Chiny dorobiły się już rodzimych przedsiębiorstw opartych na innowacyjnych produktach i usługach. Wymyślonych w kraju, a nie powielonych za innymi – przekonują w książce „Pioneers, Hidden Champions, Changemakers, and...

After 2019, which was almost record-breaking in terms of the value of VC investments, start-ups have hit a wall due to the lockdown and difficulties in raising capital. However, some of them are actually benefiting from the...

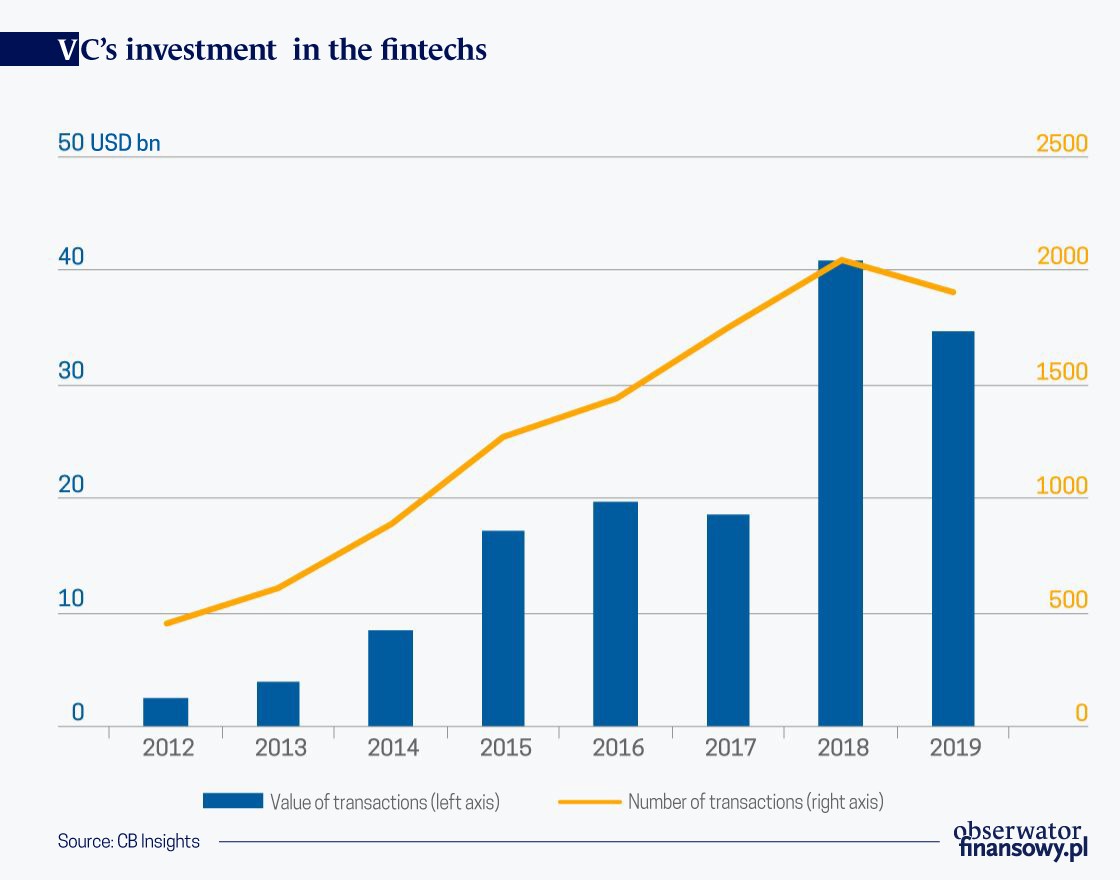

Business angels and venture capital funds are trying to identify the companies that will set new directions for the development of the economy. While they aren’t always right, taking a look at their investments may give some...

2019 was a successful year for the fintech sector. Many start-ups have increased their valuations and customer bases. They have successfully entered new markets and developed innovative services, taking over the revenues of...

Polish entrepreneurs have shown that they are able to adapt to any new situation, regardless of how challenging it is. They are used to relying on each other, to support each other. Paulina Walkowiak, CEO of cux.io, says that...

The Polish venture capital scene had a strong second half of 2019, with over PLN1bn (EUR235.7m) invested in start-ups in the Q3, led by DocPlanner, Brainly and Booksy pulling in large investment rounds from overseas investors.

Development depends on the economy's saturation with entrepreneurs who are motivated by the desire to creative new things, and not just to make a living for themselves. That is why the expansion of start-ups is so important.

Economists from the Warsaw School of Economics warn that the economic recovery after the last recession in the Central and Southeast Europe (CSE) had already lasted 20 quarters, and that the important leading indicators had gone...

Lithuania plans to take a leading role in enhancing cooperation between China and Central and Southeast Europe (CSE) in the fintech sector.

In 2017, a record amount of USD3.5bn was invested in Central and Southeast Europe (CSE) by private equity and venture capital funds. 71 per cent of this amount was spent in Poland, which is the regional leader.