Tydzień w gospodarce

Category: Trendy gospodarcze

Suzanne Bishopric, the former Treasurer and Director of the Joint Staff Pension Fund at the United Nations, has highlighted this issue in her article for the OMFIF think tank. On the example of the United States, she examines the problem of insufficient funding for women’s retirement benefits.

In the 1970s, when the baby boom generation was entering the labor market in the US, women typically only earned 60 per cent of a men’s income, which automatically entailed a lower level of retirement savings.

At the time, the authorities assumed that women’s incomes would catch up with men’s incomes within a short time. However, this did not happen and had serious consequences for women’s retirement, because the pension systems were not properly adjusted to account for the different career paths of women and men.

The OMFIF expert also indicates the additional factors negatively affecting women’s pension prospects. Firstly, women often marry older men, and when their husbands retire, they often leave their jobs as well – even before reaching the statutory retirement age.

Secondly, the situation of women is worse due to the fact that they usually take care of elderly relatives and receive no remuneration for that. At the same time, when women reach the age when they need to take care of themselves, they are often already widowed, and they have to pay for the services and the support that they once provided to others.

Another factor is the longevity of women, which creates a “risk of outliving” one’s savings. Current statistics indicate that a woman will live 5 to 7 years longer than her husband, but she will have to support herself with retirement savings that are 30-40 per cent lower than his.

The proposals for solving the problem of insufficient funding of pension benefits for women relate to three issues.

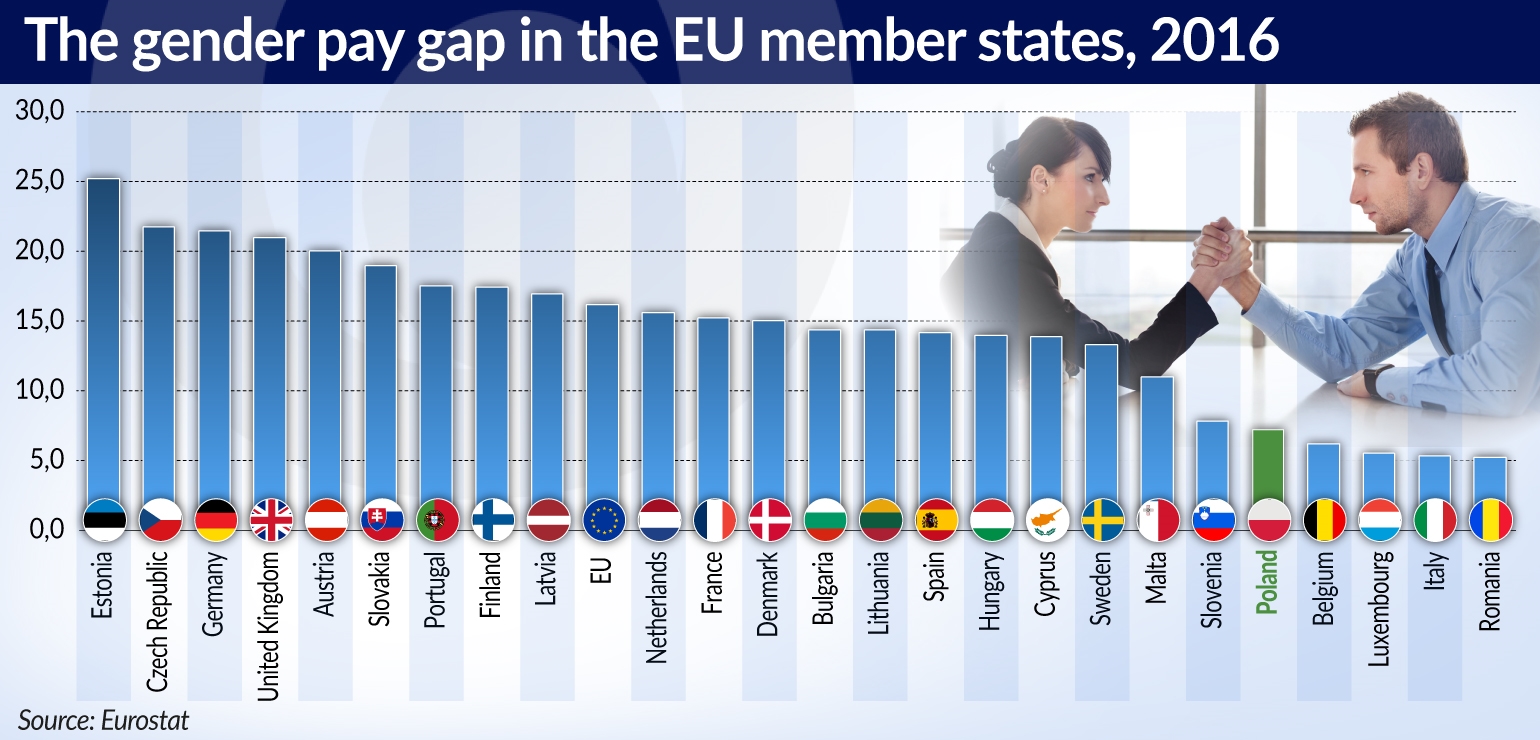

First of all, the correction of gender income inequality would require a proper adjustment of the existing income-based social security schemes or pension funds – until women’s wages are equal to men’s wages. Without such a change, the pension systems will perpetuate the gender wage gaps of the past.

According to the World Economic Forum’s Global Gender Gap Report from 2017, it will take 217 years to close the economic gap between men and women (based on the current trends).

Secondly, families with young children should be provided with support mechanisms, such as paid maternity leave or broadly available and affordable child care, in order to avoid a situation where mothers have to choose between jeopardizing their careers and neglecting their children.

Thirdly, unpaid child care or elderly care services should be included in the retirement pension schemes, for example in the form of minimum contributions to the pension funds for the people caring for children and the elderly.