Tydzień w gospodarce

Kategoria: Trendy gospodarcze

President Obama and many in his administration, as well as the Democrats left in Congress, keep expressing bewilderment as to why the economy is not producing the jobs they had promised with their “stimulus program.” The problem is that their model of what is supposed to happen is wrong, and it has been known to be wrong for decades.

In essence, they are fixated on the old Keynesian idea that government spending can create jobs. Milton Friedman, F.A. Hayek, and many other Nobel Laureates and other fine economists, such as Harvard’s Robert Barro, have demonstrated that the concept is dead wrong and neither works in theory or practice. Yet, because it gave politicians a rationale to spend more of other people’s money, it is a bad idea that has never died.

Mr. Obama still seems to actually believe that government spending is the solution, not the problem, forgetting what President Reagan correctly said: “Government is the problem and not the solution.” The Keynesian argument is that if government increases spending, there will be a “multiplier effect,” where each dollar of additional spending increases output by more than the dollar.

In an International Monetary Fund (IMF) paper published in March titled “How Big (Small?) are Fiscal Multipliers?” the authors Ethan Ilzetzki, Enrique G. Mendoza and Carlos A. Vegh conclude that “in economies open to trade or operating under flexible exchange rates, a fiscal expansion leads to no significant output gains. Further, fiscal stimulus may be counterproductive in highly-indebted countries; in countries with debt levels as low as 60 percent of GDP [gross domestic product], government consumption shocks may have strong negative effects on output.” Note the U.S. has a 68 percent debt-GDP ratio and it is rising.

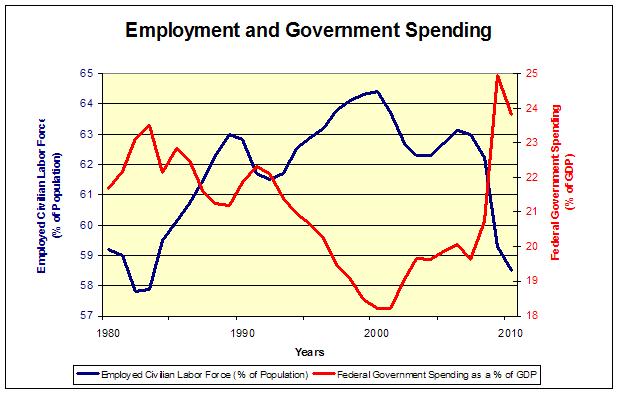

In the graph above, it can be easily seen that increases in government spending are associated with lower levels of employment and vice versa. Proponents of more government spending argue there is a lag between increases in government spending and increases in employment, but this lag is stated to be in months, not years, and the average recession lasts less than a year. The chart also clearly shows that even with a lag of a year or so, job creation, correctly measured as a percentage of the adult population employed, is again negatively associated with bigger government.

President of Encima Global and former U.S. Treasury economist David Malpass said Friday that wages are “up only 1.8 percent over the last year and well below the 3.2 percent inflation rate.” He also noted, “The more government spends, whether on so-called investment, entitlements or just plain waste, the less the private sector wants to hire new workers. Businesses realize that government debt puts them at risk.”

In addition to government spending, the other big reasons businesses are not hiring are the fears of new tax increases, particularly on labor and capital that the president has promised, the explosion in regulatory costs, and uncertainty.

One of the major impediments to job growth is the cost of regulation, which has been growing far faster than GDP. In September, economists Nicole V. Crain and W. Mark Crain did a comprehensive study of the cost of regulation for the Small Business Administration. They estimated regulatory costs were $1.75 trillion in 2008, or about 14 percent of GDP. The Crains’ report also showed that regulatory costs are about 36 percent greater for small firms (the big job creators) than for large firms ($10,585 per year versus $7,755). Regulation is a hidden tax on both employment and productivity growth. Much regulation does not even come close to meeting reasonable cost-benefit tests. Government agencies, such as the Environmental Protection Agency, the Securities and Exchange Commission, the Internal Revenue Service, etc., do not have truly independent economists evaluating the cost-effectiveness of their regulations. The IRS and Treasury are now developing regulations to try to stem tax evasion but which may have the unintended consequence of driving as much as a trillion dollars of foreign investment out of the United States, which could cost millions of jobs. Those at the IRS claim the proposed regulations will have only minimal impact, but since they have not done an independent cost-benefit analysis, such assertions are meaningless and dangerous.

The distinguished professor of law and economics, Richard A. Epstein, wrote last week, “American businesspeople complain most about the uncertainty associated with the current regulatory (and tax) environment. … Clear rules are a necessary condition for good government, but they are not a sufficient one. What is needed are rules that make sense in their ends and their means. What we have now is neither, whether we are looking at old regulations like those of the EPA or new ones like Dodd-Frank [financial reform law].”

If Mr. Obama really wants many new jobs now to bring the unemployment rate down substantially before the next election, he has no choice but to reverse his current policies:

These three measures would remove much of the uncertainty job creators face and give them the confidence they need to hire their fellow Americans.

The only constructive way out of America’s current economic crisis is to go for growth in the way that Reagan did, by cutting tax and regulatory impediments and also greatly cutting the size of government. There is no other path to liberty and prosperity.