Tydzień w gospodarce

Category: Trendy gospodarcze

Infographics DG

For years, using the word “privatisation” in the coal mining sector has had the same effect on trade unionists as showing a red rag to a bull. And although the privatisation of Lublin-based “Bogdanka” and the sale of “Silesia” coal mine in Czechowice-Dziedzice to the Czech firm EPH showed that a private owner can successfully and efficiently continue mining, the mining community clings to state ownership. However, only when the choice is closure of the mine or its sale, do trade unionists agree to the “lesser evil” – privatisation.

When in 2009 Lubelski Węgiel Bogdanka debuted on the Warsaw Stock Exchange, miners from Silesia protested in the name of their colleagues from the Lublin region against the sale of the national treasure, in other words, “black gold”. The debut proved successful, the State Treasury quickly sold its controlling stake and the mine became fully private. It is still doing well today, even in the time of crisis, and productivity calculated in tonnes per person is approx. 2.5 times greater than in Silesian mines.

The debut of Jastrzębska Spółka Węglowa (JSW) on the Warsaw Stock Exchange in 2011 was not such a success, and the State Treasury kept more than a 50% stake in the company. Today the Treasury does not speak of plans to sell its controlling stake in the largest coking coal producer in the EU, although the market is abuzz with rumours that JSW could be taken over by either Jan Kulczyk’s group or ArcelorMittal, for whose coking plants in Zdzieszowice and Kraków JSW is the main supplier of fuel.

“We do not comment such issues,” Marta Wysocka, spokesperson of Kulczyk Investments, told us.

In turn, Sylwia Winiarek, spokesperson of ArcelorMittal Poland, told us, “The key area of ArcelorMittal’s activities in Poland is steel production and that’s what we will be concentrating on for the next several years.”

Currently, the capitalisation of JSW is approx. PLN 2.2bn (as a reminder, during JSW’s debut its shares cost PLN 136, while currently they stand at less than PLN 20 per share).

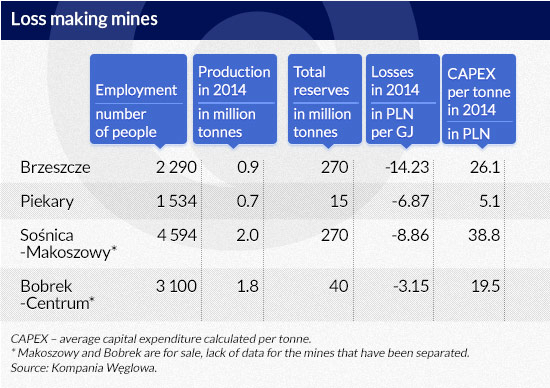

Kompania Węglowa (KW) is facing the biggest revolution. “Bobrek-Centrum” and “Sośnica-Makoszowy” mines will be separated. “Centrum” and “Makoszowy” will be transferred to the Mines Restructuring Company (SRK), as will “Brzeszcze” and “Piekary” mines. Theoretically, all of them are earmarked for closure, unless a buyer is found.It is already known that Węglokoks will acquire “Piekary” (it will also buy “Bobrek”, but directly from Kompania Węglowa), while “Brzeszcze” will be bought by Tauron. So the new investors will be companies that are also controlled by the State Treasury.

According to Jan Dziekoński, an expert of Roland Berger Strategy Consultants, in theory Tauron’s acquisition of “Brzeszcze” is sensible, because the firm already owns two coal mines and was planning to increase coal production anyway (although it could do this in the mines that it already owns). In fact, Tauron will be reducing coal consumption, because the modern blocks that have been planned (e.g. in Jaworzno) will be more efficient.

“Makoszowy” is an exception in this jigsaw puzzle – the owner of the television station TVS, Andrzej Hołda, is planning to buy the mine. This would really be privatisation. However, at the moment no facts are known.

For a while, Universal Energy was “in the game”. This company, owned by one of the richest Poles, Krzysztof Domarecki (among others, the owner of Selena), expressed interest in acquiring the mines of Kompania Węglowa that are to be transferred to SRK. However, since then talk of the acquisition has died down. Earlier, this company, headed by Waldemar Mróz, former vice-president of Katowicki Holding Węglowy (KHW), was interested in “Wieczorek” coal mine, belonging to KHW.

The remaining mines of Kompania Węglowa which will not be transferred to SRK will be incorporated into the so-called New Kompania Węglowa, in other words, a target company of the state-owned Węglokoks, whose capital is to be raised by approx. PLN 2bn by the end of the half-year by new investors (and specifically, controlled by the state-owned power sector). In other words, everything will stay in the family.

As far as KHW is concerned, at the moment there is a plan to transfer “Boże Dary Murcki-Staszic” coal mine to SRK, but nothing is known about the sale of other mines.

However, it is worth remembering that in 2007, KHW was the coal mining company best prepared to float on the stock exchange. However, the plans ended there.

“As far as selling Kompania’s coal mines is concerned, the question is from which perspective we should view this. Some could treat the sale of plants transferred to SRK to private investors as an opportunity to show that they were successfully rescued. However, in this situation, by maintaining production levels of steam coal, the new investor paradoxically increases the problem of oversupply even more,” says Jan Dziekoński. He estimates that currently we have a surplus of approx.10 million tonnes for the power sector on the Polish coal market.

According to Dziekoński, for example, the interest of the owner of the television station TVS in acquiring “Makoszowy” is rather a short-term strategy which aims to increase production of what is currently the most expensive large- and medium-sized cobbles, while at the same time investing as little as possible and making significant cuts. Meanwhile, in the case of the purchase of “Brzeszcze” by Tauron or “Piekary” and “Bobrek” by Węglokoks, we cannot speak of privatisation. In Dziekoński’s opinion, if it were possible to repeat the case of “Silesia”, which the Czech firm EPH acquired from Kompania several years ago, it would be quite an achievement.

“Greater involvement of private investors in Polish mining would bring more benefits to the economy than maintaining today’s dominance of the State Treasury in the sector. The main ownership challenge is to restore profitability of the sector in a world of low coal prices. This means the need to restructure employment and reorganise work, and also a change in the remuneration policy in the sector. The example of Silesia shows that Polish mining can change, but only when it has its back against the wall and cannot count on operational assistance from the state owner,” thinks Aleksander Śniegocki, an analyst of the Warsaw Institute of Economic Studies.

“Putting off the decisions denies the mines of their most valuable resource – time. Because time is needed to prepare a recovery plan, implement it, find investors and convince them to finance the process of rehabilitation of individual mines. In January we saw what happens when there isn’t enough time. Instead of having a discussion about the direction of the rehabilitation of unprofitable mines, we had the putting out of a fire and now we are facing the risk that part of the potentially profitable assets will remain permanently withdrawn from use,” adds Śniegocki.

On 9 March, the first of the meetings devoted to the new strategy for mining were held between the government and the community in Katowice. A specially set-up working group is to prepare the details.

“Perhaps private investors would be interested in such mines as “Marcel”, “Piast” and “Ziemowit”. “Marcel” has been profitable all along (unlike the rest of the mines in Kompania in 2014 – ed.), while the other two, with only small efforts, will easily be out of the red. If, for example, a private mine or power group were to show interest in them, it would even be rational,” judges Dziekoński.

The problem is that these mines are not for sale, because they are to be important pillars in the New Kompania Węglowa.

So in that case what about the mines of other coal companies or at least the controlling stake of Jastrzębska Spółka Węglowa ? In the strategy for the mining industry which is currently in force, there is a provision that the controlling stake must remain in state hands.

“JSW is not a strategic company from the point of view of energy security of the state, since it produces mainly coking coal and is primarily the supplier of ArcelorMittal. The sale of the state’s controlling stake would in this case be a rational decision. Except that after the recent strikes, potential investors could simply be scared off. ArcelorMittal has experience of dealing with trade unions, but it probably does not need the mines of JSW, at least not at the moment. And Jan Kulczyk? He probably has a different vision of doing business in the power sector,” judges Dziekoński.

So what with the mines of KHW and, for example, the above-mentioned “Wieczorek”?

“I don’t really see any chance of prolonging the life of that mine, because the coal will be exhausted by 2020 at the latest. However, without “Boży Dar” and with time, “Wieczorek”, KHW will manage. Of course, the problem of “Wujek” mine remains, and its potential closure would stir up a lot of emotions due to the pit being a symbol. “Staszic” and “Myslowice-Wesoła” mines are attractive facilities. In addition, given their relatively peaceful trade unions compared with the mining industry as a whole, I wouldn’t be surprised if a private investor was interested in them,” adds Jan Dziekoński.

Trade unionists don’t want to hear a single word about privatisation, but at the moment neither do large serious private investors.

“The current formula of privatisation based on the example of JSW is simply compromised,” thinks Jerzy Markowski, former vice-minister of the economy for mining. “Reality has shown that maintaining 50% of shares in the hands of the State Treasury leaves political-trade union mechanisms in the company intact, as we were able to become convinced during the recent strikes, when trade unionists had a greater say than minority shareholders. In my opinion, serious investors were put off by the protests in Kompania and JSW. Now the people who count are those who can get the mine for free,” he explains. In his opinion, a prime example is “Bogdanka”, which debuted on the stock market in 2009 and was later fully privatised, as well as, of course, “Silesia”.

“If, for example, Mr Hołd bought “Makowszy”, it would be a venture comparable to the acquisition of “Silesia” by the Czechs. Only he would have to buy that mine and not get it for peanuts, because it is only when you buy a mine that you know what it means to invest in your own property. However, I am afraid that today nobody will buy mines or mining companies without an amendment to the law on trade unions and the historically encumbered and inflated social cover and the mess of all the issues with local authorities,” Markowski tells us.

Perhaps with time someone will decide to make a different move, in other words, to develop part of the land of a former mine. At least this is what Jan Chojnacki did, whose company, Siltech, now mines a small part of the former “Pstrowski” mine (likewise in the case of “Jadwiga” mine) and every year makes a profit. Another example is Eko-Holding in Bytom, which operates on the land of the former “Powstańców Polskich” mine. The company Fasing also has such plans, which involve resuming coal production in “Barbara-Chorzów” mine with the use of part of the existing infrastructure there.

“Today, an investor who has money will sooner build a mine than buy one, because it is more rational. This is also the case from the point of view of the State Treasury. Build and create jobs for Polish builders and miners. And the coal from there will certainly be a contribution in the competition with fuel imports,” says Markowski, who himself advises German investors planning to mine in Poland (they are not the only ones – Kopex is preparing to build a mine in Preciszów and the Australian PD Co. is planning to do the same in the Lublin region).

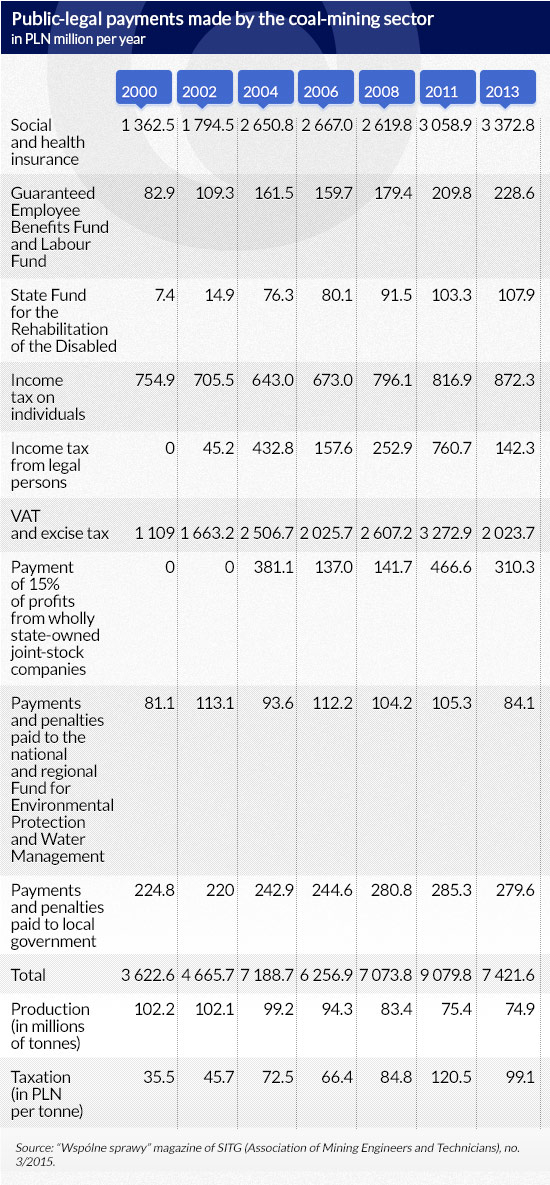

For investors – whether they buy or build mines – the problem will also be the financial burdens of the sector, which are not decreasing. Part of this, for example the 15% payment of profits of wholly state-owned joint stock companies, will not affect a private owner, but a large majority of them will. Meanwhile, tax on a tonne of coal has increased from PLN 35.45 in 2000 to PLN 99.11 in 2013.

“If the plants earmarked for closure were really closed down, supply of steam coal on the market would certainly decrease, because there is no room in the country for so much coal. This is particularly the case as far as coal dust is concerned. Apparently a price war has already started, and if everyone begins to “push” their product, then the prices will fall even more. Then, neither Kompania Węglowa nor Katowicki Holding Węglowy will break even. Only Bogdanka will remain financially viable,” judges Jan Dziekoński. “And demand in the coming years will not grow. So once again it will be necessary to plan the closure of mines and we will return to the starting point. In such a situation, paradoxically, a new investor who maintains production levels of steam coal will exacerbate the problem of oversupply even more,” he explains.

After all, potential investors look on with horror at the recent actions of Kompania Węglowa, which proposes PLN 6.9 per 1GJ (this refers to rather weak, type 21 coal, in other words PLN 145 per tonne), against an average price of approx. PLN 10 per 1GJ. It is worth adding that the average cost of producing one ton of coal in KW exceeds PLN 300. This is why the competition speaks openly about dumping.