Tydzień w gospodarce

Kategoria: Raporty

Financial crisis, which begun in 2007 is a textbook’s example of the recession. Home market downfall, structural debt and unemployment rate prove that. Prof. Carmen Reihardt, the author of This Time is No Different, predicts that world economy will slowdown even more. And some countries, among them United States and Western European states, may face from 7 to 10 years of a heavy unemployment. If she is right then one should carefully study the jobs’ creation methods. They are different from “job savings methods”.

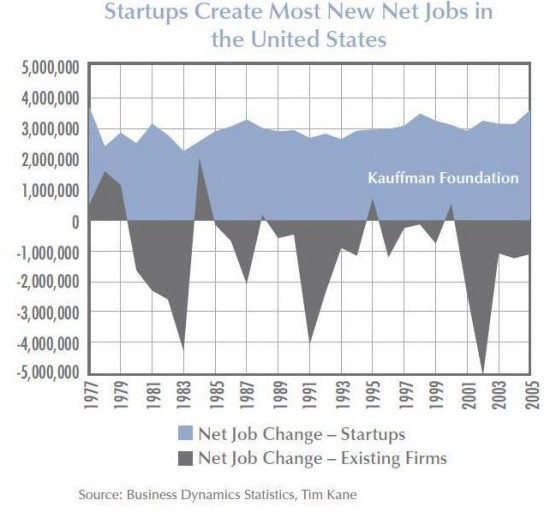

Dr Tim Kane presents his interesting paper about startups based on the research made by Kaufman Foundation economists. Dr Kane paraphrases sport slogan “winning isn’t everything is the only thing” and argues that startups are the only serious job creation method. Business Dynamics Statistic is an evidence for that. Without the startups net job growth would not have been possible between 1977 and 2005.

From 1977 to 2005 existent american companies were job killers net. They were loosing 1 mln annually. But strtups were creating 3 mln annually. For example, in 2005, startups created 3.5 million jobs, compared to the 355,000 gross jobs created that year by firms founded in 1995. However, the 1995 firms also lost a gross 422,000 jobs. Indeed, existing firms in all year groups have gross job losses that are larger than gross job gains.Policymakers can use that information in making decision on large companies’ subsidizing. One cannot wait for Intel, Microsoft or Apple to create job. Startups are badly needed.

Israeli economy prospers thanks to them. According to UN Israel economy was the fastest growing world economy. Dr Saul Singer, author Start-up Nation, said that innovations helped Israeli economy. But first Israel’s government helped to create capital funds for startups. Singer told in Obserwator Finansowy about that program which helped young innovative companies, encouraged initiative and attracted foreign investors.

Companies can make long-term investments thanks to savings which are encouraged also by lower taxes. Dr William Dunkelberg from the National Federation of Independent Business said that United States borrowed that capital from the world. But returns will not strengthen American economy.

.longer we put off making governments and firms seeking subsidies accountable, the more devastating will be the day of “settlement”. And we all know it will come. Each “crisis” brings the day of reckoning closer.

Dunkelberg calculated that American economy would have to create 225 000 jobs per 36 months to balance unemployment the pre-crisis level. It is unimaginable now.

Since the recession started, employment across the country has declined by about 8 million. Recouping those losses will take some time. If we hoped to do that in, say, three years, we would need to produce 225,000 net new jobs every month for 36 months. And, we need an additional 125,000 net new jobs to keep up with the growth in the working part of the population. That’s a tough assignment—one that’s usually led by small business.

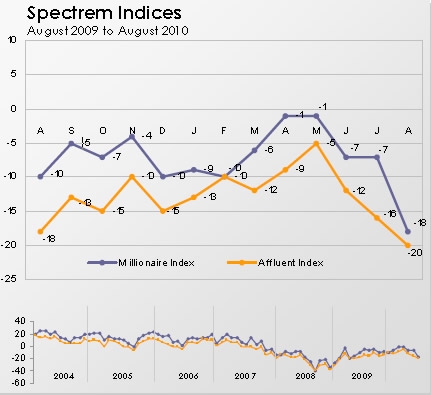

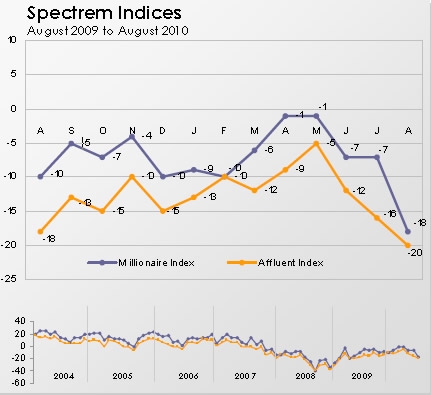

Unimaginable? Pragmatic Capitalist argues that super rich, millionaires, lost their confidence in the investment. According to Spectrum Group, quoted by Pragmatic Capitalist, super rich are withdrawing their capital from the market. Their Millionaire Investor Confidence Index plummeted to a new 2010 low and fell the most since summer of 2009.