Tydzień w gospodarce

Category: Raporty

(oprac. graf. DG)

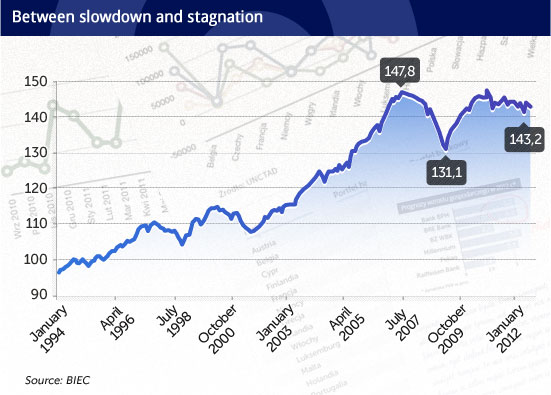

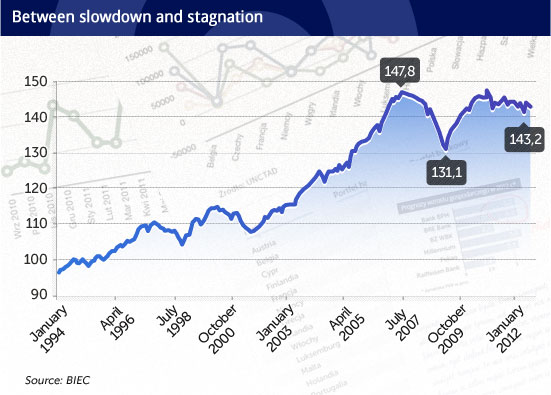

As Poland’s GDP data were released on 30 August 2012, optimism died and a giant and monster was born: overwhelming pessimism. In one day alone, the Polish economy turned from a European leader into a limping monster, from a country of investment opportunities into an untrustworthy economy. At least, one may judge so from newspaper headlines and media reports. “The economy has deteriorated, it needs fixing” (Puls Biznesu), “Economic growth clearly decelerates” (Rzeczpospolita), “Where have all investments, consumption gone or bleak semi-annual results” (Gazeta Wyborcza) – these are just a handful of examples.

Conclusions reached in the articles are clear-cut: all economic growth drivers crashed, consumers do not buy, the government penny-pinches, companies are unwilling to invest and even keep destocking. Only Polish exports come to rescue, which is of little comfort as it contributes little to GDP. In brief, it is a total disaster. And it was so beautiful only yesterday…

Does it all really look so gloomy? A slowdown in the economy has long been anticipated. However, not every contraction has clearly negative overtones, particularly when we consider the method of calculating the GDP. National accounts are a kind of a balance sheet that shows what and by how much has increased and decreased in the economy. It is sometimes better to dispose of something to reduce costs.

First of all, our inventories have decreased. And this is a very positive signal which proves that the private sector is flexible and capable of adapting to worse times. Businessmen know that when demand for their products falls during the economic slowdown, they should cut costs. Matching the level of inventories with the decreasing output is one of the ways to cut cost.

Corporate cost cutting began as early as in spring 2011 when it was clear that the path of recovery would not continue. In April 2012, companies started to vigorously reduce stocks, which was their response to the declining inflow of new orders, mainly from foreign customers.

At the same time, businessmen refrained from employment-related cost reduction, which implied no mass lay-offs, and tried to keep the existing employment level unchanged. Neither did they cut wages. Such a policy sends a very good signal for the economy as it does not lead to an abrupt decline in private consumption. Similar behaviour patterns were observed during the economic slowdown of 2008-2009. The adjustment of inventory levels and its gradual reduction started in the last quarter of 2008 and lasted until the third quarter of 2009.

Corporate cost reduction in bad economic times is an extremely important process of the restructuring of the economy, carried out without the participation of the State, special schemes and government agencies being set up. Enterprises carry out restructuring themselves, for themselves and in order to make it through in worse times. Those who do not do it are crowded out of the market. This is what the cleansing and beneficial role of a downturn is about.

Poland’s GDP growth in the second quarter of 2012 was driven by a positive contribution of net exports. It is a natural phenomenon in times of an economic slowdown, primarily due to imports contracting faster than exports, which generates a positive foreign trade balance. Imports shrink fast as in bad economic times and under the related uncertainty in economies such as that of Poland companies stop investing.

This is also a rational behaviour aimed at reducing investment-related expenditure and mitigating the risk of taking erroneous investment decisions. And it should be remembered that during long-lasting periods of slowdown, demand structure often tends to change, and new technologies and products are launched. Therefore, the private sector should wait and invest only when an economic slowdown comes to an end, i.e. when workforce becomes cheaper, the cost of credit is more attractive, commodity prices are low and investment decisions can be better matched with a new structure of demand.

The State should be the only investor active during bad economic times. Instead of increasing social transfers, the State stands a chance of using investment to ease the depth of a downturn in economic activity, and to prevent excessive unemployment growth, fall in private consumption and poverty area expansion. It is neither an irrational nor ineffective measure if the State starts public investments that satisfy the needs of all citizens; investments the private sector would not start anyway, even in times of prosperity, as they usually yield low returns. This concerns primarily investment in infrastructure, which is still poor in Poland.

The expansion of outlets for domestic producers is an advantage when imports shrink at a faster pace than exports collapse. Producers have a chance of maintaining their output levels by selling on the domestic market those goods and services whose imports are unprofitable. The collapse in imports is therefore not unambiguously negative.

The contribution of private consumption remains positive (0.9) and its growth has slightly fallen compared to the previous year (from 2.1% in the first quarter to 1.5% in the second quarter of 2012). A further decline in private consumption growth may be expected. However, this does not imply its abrupt collapse if only the government looks at the economy from the angle of citizens’ standard of living and not only from the point of view of State budget revenues.

OF