The biggest one is regaining profitability without taking on excessive risk and the associated – due to the regulatory pressure, expectations of supervision authorities and customer expectations – major changes in the business models.

The European Central Bank, owner of the supervision system Single Supervisory Mechanism (SSM), has announced five areas, which will be treated as priorities in 2016. These are huge, multifaceted issues, and they all relate to the key categories of risk faced by banks. The first and most important issue mentioned by the supervision body is the banks’ business model and the risk of loss of profitability.

Below is the list in the order which the ECB assigned to the particular areas, at the same time announcing numerous supervisory initiatives for each of them:

- business model and profitability risk;

- credit risk and elevated levels of non-performing loans;

- capital adequacy;

- risk governance and data quality;

- liquidity.

The SSM adds that, depending on the country and the situation of a bank, it will also focus on other risks which include the search for yield in an environment of low interest rates, the risks associated with government debt, geopolitical situation, the deepening weakness of emerging economies, as well as risk related to banking IT systems and cybercrime.

Banks have firmly strengthened their capitals

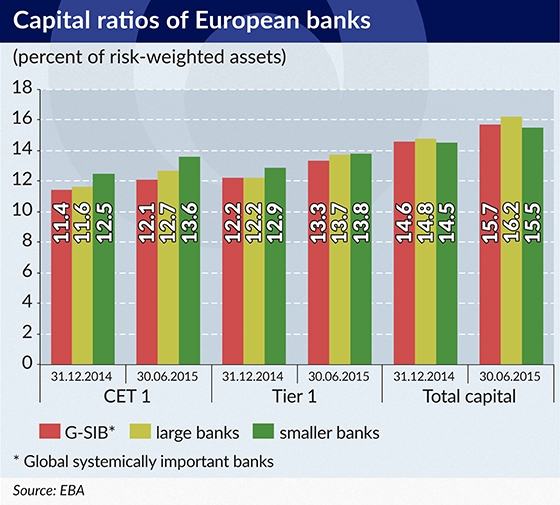

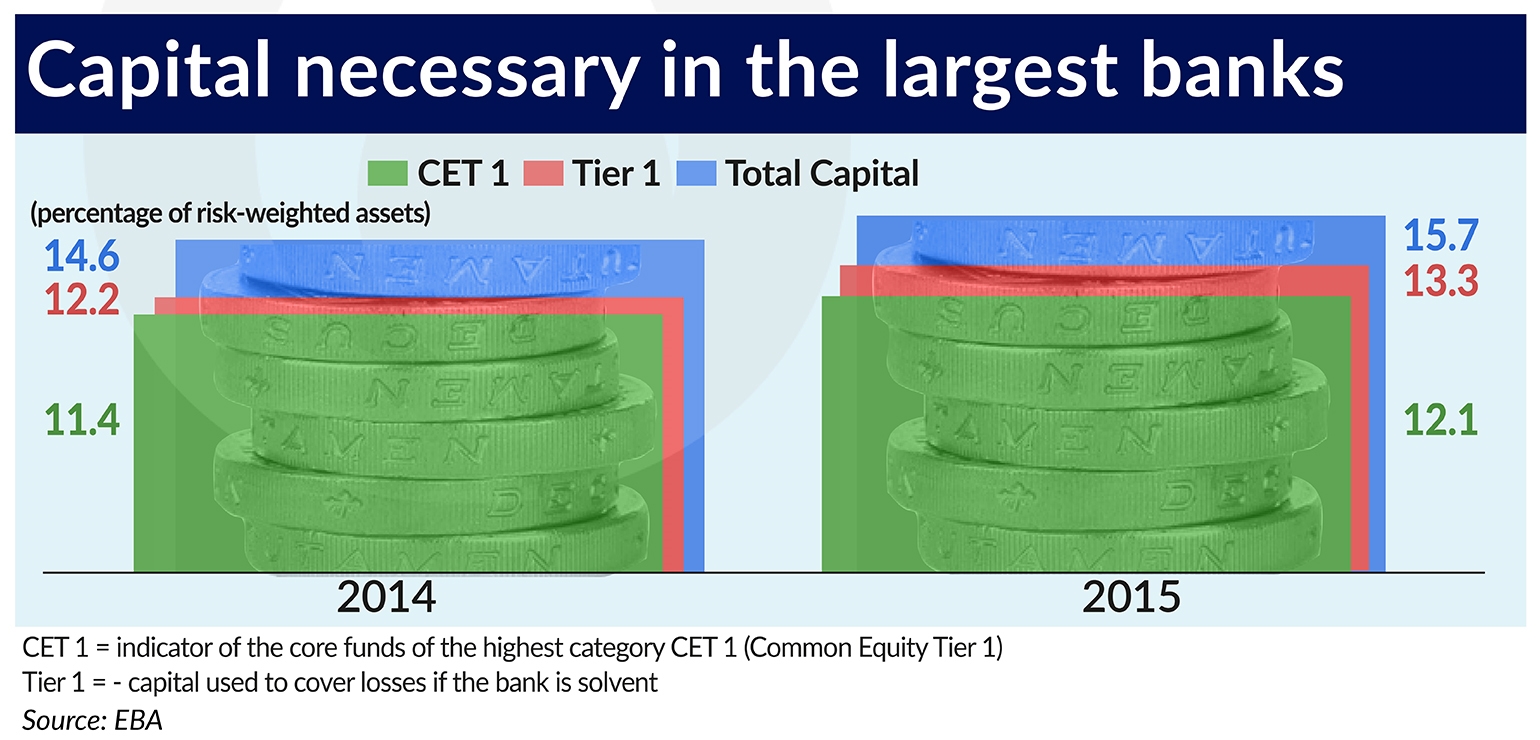

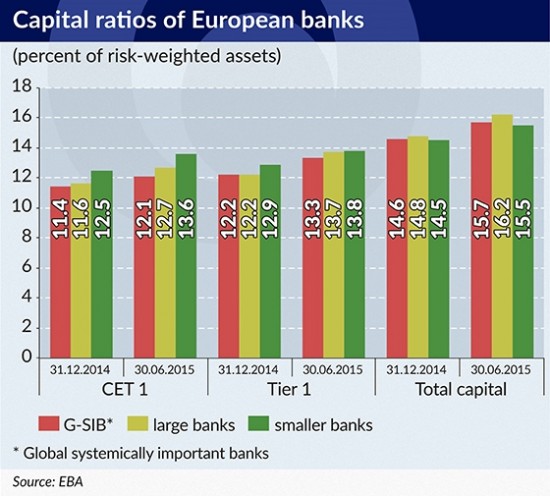

Until now, the main focus of both the regulators and the supervisory bodies was the capital adequacy. Since the establishment of capital adequacy rules, known as Basel I, II and III, the Basel Committee on Banking Supervision (BCBS) has monitored semi-annually how these requirements are met by approximately 200 banks from the member countries of the Bank for International Settlements (BIS). At the same time the European Banking Authority (EBA) is performing a similar review in the EU banks. Its analysis performed at the end of the first half of 2015 shows a further strengthening of capitals both in large and in smaller banks.

At the end of the first half of 2015 large banks (over EUR3bn Tier 1 capital and operating across borders) from 14 EU countries had, on average, 11.6 per cent of CET1 capital (smaller banks 12.5 per cent respectively), 12.2 per cent of Tier 1 capital (12.9 per cent), and 14.8 per cent of total capital (14.5 per cent). That is significantly higher than the minimum ratios – CET 1 along with a buffer – 7 per cent, Tier 1 – 8.5 per cent, and a total capital – 10.5 per cent of the risk-weighted assets. All the banks which do not meet the capital requirements are lacking a total of EUR13.6bn for their full coverage.

The EBA analysis assumes that all the principles of Basel III have been fully implemented. Some of them will not be introduced until 2024. When they come into effect, this will reduce the proportion of CET 1 capital to risk-weighted assets by 100-150 basis points (bps), and the leverage ratio – by 50 bps. The average leverage ratio, which shows the amount of capital in relation to total assets, was 4.2 per cent for the larger banks and 5 per cent for the smaller ones. In addition to EUR13.6bn of capital shortfalls, the analyzed banks also lack EUR5bn in order to achieve a leverage ratio above the required 3 per cent.

„(…) only a small number of banks suffer from potential capital shortfalls. Those shortfall amounts constitute only a very minor fraction of the amounts observed at the beginning of the monitoring period (mid-2011), and the difference between current and full implementation capital ratios [Editor’s note – of Basel III] has been shrinking continuously,” wrote the EBA in its report.

The situation with liquidity requirements also looks good. The liquidity coverage ratio (LCR), designed to ensure that an institution will have enough liquid assets over a period of 30 days to cover the outflow of liabilities maturing at that time, is fulfilled by the big banks in 121.2 per cent, and by the smaller banks – in 156.7 per cent. This is in spite of the fact that LCR will start applying in 100 per cent only from the beginning of 2018. Only 9 per cent of the banks surveyed by the EBA did not meet the LCR requirement of 70 per cent, which was a minimum level required as of the beginning of this year. In total, the banks are short of EUR32.6bn in liquid assets in order to fully meet the LCR requirements.

The situation is a bit worse when it comes to the net stable funding ratio (NSFR) which requires the institutions to finance long-term assets with long-term liabilities. Larger banks meet this standard on average in 104 per cent, and the smaller ones – in 111 per cent. The shortfalls in long-term funding, however, are considerable and, out of the nearly three hundred respondents, almost 70 institution have an overall shortfall of EUR341bn. Although the BCBS announced its principles at the end of 2014 the NSFR has not yet been introduced into the European law.

A new approach to adequacy

According to the EBA, the CET1 ratio of nearly 300 European banks from 21 EU Member States (including five from Poland) rose by an average of 500-600 basis points over the course of four years. When it comes to capital adequacy, this year’s stress tests will serve as a new installment of the assesment. However, it will look differently than before. It will not be „mechanically” announced which bank met the requirements and which didn’t.

The results of the tests which involve more than 50 EU banks, will be known at the beginning of the second half of 2016. They will be analyzed by the SSM in connection with the individual risk profile of a given bank and its individual capacity to cope with stress conditions. The supervision authority has already announced that it will provide banks with individual capital recommendations, taking into account also the balance of other risks in a given institution.

The SSM has also announced that it will evaluate the quality of capital and seek to harmonize exemptions from the general principles established in the European law. Some of the countries have negotiated such derogations, for example, in the calculation of capital in so-called „national options”. The attention of the supervision authority will also focus on new regulatory standards, i.e. the total loss-absorbing capacity (TLAC), concerning the largest global banks, and the minimum requirement for own funds and eligible liabilities (MREL), that is, the obligation to maintain equity instruments to cover losses in the case of liquidation of the institution.

The banks have significantly improved their liquidity standards. SSM states that the supervisory assessment conducted in 2015 showed that many of them do not fully meet the expectations concerning the liquidity risk management. The supervision authority will therefore continue to investigate the reliability of the internal liquidity adequacy assessment processes (ILAAP) and whether the banks have adequate structures for the management of liquidity and financing risks, not only in normal activities but also under stressed circumstances.

How will new regulations be developed

Despite the improvement, the SSM is far from claiming that the European banking crisis is over. This is proven by the set of priorities of the supervision authority resulting from the types of risk which have not been resolved thus far.

„The situation of the banking sector still has to normalize. Regulation is not finalized, there are low interest rates and high cost problems. We need to assess whether business models are sustainable, even in adverse scenarios” – Korbirian Ibel said, Director General of the SSM’s Microprudential Supervision IV during a high-level bankers meeting organized by the Tapestry Network and the consulting company EY, according to a quote in a report published by EY.

Some risks, such as those related to government debt, which are not decreasing, could explode at any moment with a new force. For the time being the only answer to this is for the ECB to buy out government bonds from banks’ portfolios. Equally important, however, are these risk categories which are deeply embedded in the foundations of the entire banking system.

Europe is still „overbanked” and the assets of banks are much larger than the GDP of many countries of the European Union, although in four years the banks have reduced their RWA by nearly 20 per cent on average. Shareholders and managers are becoming increasingly aware that there simply is no place for so many banks on the continent. Especially since many of their functions are being taken over by technological companies which are conquering more and more areas belonging to the banking sector and also profiting from their profitability. The banks are launching a great transformation of business models, but this is happening in conditions of low interest rates and low profitability and the loss of the value of many assets, under strong pressure from the competition.

The supervision authority’s response to these risks will consist ‚thematic’ assessments, later included in the comprehensive Supervisory Review and Evaluation Process (SREP). They will concern business models, credit risk and risk governance. There is a place provided for soft qualitative assessments, in contrast to the rigid, quantitative data on the compliance with the capital or liquidity indicators.

(infographics Bogusław Rzepczak)

The introduced regulations, as well as the stress tests, were criticized for their rigid adherence to the indicators, their lack of proportionality, failure to take into account the profile and nature of the given institution’s activity. These accusations were raised in particular by smaller institutions, such as the Polish cooperative banks. The SREP is supposed to be a tool to provide a soft adaptation of the regulations to the specific challenges related to the situation of each bank individually, as well as to compare banks with similar characteristics.

The SSM is still at the stage of developing appropriate measures, comparisons and benchmarks. It intends to create them through the analysis of the behavior of comparable institutions, a review of the current practices, identification of the good and the bad ones. This, in effect, will serve the establishment of regulatory foundations.

What will be the subject of the review

This year the ECB is planning to perform a ‚thematic’ review of the causes of low profitability of banks in Europe and, on the basis of such an analysis, to identify where it is structural in nature. The reverse side of this issue is whether the banks that achieve high profitability are doing this through weakened credit standards, greater dependence on short-term financing or increasing risk exposure to the level incommensurate to the declared risk appetite.

Low profitability in an environment of low interest rates and cheap money provided by the central banks lead to seeking higher returns. This, in turn, leads to taking greater risks. We can already see such phenomena, and one example are the so-called covenant-lite loans. They consist in the fact that the bank turns a blind eye to financial covenants, i.e. parameters such as cash flow, debt-to-capital ratio or capital expenditure limits, which the borrower undertakes to keep in the period of debt repayment.

Such activities may result in an explosion of provisions against risk, when the International Financial Reporting Standard (IFRS 9) enters into force from the beginning of 2018. It will introduce, i.a. an impairment model based on the expected loss. This means that, for example, when the risk of a given loan significantly increases (delay in repayment exceeding 30 days, downgrading, etc.), the bank should create a provision for the entire outstanding debt. The potential impact of IFRS 9 and the banks’ preparation for that is another subject of the SSM’s activities in 2016.

Meanwhile, irregular loans in the euro area are estimated at EUR826bn. Their value is the greatest in the countries most affected by the crisis. The SSM established a task force which is reviewing the situation of institutions with a high level of bad loans, and sees the solving of these problems as another key priority for 2016. Korbirian Ibel, quoted in the EY report, said that dealing with bad loans is complicated by the diversity of the local insolvency laws.

For the subsequent years the SSM is also planning to examine the bank’s internal models. „The board should understand the mechanics: what does the model react to? What parameters are driving it? What is the sensitivity? If the answer you get is mathematical, the executive is on shaky ground. You need an economic answer,” – Korbirian Ibel said.

It would seem that the management boards of banks should have reliable data and information about the risks, allowing them to make correct business decisions. Based on the previous supervisory activities, however, the SSM is beginning to have doubts in this regard. Therefore it plans to perform another ‚thematic’ review of the quality of data and risk reporting, as well as risk governance and risk appetite. A part of this review will be devoted to the IT infrastructure and cybersecurity, since European banks have aging systems. Under the pressure of cost-cutting they are also saving on technologies related to security.

„Are banks investing in their aging architecture? If something goes wrong, then what happens to the bank? Are the systems tied to the right things? Are finance and risk data able to be aggregated? Test it. If it is hard for you, then there is a problem,” – Korbirian Ibel said.

It turns out that the capital strengthening of the banks was a prerequisite to talk about leaving the crisis behind, but it is not a sufficient condition on its own. Now comes the time of further, `softer’, but at the same time, essentially important activities.