Tydzień w gospodarce

Category: Trendy gospodarcze

(CC BY-NC-SA Jez Page/DG)

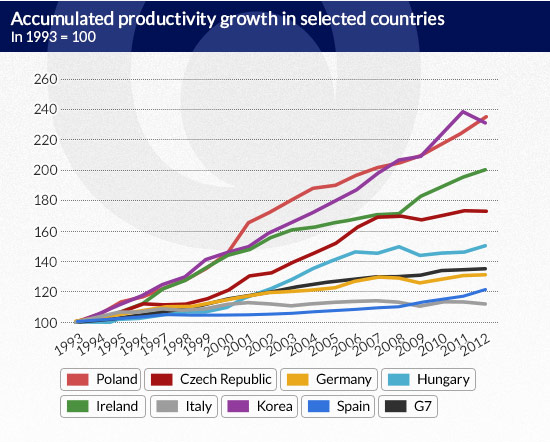

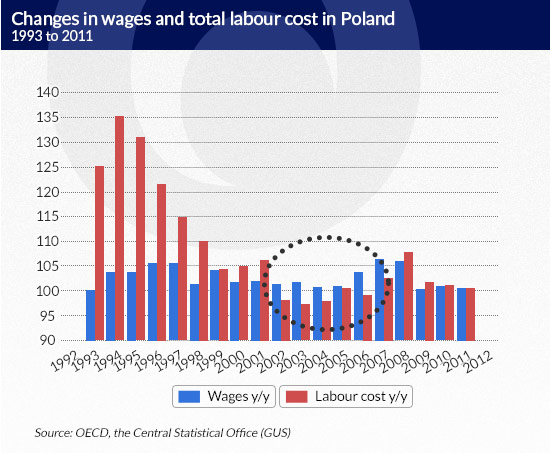

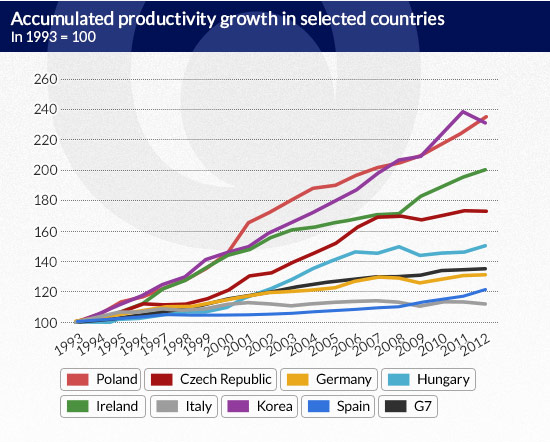

Over the past 20 years, Poland has been an unquestionable leader in terms of increasing labour productivity. According to OECD data, compared to 1993, labour productivity has grown almost two and half times, and only few economies have achieved such a result. Besides Poland, the top global leaders include Korea, while Italy, Spain, the Netherlands and Denmark are among the European stragglers.

Even though average labour productivity of Polish employees have grown annually by 4 per cent over the past two decades, we are still ca. 60 per cent less productive than Germans, almost 70 per cent less productive than Norwegians and by half less productive than the average productivity for the 27 EU Member States.

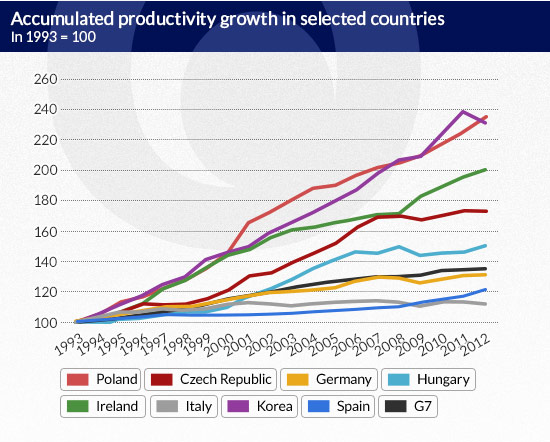

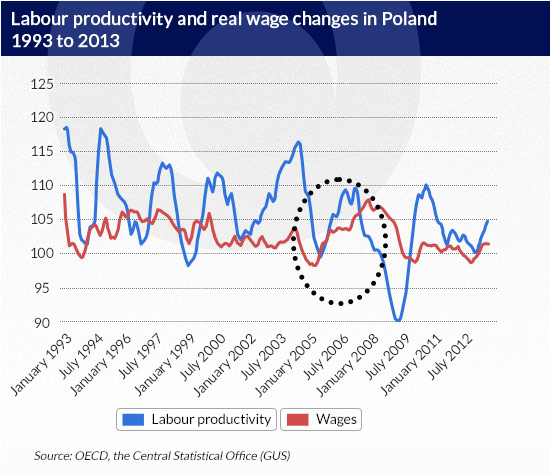

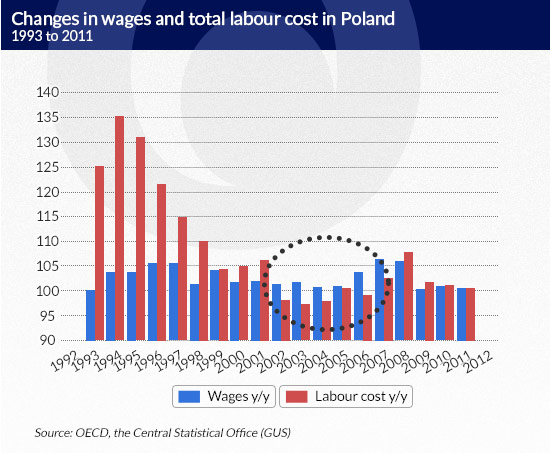

Wages have failed to keep pace with productivity. Over the past 20 years, the real wage growth in relation to productivity growth has been 1 to 4, which basically means that for wages to grow by 1%, labour productivity has to improve by 4 %. This relation was not constant in successive years. The most beneficial for workers were the years 2004-2007, when the relation between real wage growth and labour efficiency growth was 1 to 1.8.

What do then the economy and employers need in order to translate productivity growth into higher wages and more wealth? Does it mean that employers are not always willing to share the profits generated by higher productivity with their workers?

Infographics DG

The key factors related to employers that determine wage growth are:

Wage-related taxes include pension insurance, disability pension insurance, accident insurance and contributions to employee targeted funds. In Poland, according to Eurostat, over the past decade, the share of wage-related taxes in overall labour cost amounted to 20-24%, which makes us stand close to the EU average. According to employers’ calculations, in 2012 taxation of labour in the case of income exceeding the first tax band of PLN 85,528 was 32%.

Infographics DG

Hiring employees with higher wages is therefore far more expensive for employers, which is a significant obstacle to increasing wages and creating new jobs. The smaller the company, the larger the share of wages in the total operating expenses. For this reason almost 80 per cent of SME employers point out to taxation of labour as a major obstacle to their development.

For employers, the level of tax rates is not as important as its change. Even a small increase in taxes ruins the employer’s earlier calculations, reduces estimated profits and savings for investment. In short, the financial situation of companies is deteriorating, which reduces the possibility of increasing wages.

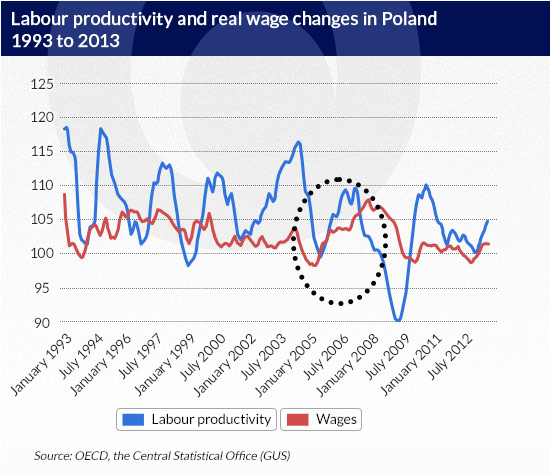

In Poland, over the past 20 years, direct labour cost (wages) grew faster than total labour cost only in the years 2002-2007, which means that tax burdens related to employment paid by employers increased over the other years. Thus a smaller propensity to increase wages and create new jobs among businesses was conditioned on an economic account.

Infographics DG

Because of increased taxation of labour, companies have smaller disposable resources, are less creditworthy, and consequently the possibilities of investment are limited. And investment is another important wage determinant. Increasing productivity without investment in more advanced production facilities have its natural limits. It is possible to introduce better management systems, employee motivation schemes or employ better-qualified personnel, but each of the methods is naturally limited by the human factor.

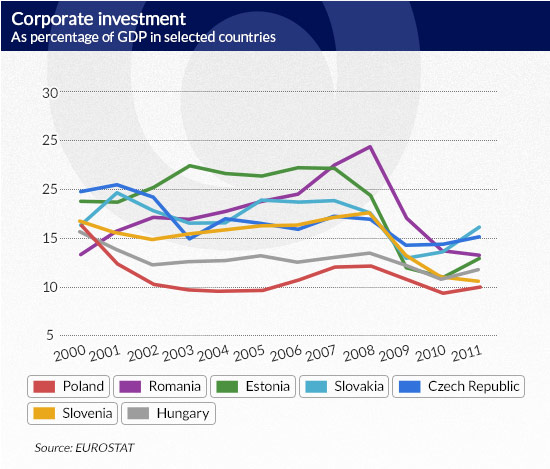

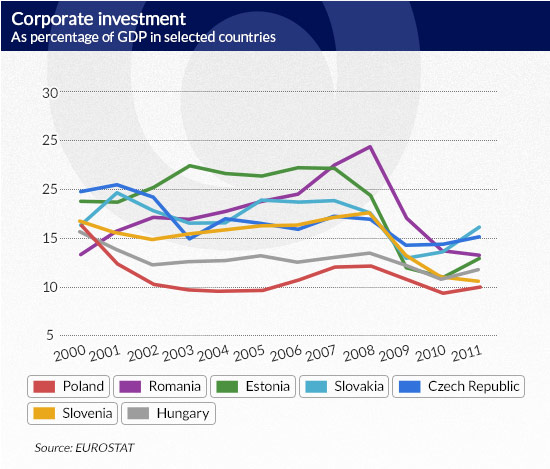

When the above methods have been exhausted, the only way to boost productivity again is to invest in more advanced, efficient machinery, equipment and technologies. In Poland, corporate investment in relation to GDP is among the lowest in the region. In the past decade, the average investment was slightly more than 10% of GDP. The Czech, Slovak, Estonian, Hungarian and even Romanian enterprises invest more.

Infographics DG

Recent years have seen an unfavourable trend of corporate investment pushed out by government investment. In the years 2001-2011, average investment by local companies accounted for 53% of total investment. This figure was close to 61% per cent even 10 years ago, while in 2011, it was only 49%. In countries such as Korea, Japan, Sweden, the share was more than 65%. In our region, the share of corporate investment in total investment was almost 70% in Slovakia, ca. 62% in Slovenia and 60 % in Hungary.

Recent years have also seen shrinking corporate investment in machinery and equipment, i.e. investment in the elements that are necessary for an increase in labour productivity and building up prospects for wage growth. Even a decade ago, investment in machinery and equipment accounted for 30% of corporate investment. In 2012, it contracted to 26%. In our region, we also come out poor. Investment in machinery and equipment stands at 36% of total investment in Slovakia and Hungary, 34% in Estonia and Slovenia and 33% in the Czech Republic.

Universality of investment also plays an important role. Concentration of investment only in the largest enterprises or selected industries will most likely cause wage growth in such enterprises, and as a result, higher average national wage. However, it will also diversify wages and most workers will not see any improvement. Universality of investment is then another condition for labour productivity growth, and in consequence – higher wages.

Investment also fosters price competitiveness. The manufacturers’ market by share of value added in manufactured products takes the form of a pyramid. The base shows manufacturers of the least processed goods with a small share of value added and the toughest competition. As we climb the pyramid, competition weakens. Yet to climb the pyramid, investment is needed.

In consequence, for workers to feel wage growth similar to growth of their productivity, it is required to have a stable tax system, in particular in terms of taxation of labour and continuously invest in machinery and equipment in order to increase and modernize companies’ manufacturing potential, which will become universal, irrespective of its size and industry.

The author is a habilitated doctor of economics at the Warsaw School of Economics. She supervises publication of analyses in BIEC, Bureau for Investments and Economic Cycles.