(©PAP)

It is not easy to evaluate them due to the fact that the party programmes are subject to continuous small changes that are nonetheless of great significance to public finances. When appearing before a large audience, politicians propose solutions that could, in their opinion, attract the biggest number of supporters. In unofficial conversations, they hint that ideas costly for the budget would not be implemented immediately, but gradually, with fiscal discipline maintained.

Law and Justice

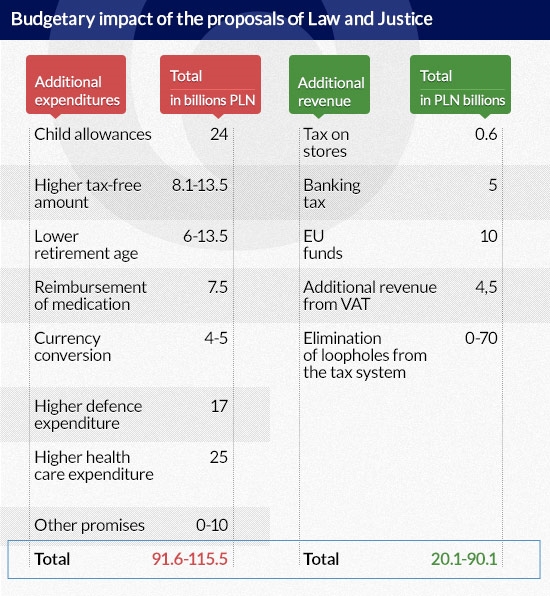

Law and Justice – the party that has a chance of winning the elections and gaining an independent majority in the Sejm (lower house of the Polish parliament) – has prepared the most extensive programme. The programme, which is over 160 pages long, was prepared as early as 2014 and was partially presented during the presidential election campaign. Its main points that are associated with higher expenditure but also higher budget revenue include the following:

- Increasing the income tax threshold in the Personal Income Tax system from PLN3,091 to about PLN6,000. In Andrzej Duda’s presidential campaign, conducted by Beata Szydło, who is the current candidate for Prime Minister, the tax free amount was set at PLN8,000. There are over 24 million taxpayers paying their taxes according to two tax scales. Some will not benefit from the increase in the tax-free amount due to their very low income. Assuming that 15 million taxpayers will benefit fully, the cost for the budget would be as follows: 3,000 x 15,000,000 x 18per cent = PLN8.1bn. If the tax-free amount was increased to PLN8,000, the cost for the budget would amount to PLN13.5bn.

- Monthly family allowance of PLN500 for each second, third and subsequent child in the family. The wealthiest families would be excluded from this programme and poorer families would also receive an allowance for the first child. We do not know the income criteria yet. There are currently 6.94 million people aged 0 to 18 years in Poland. This number will change, but only slightly. The highest number of children were born in 2009 – 433,638 children, while the lowest number were born in 2003 – 350,999. Assuming that 4 million people will be entitled to the allowance, the cost for the budget will amount to PLN24bn.

- Restoration of the retirement age for women to 60 years of age (with 20 years of service) and for men to 65 years (with 25 years of service). This point is not clear, as some Law and Justice politicians, as well as the head of the „Solidarity” trade union Piotr Duda note that the criterion of years of service may be stricter. In addition, the Constitutional Tribunal challenged the different retirement ages for men and women. If the changes in the retirement rules were carried out in accordance with the provisions of the Law and Justice party programme, the impact on the finances of the Social Insurance Institution ZUS (and hence the State budget) would increase with each passing year.In the years 2016-2020, the costs would amount to PLN48.7bn, while the cost in 2016 would be PLN6bn and in 2020 –5bn. These figures were given in the justification of the Act raising the retirement age.

On September 21st, the draft law lowering the retirement age was submitted by President Andrzej Duda. Thus he fulfilled his promise from the election campaign. The President is formally nonpartisan, but his project should be ascribed to the Law and Justice party.

The former president Bronisław Komorowski also proposed lowering the retirement age, under the condition, however, that it would be linked with appropriate seniority. There is no such condition in the proposal submitted by Andrzej Duda. According to the President’s advisors, in the years 2016-2020 the costs for the budget would amount to PLN30bn plus PLN10bn due to additional costs. The justification for the draft law proposed by the President does not contain precise calculations supporting these estimates. They are only slightly lower than the estimates from 2012, when the law raising the retirement age was passed. The justification also states that the effects could be weaker if irregularities in the labour market were eliminated. These include the use of civil law contracts instead of employment contracts, which hide part of the salaries paid to employees, and work in the so-called shadow economy.

The law will not be adopted by the current parliament, but it will probably be among the first ones to be adopted in the next parliamentary term. This means that as early as 2016 the costs resulting from the lowering of the retirement age will amount to PLN5-6bn.

Law and Justice also proposes the following:

- A reduction in the Personal Income Tax rate to 15 per cent for small businesses employing at least 3 people with a salary no lower than the national average. It is difficult to estimate the budget costs, but they are likely to be minor.

- An increase in defence spending from 2 to 3 per cent of GDP. This was announced by Beata Szydło, although the Law and Justice party programme did not include such a proposal. The budgetary cost would amount to PLN17bn.

- Free medication for people over 75 years of age. In addition, the Law and Justice party programme of 2014 contains a declaration to reduce the prices of all the drugs sold in pharmacies to PLN8-9 per pack. Only a rough estimation can be given of the budgetary cost of such an operation. Currently, the cost of reimbursement of the medication sold in pharmacies amounts to approximately PLN7.5bn. The value of sales on the pharmacy market is about PLN30bn per year. The provision of free medication to the elderly would be vulnerable to abuse. The cost of refunds would probably double, which means an additional budget expenditure of PLN7.5bn.

- An increase in health care spending from the current 4.5 to 6 per cent of GDP, or by about PLN25bn.

- A solution to the problem of Swiss franc loans. Law and Justice has supported a law passed in the Sejm and later amended in the Senate, according to which banks are to bear 90 per cent of the cost of currency conversion. If it returns to this idea after the elections, the cost for the banks would amount (according to the estimates of the Polish Banks Association) to PLN20-25bn. However, there would also be costs for the State budget. One direct cost would be a reduction in CIT revenue by PLN4-5bn. Indirect effects associated with economic slowdown and the resulting decrease in revenue mainly from VAT would be more acute. In addition, Poland would almost certainly be drawn into legal disputes with the banks’ foreign headquarters and ultimately the entire cost of conversion could be borne by the state budget.

- Provision of free kindergartens for all children, dental care in each school, an increase in the income threshold entitling a person to social benefits, the introduction of the status of a democratic opposition veteran which entitles the holder to additional state support, state financing of natural disaster insurance in agriculture, and support for the construction industry. Due to their vague nature, it is impossible to provide even a rough estimate of the budgetary impact of these promises. If they were implemented, it would probably be over many years.

- Allocation of EUR12bn (PLN52bn) from the current EU budget perspective (2014-2020) for pro-family policies. If this goal was achieved, additional state revenue for the implementation of social objectives would amount to more than PLN10bn The allocation of EU funds for current social needs will require the consent of the European Commission. It is difficult to determine whether such consent will be obtained.

- The introduction of a third rate in the Personal Income Tax – 39 per cent on income above PLN300,000 per year, whereby taxpayers who invest and create new jobs could avoid this rate by deducting the amount of investment expenditure from their tax base. This change would be neutral for the budget.

- The introduction of a tax on large-format stores. According to the Law and Justice experts, it would provide budget revenue of PLN2.5bn. However, according to PwC estimates, it would also result in a PLN1.5bn reduction in revenue from VAT and approx. PLN0.4bn fall in revenue from CIT. Thus the real benefits for the budget would be minor. They are estimated at PLN0.6bn.

- The introduction of a banking tax. Law and Justice does not provide details as to the structure of this tax and does not specify its rate. The programme only states that „the rate of tax on financial institutions will be set at a level adjusted to the current economic situation”. The politicians of Law and Justice initially spoke of a tax on bank assets, but recently they disclosed that it would be a tax on „speculative transactions”. From next year the tax on assets in Hungary will amount to 0.31 per cent and will be reduced in subsequent years. If Poland were to apply the Hungarian rate, this would give budget revenue of PLN5.5bn. But even the estimates of the Law and Justice experts are lower and do not exceed PLN5bn. In the case of a tax on „speculative transactions”, the revenue would be even lower.

- Elimination of loopholes in the tax system. This point is controversial, all the more so as Law and Justice estimates that the budget would gain PLN20-25bn next year and PLN52bn in 2017 on this operation. These figures were provided by Henryk Kowalczyk, who is responsible for the party’s economic programme. In a report published in May, the International Monetary Fund stated (citing the analysis of the PwC consulting company) that the shortfall in VAT revenue resulting from violations of the law increased from PLN7.1-23.7bn in 2007 to PLN36.4-58.5bn in 2012. The shortfall in other taxes is lower, though also significant. The revenue from VAT, PIT and CIT declined from 16 per cent of GDP in 2008 to 13.5 per cent in 2014. Therefore, there is a large potential for additional budget revenue resulting from the closing of loopholes in the tax system. Raising tax revenue to the 2008 level, i.e. 16 per cent of GDP, would give an additional PLN70bn. The question is whether this is possible and over what time period.

- Additional revenue from VAT associated with the higher spending of families and beneficiaries of the increased tax-free amount. Assuming that the increase in spending will amount to PLN30bn (allowances for children, plus the reduction in PIT minus savings) and the average VAT rate is 15 per cent, the budget would receive an additional PLN5bn in revenue.

- Investment expansion. Law and Justice has announced an investment expansion, financed primarily with extra-budgetary funds, among others, by Narodowy Bank Polski. Some components of this programme could be classified by Eurostat as expenditure of the public finance sector, and thus increase the sector’s deficit.

- A reduction in the basic VAT rate to 22 per cent. I assume that this move would be budget neutral due to the gradual closing of loopholes in the tax system.

- An increase in the minimum wage and the establishment of an hourly rate of 12 PLN. This will have budgetary implications, as a number of social benefits are linked to the minimum wage. The effects will not exceed PLN1bn, so they can be omitted in the budget calculations. The consequences for the whole economy will be much more serious – the risk of increased unemployment.

(infographics: Dariusz Gąszczyk)

Civic Platform

The programme of Civic Platform titled „Poland of the Future”, presented in Poznań on September 12th, does not include proposals increasing budget revenue. However, it contains several promises concerning spending or tax reductions, including the following:

- An extension of tax credit enabling the deferment of payment in times of crisis,

- The introduction of tax relief for research and development activity,

- Assistance to people who have difficulties with the repayment of loans, including in particular foreign currency denominated loans,

- An increase in family allowances and the introduction of new income criteria, allowing the assistance to be better addressed to poorer families,

- An increase in expenditure on the construction of nurseries,

- The introduction of a reimbursement voucher for medicines for people with low incomes,

- The introduction of a minimum hourly wage of PLN12.

It is impossible to assess the budgetary costs, as Civic Platform has not presented specific solutions. In its programme it emphasized the necessity of maintaining fiscal discipline and not increasing spending above the level resulting from the expenditure rule.

The most controversial solution proposed by Civic Platform is the announcement of the consolidation of the Personal Income Tax and contributions to the National Health Fund and the Social Insurance Institution, along with the introduction of a special algorithm allowing the calculation of the amount of charges for each taxpayer. The family situation – the number of the taxpayer’s dependents – is to be taken into account in the determination of the tax burden. The tax progression will be in the range between 10 and 39.5 per cent and salaries will be grossed up – they will also include the Social Insurance Institution contribution paid by employers.

The Minister of Finance assures that the cost of these changes will not exceed PLN10bn and that the changes will begin in 2017 at the earliest. At the same time, VAT is to be reduced (return to the situation from before 2010) and measures will be taken to improve tax collection. An electronic invoice registry is to be introduced.

Civic Platform does not specify, however, the sources of financing for covering its other election promises.

United Left (coalition of left wing parties)

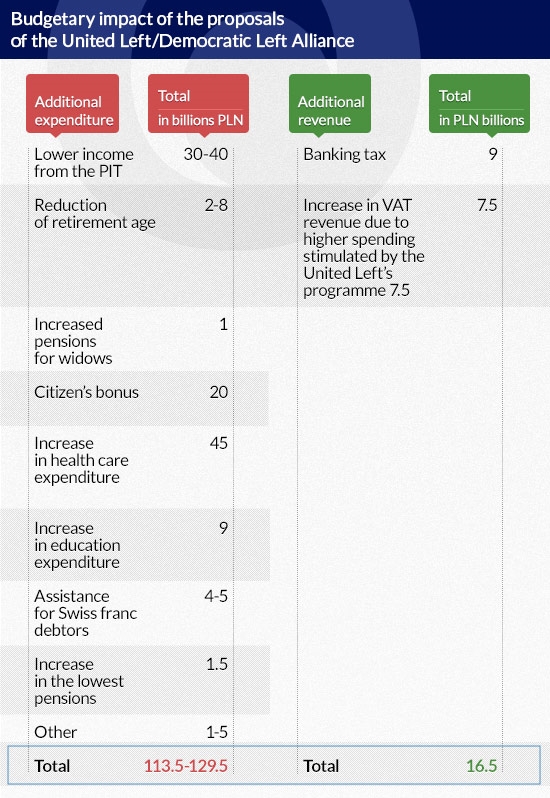

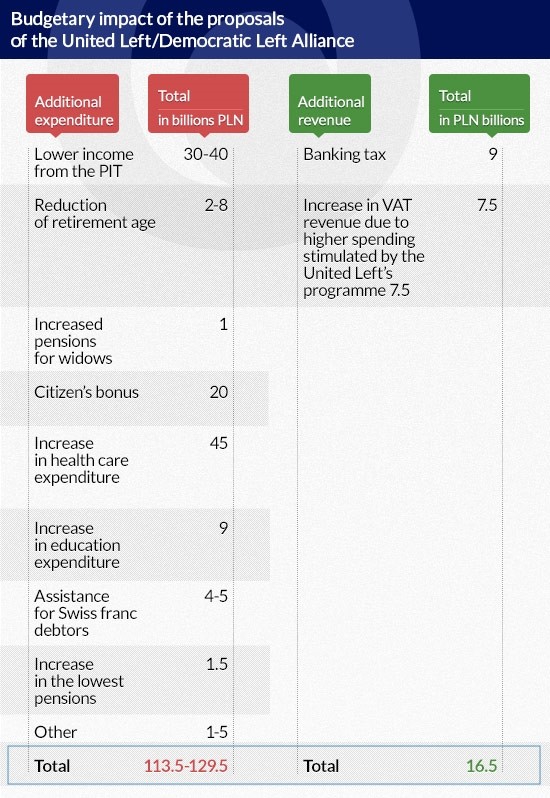

The programme proposals of the United Left are as extensive as those of Law and Justice. The Left proposes the following:

- The introduction of a 40 per cent Personal Income Tax rate for top earners. It does not specify the income threshold. This change would be neutral for the budget.

- Exemption of incomes up to PLN21,000 per year from the Personal Income Tax. Incomes not exceeding the level of the minimum wage should be tax exempt. At the current level of minimum wage, people with incomes of up to PLN21,000 per year would not pay the Personal Income Tax. The Left calls for raising the minimum wage to PLN2,500 per month (PLN15 per hour). In such a case, people with incomes of up to PLN30,000 per year would not pay the Personal Income Tax. It is not clear from the programme of the United Left whether this means a tax-free amount, or whether people with incomes exceeding PLN21,000 per year (or possibly PLN30,000) would pay tax according to the current rules. The second solution would be difficult to implement, as even a slight increase in income would cause a significant increase in the tax burden. Therefore, if PLN21,000 (or alternatively PLN30,000) was a tax-free amount, this would mean a reduction in budget revenues of approx. PLN30bn (or alternatively of approx. PLN40bn).

- The introduction of a „citizen’s bonus”, that is, the participation of all the citizens in the GDP growth. According to the United Left, in 2014 the „citizen’s bonus” would amount to PLN500 per citizen, which is approx. PLN19bn. In the next year it would exceed PLN20bn. Of course, the payment would come from the State budget and not from the GDP.

- An increase in the lowest pensions by PLN200. Currently, the lowest pension is PLN880, and about 1 million pensioners receive a pension lower than PL 1,080 (i.e. the minimum pension proposed by the United Left). The cost of the operation for the Social Insurance Institution, that is, for the budget, would amount to approx. PLN5bn.

- A reduction in the retirement age. Workers could retire after 40 years of work in the case of men and after 35 years in the case of women. The United Left does not specify whether seniority would only include the years of contribution to the pension system or also the period of studies and military service. In the first case, the budgetary impact would be negligible, and in the second case it would amount to approx. PLN2bn in 2016 and PLN8bn in 2020.

- An increase in pensions for widows or widowers. The budgetary impact is difficult to assess due to lack of data, but it would probably amount to approx. PLN1bn.

- An increase in public expenditure on health care to 7 per cent of GDP, or by about PLN45bn.

- An increase in expenditure on education. The Left does not specify the amount, but cites statistics from 2005, when education spending was 0.5 percentage points of GDP higher than today. This would involve approx. PLN9bn of additional expenditure.

- Assistance for the Swiss franc debtors through the invalidation of abusive clauses in credit agreements. The members of the Sejm representing the Left proposed to increase the banks’ participation in the costs of currency conversion to 90 per cent. If they return to this proposal, they will burden the banks with a cost of PLN20-25bn, which will then probably be reimbursed by the budget.

- Other promises, include an increase the income criterion entitling a person to social assistance and family benefits, an increase in the family allowance for poor families up to PLN 300, as well as the indexation of supplements to the allowance, increased spending on nurseries and kindergartens, and paid leave for carers of people with disabilities, etc. The budgetary cost would be PLN1 to 5bn, depending on the variants.

- Taxation of banking assets at the rate of 0.5 per cent (which would be the highest in Europe). In theory, the revenue would amount to PLN9bn, but in reality they would probably be lower, if only due to the tax optimization that banks would carry out.

- Liquidation of the Church Fund and religious education in schools. The budget expenditure on the Church Fund is under PLN100m, therefore is insignificant for public finances. Catechists’ salaries amount to approx. PLN2bn per year, but the Left proposes an increase in the number of hours of instruction of other subjects in place of religion, so the effect for the state budget would be neutral.

(infographics: Dariusz Gąszczyk)

The biggest shortcoming of all the parties’ programmes is the lack of ideas for faster and stable GDP growth in the long term. This issue, however, requires a separate discussion.