstanding commercial loans in 2016.

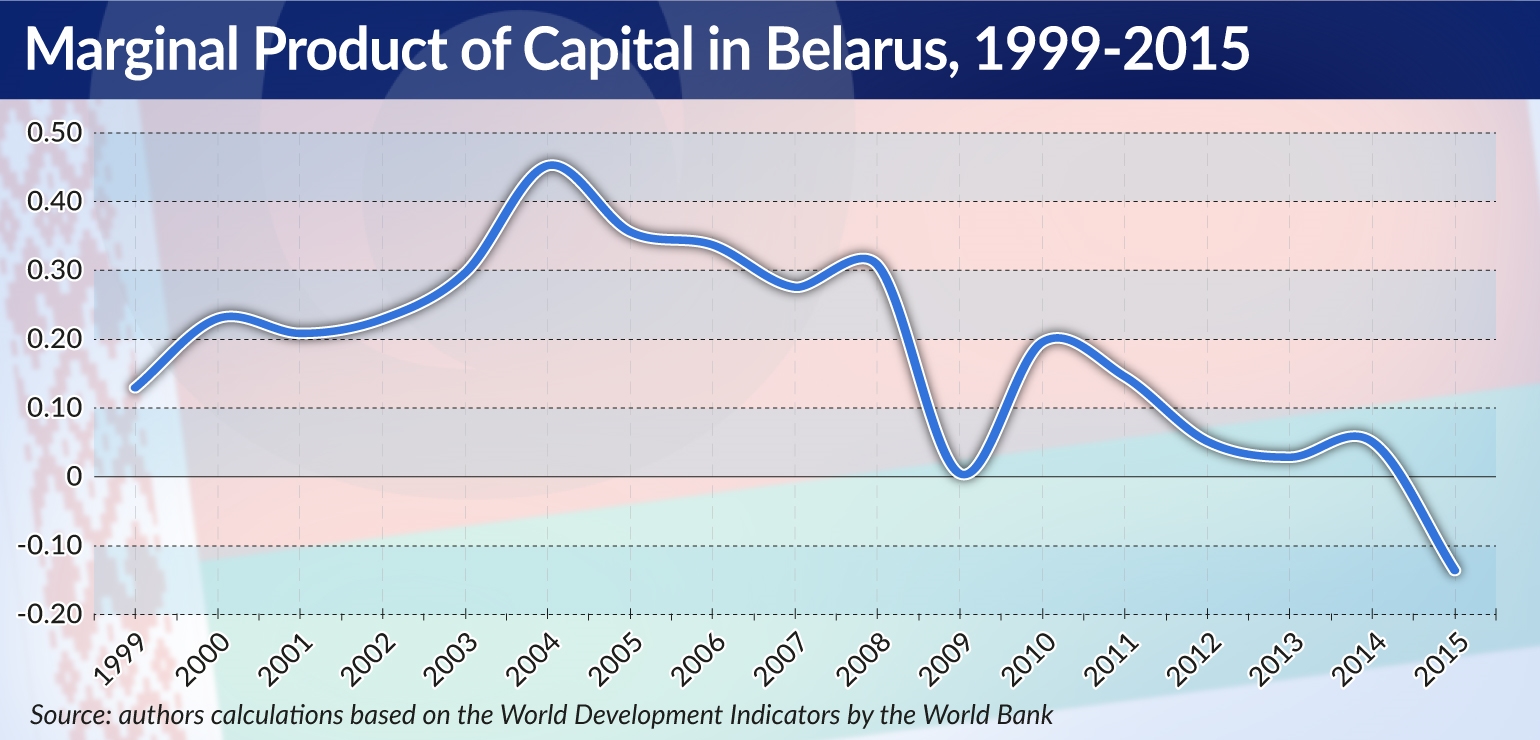

But the core problem seems to be the investment efficiency in Belarus. A Marginal Product of Capital shows how much in terms of percent of GDP growth is provided by investment of 1% of GDP.

There is an eleven-year trend of falling investment return in Belarus. The marginal product of capital decreased from 0.45 in 2004 to -0.14 in 2015 (0.19 was the average for 2005-2015). One of the key reasons of poor capital performance is deficient investment structure by sector caused by the dominance of the state-owned banking sector, as well as redistribution of investment through state support programs. Simply speaking, investment is not going to the most effective sectors and companies in Belarus.

Productivity growth?

In fact, having older people at work does not necessarily improve labour productivity. The possible negative effect of retiring later should be compensated by total labour productivity growth. But this does not happen currently in Belarus. The official data shows the contraction of labour productivity in the country in both 2015 (-2.6 per cent y/y) and 2016 (-0.8 per cent y/y). The Economic Research Institute at the Ministry of Economy confirms there is a huge divergent gap (four-five times) in labor productivity in Belarus comparing to advanced economies.

Is there a productivity growth in Belarusian economy in general? One has to look at the total factor productivity (TFP), which is often taken as a measure of the economy’s efficiency and technological advancement. The decomposition of Belarusian economic growth in 2011-2015 into the growth of capital, labor and TFP indicates a sharp decline in TFP in 2012-2013 and 2015 driven by distortive policies of capital accumulation and allocation. The latter may explain the downward dynamics of Belarusian GDP over those years.

Having the above arguments in mind, a positive effect of retirement age extension for Belarusian GDP might be lower than expected, at least in the nearby future. It doesn’t mean that the retirement reform is not needed in Belarus but if the Belarusian government wants to see a positive cumulative effect from the parametric pension reform in a longer perspective, it should seriously think about parallel reforms. A reform towards managing state-owned companies to put them into the same conditions as private companies. A reform towards stimulating more competitive allocation of bank loans into the most effective companies. And finally, a reform towards withdrawing practices of wage targeting. All this additional steps might hurt today, but will boost the growth tomorrow.

Sierž Naūrodski is the President of CASE Belarus, part of the CASE Network, which is the biggest research network in Central Europe and CIS.