Tydzień w gospodarce

Category: Raporty

This concerns the role of three agencies: the European Banking Authority (EBA), the European Securities and Markets Authority (ESMA), and the European Insurance and Occupational Pensions Authority (EIOPA). All three of them form the European Supervisory Authorities (ESAs) that were created in response to the global financial crisis and which began to operate at the beginning of 2011. It quickly became apparent that their prerogatives were insufficient to cope with the crisis, which soon engulfed the Eurozone.

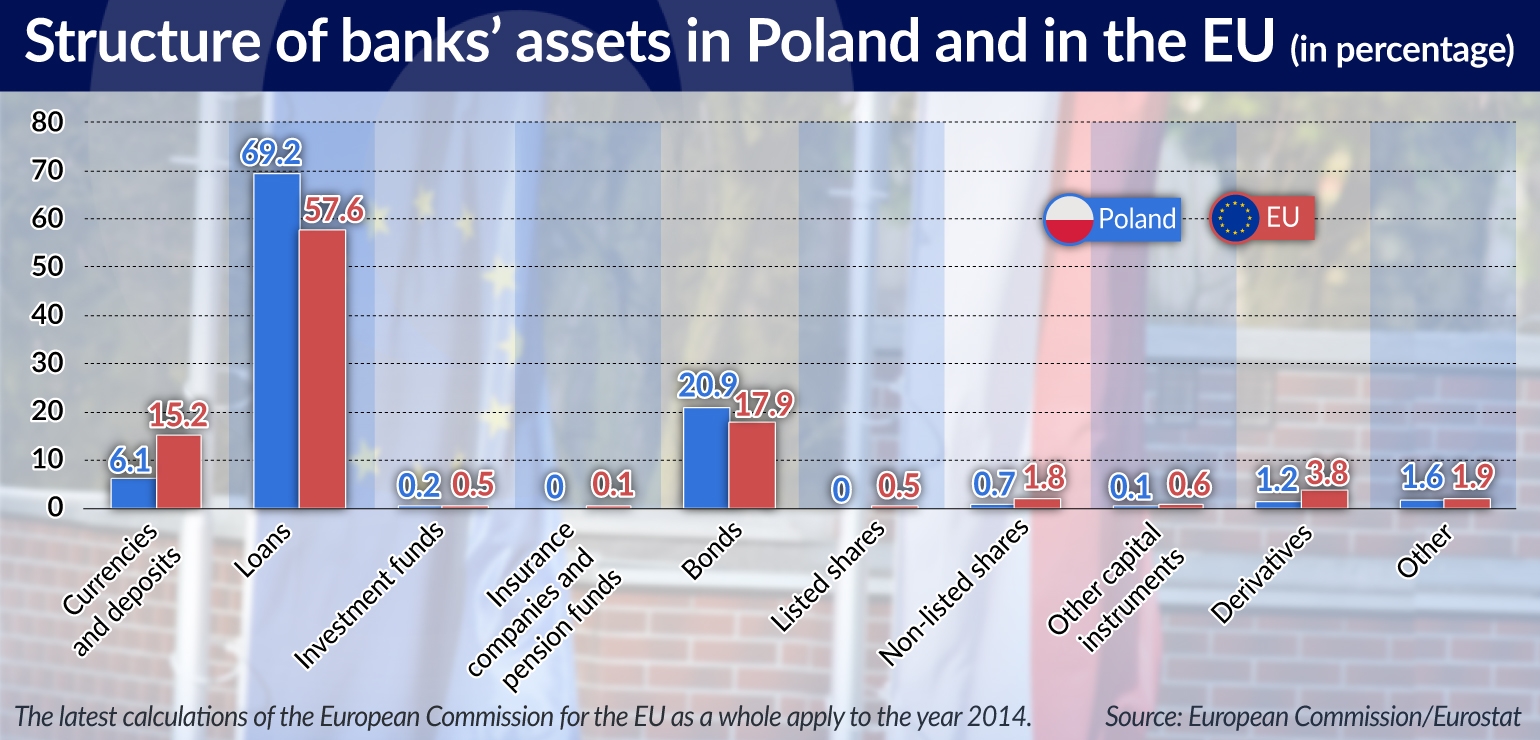

The project of a capital markets union was prepared in 2015 and was immediately announced as the flagship plan of a new European Commission appointed just a few months earlier. It involves the shifting of the burden of financing the economy from the excessively developed and weak banking sector onto a wide range of institutions and financial instruments of the capital market. The latter is broadly understood as the whole of the non-banking financial intermediation sector. The CMU is also supposed to help banks find some room in their balance sheets for the supply of new loans, for example, thanks to the new standards of securitization.

After the crisis, the situation of banks became obvious — the sector was oversized and weak. The total value of the assets of the banking sector in the euro zone amounts to approx. 280 per cent of GDP compared with 88 per cent of GDP in the United States. Even after the number of banks decreased by 20 per cent since 2008 to approx. 5,000, and after the number of bank employees decreased by approx. 300,000 to 1.9 million, Europe is still „overbanked”, claims the Single Supervisory Mechanism (SSM), operating at the European Central Bank and supervising the largest institutions in the euro zone.

“The truth is that competition means that not everyone can win. So we would expect that some banks will have to exit the market. Banks must be allowed to fail,” said Danièle Nouy, the Chair of the Single Supervisory Mechanism, during the 7th Financial Forum held in September in Madrid.

Banks are also overwhelmed by the mountain of post-crisis bad debt, whose value in the EU exceeded EUR1 trillion at the end of last year. Due to the Basel III regulations, banks have the choice of increasing capital or reducing the risk-weighted assets. Because capital is expensive, even the banks that are coping relatively well are most frequently choosing the latter option.

The financing structure of the European economy provides a good argument for the establishment of a capital markets union. As much as 85 per cent of it is financed with loans, while in the United States the capital market provides 75 per cent of the financing of companies. William Wright, from the think-tank New Financial calculated, that the capitalization of all the European stock exchanges amounts to 69 per cent of the EU’s GDP, while in the United States it amounts to 116 per cent. All the European stock exchanges put together have a market capitalization of less than half of the capitalization of the US stock market, and the debt market only represents one-third of the value of the instruments listed in the United States.

Moreover, ever since the crisis the EU has been suffering from a low rate of investment. The volume of investment decreased by 10 per cent in 2007-2014. In an analysis from June 2017, dedicated to the review of the activities concerning the CMU, the European Commission wrote that even assuming an increase in investment and GDP growth consistent with the forecasts for 2017, by 2023 the share of investment in GDP will only rise to the level of 22 per cent, which is the same as the level recorded in 2000-2005.

„The EU needs CMU today more than ever,” wrote the European Commission in a recent report on the implementation of this project.

The CMU project includes all the 28 member states of the EU, and not only the Eurozone ones, as was the case with the banking union. The Action Plan on Building a Capital Markets Union adopted by the European Commission towards the end of 2015 stresses that the development of capital markets is supposed to unlock investments throughout the EU and the possibilities of influx of investment from outside its borders, improve the availability of financing for investment projects, stabilize the financial system and deepen the financial integration of the states and the competitiveness of the economies.

The capital market of the EU is inconsistent in terms of the legal framework governing the functioning of both the institutions and instruments. Various countries have different rules for the protection of investors, disclosure obligations of entities offering shares on the public market, etc. If the availability of raising capital through, for example, offerings of shares and corporate bonds is to be comparable, the national regulations would have to be unified, which could significantly lower transaction costs, e.g. the costs of legal services.

If the funds – from risk-prone venture capital to those gathered by insurers or conservatively investing pension funds – are to operate throughout the entire EU market, they should have comparable regulations but also conditions of operation in every country. The bankruptcy proceedings should have to be conducted in a comparable way, regardless of whether they occur in Italy or Sweden.

The objective of the project is therefore to reverse the fragmentation of the markets, which was revealed and deepened by the crisis. It is also based on the generally correct belief that the capital market is able to disperse risk instead of accumulating it thanks to the sectoral and regional diversification of investment streams. This belief should not be accepted without any objections, however. The consolidation of the European supervisory network is a response to these objections.

In its first version proposed by the British Commissioner Jonathan Hill, the project of the CMU was prepared with a clear focus on the interests of the City of London, one of the three largest markets in the world. After last year referendum in the United Kingdom it has a new dimension – attention was paid to the complexity and the various stages of development of the small local capital markets.

In June, the European Commission announced a review of the implementation of the project for the CMU. The Commission has already prepared 20 out of the announced 33 projects. However, many of them are still stuck in negotiations between individual member states.

The main controversies concern the harmonization of the tax systems (this does not concern the rates, but the comparability of the tax base, i.e. the Common Corporate Tax Base and the Common Consolidated Corporate Tax Base) and the insolvency law. One unquestionable success, however, was the adoption of a regulation concerning issue prospectuses. It will enter into force in 2019.

The CMU plan contains 33 proposals for comprehensive changes within six main areas:

The original plan was that the path to success of the CMU should lead through the deregulation and removal of legal barriers existing in the individual countries of the EU. It soon turned out, however, that this approach is overly simplified. The concept of the CMU intends to utilize the financial intermediation capacities existing outside weak banks, and therefore also in the shadow banking sector. The Financial Stability Board, the European Systemic Risk Board and the International Monetary Fund have long claimed that the latter sector is still poorly explored and poorly regulated. Hence the conclusion – currently implemented by the European Commission – that supervision of the financial sector in the EU should be strengthened.

The free movement of capital is one of the four pillars of the single market. While there is nothing wrong with freedom, it is important, however, to control whether the free movement of capital leads to a build-up of speculative bubbles and systemic – even on the scale of a single country – imbalances. These imbalances caused such negative phenomena as household foreign-currency debt – not only in the new, but also in the old EU member states. This was among the reasons why the European Central Bank proposed to strengthen the mandate of micro-prudential supervision.

The project of the CMU is not only a supervisory challenge, but also a technological leap. Trading in securities is migrating from traditional stock exchanges onto electronic platforms. Technological companies, such as fintechs, are already providing the majority of intermediation services previously carried out by banks. Shadow banking institutions are growing rapidly.

New ways to obtain financing or capital, such as crowdfunding, are becoming a fact of everyday life. For the time being, it is known that approx. 500 such platforms operate within the EU. Financial transactions are increasingly frequently concluded in cryptocurrencies. The concept of initial coin offering (ICO) has entered our language. It means the raising of funds for the development of a business through blockchain platforms in exchange for future rights granted to the donors. In Poland, at the end of last year the start-up named Golem obtained USD8.6m in 29 minutes for a project of sharing computing power, states the report of the Start-up Poland foundation. Perhaps the ICO will one day become an alternative to the IPO. For now, however, even the representatives of the industry themselves are warning that there are many scammers among people conducting ICOs.

It is therefore necessary to first and foremost recognize possible risks created by financial innovations. Both for consumers and for the financial system as a whole.

This is precisely the goal of the reform of the system of supervisory agencies in the European Union. Since the London market will no longer be the UE market, a common and coherent system has to be developed on the continent. It is possible that Brexit will result in the migration of the operations of numerous financial institutions from the City to the continent, and therefore it is necessary to ensure that individual financial centers will not compete against each other by creating opportunities for regulatory arbitrage or arbitrage in supervisory practices.

The competencies with regard to the supervision of banks are divided between the SSM and the EBA and nothing will change here. Meanwhile, very extensive powers will be granted to the body supervising capital markets – the European Securities and Markets Authority. It will exercise supervision of the indices and benchmarks which are of critical importance for the entire EU market in accordance with the adopted benchmark reform, and also of credit rating agencies, clearing houses and transaction repositories. In the case of public offerings of large cross-border companies on the European market, it will also approve their prospectuses.

The Agency is also supposed to supervise European venture capital funds, European funds for social entrepreneurship and the European long-term investment funds operating on the basis of new legislation. It is also supposed to play a greater role in coordinating investigations concerning market abuse. It will have the right to act, among others, in cases where market abuse has cross-border effects, or may also have an impact on the financial stability of the European Union.

The European Insurance and Occupational Pensions Authority should supervise cross-border insurance companies and pension funds operating in the European Union. It is supposed to assess their internal models used to determine the solvency requirements. Meanwhile, the European Systemic Risk Board is supposed to have broader competencies when it comes to the supervision of the risk for the entire financial system. The responsibilities of EU supervision authorities will also cover matters associated with cybersecurity in financial markets and the coordination of activities undertaken by national supervisory bodies.

The proposal of the European Commission provides for the agencies to also have the authorization to monitor the operations of European financial institutions outside the EU. The goal is to prevent them from circumventing the regulations and to observe the possible build-up of cross-border risks.

The direction of the future evolution of supervision authorities is as important as their extended competencies. While the project of the CMU is aimed at the harmonization of the legal basis for the functioning of the broadly understood capital markets, agencies will have the task of ensuring the convergence of supervisory practices.

Their actions are to be guided by the opus magnum developed by the EBA – the Single Rulebook. It is being created in such a way that individual directives delegate to the EBA the power to fill them with content, as a result of the settlement of disputes and doubts, and also as a result of received questions concerning the interpretation of specific cases.

In the future, the agencies of the European financial safety net will only partially be financed from the EU budget. The remaining part of the financing will be based on fees paid by financial sector institutions.