Tydzień w gospodarce

Category: Raporty

The changes in the international model of production and trade have necessitated the development of a new database — the statistics of trade in value added. It takes into account the contribution of the individual countries in the creation of a given final good and eliminates the double counting of trade turnover values which is inherent in the traditional statistics. In 2013, the Organization for Economic Cooperation and Development (OECD) and the World Trade Organization (WTO) started publishing data on the origin of the value added in the exports of dozens of countries. Due to the complex nature of the process of developing such data, the latest available estimates are from 2014.

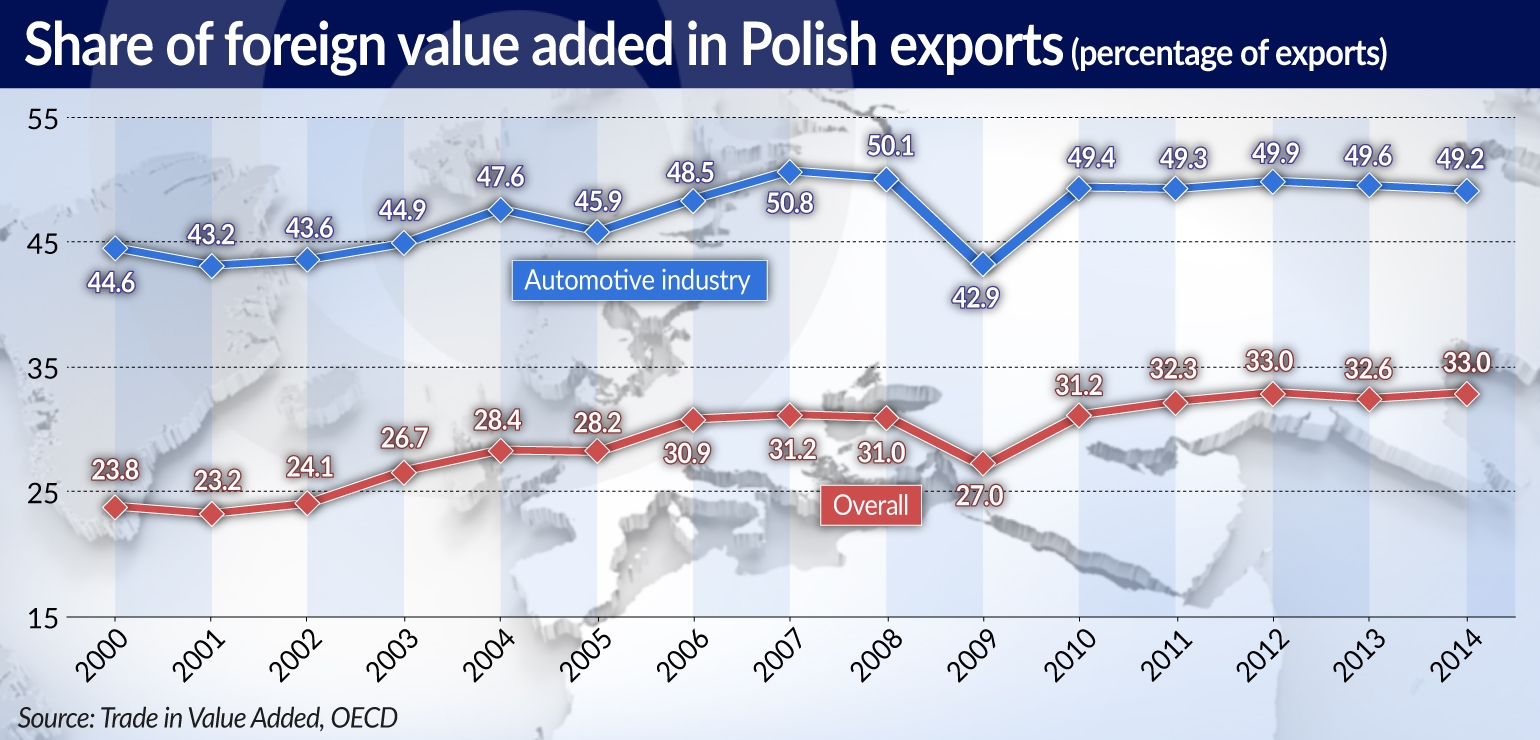

Poland’s growing participation in the processes of international fragmentation of production significantly increased the foreign value added content of Polish exports. According to the OECD-WTO Trade in Value Added (TiVA) database, the foreign value added content of Polish exports grew to 33 per cent in 2012 and remained at this level in the years 2013-2014. The changes in the product and geographical structure of Polish trade that has been observed in recent years may suggest, that there was a decline in the share of foreign value added in Poland’s trade, along with an increase in the importance of sectors requiring a greater share of domestic value added.

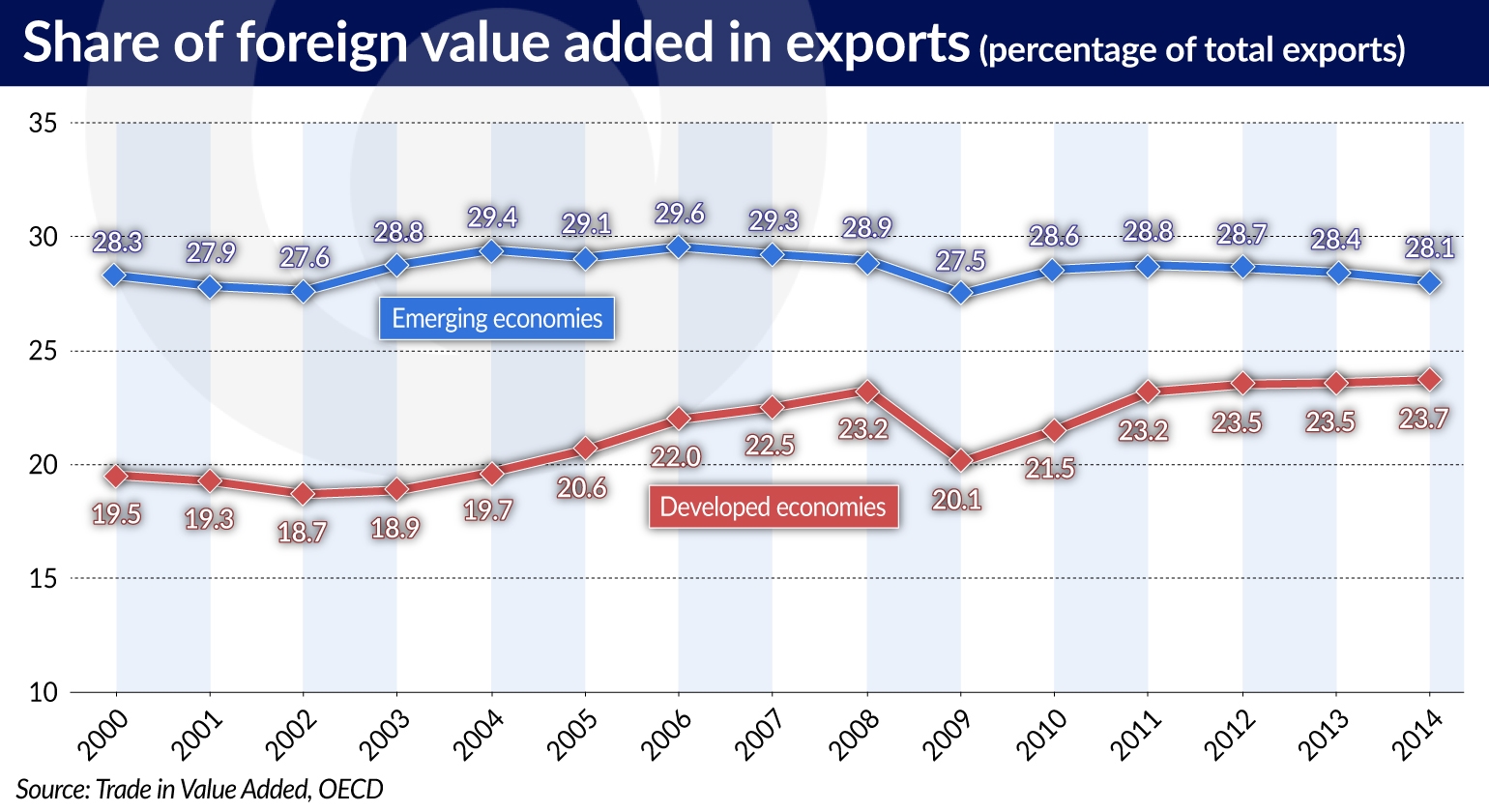

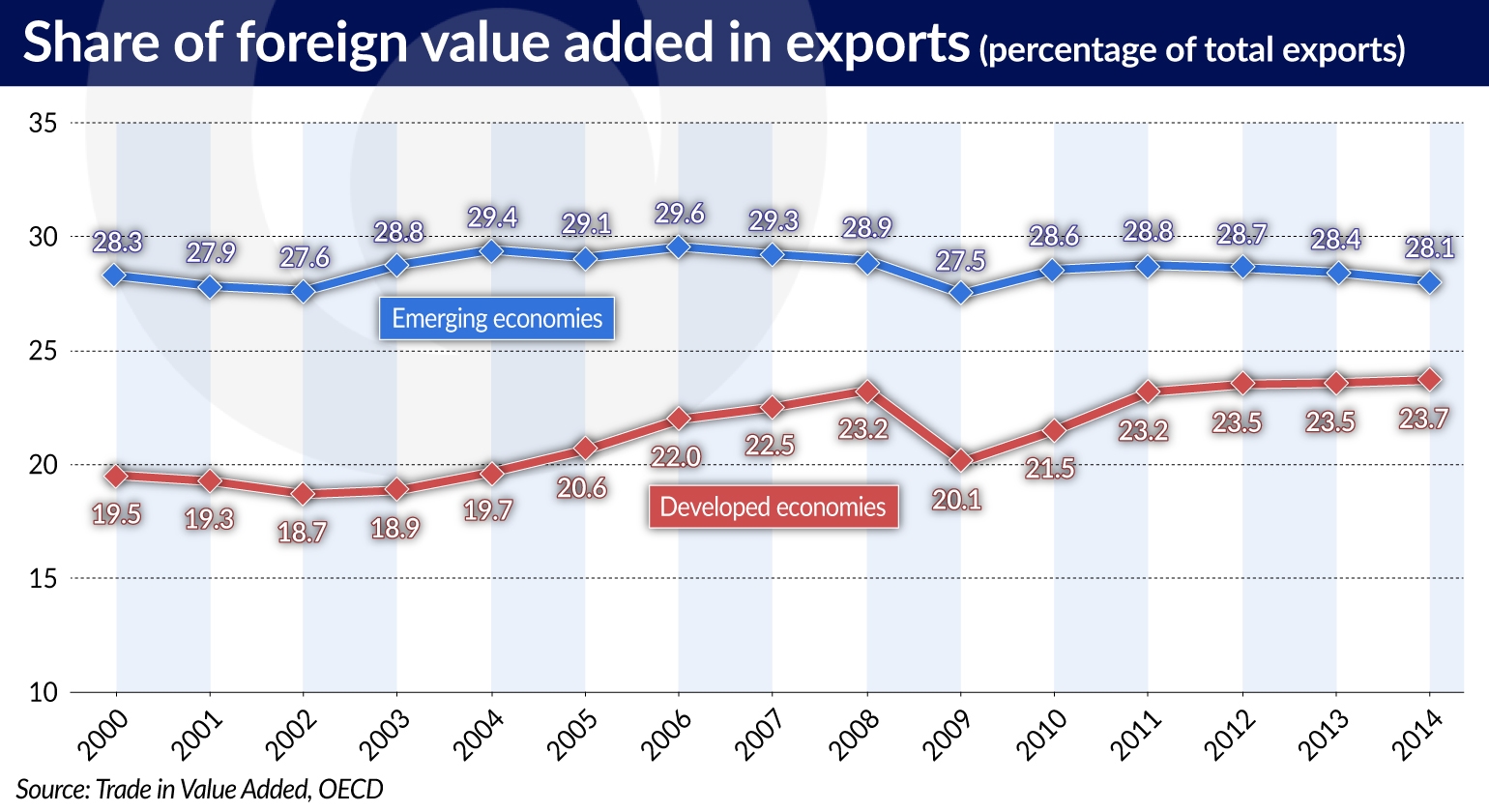

This trend was consistent with the tendencies observed in the global economy. The slowdown in the previously observed increases in the foreign value added content in global trade was caused by the slump in the flows of foreign direct investment, and in particular in FDIs flowing from developed economies to developing countries. As a result, the rate of growth of global trade has clearly slowed down compared with the period before the global crisis. Among the so-called emerging economies, in the years 2012-2014 foreign value added decreased the most in the exports of China, South Korea and Turkey.

The changes in Polish exports mainly resulted from the growing importance of the services sector, which is characterized by a lower share of foreign value added. For example, according to the TiVA database, in 2014 foreign value added accounted for 15 per cent of the exports of services and for 40 per cent of the exports of goods. In the years 2012-2017, the share of services in Polish exports (in gross terms) rose from 18 per cent to 21 per cent. Similarly, when it comes to the export of goods, during this period there was also an increase in the share of categories of goods which are characterized by a lower foreign value added content. The fastest increases were recorded in the export shares of food products and „other products of industrial processing” (mainly furniture is classified in this group), where the foreign value added content is generally lower than the average in the exports of industrial products. The export share of both groups of goods increased from 16 per cent in 2012 to 19 per cent in 2017.

The research conducted by OECD/WTO suggests, that the main factor inhibiting the growth of the foreign value added content of Polish exports in the years 2012-2014 was the decrease in the foreign value added in the exports of the group of goods covering motor vehicles and automotive parts. This was the only group of exported goods out of the 18 groups included in the TiVA statistics, where a decrease in the foreign value added content was recorded. This was probably due to the fact that the share of automotive parts in exports increased, while the share of passenger cars — which are characterized by higher import intensity — in exports declined. In the years 2011-2017, the share of automotive parts in the exports of the Polish automotive industry increased from around 50 per cent to nearly 60 per cent.

The decrease in the importance of foreign value added in Polish exports may also have been the result of the continued strengthening of China’s role in Polish imports of intermediate goods which are used in production destined for exports. The substitution of the imports of intermediate goods mainly from European countries with imports from China likely contributed to a decrease in import prices. Traditional foreign trade statistics indicate that China’s share in the imports of intermediate goods to Poland has doubled in the years 2012-2017. The strongest growth was recorded in the case of electronics, where supplies from China accounted for 35 per cent of the value of imports of intermediate goods in the group of goods covering electronics (compared with 16 per cent in 2012). The TiVA database indicate a steady increase in China’s share in the foreign value added of the exports of industrial processing goods. In 2011 that share reached 6.5 per cent (including 17.5 per cent in the exports of textiles and 15.2 per cent in the exports of electronics).

The decline in the prices of raw materials, and in particular fuels, had an even greater impact on the decrease in the foreign value added content of Polish exports. In 2011 imported fuels accounted for 6 per cent of the foreign value added content of the total exports and for 12 per cent in the exports of chemical products. Due to the drops in fuel prices on the world markets, the share of fuels in Polish imports decreased from 13 per cent to 7 per cent in the years 2012 -2017.

The current account statistics show, that the value of service exports is growing faster than the value of the exports of goods. This may indirectly indicate, that the importance of services in the creation of the value added in Poland’s exports will further increase. Poland belongs to a group of countries in which more than half of the value added in exports is created in services. Services play a very important role in the functioning of international production networks. They integrate the individual processes within the global value chains and enable the proper functioning of entire networks as well as individual companies.

The growing importance of services in the creation of the value added content of exported goods increases the scale of product differentiation and determines the quality of the goods. For this reason, the majority of exports of value added created in services is associated with the exports of goods and, according to traditional statistics, is included in the value of the exports of goods. This is the reason for the marked difference between the share of services in exports according to the gross export statistics and according to the value added statistics (for example, according to TiVA, in 2014 the share of services in Poland’s total exports accounted for as much as 54 per cent). In the case of Poland, in 2014 services accounted for over 40 per cent of the value of industrial processing exports.

Given the fact that Poland’s surplus in trade in services is structural in nature, it can be expected, that the observed decline in the foreign value added content of Polish exports will continue in the coming years.