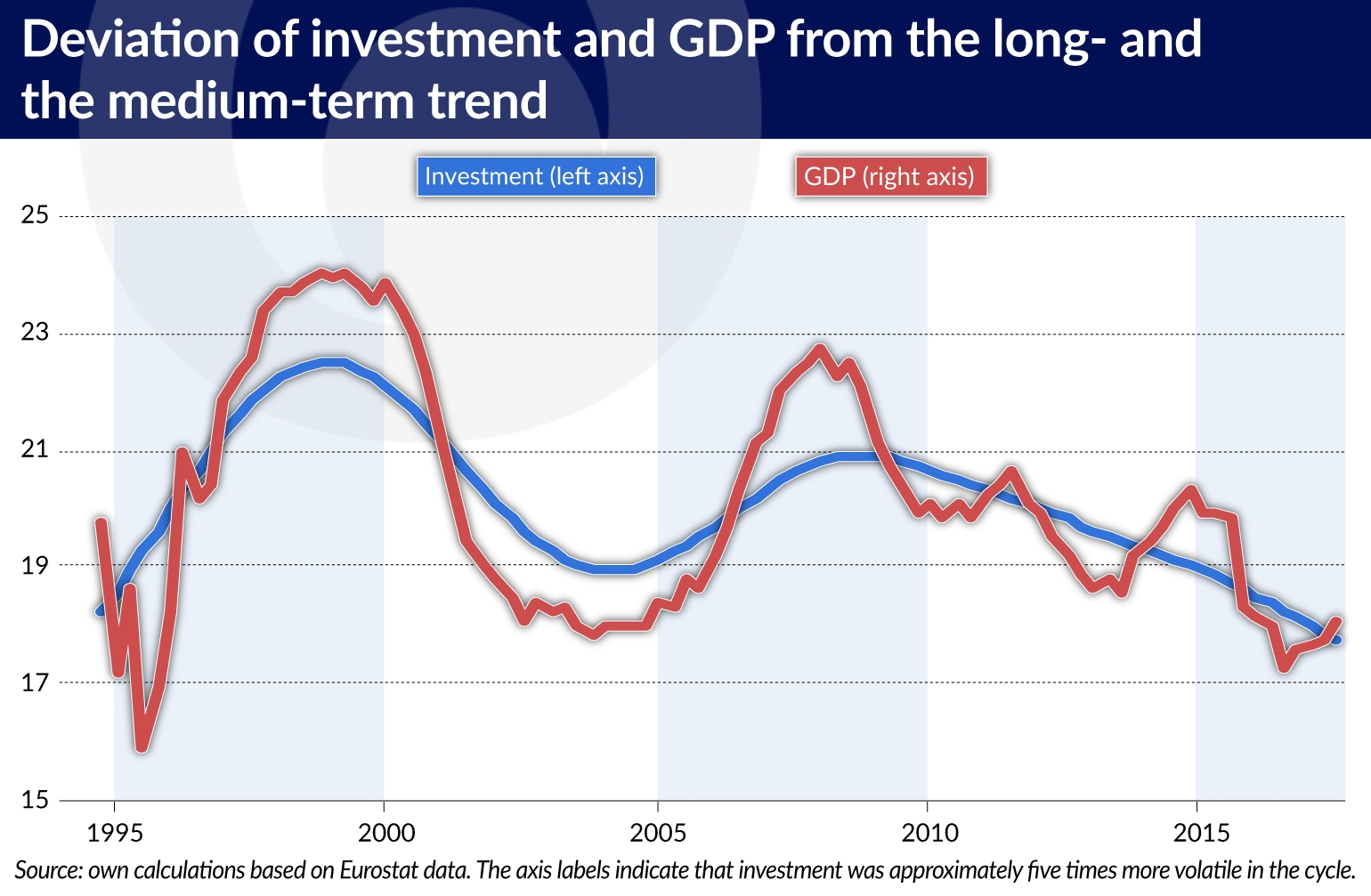

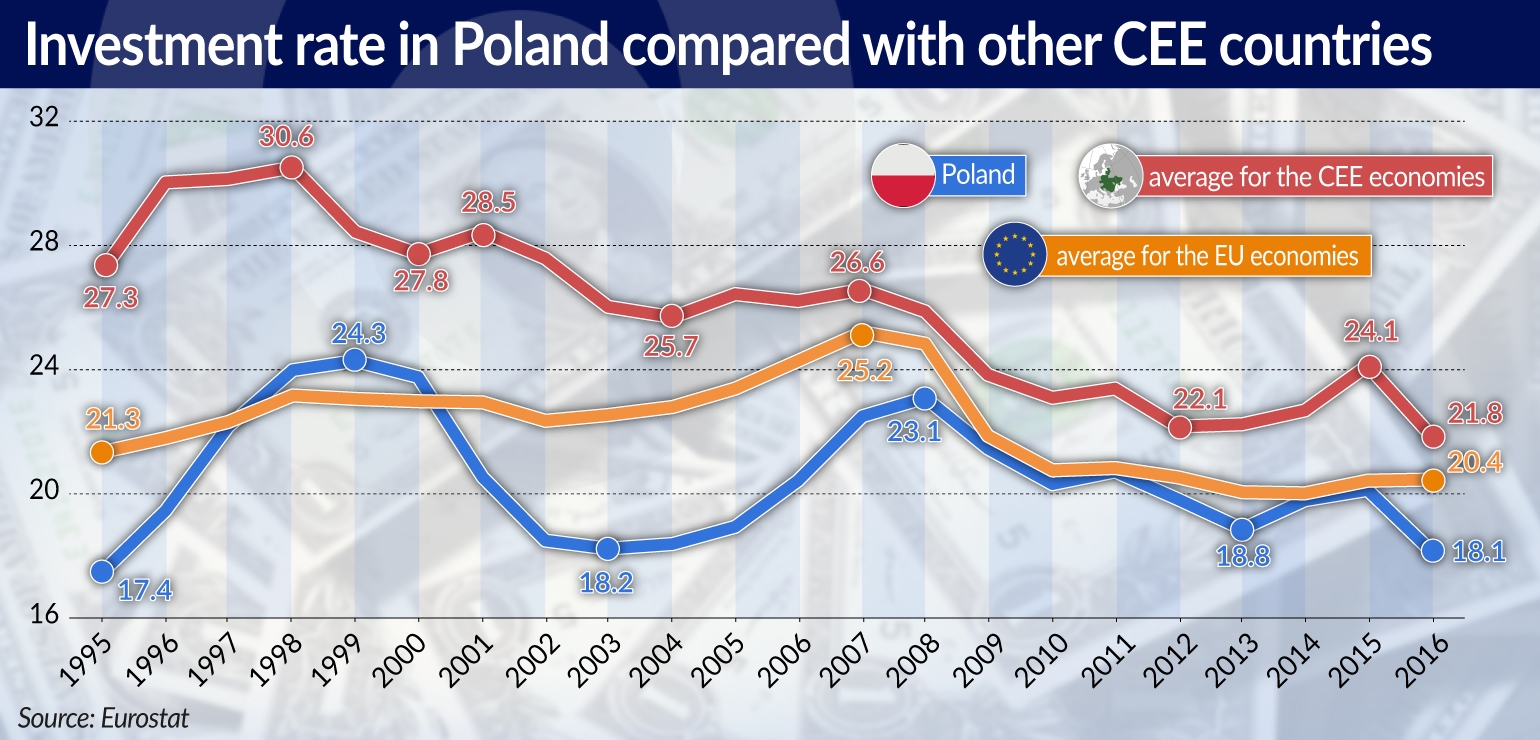

In the years 1995-2017 the investment rate (i.e. the ratio of investment expenditure to GDP) in Poland was between 18 and 24 per cent. Since 2009, it has remained close to the EU average, but is lower than in the other countries of Central and Southeast Europe (CSE), which we take into account (Czech Republic, Slovakia, Hungary, CEE3). However, due to the fact that these countries have experienced gradual decreases in the investment rates throughout the entire period of 1995-2017, the difference between Poland and the other CEE economies has been systematically decreasing. Compared to the other countries of the world, the investment rate in Poland stands at an average level.

The statistics of the World Bank indicate that the investment rate does not depend on the level of a given country’s economic development. Since 2008, gradual decreases in the investment rates have been observed in most of the EU member states, including Poland. Construction investment, including investment in housing, and intellectual property products is particularly low in Poland compared to other countries.

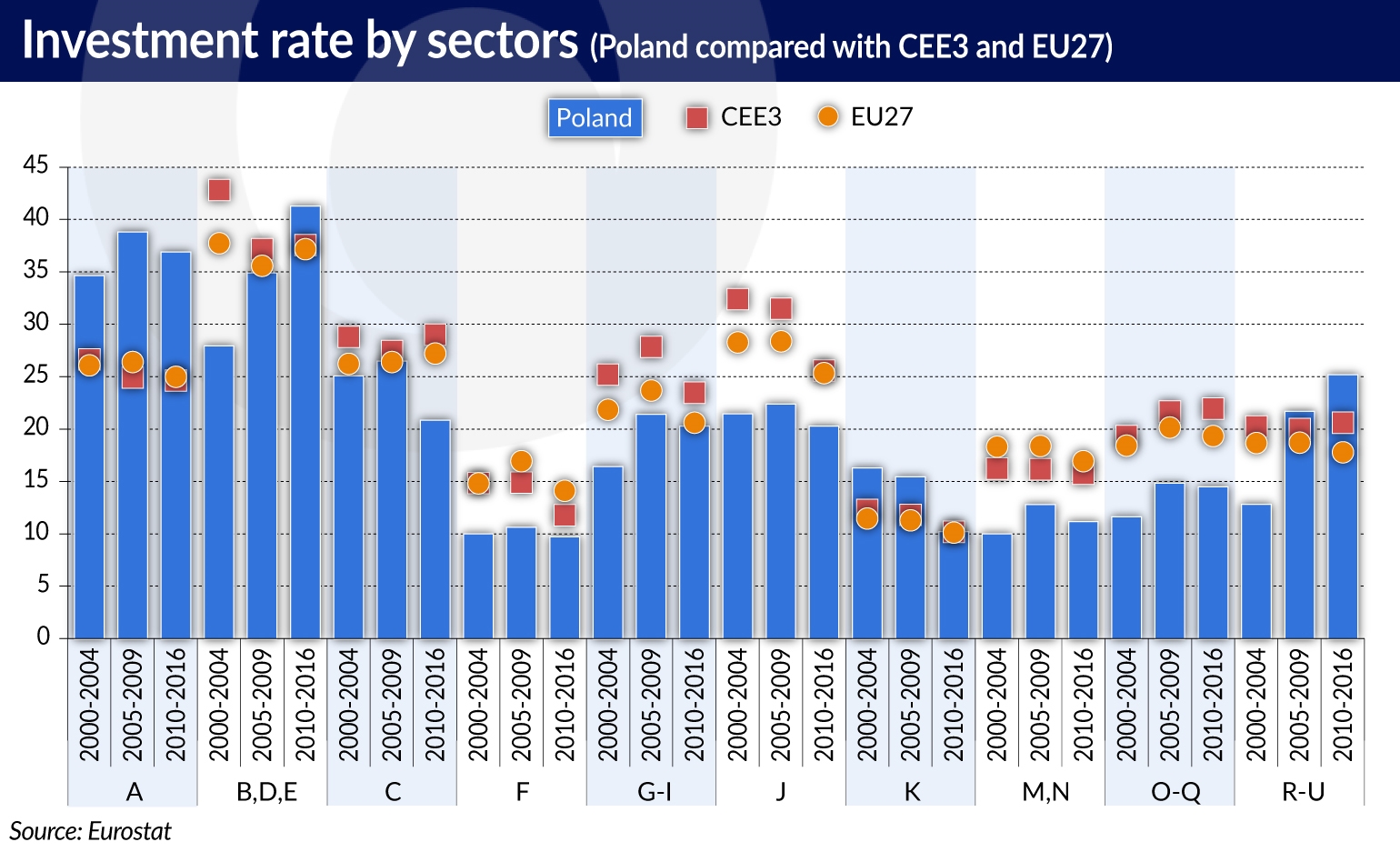

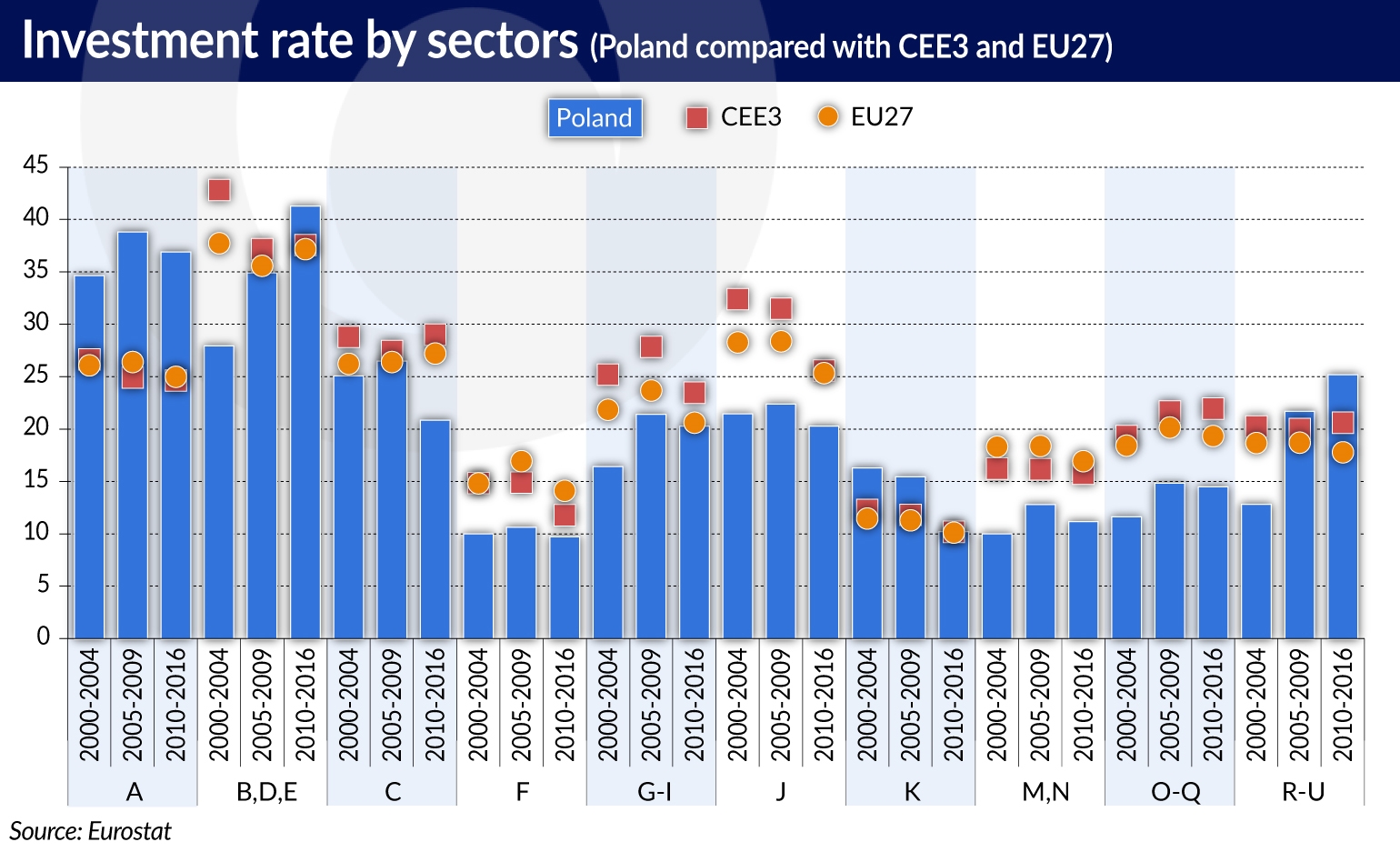

According to our analyses, the sectoral structure of the Polish economy is responsible for a part of the difference between the investment rate in Poland and the other countries of the region. If the share of the individual sectors in the creation of added value in Poland was the same as on average in the EU member states, then the investment rate would be systematically higher by about 1.5 percentage points. In Poland, the sector of real estate market services is characterized by an exceptionally high investment rate. However, this sector is relatively small in the country.

We can also observe differences in the investment rates within the individual sectors. In Poland investment rates that are particularly low by international standards are recorded in the service sectors, including in sector J (information and communication), M-N (professional services, scientific and technical, administrative and support services) and O-Q (public administration, defense, education, human health and social work). The differences observed within these industries are significant and persistent over time.

The investment rate in Poland declined after the global crisis of 2007-2009. A similar phenomenon was also observed in most European countries, and the sharpest declines in the investment rate were recorded in small CSE countries (Latvia, Estonia, Romania, Slovenia, Lithuania) and in the peripheral economies of the Eurozone (Greece, Spain). Our analyses indicate that this wasn’t just a short-term cyclical fluctuation, but also a manifestation of a long-term downward trend, which is visible not only in Europe, but more generally in the developed countries.

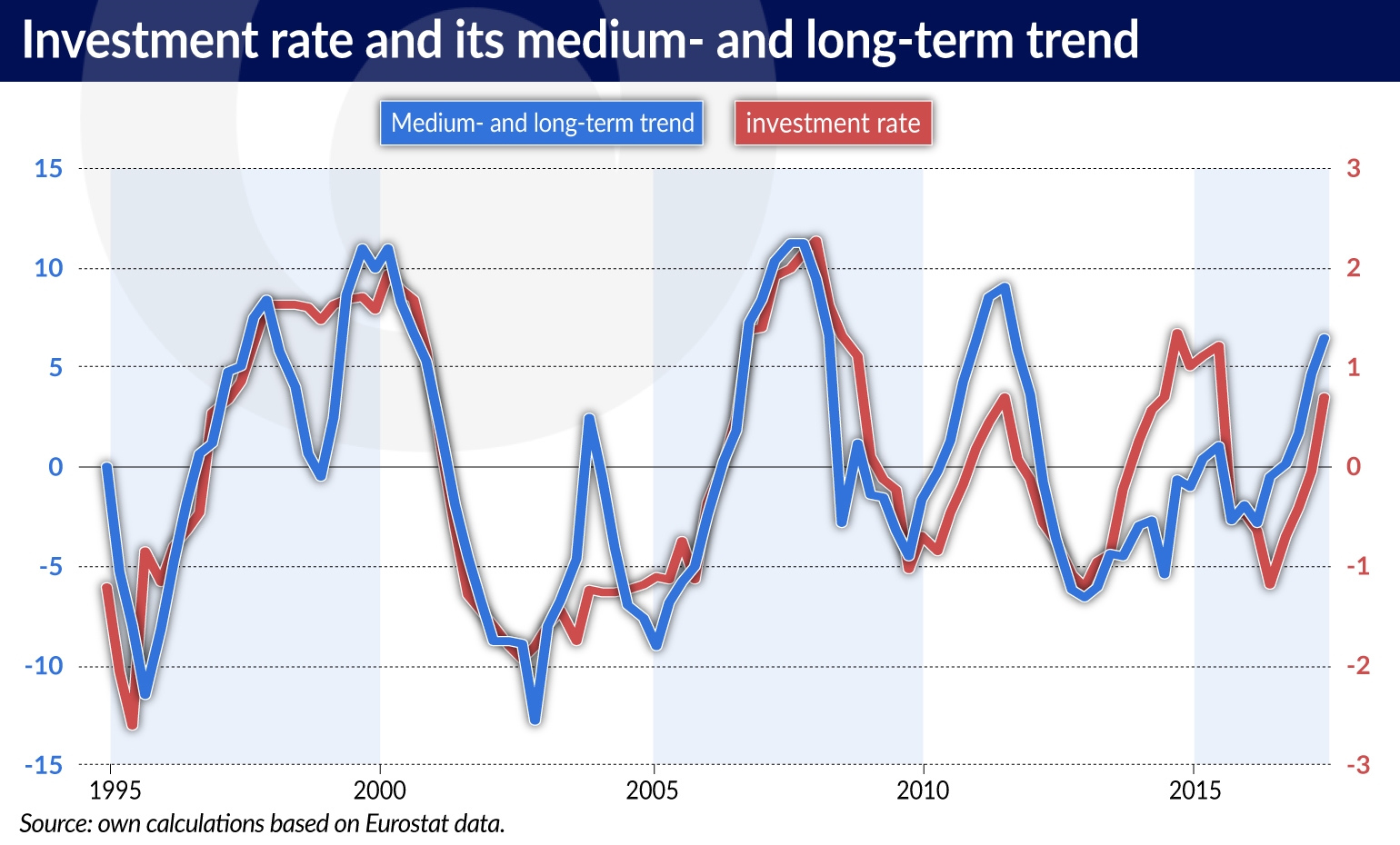

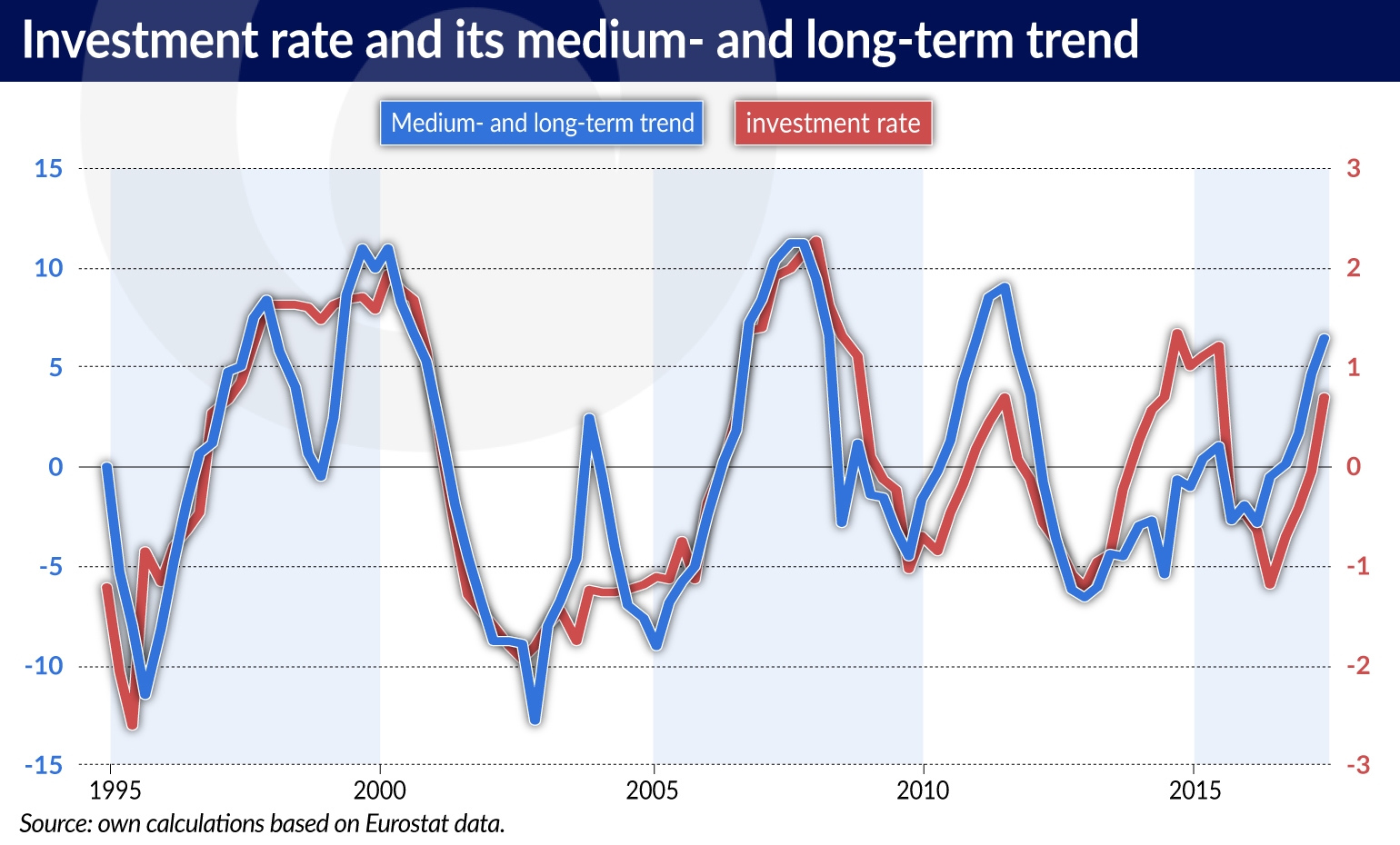

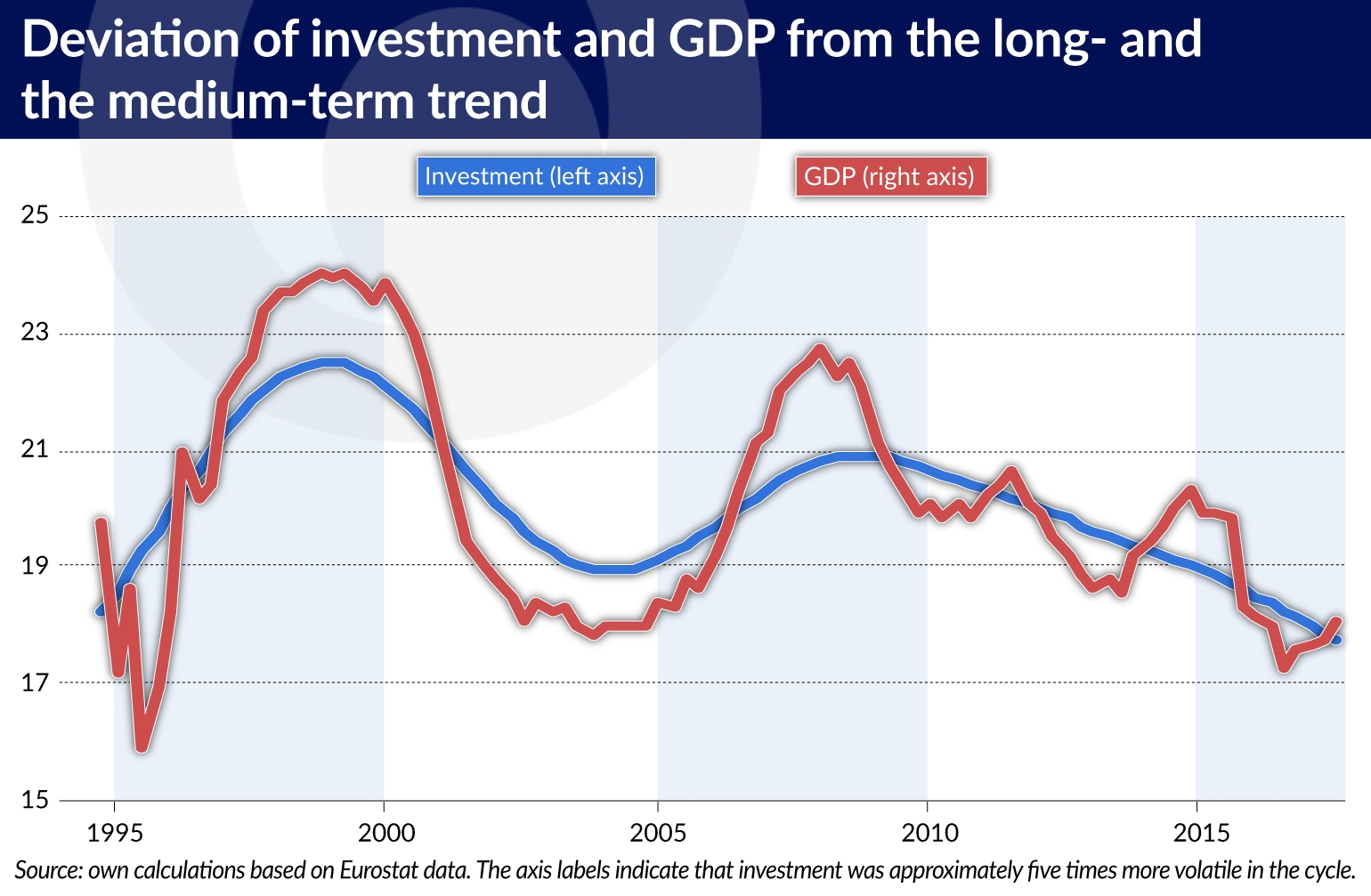

At the same time, the pattern of investment cyclicality in Poland has changed: in the years 1995-2007 the investment rate in Poland was strongly procyclical and strongly volatile (investment was approximately five times more volatile in the cycle than GDP, compared with 2.26 times in the Eurozone). Later, its cyclicality and variability weakened. This was the result of a stabilization of investment in non-residential buildings and equipment, which may be associated with an increased role of investment co-financing by the EU under the 2007-2013 financial framework. The inflow of EU funds is not subject to cyclical fluctuations, but to a separate cycle (not synchronized with the economic situation) related to successive EU budget planning frameworks.

Investment and the investment rate are strongly correlated with GDP in the business cycle (a correlation of 0.8 and 0.75, respectively). However, the degree of cyclicality of investment has weakened over time. This is indicated by the decreasing correlation between the GDP cycle and investment cycle, as well as the investment rate cycle. After 2008, the cyclical fluctuations of investment in Poland have become shallower and more frequent, and therefore less procyclical.

The cyclical fluctuations of investment in Poland are highly synchronized with the European Union, and in particular with the Eurozone. In the entire period since 1995, the correlation of investment between Poland and the Eurozone has amounted to 0.53 (for comparison, the correlation of GDP calculated in a similar way amounted to approx. 0.6). However, this relationship weakened after 2008, when the pro-cyclicality of investment in Poland decreased. Meanwhile, the degree of synchronization of the economic cycle between Poland and the EU, as well as the Eurozone, has remained high.

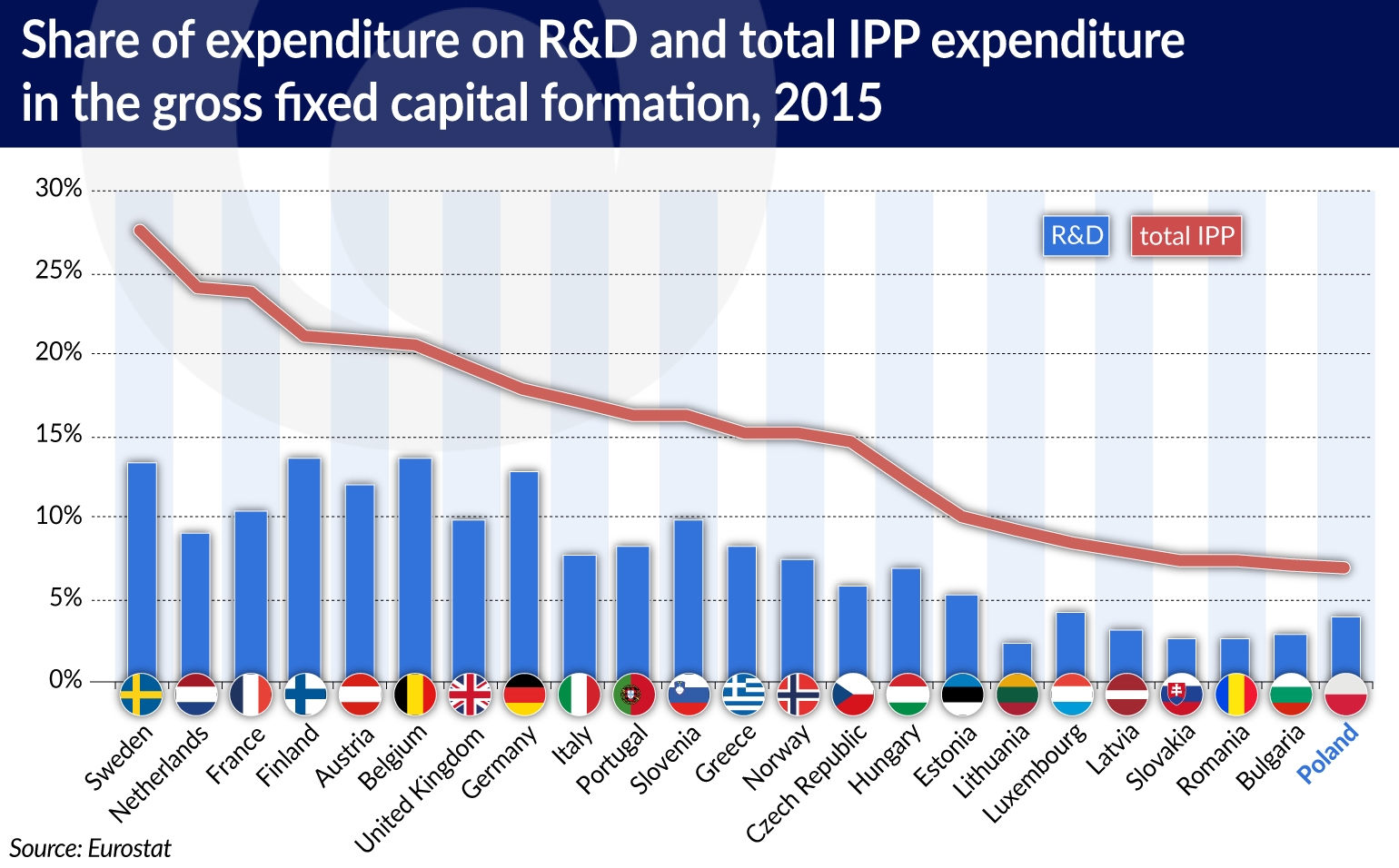

What is important from the point of view of the economy’s development prospects is both the investment rate (for example, China’s rapid growth has been accompanied by an investment rate exceeding 40 per cent for many years), as well as where these investments are allocated — for example, whether the investment is made in buildings or in modern equipment. In this respect, over the past several decades in highly developed economies we see a clear trend of a systematic increase in the role of investment in intellectual property products (IPPs), such as R&D, computer software and databases, as well as the value of the exploration of mineral deposits and works of art. Particularly, expenditure on R&D and on software exhibits significantly higher rates of growth than overall investment. An increase in the rates of investment in intellectual property products is, by definition, associated with an increase in innovative potential of the economy in question.

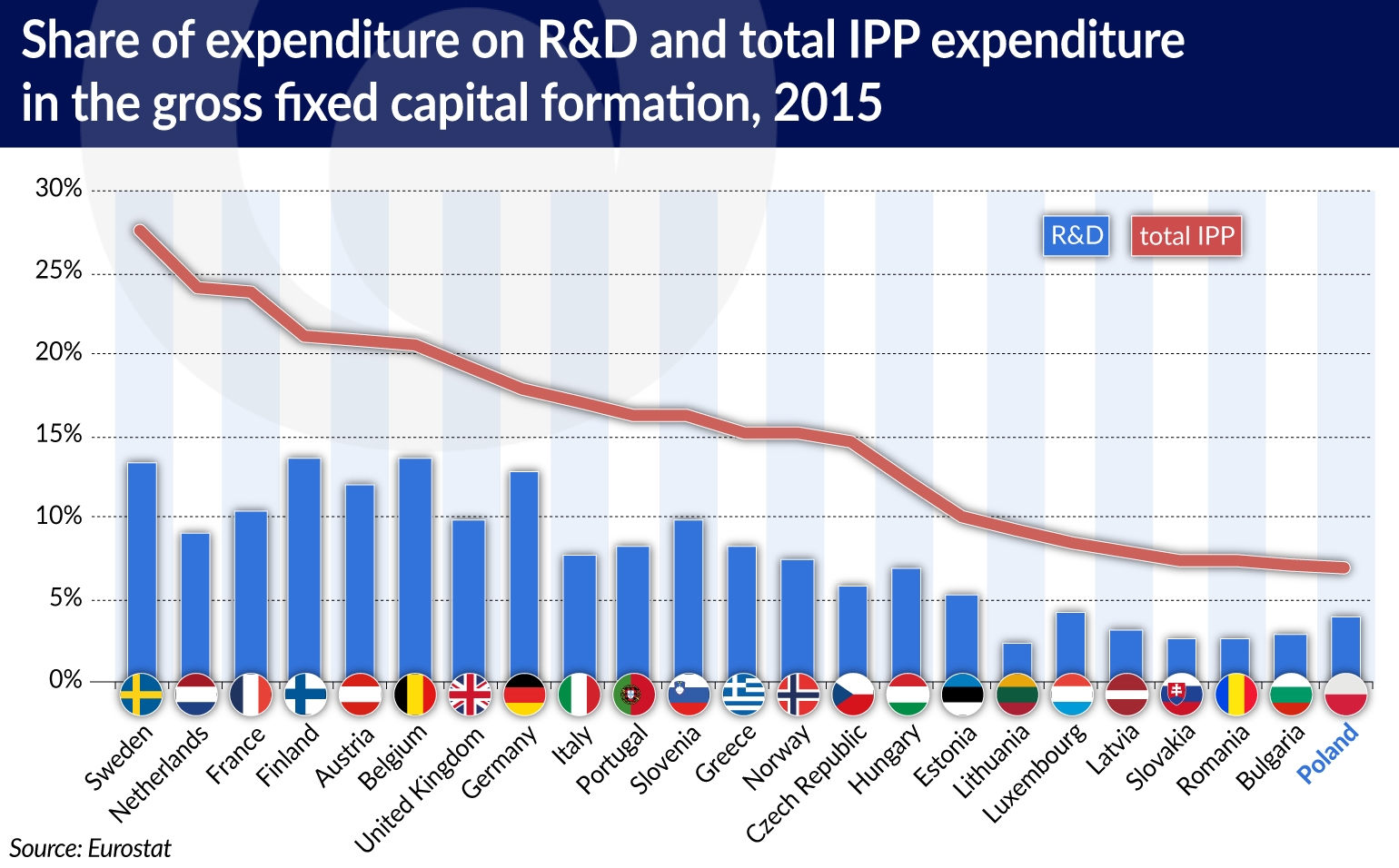

According to the EU KLEMS growth and productivity statistics, in 2014 the share of IPPs in investment in the United States was 26 per cent. In Western European countries this share is slightly lower than in the United States, but the trends are similar. In Poland, the share of investment in IPP in total investment expenditure is very low by European standards and is growing at a slow pace.

For example, in 2014 the share of investment in IPP in total investment expenditure reached 24 per cent in France, 17 per cent in Germany, 16 per cent in Italy, and only 7 per cent in Poland. Expenditure on R&D, as well as on software and databases remains particularly low in Poland. This observation is consistent with the relatively low level of innovation of the Polish economy (European Innovation Scoreboard 2017).

In economies characterized by a low rate of investment in IPP, the development of growth potential was supported by technology imports. This is illustrated by the high import intensity of investment in Poland and other countries of the CSE region. In 2014, the import intensity of investment in Poland amounted to 44.7 per cent and was lower than in Hungary (57.1 per cent) and in the Czech Republic (50.8 per cent).

At the same time, in developed economies, which have a significant R&D infrastructure, investment was based to a greater extent on domestic technologies and products. For example, in 2014 the import intensity of investment in the United States, France and Germany amounted to 17.5 per cent, 27 per cent, and 35.5 per cent, respectively. This means that Poland and the economies of the CSE have partly substituted the development of their own domestic research potential by importing technologically advanced investment goods.

Such a low level of investment in IPP in Poland’s economy is bad news, because the potential for Poland’s growth to be driven mainly by the mechanisms of real convergence is being gradually exhausted. In 2016, Poland’s central bank, NBP stated in its report “The innovative potential of the economy — conditions, determinants, perspectives”, that “over the last quarter of a century economic growth in Poland has been fast, despite the low level of innovation in our economy. Throughout this period, economic growth has been based on (i) a rapid accumulation of capital; (ii) an influx of modern technologies from abroad; and (iii) a rapid increase in society’s level of education.”

Given that capital resources increasingly include R&D capital and other intellectual property products, it may turn out that the level of capital that can be achieved in Poland through the processes of real convergence alone (also including technology transfer) is lower than previously believed. This is known as the so-called “middle income trap”. At the same time, investing in R&D is becoming more important today, as it allows Poland to both increase the capital resources and to increase the productivity of the factors of production.

Jakub Growiec, PhD, is an associate professor at the Warsaw School of Economics and an economic adviser at the Economic Analysis Department of Poland’s central bank, NBP. Jakub Mućk, PhD is an economic expert at the Economic Analysis Department of NBP.

The article presents private views of the authors.