Banki pod presją fintechów

Kategoria: Trendy gospodarcze

Wczorajsze przemówienie prezydenta Baracka Obamy na Wall Street rozczarowało ekonomistów zajmujących się regulacjami bankowymi. Prof. Johnson wylicza zapowiedzi prezydenta USA kwaśno je komentując:

“First, we’re proposing new rules to protect consumers and a new Consumer Financial Protection Agency to enforce those rules.” This is a very good thing, and of course the banks are adamantly opposed. But this Agency will not by itself bring us financial stability; that requires change at the level of how banks and other financial institutions are operated.

Second, he talked about “gaps in regulation”; this is international finance bureaucrat code for mush (doesn’t the President know this?). The specific potentially interesting pieces he put under this heading were run together in this paragraph”

Bruce Bartlett dostrzega obawy Chińczyków czy uda się im obsłużyć amerykański dług.

As our biggest shareholder, so to speak, they are naturally concerned about our ability to continue servicing our debts. And they are becoming increasingly knowledgeable and sophisticated in their analysis of our fiscal problems

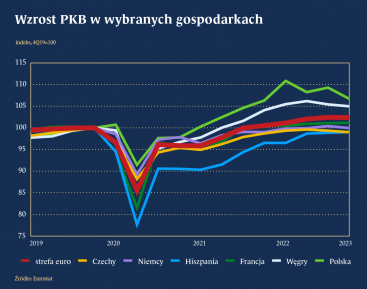

W styczniu 2020 roku Wielka Brytania formalnie opuściła Unię Europejską. Oczekiwane korzyści z brexitu, poza odzyskaniem suwerenności w zakresie kształtowania prawa i zewnętrznych relacji gospodarczych, jednak się nie zmaterializowały. Widoczny jest natomiast spadek wydajności i konkurencyjności brytyjskiej gospodarki, co wpływa także na kondycję rynku pracy.