Tydzień w gospodarce

Category: Raporty

What did happen was that the Authority, pressured by borrowers and many politicians, imposed a requirement in July 2007 for stricter creditworthiness checks. Customers borrowing in foreign currencies would have to be able to repay the loan even in the event of the zloty weakening by 20% – a worst case more than bested by the real world plunge of the zloty against the franc in recent years.

Not every bank was keen on the change in regulations. Risky forex loans gave a chance for fast growth and high rates of return. Had it not been for the rapid development of lending in francs, state controlled PKO BP would not have regained its spot as Poland’s largest bank in 2008. Instead Pekao SA, owned by Italy’s UniCredit, would have been the largest. But that bank was more cautious than most. For more risk prone banks, those loans acted like balance sheet rocket fuel – in one year alone, PKO BP increased the value of its loan portfolio by as much as 10.5bn zlotys and became the market leader in forex mortgages.

mBank, a unit of Germany’s Commerzbank, had an equally aggressive policy. It saw an increase in its portfolio of 10.4bn zlotys and took ING Bank Śląski’s position as the third largest bank. The biggest race for customers borrowing in francs was among slightly smaller banks. This strategy was chosen by Getin Holding, Noble Bank (the two merged in 2009) and Millennium Bank, a subsidiary of Portugal’s BCP, which thanks to franc loans jumped four places in the ranking.

Profits and shareholder income increased together with rising assets. Banks made money not only from the margin on the loans but also from charging steep fees to exchange zlotys into foreign currencies needed to make monthly payments and from the sale of other products ― insurance, credit cards, investment funds and expensive accounts which were a requirement to be granted a loan on the most favourable conditions. More conservative banks, which for a long time refused to take the risk of lending in francs, lost out. As they shed market share, their shareholders grew increasingly disgruntled and in the end most institutions gave in to rising pressure and also started to lend francs. Bank Zachodni WBK (now a unit of Spain’s Santander) and Kredyt Bank (now also part of Santander) saw a rapid increase in Swiss loan portfolios after scrapping their concerns in 2008.

The only cure for that sort of a competitive race to the bottom is efficient banking sector supervision which notices risky behaviour in a timely manner and forces all competitors to stop actions that are dangerous for financial stability. Therefore, had the KNF banned lending in foreign currency, it would have affected more than just the rankings of the country’s largest banks. With fewer Swiss franc loans clogging bank portfolios, the entire sector would be more stable. Capital adequacy would have increased, and institutions such as Getin Noble would not have had to raise additional capital after recent stress tests conducted by the KNF.

Other banks could have earmarked larger portions of their profits for dividend payouts. Despite this, the total income of financial institutions would probably be smaller. Thanks to the margins on franc loans alone, banks have annual revenues of nearly 2bn zlotys, further boosted by the sale of related products.

The main advantage of the introduction of a more stringent Recommendation S as early as in 2007 would be avoiding the problems now associated with franc loans, something giving sleepless nights to more than half a million borrowers, as well as bankers and politicians. The degree of heartburn depends on when the loan was taken. Those who borrowed before 2006, when the franc was relatively expensive, are still doing better than if they had taken a zloty loan. It is totally different in the case of 62bn zlotys worth of loans granted in 2007-2008, the peak of the housing boom.

A large majority of the nearly 300,000 people who took out loans in francs in that period have lost on that decision. After the strengthening of the Swiss franc, the amount of their debt has significantly exceeded the amount they borrowed, and often is even larger than the value of the property on which the mortgage was established. Had the KNF stepped in more forcefully, they would be in a significantly better position today.

Although without those franc loans many people would not be struggling under a large debt, there is also a decent chance that they would not have their own home at all.

Not having a mortgage would have allowed them to consume more, as paying down a mortgage is a kind of forced saving. According to estimates based on KNF data, people who borrowed in francs repaid 9.4bn zlotys of capital and about 2bn zlotys in interest last year, accounting for 1.1% of all household consumption.

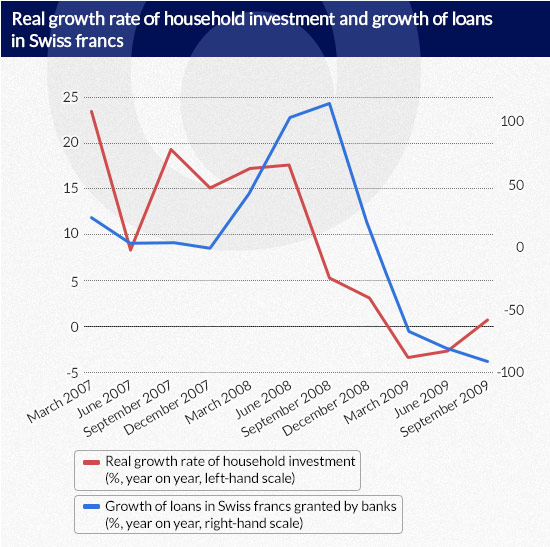

Despite the growth in consumption, the introduction of a more stringent Recommendation S would have reduced the rate of economic growth in 2007-2008. The vast majority of mortgage loans were in fact spent on the purchase of property, and the need to make a down payment depleted household savings. This boosted investment expenditures and increased the added value in construction, and thus GDP.

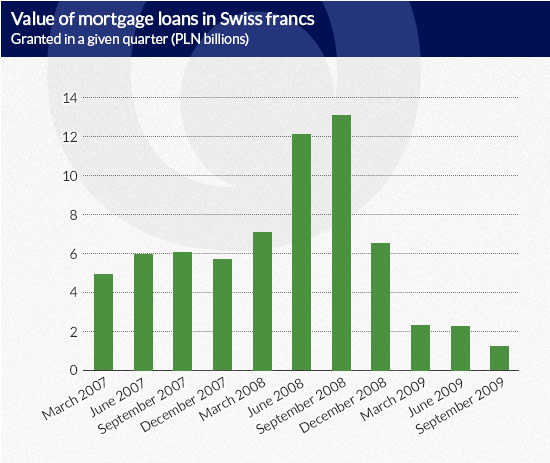

Assuming that the average ratio of the value of the granted loan to the price of the dwelling (LtV ratio) in the studied period was 80%, it can be estimated that the contribution to the increase in spending on real estate by people who borrowed in francs added as much as 13-14 percentage points to real investment growth at the peak of the credit boom. In the third quarter of 2014, more than 80% of the 17bn zlotys of household investment was funded by loans in francs. It must be remembered, however, that not all of these people would have given up buying an apartment ― many would have obtained a smaller zloty denominated mortgage. Making conservative assumptions, it can be estimated that people who borrowed in francs increased the real economic growth rate in 2007-2009 by an average of 0.3-0.5 percentage points per year, and in the following three years ― by reducing consumption ― they lowered the growth rate by an average of 0.1-0.2 percentage points per year.

The Swiss franc credit boom also had a very strong impact on the situation in the housing market. Due to short-term housing supply rigidity, the growth in demand immediately caused an increase in real estate prices. Developers regularly raised prices, hoping to make profits off a large group of consumers who were granted loans in francs.

As a result, the average price per square metre in the primary housing market in major cities increased by 29.4% between the end of 2006 and 2008, and in smaller provincial towns, this increase was as high as 65.8% . Without franc loans, housing prices at the end of 2008 would have been about 8-10% lower.

Also the structure of the real estate market would be different. Reduced access to housing loans would have forced people who borrowed in francs to instead rent housing. It is therefore possible that a tightening of Recommendation S would have helped to solve another problem of the Polish housing market ― the very low availability of rental housing. According to OECD data, only 4% of all available housing in Poland is rental property offered by private investors. In comparison the percentage is more than 9 times higher in Germany.

This situation often forces young people to take out mortgage loans if they want to move out of the family home. These people unnecessarily incur debts in exchange for small apartments and become tied to one city. In consequence, the low supply of housing reduces the flexibility of the labour market.

Trying to balance the costs and benefits of the boom in mortgage loans in Swiss francs is very difficult. Thanks to cheap forex loans, GDP grew faster and the economy is now larger than if that KNF had imposed more restrictive regulations on banks. However, this slightly higher level of development is burdened with social costs, higher property prices, lower stability of the banking sector, reduced mobility of the population and greater fluctuations of the economy.

Poland has also lost the chance to develop a rental market, which would bring long-term benefits by reducing unemployment in the poorest regions of the country, increasing the economy’s resilience to future credit booms, as well as decreasing fluctuations in housing prices.

The lack of availability of loans in francs, however, may not have changed much in the mood of people who now have such mortgages. Instead of suffering through fluctuations of loan instalments, they may have had problems with financing their own housing in zlotys, and some of them could now be demanding a higher subsidy for the purchase of new housing instead of government assistance in the repayment of Swiss franc loans.

The author is an Assistant Professor at the Department of Economy II (Warsaw School of Economics) and the chief economist in Centrum Analityczne Polityka INSIGHT. The analysis uses data from the KNF, the Polish Banking Association, Eurostat, the Central Statistical Office, Narodowy Bank Polski, the OECD, the Social Diagnosis research project and banks’ annual reports.