“In the period from March 16th to the end of September NBP injected PLN158bn (approx. EUR 35bn) into the Polish banking system. This corresponds to approximately 7 per cent of Poland’s GDP – said Adam Glapiński, the...

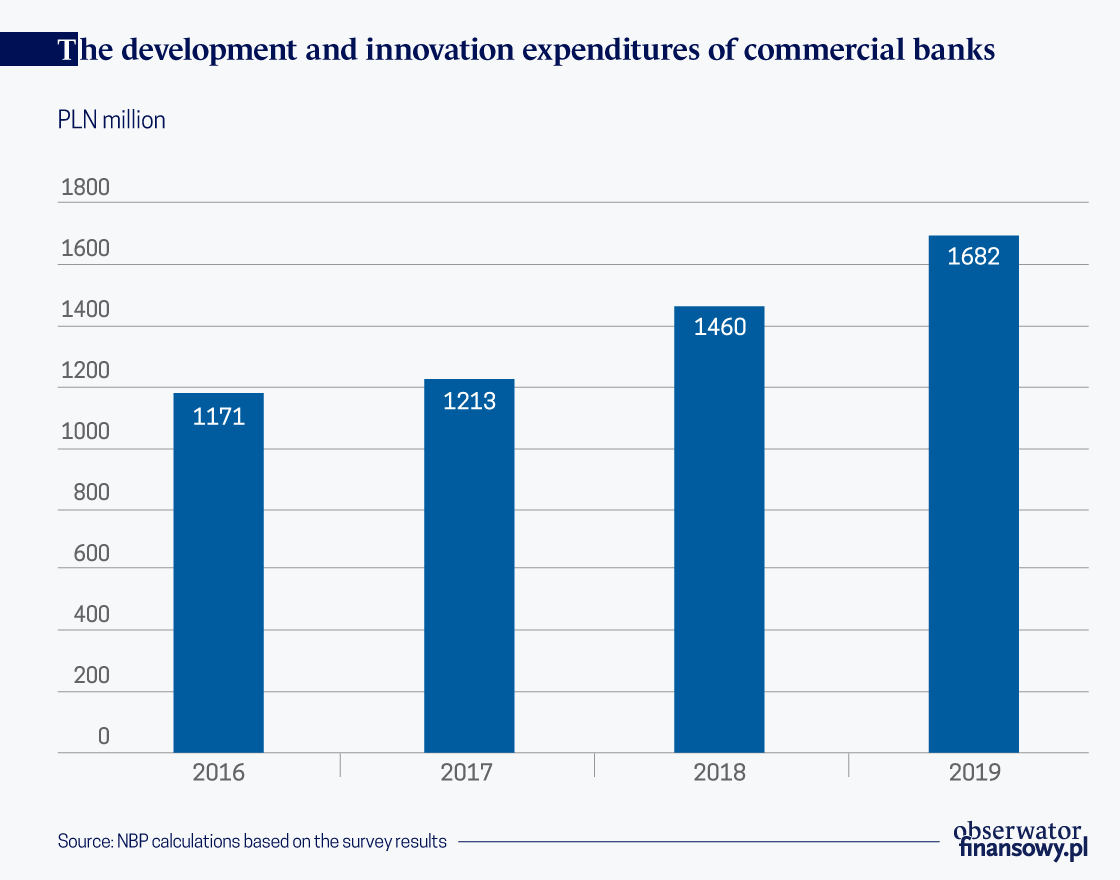

The results of a survey conducted by Poland’s central bank, NBP and the Polish Financial Supervision Authority (KKNF) show that large banks are investing heavily in technology and rapidly increase their competitive advantage,...

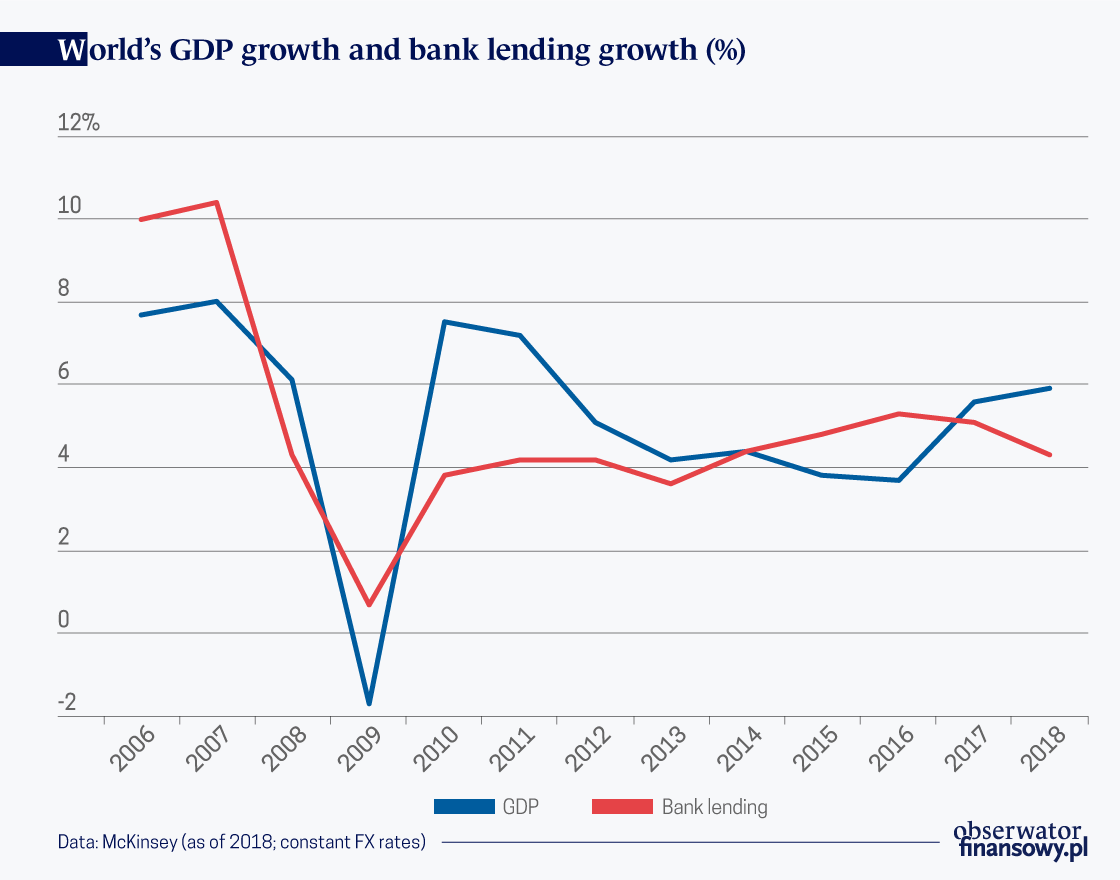

The global financial crisis originated in the banking system, first in the US, and then in Europe. The 2009 recession was the consequence of the banks’ freeze on lending and the resulting uncertainty. Today, the situation is...

In spite of the pandemic, the commercial banks operating in Ukraine have achieved sound profits. However, according to the Ukrainian central bank NBU, this may soon change because the conditions for the functioning of the...

“The current crisis is a crisis of the real economy, which may turn into a banking crisis, but doesn’t have to. Fortunately, the Polish banks are well prepared, with high capital buffers, which will help to absorb the...

The expenditures on technology by banks are on the rise, although innovation is primarily gradual in nature and mostly focuses on improving the existing systems to include additional processes. The largest banks are implementing...

The Central Bank of the Russian Federation sold its 50 per cent+1 share in Sberbank, Russia’s largest financial institution, to the Russian Finance Ministry. Although officially carried out to avoid conflict of interest, some...

A large percentage of banks will have to face the threats resulting from the dynamic processes of digitization in conditions of a global economic crisis. This will force them to transform their traditional business models.

Croatian economy is especially prone to international shocks. Dramatic spread of coronavirus, followed by drastic fall in supply&demand chains badly affected Croatian economy, which did not even have enough time to recover...

The establishment of the banking union in the Eurozone means that banks are operating in a single regulatory environment, which is important especially in the case of cross-border banking groups. However, the banking union still...