Tydzień w gospodarce

Category: Trendy gospodarcze

„Privatization is a critical factor in anti-corruption activities, since the state-owned enterprises used to privatize profits while regularly leaving losses to the state,” Ukrainian PM Oleksiy Honcharuk said during the government’s meeting in November 2019. „The more objects we manage to transfer to private ownership, the less the state will borrow. Therefore, privatization implies speed and trust, so everything must be transparent.”

In his remarks, Mr. Honcharuk was clearly referring to a long tradition of Ukraine’s oligarchs and powerful business groups using state-owned companies to serve their own interests. With the assistance of politicians and, sometimes, of the management of state-owned corporations, businessmen have been able to gain control over supply chains, gaining multi-million profits. At the same time, the financial health of many state-owned companies remain deplorable.

This scheme is not only a source of corruption, but also a huge headache for the Ukrainian government, which is duty-bound to support state-owned firms via re-capitalization and loans provided by state-controlled banks.

„It becomes necessary to find independent professional advisers, to clear the available property from all corruption interests, criminal cases and contrived debts. It is critical to make these objects interesting for investors,” the PM added.

In recent years, Ukraine has seen many examples of the vested interests of different business groups undermining the transparent operations of state-owned companies — including firms that were declared by the post-Euromaidan authorities as jewels in the privatization crown.

In late 2018, many Kyiv-based market experts were confident that the nation’s largest power generating company, Centrenergo would be purchased via a privatization tender by Ukrdoninvest. Ukrdoninvest is a company controlled by a businessman Vitaliy Kropachev, who monopolized coal supplies to Centrenergo on the eve of the tender, allegedly thanks to support from the team of then-President Petro Poroshenko.

In the last moment, however, the privatization tender was cancelled by the Ukrainian authorities. Centrenergo consists of three thermal power plants — Vuglegirska, Zmiivska and Trypilska — with a total designed capacity of 7690 MW, equal to about 14 per cent of Ukraine’s total generation.

Meanwhile, the change of the country’s leadership in 2019 brought no relief to those who wanted to see transparent operations at Centrenergo. In July, after a change in the company’s management, it started to purchase coal primarily from enterprises controlled by oligarch Ihor Kolomoisky, who is widely considered to be a sponsor of President Volodymyr Zelensky.

Another drama has unfolded in recent years over Odesa Portside Plant (OPP), a major chemical production company, which accounted until recently for 17 per cent of Ukraine’s ammonium nitrate production capacity and 19 per cent of urea production capacity.

In 2016-2017, the Ukrainian authorities failed to sell the company via two privatization tenders due to a lack of bidders. Remarkably, the second tender failed despite the fact that Kyiv more than halved the plant’s starting price to UAH5.16bn (around USD220m).

Despite a powerful promotion campaign, potential investors were reluctant to purchase the company, which is currently facing unclear prospects of supplies of its main raw material, natural gas, as well as the need to repay multi-billion debts to state-owned gas monopoly Naftogaz and the company Ostchem, controlled by oligarch Dmytro Firtash.

Moreover, Mr. Kolomoisky has pledged to block any attempts to sell OPP, because he believes that the company Nortima, which is reportedly controlled by the billionaire, was, back in 2009, already a winner of a privatization tender that was cancelled by the authorities at the final stage.

According to Ukraine’s state budget for 2020, the government should secure UAH6bn (around USD250mn) of receipts from the privatization of large-scale companies and a similar amount from the privatization of small-size enterprises.

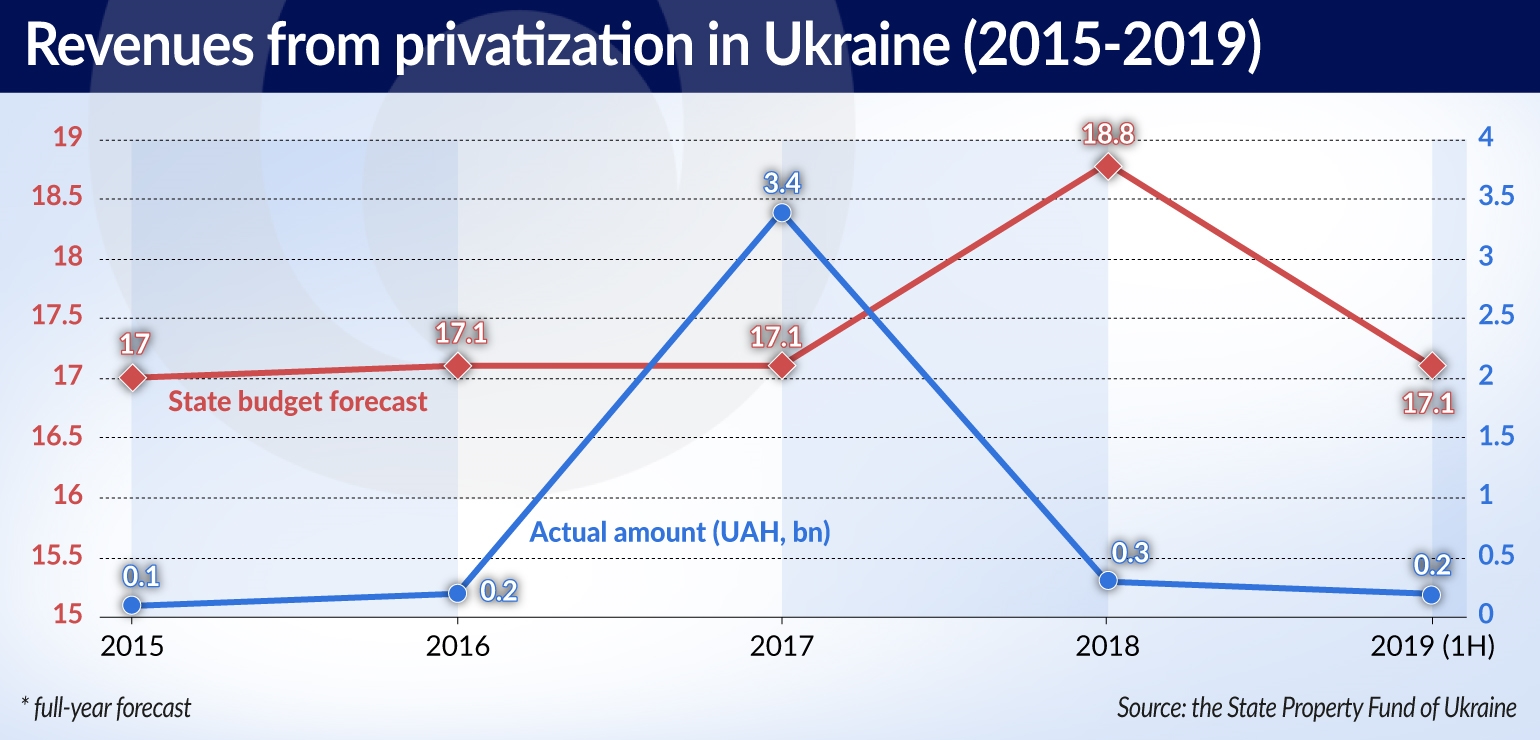

These plans seem to be more realistic than those drafted by previous cabinets for 2015-2019, in which UAH17-18bn per year were foreseen in revenues from privatization. The result, however, was disappointing. For instance, in 2015-2016, Kyiv was able to obtain only around 1 per cent of the expected amount.

The only exception was 2017, when receipts from privatization grew to 20 per cent of the planned amount due to the sale of minority stakes in five power distribution companies to the nation’s richest oligarch Rinat Akhmetov, who already had controlling stakes in them.

Dmytro Yablonovskyy, deputy director of the Center for Economic Strategy, a Kyiv-based think tank, believes that the success of the government depends on whether it is able to prepare and „properly” present state-owned companies to investors. „For these purposes, investment advisers [among the leading consulting companies] are hired. In some cases, enterprises may need restructuring in order to become interesting [for potential investors], and this procedure may take some time,” he told the CE Financial Observer.

„The state will have a choice: to sell a company in its current state or to spend time and resources on its restructuring. Every state-owned enterprise has its skeletons in the closet. For one company it is debts, for another, long-term lease agreements,” Mr. Yablonovskyy says, adding that he sees a „political will” in the new Ukrainian leadership to re-launch large-state privatization. „This will help to overcome the abovementioned difficulties.”

According to numerous statements by Ukrainian officials, Kyiv is going to offer potential investors five to seven large companies in 2020. Among them are battered OPP and Centrenergo. The latter was described by the PM in November as a company which „is the top priority for privatization”. „I want this company to be privatized by an external, real player. And the government will do everything for some kind of strong player to come here,” he said.

Kyiv has also mentioned among the most likely state-owned companies for the first wave of large-scale privatization: the United Mining and Chemical Company, the Electrotyazhmash high-power electro generators producer, the Krasnolymanska coal company, the Indar insulin producer and Kyiv-based President Hotel.

„You should not count on the successful privatization of all mentioned companies, but it’s possible to sell one or two enterprises in 2020,” Mykhaylo Demkiv, a financial analyst at Kyiv-based consultancy Investment Capital Ukraine (ICU) told the CE Financial Observer.

Mr. Demkin expects privatization in Ukraine to get „a second breath” at the expense of small and medium enterprises. „At the same time, individual infrastructure complexes — such as seaports, train stations, airports — will be transferred to concession. This process is already underway, having started even before the change of the Ukrainian leadership [in 2019],” he added.