Tydzień w gospodarce

Category: Trendy gospodarcze

CC BY-NC Israel Defence Forces/DG

CE Financial Observer: In the report on our region of Europe, you find that the most important driver of GDP growth in the first half of 2014 will be exports. Do exports underpin the functioning of these economies in general?

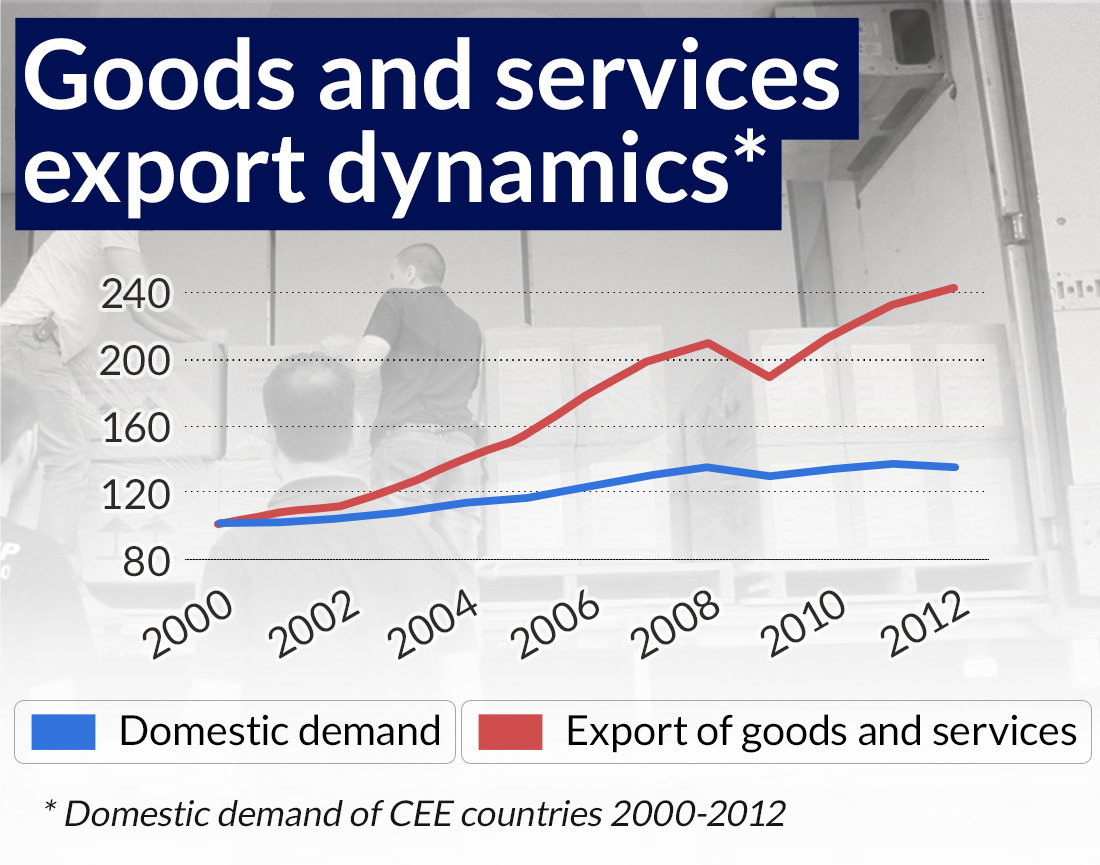

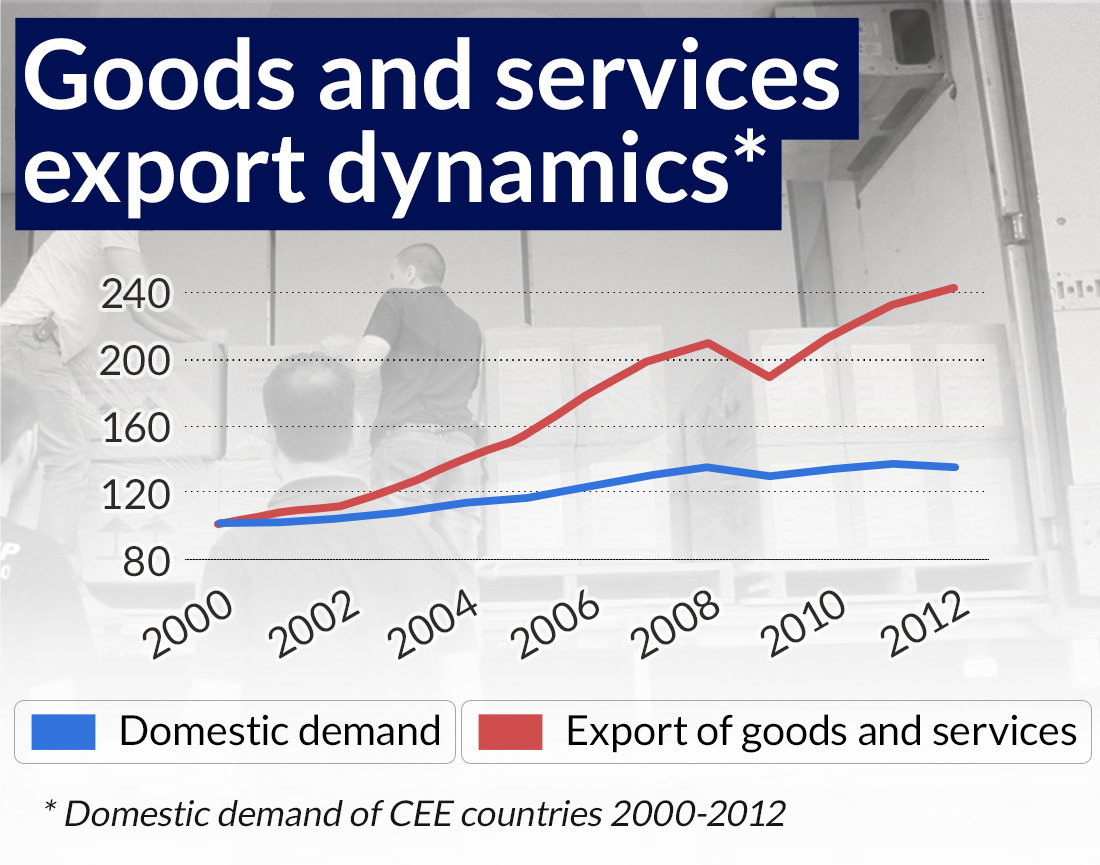

Marcin Grela (MG): Yes, the countries of Central and Eastern Europe have small, open economies, which rely more on exports than on domestic demand. This has been the case since the first half of the 90s, and a major factor in the growth of exports was the entry of multinational corporations relocating production from Western Europe. Wages in our region were lower and the geographical location between Germany and – long neglected by corporations – Russia, along with a large group of post-Soviet countries, also played a role.

What does it mean that Germany has become the intermediary of exports from Central and Eastern European countries?

Wojciech Mroczek (WM): This means that Germany primarily uses goods and indirect services from countries in the region, including Poland, in its exports. It is German corporations that dominate trade in the region and organize supply networks. In practice, for Volkswagen to produce a car then belts produced near Wroclaw, among other parts, must appear on its assembly lines. This is a portion of Polish exports to Germany.

What are the advantages and drawbacks of Polish exports being dominated by foreign corporations?

MG: Being dependent on the markets for the products these corporations produce can be both an advantage and a disadvantage. If the market for those products is buoyant then our exports gain, if not then they lose. On the other hand, an element of diversification could be important. It is potentially easier for companies that are part of multinational corporations to export to geographically distant markets, thereby decreasing exposure to local market conditions. Yet this is more a theory, in fact the share of non-European markets in our exports remains very small. Our products do not compete on the U.S. or Chinese markets.

WM: You have to take into account that the final products of large corporations are those for which there is the greatest demand. Therefore, the exports of countries that offer the most products of multinational corporations grow the fastest.

The report states that the structure of Polish exports is an anomaly in the region when it comes to Poland’s „continued comparative advantage in little-processed goods such as furniture and furniture parts, and products from wood and cork.” Are we lagging behind?

WM: No. This phenomenon is due primarily to the size of our economy. Perhaps indeed we are also less competitive in attracting corporations. Other countries in the region are more dominated by them. But I would not look at this solely in terms of backwardness. Look at the example of Denmark, where the export of agricultural goods has been cherished for years. This does not stem from the fact that they cannot produce anything else and are simply selling food. This is high-volume agriculture with appropriate marketing to direct the sale of these products. There is likewise nothing anachronistic about the Polish export structure.

We read in the report that „multinationals largely gave the countries of Central and Eastern Europe the role of producing cheap counterparts to products offered by the countries of Western Europe.” So we have a similar export structure to EU15 countries, only we make cheaper things?

WM: Yes. German companies, for example, focused on higher quality products and the greater value-added of exporting them out of Europe to countries with higher demand, whereas cheaper production, which was intended for Western Europe and the former Soviet Union has been moved to Poland and other countries. As a result, we specialize in cheaper and lower quality products.

In the future, will we be producing more expensive, higher-quality products approaching the level of wealthier Western European countries?

WM: I don’t think so. The production of cheaper goods in Poland is the result of corporate policy. Their goal is not for Poland to match the production quality of Germany because generally the products made in Poland or in other countries of the region are destined for other consumers than their German counterparts.

MG: It is worth noting that the greatest gains in the hierarchy of international supply chains are formed at the stage of inventing, marketing, after sales services. Those who are engaged only in production unfortunately earn the least.

Are there some areas in which we could invent, sell and make money?

WM: We should look for such a niche, but remember that, for example, to create the big Japanese brands required decades of state industrial policy. Without consistent policy from the Japanese government Sony would not exist.

What are the practical implications of this – what should we demand of corporations investing in Poland?

WM: We should look at the hierarchy of production chains and find sectors where displacement (the relocation of production) will be difficult, even if you can find another country with even lower costs. I think that a future opening-up of the countries of the former Soviet Union will be a challenge for us because few corporations are active there presently. Once we have production that it is difficult and commercially unviable to move abroad then we can start to think about industrial policy and moving higher up the value chain, but the process takes years.

Interview by Mark Pielach